Who is Danish Elahi? A white knight VC, a takeover artist, or a business genius.

Protagonist of a family drama involving a tragic death, forgeries, successful and unsuccessful takeovers, child abduction, sexual assault, torture and intimidation, embezzlement.

1. Prologue - A tragedy and a double whammy

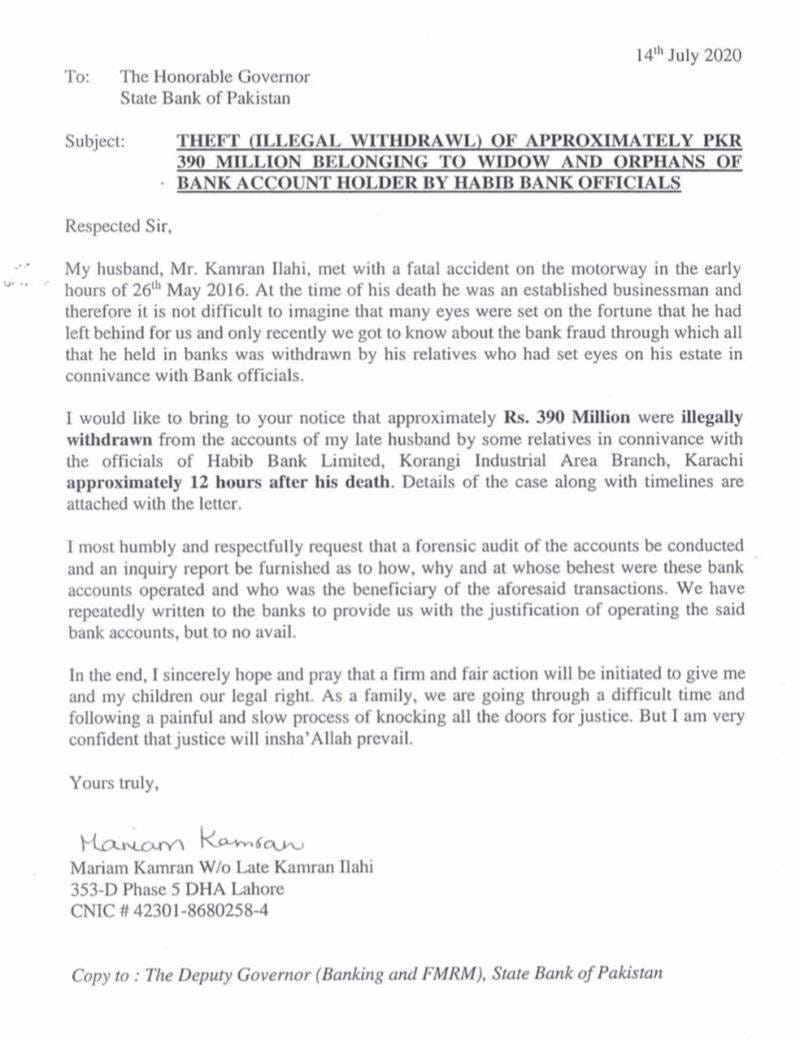

On June 26, 2016, Kamran Elahi, an established trader, and proprietor of well-known Elahi Electronics, passed away in a car accident on the Lahore Islamabad motorway. He left behind a widow Mariam Kamran and a son Usman Ilahi who was studying in Australia at the time.

12 hours after the death of the deceased, as per the later complaint by the widow to SBP because the HBL officials weren’t helpful, Rs.390 million was wiped out of the deceased’s account at HBL. Talk about a double whammy. First, you lose your husband and then on the following day, most likely by forging a signature, someone wipes out the account to prevent the legal heirs from getting their due share.

SBP wrote to HBL to carry out the inquiry.

We don’t know what became of the case. Rs.390 million isn’t a trivial amount that would be taken out in cash and HBL couldn't trace it. It would have been transferred through cheques. However, f indeed it was taken out in cash, it would have set off all sorts of red flags and alarm bells at HBL requiring additional signatures and scrutiny from the branch manager as well as CCTV footage of who is withdrawing such a large amount in cash. But as we will find out here, the wheels of justice move slowly in this country and sometimes don’t move at all.

While the name of this substack is SBP watch and other hot takes, lately the focus has been on the other takes since Reza Baqir’s departure. But the core theme remains centered around business, making the narrative here qualify as a business story, despite its origins in a family drama.

I feel that my recent substacks have been leading up to this post. This has an element of everything that a good writer can craft into a captivating piece of non-fiction or draw inspiration from to create a compelling piece of fiction: a tragic death, forgeries, successful and unsuccessful (family, business, hostile) takeovers, lawsuits, torture and intimidation, embezzlement, court cases, child abduction, and a sexual assault. I admit, I am not a good writer, but I will do my best not to mangle the narrative.

I have attached a lot of snapshots to back the narrative. You can gloss over them as I summarize the key parts in the write-up. Resultantly, the length of the post is long and if you are receiving it over mail, there is a possibility that your mailbox may have truncated the email. So click on the headline above and read it on the website.

2. Family comes to the rescue

As the business the deceased Kamran Ilahi was running was well-established and successful, “there were huge liabilities of the deceased payable to the banks, contractors, vendors, employees, transporters, etc. In addition, there were also family expenses including domestic, traveling, medical, wedding, etc. which were also required to be paid regularly to the deceased’s wife and children.”

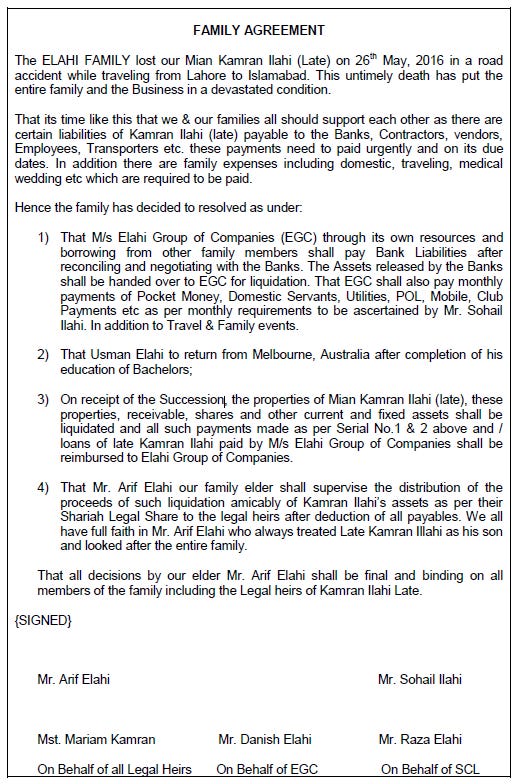

A day after the soyem of the deceased, on August 30, 2016, persuaded by the elders of the family, Danish Elahi, nephew of the deceased and proprietor of Elahi Group of Companies (EGC), assumed the responsibilities of settling outstanding liabilities of the deceased and the payment of monthly domestic expenses to the deceased’s wife and children. This was formalized through a family agreement which was signed by the widow on behalf of all legal heirs of Kamran.

