Nishat Group #3: Hostile takeover of Adamjee Insurance

This is my third post in my series on Nishat Group which started with Shahzad Saleem’s tweet. It will be another wonky post and is about one of the largest and most successful hostile takeovers in the country. If you are receiving it over email, it may have been clipped. Click on the title above to read it on the website.

Just a note, when the newspaper reports mention Adamjee Insurance as the largest insurance company, they are referring to the non-life insurance sector where Adamjee Insurance had around 40% market share.

The Timeline

Adamjee Insurance had fought a few hostile takeover attempts by various entities over the previous years where investors would acquire Adamjee shares from the market and then try to appoint directors on the board of Adamjee to wrest control away from the Adamjee family.

July 1999

One such attempt was made in the Annual General Meeting (AGM) of 1999 when I.Puri Securities (Pvt) Limited tried to get 7 seats on the 9-member board of directors of Adamjee but was successful in getting only one.

Adamjee family retains insurance co management

KARACHI, June 30: The Adamjee family managed to retain firm control over their Rs 3.3 billion insurance company, when seven directors nominated by the group, were elected to the nine- member board.

The elections to the Adamjee Insurance Company board of directors were held at the company's annual general meeting on June 30. All the month-long sound and fury of a possible hostile take-over of the largest insurance company of Pakistan, died down with a whimper as I.Puri Securities (Pvt) Ltd., managed to bag only a single seat. The securities firm was said to be eying seven. The ninth seat was captured by HBL.

Contrary to expectations, proceedings at the AGM turned out to be quiet and peaceful. Shareholders participated in large numbers and at least four past presidents of the Karachi Stock Exchange (Jahangir Siddiqui, Amin Issa Tai, Ferozuddin A.Cassim, Arif Habib) and the sitting chairman, Mohammad Yasin Lakhani, were conspicuous by their presence.

Earlier, the Adamjee family had filed eleven nominations, but withdrew four; all of the seven in the run up to the elections were successful. They included Mohammed Hanif Adamjee; Abdul Hamid Adamjee; Abdul Razzak Adamjee; Mohammed Choudhury; Izaz Ahmed Rafiqui; Akhtar K.Alavi and Iqbal Adamjee.

Of the two candidates who stood for HBL, Mian Asif Saeed was elected. Saad M.Ali, nominee of the I.Puri Securities (Pvt) Ltd. filled the ninth place on the Adamjee Insurance board.

In the same AGM, the shareholders criticized Adamjee as making more profits from investments than their core business of insurance. The Chairman and MD disagreed with the sentiment. The shareholder should have been content as in a few years, the company’s core motor insurance business in UAE will wipe out all the profits made in the earlier years.

Before the shareholders were called to vote, the accounts for the year ended Dec 31, 1998 came up for discussion.

Chairman Mohamed Hanif Adamjee pointed out that the company had made after tax profit of Rs 196.4 million during the year.

He did not agree with a shareholder that the company was losing money on the core insurance activity and that it was deriving all of the profit from investments.

He said that the underwriting profit for 1998 had improved to Rs 90.9 million, from a year ago profit at Rs 87.8 million. But he did concede that in line with the general trend in the industry, motor business was contributing major losses; motor revenue account posted loss of Rs 95.2 million for the latest year, up from Rs 31.6 million in 1997.

The company MD, Mohammed Choudhury said it was unfair to criticize the company for a lean year.

All of the reserves and investments that the company had built up over the years, he argued, had been made from the insurance business, which was still showing steady growth.

March 2002

Three years later, in 2002, two things happened.

One, Adamjee declared the first loss in its 40-year history, and that too a huge one at Rs.500 million. most likely on account of its core insurance business of motor insurance in the UAE.

KARACHI, March 23: Adamjee Insurance Company Limited — the largest insurance company in Pakistan — reported on Friday, net loss in the staggering sum of Rs500 million for the year ended December 31, 2001. The loss is thought to be the first red ink in the 40- year history of the company.