You can read the agreement above, but the key features are

All assets released by banks should be handed over to EGC for liquidation and settlement of all liabilities.

Upon receipt of succession, the assets of Kamran Ilahi will be transferred to EGC for settlement of all liabilities.

Danish’s father, Arif Elahi (“elder of the family”) will be the arbiter, his decisions will be binding and will oversee distribution in line with Shariah.

Usman Elahi, the legal heir, does not have to return from Australia till he completes his studies.

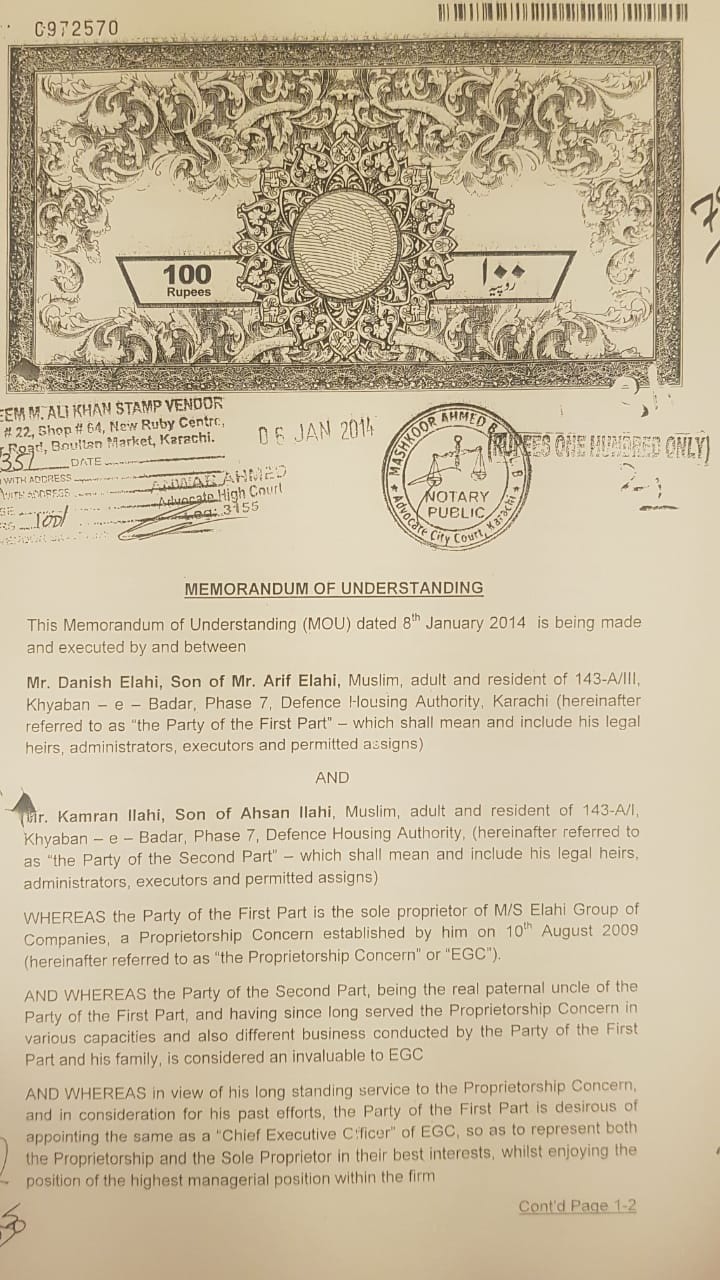

Maybe Danish is reciprocating the favor his deceased uncle bestowed upon him by becoming the “CEO” of his fledgling EGC in 2014.

3. VC that the country needs

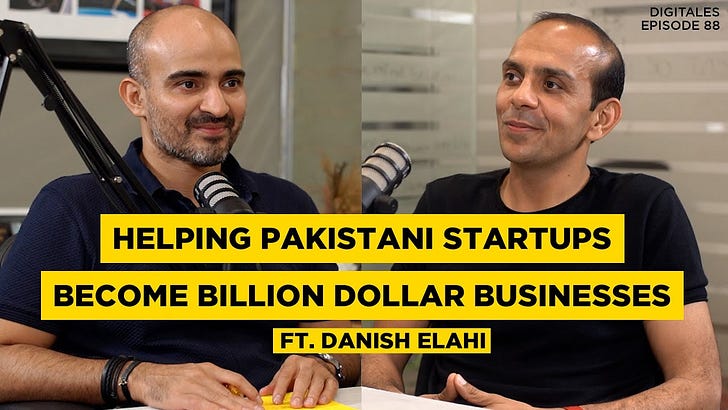

I admit, a few weeks ago, I didn’t know who Danish Elahi was. Now I wish, I never knew him. I came across this podcast on youtube where he is talking about helping Pakistani startups reach billion-dollar valuations.

The podcast and vision of Danish Elahi is very timely considering that VCs in Pakistani Twitterverse (or Xverse as Elon has changed its name to X) are complaining about the press Jugnu’s scaling down and pivot was receiving.

Last week, we saw Danish putting his money where his mouth is by getting his Blueex to sign an MoU with the darling Pakistani startup Abhi.

ABHI has partnered with Universal Network Systems Limited (UNSL), which operates under the brand name BlueEX, to offer e-commerce Revenue, Cash-on-Delivery Financing, and inventory financing in Pakistan, a complete solution for the financing needs of not only eCommerce Companies but also other SMEs in Pakistan (AbhiCOD).

This follows an earlier announcement in March 2023 where Abhi to acquire 2.74 million shares in Blueex.

Universal Network Systems Limited (UNSL), operating under the brand name of BlueEX, announced on Wednesday that ABHI Private Limited (ABHI) will acquire an equity stake in the company.

In a notice to the Pakistan Stock Exchange (PSX), the company said that the acquisition will make way for Pakistan’s largest platform to tap into fintech & logistics deployment in the retail distribution of products across Pakistan.

How the acquisition by ABHI of shares in Danish’s Blueex and the subsequent signing of MoU with the same Blueex will turn ABHI into billion dollar startup is left as an exercise for the reader.

Board of Directors of Blueex.

I covered ABHI’s earlier financial engineering attempt in my post Analyzing the ABHI Sukuk

So while it may look naive to us that the company is having a negative carry i.e., earning 20% on MMF while paying 25% on Sukuk, the company is showing growth in the balance sheet. In the above illustrative example, a company doubled the size of its balance sheet by borrowing through a Sukuk. If the company had encashed the units to lend money, the balance sheet size would have remained the same.

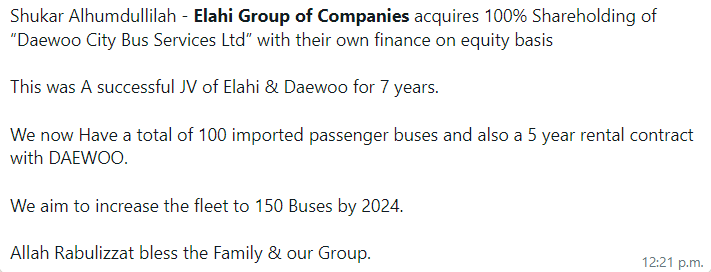

But I am digressing. This post isn’t about Abhi. It’s about Danish. My first formal introduction to Danish was when I wrote about his WhatsApp message broadcast on June 12, 2023, about his 100% takeover of Daewoo City Bus Services Limited in my Daewoo Pakistan: The story that wasn't told.

4. The Family Tree

Note the last line mentioning “the Family and our Group”. My formal research into Danish, the Elahi family, and the Elahi group made me realize that there are too many Elahis in this story so I made a family tree based on various publicly available documents. The tree isn’t exhaustive as people not mentioned in the documents aren’t shown. Some of them spell their name as Ilahi instead of Elahi. As I don’t have an editor and this is a free substack, I can’t be bothered to make sure I get the spelling right everywhere. Apologies in advance if I offended anyone in the Elahi family by misspelling their Elahi/Ilahi. (You can click the image to enlarge and come back to it if you get lost in the Elahis in the rest of the post).

From the sons of Ahsan Elahi, Arif Elahi is an IBA grad with a questionable reputation and rumors of also being a loan shark, while Kamran Ilahi was a proprietor of the successful trading firm Elahi Electronics and reportedly had a good reputation in the market. Danish is the son of Arif Elahi and the proprietor of the proprietorship Elahi Group of Companies.

5. Kamran Ilahi - an obliging family man

A couple of years before Kamran Ilahi’s tragic death, in 2014, though Danish Elahi boasted a significant net worth, neither he nor his proprietorship concern Elahi Group of Companies (EGC) had a standing in the market. He reached an arrangement with his uncle Kamran Ilahi to appoint the latter as CEO of EGC. The purpose was to ride the coattails of Kamran Ilahi’s reputation as a successful operator of businesses and gain access to Kamran’s network of business relationships. Below is an MOU between Kamran Ilahi and Danish Elahi appointing the former as CEO of EGC. From the phrasing, it is clear that the purpose of the MoU is for EGC and Danish to benefit from Kamran’s standing in the business community.

6. Birth of a takeover artist

Now that Danish has appointed Kamran as CEO of EGC, he makes his move. He makes a bid in 2014/15 for taking over Heavy Electrical Complex (HEC) at its privatization. The privatization commission even pre-qualified EGC. Only three companies bid for it, but two of them bowed out including EGC.

In all, three parties were qualified to bid in response to the current divestment process that has been going on for more than a year. These included Fauji Fertilizer Company, Elahi Group of Companies and Cargill Pakistan Holdings; though none has the experience or background of running a similar or any engineering industrial unit that should have been the pre-requisite for pre-qualification. The due diligence was carried out by all the three parties but only Cargill participated in bidding on due date. Given the conditions, it seems that the prospective investors were interested only in valuable real estate belonging to the HEC, as the factory is located in a front-line industrial estate, with all requisite infrastructure facilities.

Privatizations are usually political affairs. We don’t know what took place behind the scenes that EGC and Faujis opted out. But we can see Danish’s shrewd business acumen of already benefitting from making his uncle a token “CEO” of EGC to make a bid for HEC.

7. Was the family agreement a family rescue or family usurpation?

Maybe Danish signing the family agreement under the influence of family elders was reciprocating this generous favor that his deceased uncle bestowed upon him by becoming a token CEO. But the two lawsuits in Sind High Court tell a different story. Here Danish Elahi and family (“Elahi family”) question the succession certificate that the deceased’s heir got rightfully issued in their own favor. You can download the court judgments and reach your own conclusions.

Elahi Group of Companies claim that they paid the bank liabilities of Kamran Elahi but the court notes that not a single letter was produced to substantiate this claim. (We will see later that Danish et al frequently make such unsubstantiated claims). Defendants in the below excerpts are heirs of the deceased i.e., Mariam Kamran and his son Usman Elahi while the plaintiffs are Danish Elahi and the rest of the Elahi family.

the plaintiff (Danish Elahi) paid an amount of Rs.1,855,904,866/- to various banks, expended an amount of Rs.328,564,000/- on the suit properties as well as paid an amount of Rs.75,000,000/- to the defendants (Widow and the son of the deceased) for their personal travelling and general household expenses (not a single letter from any bank is available to show that deceased’s liability has been fully paid). The plaintiff further averred that the defendant surreptitiously and furtively obtained succession certificate without disclosing the liabilities of the deceased and Family Agreement, as well as breached the Family Agreement. As the time went by, per learned counsel, the banks served notices upon the plaintiff No.1 (Danish Elahi) to pay the liabilities of the deceased as the plaintiff No.1 was directly accountable (no such letter has been shown either)

The heirs Mariam Kamran and Usman Elahi claimed that the agreement and signature were forged.