Since the insurance giant had already posted Rs212 million in losses for the first half of the year, everyone was expecting the full year also to end in deficit. But the after tax loss of Rs499 million announced by the Board at mid-day Friday, stood out as ‘worst-than-expected’. (Just how ‘worst’ can be gauged by the fact that one leading brokerage house had estimated the loss to be lower than Rs200 million).

The year before, company had reported after tax profit of Rs156 million and distributed cash dividend at 15 per cent along with bonus shares also at 15 per cent. The board did say on Friday, that it was omitting dividend for the year 2001, but did not disclose other relevant figures of revenue and claims paid.

The Board also did not issue a statement to explain the reasons for the devastating loss, leaving investors to fend for themselves. Annual General Meeting (AGM) is scheduled to be held on May 7, at Karachi.

Two, a hostile takeover was expected in their AGM scheduled for May 7, 2002.

Election of directors would presumably be on the agenda at the AGM. While several previous attempts to wrest the company control from sponsors have failed, the threat this time looks real. Mansha group — that has interests in cement, textiles and of course the Muslim Commercial Bank — is understood to have prepared itself for the raid.

The latest MCB accounts for the year ended December 31, 2001 show that the bank has bought 15.8 million shares in Adamjee at cost of Rs943.6 million (at average of Rs60 per share). MCB had raised its stake in Adamjee, from Rs798.1 million at end of 2000. Given the total outstanding Adamjee shares at 54.3 million, MCB was seen to be in command of nearly 30 per cent of the Insurance company’s equity.

Employee funds and associated companies could also be holding some of the equity. “We estimate that MCB sponsors hold over 40 per cent of Adamjee equity”, says Mohammed Sohail, head of research at Invest Capital & Securities. He argues that with the support of some proxies, the group would be able to place as many as five of the nine directors on the Board, “assuming no legal restrictions occur”.

The hostile take-over law is yet to see the light of day, but if the corporate raiders succeed in wresting the control of Adamjee Insurance at the AGM on May 7, it would go down in history as the first ever takeover of a huge company in Pakistan.

This time, it wasn’t some upstart brokerage. It was the Mansha Group, one of the newer robber barons and one of the richest families in the country. They had already acquired 40% of shares, 30% directly (owned by MCB), and 8-9% indirectly (owned through MCB employees’ pension and provident funds).

There was no takeover law or substantial acquisition law in the country i.e., investors can acquire as many shares from the market without any restrictions or requirement to make announcements or having to make a tender offer.

There was a rumor at the time that the first substantial chunk of shares that MCB came to possess were on account of a broker default i.e., a broker had pledged Adamjee shares with MCB to borrow and speculate heavily and subsequently defaulting on the loan, resulting in MCB taking over the shares.

According to market sources and SECP’s formal assessment of the crises, a group of investors had traded heavily in the equity markets during the third quarter of FY00, contributing to the sharp rise in trading volumes during this period. It is said that these investors had taken heavy speculative positions, which were financed by loans against specific stocks. It is claimed that speculators had cornered these stocks, and were able to manipulate their prices. Such stocks could be used as collateral for loans, and also pledged to fulfill margin requirements of brokers. Since the market price of these scrips determines the value of collateral and margins, this created a moral hazard problem. Investors have the incentive to play the market to inflate the price of these select scrips, which in turn, allowed them to increase their speculative positions. It was observed that the volume of weekly trading in stocks of Adamjee Insurance and Bank of Punjab, far exceeded what had been observed before, without any real improvement in the fundamentals of these companies. During February and March, the carry-over trade in Adamjee Insurance even exceeded the net free float of the scrip. This contributed to the large volume of shares traded during March and April 2000.

If this were indeed the case, KSE acted prudently to increase margin requirements by downgrading the risk profile of these stocks, which effectively increased margin requirements for speculators. The resultant liquidity squeeze for speculators is directly responsible for the sharp fall in the markets (see Figure VI.1) and the resulting settlement problems that led to the closure of trading on the KSE and the LSE in end-May and early June, 2000. This also resulted in the subsequent default of one member from KSE, while four members of LSE were suspended.

There was also a theory that the family basically lost shares in the badla crisis, because they had pumped up the prices by taking margin on their own shares.