…challenged very authenticity of the subject Family Agreement by pointing out that the said Agreement is shown to have been signed by the deceased’s wife on 30 May 2016, just within 3 days from the death of Mian Kamran Elahi when the lady was in Iddut as well as under utter shock and duress. As well as if the said agreement is taken on its face value, it is not signed by other legal heirs of the deceased, thus cannot be enforced against them.

The counsel for the legal heirs (Mariam Kamran and Usman Elahi) further argues

….Family Agreement is a forged and fictitious document (not even written on a Stamp Paper nor witnessed by any independent persons) that also contrary to the public policy as well as void in terms of Section 24 of the Contract Act, 1872, therefore, cannot be enforced through a court of law…. The next stance is that three assets/properties in the list of properties ordered to be stayed are personal assets of the widow hence cannot be subject to the terms alleged by the plaintiffs.

The shamelessness of the Elahi family to go after the personal assets of the widow.

The court sided with the widow and her son and passed the judgment that the request of Danish Elahi and the Elahi Family to prevent their heirs’ access to their own assets is throttling the livelihood of the heirs.

the present application for seeking a moratorium on access of the grieving family to the assets of their father/husband is not only against injunctions of Islam, it also offends the provisions of the Succession Act which enables the legal heir to administer assets of the deceased, and if the Plaintiffs had any objections, they could have joined the proceedings as objectors. This court sees acts of the plaintiffs aimed to throttle livelihood of the deceased‟s legal heirs and put them to the caprice of the Plaintiffs, an act offensive to dignity of human thus the Family Agreement sought to upkeep family‟s honour in fact is nothing but a sophisticated form of honor killing, tossing the widow (alongside her children) to the dust of injustice. For what has been reduced in the foregoing, I do not see any prima facie case of plaintiffs, neither balance of convenience in their favour, nor they would suffer any irreparable losses as their claim is only for money. The application is hence dismissed.

The court called the forged family agreement a “sophisticated form of honor killing”. Initially, I thought that this was the court being too dramatic. As I learned more about the Elahi Group of Companies, I realized the court had it correct. May Allah save us from having such relatives.

The Elahi family forged a signature of the widow on a family agreement when as a pardanasheen lady she was in iddat and in shock and duress on the fourth day of the death of her husband.

The document has apparently been signed by the widow on behalf of legal heirs which she can’t do anyway as other heirs are apparently of legal age.

The Elahi family claims that banks are approaching them for payment of Elahi Electronics liabilities though no such letter has been shown

The Elahi family claims that they have paid substantial sums to pay the living expenses of the widow and the liabilities of Elahi Electronics though no such letter has been shown.

The Elahi family not only tries to deny the rightful succession to the heirs but also tries to take over the personal assets of the widow.

The court sides with the defendant and allow them to have control of the assets as per the succession certificate.

If you go to the family agreement again, you will see that this is how the elder of the family Arif Elahi was trying to manage the distribution of assets in the light of Sharia. More like, cannibalistic scavengers if you ask me.

7.1 - Appeal

The Elahi family isn’t satisfied. They file an appeal.

8. The Elder of the family - Arif Elahi

In the above court documents, the court notes that Arif Elahi was present in all the court proceedings while not being a party to the case. Who is Arif Elahi? The brief summary from the IBA page. He claims to regularly give lectures at IBA and is listed among their notable Alumni.

For some reason, Arif Elahi tried to get himself elected to the board of K-Electric last year and submitted the following CV.

See below the notice announcing the election to the Board of Directors of K-Electric. Arif Elahi at Serial #2 nominated himself for the director position at K Electric.

Unfortunately, he was one of two candidates in the above list that were unsuccessful.

I don’t know why he hoped he had a chance unless he expected his friends in bureaucracy to support him as a GOP-nominated director.

In 2015, Arif Elahi and EGC were accused of loan sharking. The below is from the October 23, 2015 issue of Daily Times which has been taken offline. But if you have access to their archives, you can find it.

9. Loan Sharking and a trip to Adiala

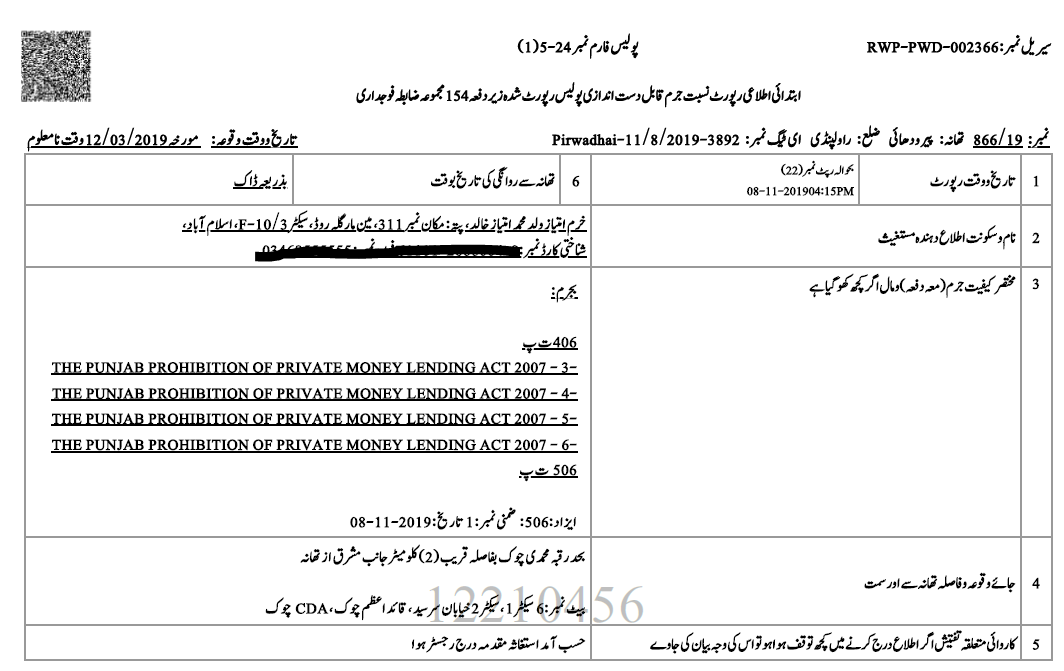

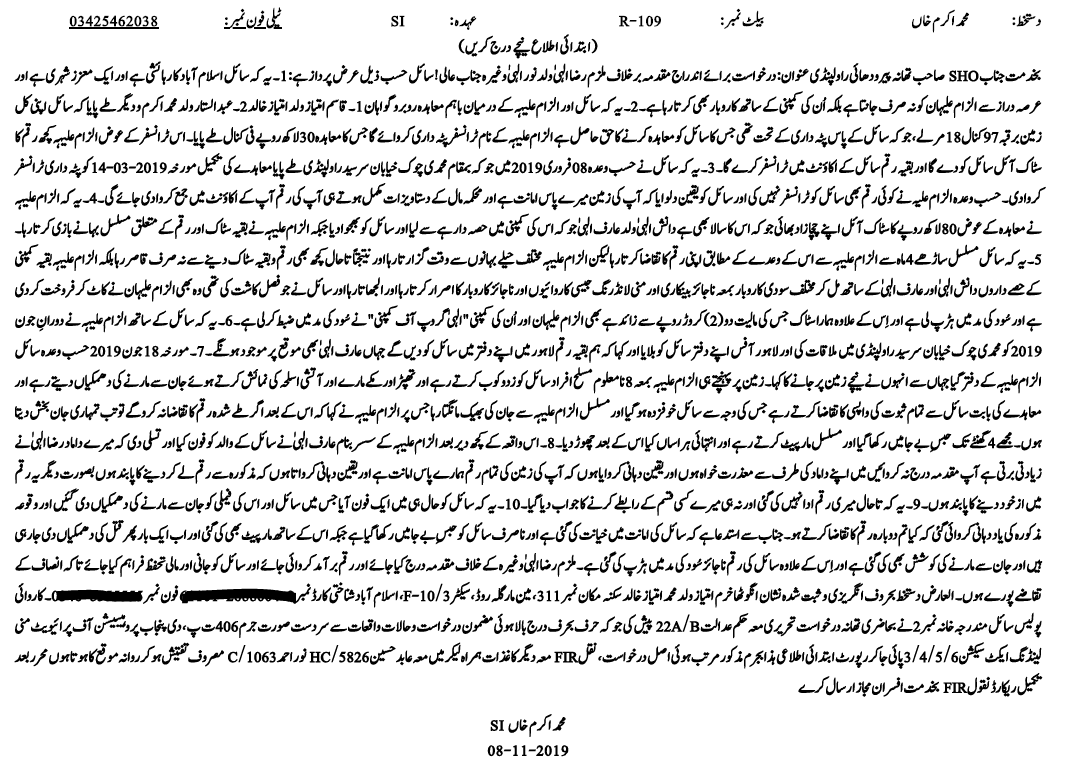

Whenever I inquired about Danish Elahi, the reply in hushed tones, without any substantial evidence, has been that he is the largest corporate loan shark. I apologize that I am introducing a rumor in this post when I always try to stay clear of those. The closest evidence I came across is the below FIR (caveat: FIR is an allegation and not a conviction).

The FIR is registered referring to the “Punjab Prohibition of Private Money Lending Act 2007”. The “family elder” Arif Elahi who some call the original loan shark of the family makes an appearance in the FIR.

You can read the FIR by clicking on the above image to enlarge it but the summary is

Imtiaz (the complainant) has been dealing with Elahi’s for a while. He sold a plot of land to Raza Elahi who is the son of Noor Elahi (brother of Danish’s dad Arif Elahi) and married to Danish’s sister. The payment was supposed to be made in the form of money and the balance in oil stock. Part of the oil stock was taken from Danish and transferred to Imtiaz but the rest of the oil stock and balance of money was never transferred. Rather Imtiaz was encouraged by the Elahi’s to become a partner in the money lending and money laundering business that the Elahi’s run, which Imtiaz refused. Moreover, they treated the oil stock given to Imtiaz as a loan and harvested his field and sold off the produce saying it is being adjusted in lieu of interest on the loan of oil stock. On Imtiaz’s repeated insistence, he was called to the office of Raza Elahi and was told that the elder of family Arif Elahi will be there. In the office, he was beaten, kept on habeas corpus for 4 hours, threatened with death, and released on the promise that he won’t ask for money again. Subsequently, Arif Elahi called Imtiaz’s father apologizing on behalf of Raza Elahi and saying that he himself will ensure the payment of money. Later Imtiaz received a call saying that he and his family will be killed if he doesn’t back down.

They were arrested and sent to Adiala

Accused sent on judicial remand in embezzlement case

A court on Tuesday sent an accused to Adiala Jail on 14-day judicial remand in a case registered against him on charges of misappropriation of money and private money lending, informed sources.

The court also disallowed the request of Pirwadhai Police for discharge of accused identified as Raza Elahi in the case, they said.

The accused is said to be owner of Elahi Group of Companies, who has been arrested by police from Lahore and transferred to Rawalpindi with transit remand.

Earlier, Pirwadhai Police booked Raza Elahi with ex-Federal Secretary Arif Elahi and Danish Elahi under section 406 of Pakistan Penal Code (PPC) and under The Punjab Prohibition of Private Money Lending Act 2007 (3-4-5-6) on complaint of Khuram Imtiaz and began investigation, source said.

9.1 - Buying off the investigative officer

A feature amongst the elites is that they can buy off the investigative officers or minimize the nature of the offense. We will see this again later in the post. When the matter went to court, the Investigating Officer (IO) wanted the charges against Raza Elahi dropped but the court was having none of it.

“Furthermore, the opinion of IO is not based on legal ground. It is settled principle of law that opinion of police is not binding upon the court, especially when not based on any cogent material,” the judge observed in his verdict copy of which is also available with The Nation. The judge also stated in the light of above discussion request of IO for discharge of accused is hereby disallowed and the accused Raza Elahi is sent to judicial lock-up from where he would be produced before the court on December 14, 2019 for further proceeding.

The police shifted the accused to Adiala Jail amid tight security, sources said.

The accused were subsequently released on bail.

10. Child abduction and sexual assault

Loan sharking is a thuggish business. We see in the above FIR that the elder of the family Arif Elahi was actively involved in the loan sharking business of his son-in-law Raza Elahi. You have to hire thugs to enforce your decisions. Below is one such FIR which shows the kind of thugs these loan sharks hire.

I don’t have the heart to translate or summarize the above FIR. The usual caveat that this is an FIR and not a conviction applies. However, if your googling skills are good, you can find news about how police conducted a raid and were able to free the child. However, they released the culprits who abducted the child without any charge. Not surprising at all.

11. Bank Islami Embezzlement - Notice lawsuit

This section may become a document dump. But the payoff will be worth it.

In 2019, Bank Islami Pakistan Limited (BIPL) filed two lawsuits against Elahis. In addition to the usual culprits, Danish Elahi and EGC, we also have Zafar Agencies (a sole proprietorship of Danish’s mother Shazia Arif as a respondent. The total claim is for ~Rs.1,390 million (Rs.518million + Rs.872 million).

FIA investigated the matter. The summary is:

Bank Islami employees, mainly Saad Ahmed Madani, Head of Corporate Banking, and Adnan Naseem, Head of Corporate Banking (South), were working in connivance with Elahi Group of Companies. They would call borrowers to repay their banking facilities by issuing a cheque/payorder in favor of BIPL (for payment of principal and interest/profit) and BIPL charity accounts ( for the late payment fees and late payment interest as an Islamic bank is not supposed to charge late payment charges but if it does so as a deterrent, the bank is supposed to direct late payment charges towards charities).

Once the two officers received the cheques (note that the cheque was in favor of BIPL or BIPL charity account), they would request the branches to submit them for payment of loans of Elahi entities. They would even get Elahi entities to issue cover letters to go along with these cheques.

While the above MO was tried on many companies (mainly sugar refiners but others as well), only three filed complaints with FIA i.e., Ali Altaf Saleem, MSA Industries (Pvt) Limited, and Husein Sugar Mills Limited. You can download the FIRs below.

Ali Altaf Saleem

2. MSA Agenices

Husein Sugar Mill

11.1 - Ali Altaf Saleem - misdirection of cheques

Below is the excerpt from FIA’s investigation into Ali Altaf Saleem’s claim. The cheques issued by Ali Altaf Saleem were deposited into Zafar Agencies account supported by letters issued by Zafar Agencies (Danish’s mother’s proprietorship).

The BIPL employees went a step further. They asked the borrower, Ali Altaf Saleem, to issue a cheque favoring the charity account. However, after receiving the cheque, they requested a waiver from the senior management for the charity fee without informing them. Once the approval was received, the cheque was used by the employees for other purposes (paid to themselves or to Zafar Agencies - we don’t know how the charity cheque was directed from the FIA investigation report). An evil masterstroke because borrower would have no idea: from his account statement, he would see late payment charges disappear and presume that his cheque was used to payoff the charges while in truth, charges were waived by the management and cheque proceeds were used by employees/Elahi family.

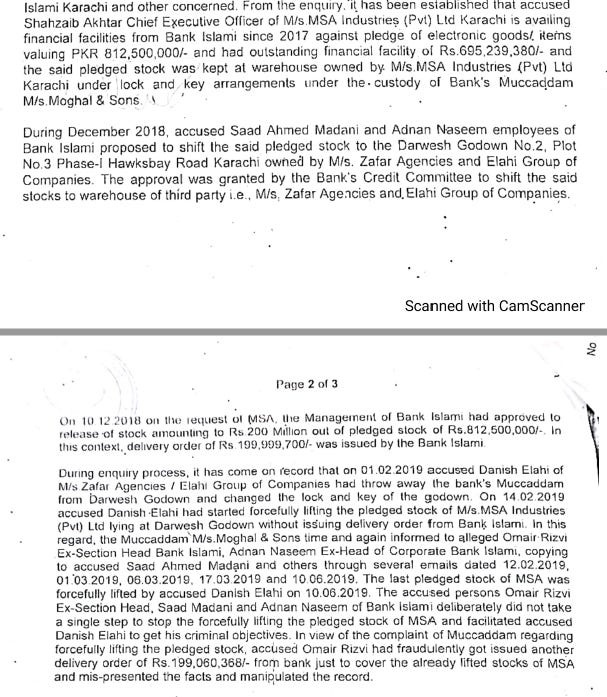

11.2 - MSA Industries - forcefully removing muccaddam and stealing stocks

To be a loan shark, one needs to be a thug and be willing to intimidate, torture and even threaten to kill the family of the borrower. If that is the case, removing the muccaddam of the bank and stealing / illegally lifting stocks doesn’t seem like such a big deal.

Do you know what is the most interesting aspect of this event? Danish claims to be building a next-generation logistics, supply chain, and warehousing enterprise in his various press releases, announcements, MoUs with startups and taking over Daewoo. Yet here he is acting like a common thug and lifting stocks. I wouldn’t trust my supply chain to him.

11.3 - Husein Sugar Mills - misdirection of cheques

This case is similar to the Ali Altaf Saleem where the cheques issued by Husein Sugar Mills to pay off their loans were misdirected by bank employees supported by letters from Zafar Agencies (Danish’s mother’s proprietorship).

11.4 - Tip of the iceberg

But this is just the tip of the iceberg. As per the below excerpt from the FIA investigation (not attached here), there are other entities where FIA suspects Danish Elahi to have committed similar fraud including such entities as Huda Sugar Mills, Seven Star Sugar Mills, Q Mobile, Changhong Ruba, and Noon Sugar Mills.

However, the way FIA works is it doesn’t approach other such entities. To give you an example, see the below 2-minute report about a banking fraud (unrelated to Elahi Group) being investigated by the FIA Cybercrime wing in Gujranwala. The interesting this is at 1:40 mark, the FIA official says that FIA has identified many more victims that have been scammed but waiting for the victims to approach FIA before providing redressal. May be FIA cannot take action unless the affectees complain but no one is stopping FIA from reaching out to the affectees and asking them to lodge the complaint. Since many affectees are unaware or may be turned away by bank staff, FIA is not reaching out to them. WTF!!!!

The same thing is happening in the aforementioned case where FIA knows that Danish Elahi has scammed these companies but since no one from these companies has approached FIA, FIA itself won’t be reaching out to them. If you know people in those companies, you may want them to have their loans with Bank Islami audited.

11.5 - Danish Elahi Arrested

FIA arrests Danish Elahi in the Husein Sugar Mills case.

Based on these acts of omission and commission, it has been prima facie concluded that Naseem, Elahi, and Arif, with criminal and common intentions by the misuse of power, and criminal breach of trust by fraudulent activities have caused substantial loss to the customer M/s Husein Sugar Mills, which is ultimately a loss to BankIslami and a wrongful gain of Rs. 15 million by them. Therefore, the offense committed is punishable under the law.

Officials said that the FIA has arrested the prime accused and a few former employees of BankIslami Pakistan Limited as their bails were rejected by the magistrate.

Elahi Group is also in default of Rs 1.4 billion of the bank, and the FIA is also conducting a separate inquiry against it, officials said.

Danish Elahi is out on bail now.

12 - PR pieces - Cordoba Logistics

I get published in The Profit so I have a soft spot for them. The BIPL case has been running since the end of 2019 and Danish is arrested in September 2021. The Profit had two pieces in 2021 on Elahi Group’s acquisition of Mian Textile Mills which Danish is converting into a warehousing business under the Cordoba Logistics brand name. The first report doesn’t mention the BIPL case which one would presume is pertinent news if one is writing a profile of the person.

In April 2021, the deal was finalised and Danish Elahi acquired a comfortable majority of 70.23% of the company. However, the change in ownership was not the only transformation that Mian Textiles was undergoing. Since Elahi took over, the company has made a hard pivot towards what would seem like an unrelated field – logistics and other ventures. This is where the Elahi Group of Companies has their expertise.

The second piece was puffy and published a couple of months Danish Elahi was arrested by FIA in their inquiry into the case of Bank Islami embezzlement but the Profit piece didn’t make any mention of it.

Board of Directors of Cordoba Logistics

13 - Guns to the head - again

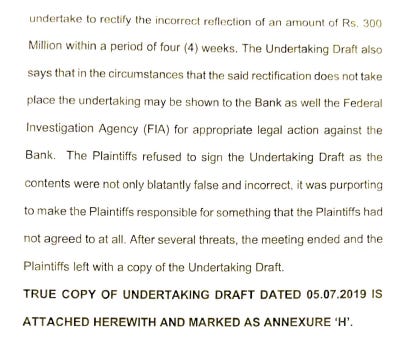

If you aren’t impressed yet, I am sure this section will provide a nice jolt. Below is the excerpt from FIA report. There is a lot going on in that excerpt and it is not written clearly. Unfortunately, this is how our babus write their investigative reports. To summarize:

Elahis had two facilities. One for Rs.1 billion and another for Rs.300 million (Remember the total lawsuit of BIPL against Elahi’s is for ~Rs. 1.3 billion). Elahi’s are disputing through a legal notice that they never availed the said Rs.300 million and attached a legal undertaking from Saad Madani and Adnan Naseem (see point 4 below) that they as officers of BIPL are personally responsible for this misunderstanding.

In response, Saad Madani and Adnan Naseem filed the following in court.

There is a lot going on in this case but right now we are focusing on the undertaking. In the below excerpts, the plaintiffs are the two officers mentioned earlier in this paragraph. Defendant 1, is Shazia Arif, Defendant 2 is Danish Elahi and Defendant 5 is the elder of the family, Danish’s father, and Shazia’s husband Arif Elahi. Defendent 3 is MSA Agencies and Defendent 4 is Sigma Refrigeration with whom the Elahi’s have a loansharking relationship as will become clear in the next section after this one.

The plaintiffs (BIPL employees) claim that the Elahis called them to their offices and asked them to sign an undertaking under threats of dire consequences including immediate arrest as the DIG of the police was on the speed dial of Arif Elahi. The undertaking will say that it was the error of BIPL’s employees that resulted in the books showing Rs.300 million to Zafar Agencies. The employees balked at the utter ludicrousness of this and despite the threats, refused to sign the undertaking. Later it turns out that the Elahis forged the signature of the employees on the undertaking and submitted it as part of their response to the court/FIA inquiry about the Rs.300 million loan.

So what we see here is that the illustrious Elder of the Elahi family, Arif Elahi not only threatens bank employees with dire consequences if they don’t sign false undertakings but also forges their signatures and then submits them to FIA and the court.

Please tell me, dear reader, that you are somewhat surprised.

14 - Loan Sharking Again

The same lawsuit also hints at the loan sharking business. Apparently, the Elahi’s borrow from BIPL and then lend the money to MSA and Sigma (defendants 3 and 4 respectively) most likely at higher rates. The only question is why is the bank and bank officers a party to such loan sharking arrangements.

If you noticed, BlueEx Logistics (the logistics startup of Danish Elahi) also made an appearance. The same Blue Ex in which the startup ABHI is buying a stake and later with whom signing an MoU.

15 - BIPL Settlement

On November 2021, BIPL and Elahi Group settled.

BIPL, Elahi Group file compromise pact in SHC - Pakistan - Business Recorder (brecorder.com)

KARACHI: Bank Islami Pakistan Limited (BIPL) and Elahi Group of Companies (EGC)/Zafar Agencies (ZA) have filed a compromise agreement in the Sindh High Court through which all liabilities will be settled and full closure and withdrawal of all pending complaints and litigation has been agreed on a no-fault basis between the parties; accordingly, the matter stands fully resolved.

According to an announcement made by Elahi Group file compromise on Tuesday, both parties expressed their disappointment that a commercial dispute got dragged in with the Law Enforcement Agencies; and both parties shall make concerted efforts to facilitate each other and further strengthen their relations.

Reportedly, as part of the settlement, Elahi Group paid back only the principal amount of Rs.1 billion (interest on the two years for which the loan was outstanding and in default wasn’t paid nor the Rs.300 million that was disputed through the forged indemnity).

16 - Buying off FIA officers

In section 9.1 above, we talked about how the police investigative officer was apparently bought off by Raza Elahi but the court was having none of it. The same appeared to be the case in the Bank Islami case where the FIA officers wanted to recuse Shazia Arif because she reached a settlement with BIPL for all the frauds that were conducted under her signatures to settle the Zafar Agencies’s loans yet continue to try the BIPL employees. The below is from FIA challan.

So FIA is charging the bank employees but the mastermind of the entire embezzlement Ms. Shazia Arif (and the rest of the Elahi clan) is not being charged. This is how the wheels of justice work.

16.1 - The court disagreed with FIA

Thankfully, not only the court disagreed but also questioned the credibility of FIA officer.

Each and every sentence of the below court judgment needs to be read hence I have highlighted all of them. Just goes to show you the influence of Elahis.

The cases are ongoing but we don’t know how they will turn out.

17 - Elahi Group loses the appeal

In section 7.1, I mentioned that the Elahi Group had filed an appeal against the court judgment favoring the widow Mariam Kamran and her access to assets.

The court dismissed the appeal.

When the Family Agreement by itself has been disputed in toto by respondents, and the trial court is not certain of its authenticity, as expressed by it in the impugned order, no sanctity prima facie could be attached to it by this court by putting it in contrast with above provisions of law in order to determine respective performances and rights of the parties under thereof. The foregoing discussion has persuaded us to believe that in this appeal the appellants, for the relief sought for by them, musts fail. Accordingly this appeal is dismissed and disposed of accordingly along with all applications without any order as to cost.

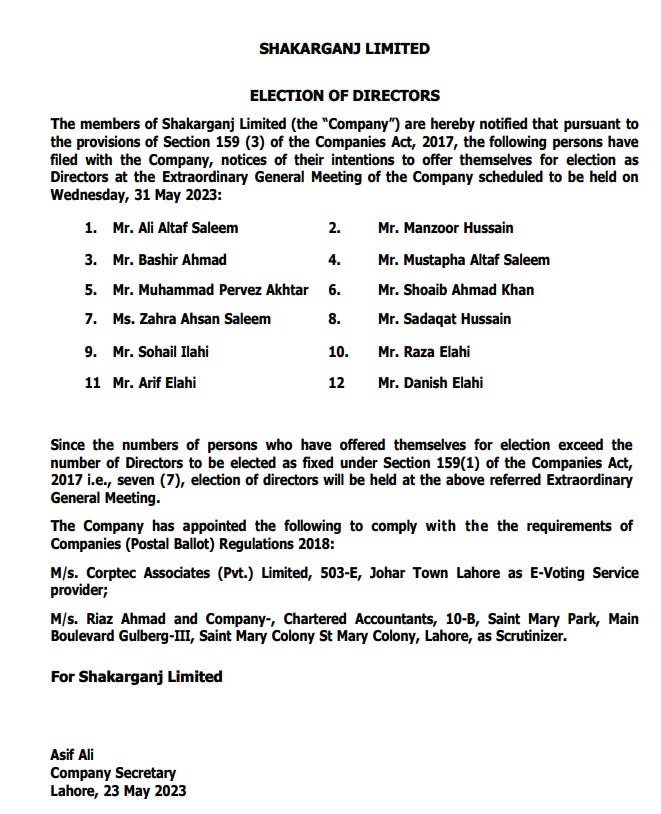

18 - Elahis try to take over Shakarganj Mills

We have seen that Elahis love to take over. Started with Heavy Electrical Complex, took over Mian Textiles, and Daewoo City Bus Services Limited. The elder of the family Arif Elahi nominated himself on the board of K-Electric but failed. Tried to take over the assets of their deceased brother Kamran Elahi and deprive the heirs of their rights. In May 2023, the entire Elahi clan (ok, four members of the family i.e., Danish, his father Arif, his chacha Sohail and his cousin Raza at sr# 9-12 below) applied for directorships at SML.

Now some technical details. The total number of shares of SML is 125MM. The Elahi’s own 6MM shares but claimed proxies of 36MM more translating into a ~33% shareholding base. Those 36MM shares are owned by Mahmood Group of Multan. 36MM shares translated into a holding just below 30%, a threshold wherein under Securities Act 2015, Mahmood Group had to make a tender offer. But in this takeover attempt, Mahmood Group is siding with the Elahi Group.

Elahi Group (along with Mahmood Group) holding 33% votes was asking for 4 seats on a 7-member board thus taking over the SML board. However, due to legal and technical deficiencies in the 36MM proxy votes, those votes couldn’t be counted. The Elahi clan failed in its takeover attempt as not one of their member made it to the board.

And now Arif Elahi (along with Mahmood Group) has filed a suit in Lahore High Court on July 5, 2023, against the rejection of proxies.

We will see how this will evolve.

19 - Digression - Shameless Replug

Now for some shameless replugging. If you find the above-failed takeover attempt interesting, I recommend you read my following piece on the successful hostile takeover of Adamjee Insurance by MCB Bank.

Nishat Group #3: Hostile takeover of Adamjee Insurance

This is my third post in my series on Nishat Group which started with Shahzad Saleem’s tweet. It will be another wonky post and is about one of the largest and most successful hostile takeovers in the country. If you are receiving it over email, it may have been clipped. Click on the title above to read it on the website.

20 - Epilogue - Secret to their success: Believe in Allah and Honesty.

I think it has come to wrap this post up. Despite a few setbacks, Danish Elahi and Elahi Group have quite a few successes to their name. And they boast significant net worth. What is the secret to their success? From their website

If you made it this far and found it interesting, please smash the LIKE button and share this post with your near and dear ones.

Let me repost section 3 from above.

REPEAT: Danish Elahi - the VC that the country needs

I admit, a few weeks ago, I didn’t know who Danish Elahi was. Now I wish, I never knew him. I came across this podcast on youtube where he is talking about helping Pakistani startups reach billion-dollar valuations.

The podcast and vision of Danish Elahi is very timely considering that VCs in Pakistani Twitterverse (or Xverse as Elon has changed its name to X) are complaining about the press Jugnu’s scaling down and pivot was receiving.

Last week, we saw Danish putting his money where his mouth is by getting his Blueex to sign an MoU with the darling Pakistani startup Abhi.

ABHI has partnered with Universal Network Systems Limited (UNSL), which operates under the brand name BlueEX, to offer e-commerce Revenue, Cash-on-Delivery Financing, and inventory financing in Pakistan, a complete solution for the financing needs of not only eCommerce Companies but also other SMEs in Pakistan (AbhiCOD).

This follows an earlier announcement in March 2023 where Abhi to acquire 2.74 million shares in Blueex.

Universal Network Systems Limited (UNSL), operating under the brand name of BlueEX, announced on Wednesday that ABHI Private Limited (ABHI) will acquire an equity stake in the company.

In a notice to the Pakistan Stock Exchange (PSX), the company said that the acquisition will make way for Pakistan’s largest platform to tap into fintech & logistics deployment in the retail distribution of products across Pakistan.

How the acquisition by ABHI of shares in Danish’s Blueex and the subsequent signing of MoU with the same Blueex will turn ABHI into billion dollar startup is left as an exercise for the reader.