Whichever theory one goes with, badla crisis of May 2000 was pivotal moment in the hostile takeover saga.

Knowing that this isn't some shifty broker they are dealing with and there is a real risk that Mansha can mount a successful takeover, Adamjee filed a lawsuit in Sind High Court seeking a permanent injunction against MCB from acquiring more shares and taking over the board.

May 2002

On May 7, 2002, (the day AGM was supposed to be held), the high court announced that AGM cannot be held till the court decision is announced. In August 2022, the court further prevented MCB from taking any action to influence the Adamjee board including electing any directors.

October 2002

Takeover Ordinance is enacted. I will discuss it later in this post.

December 2002

Mansha Group filed an appeal and a division bench of Sind High Court comprising three judges in December 2022 set aside the above order by the single judge.

Adamjee Insurance asked to elect board - Newspaper - DAWN.COM

ISLAMABAD, Dec 10: The Securities and Exchange Commission of Pakistan (SECP) has directed Adamjee Insurance Company Limited (AICL) to hold its overdue election of their directors within 40 days, according to official source.

The term of existing board of directors expired on June 29, 2002, because of a dispute between AICL and Muslim Commercial Bank Ltd. etc., in the Sindh High Court.

The last hurdle in this connection was removed following the decision by a division bench of Sindh High Court comprising Mr Justice Saiyed Saeed Ashhad, C.J., and Mr Justice Ghulam Rabbani.

By its decision, according to SECP press release here on Tuesday, the division bench set aside the order passed by single judge of the same court, Mr Justice Mushir Alam, whereby Muslim Commercial Bank (MCB), its directors, MCB-Employees’ Pension and Provident Funds were restrained from exercising any rights to interfere in the management of, or, to exercise their rights, to elect the directors of AICL.

The order had been passed by the learned judge on a suit filed against MCB by AICL and its three directors. The learned single judge in his order of August 22, 2002, while restraining MCB and others to seek election on the Board of Directors of AICL, had also made some adverse observations on the SECP as well as the State Bank of Pakistan.

The division bench of SHC, while setting aside the said order, also expunged the remarks/observations of the learned single judge against SECP and SBP.

In its order, the division bench observed, “From the facts on record, we find that these adverse observations/remarks were uncalled for as neither SECP nor SBP allowed commission of any irregularity nor had attempted to avoid responsibility to assist the court.”

Following this order, the Adamjee Insurance Company Limited has now been directed by SECP to elect new board of directors without delay.

Adamjee Insurance files an application in Supreme Court and SC in its interim order dated December 20, 2002, directing the parties to maintain the status quo. SC will take more than a year to issue a decision. During this time, no AGM is held to approve annual accounts.

March 2004

15 months after MCB filing the petition in SC, on March 24, 2004, the SC dismisses the petition and asks Adamjee to hold the AGM.

SC rejects Adamjee Insurance petition: Take over bid by MCB - Newspaper - DAWN.COM

ISLAMABAD, March 25: The Supreme Court on Wednesday dismissed a petition of Adamjee Insurance Company Limited which had alleged that MCB, owned by Mansha group, was attempting to take over AICL by acquiring its 40 per cent shares through the stock trading.

The Supreme Court bench, headed by Chief Justice Nazim Hussain Siddiqui, heard the case for about two days, before it upheld the Sindh High Court's division bench order, holding that MCB had not violated any law by acquiring shares through the stock trading.

The Supreme Court decision on Wednesday would allow the MCB to participate in the annual general meeting of Adamjee Insurance. Adamjee Insurance Company Limited had alleged that the Mansha group was attempting to take over the insurance company by acquiring its 40 per cent shares through the stock trading.

A single bench of the SHC had passed a prohibitory order and directed MCB not to attempt to take over AICL. The decision was vacated by the SHC division bench.

The SHC order was challenged in the Supreme Court in December 2002, which stayed its operation. The case was taken up a number of times, but was adjourned on different grounds.

The Supreme Court bench comprising Chief Justice Nazim Hussain Siddiqui, Justice Abdul Hameed Dogar and Justice Fakeer Mohammad Khokhar, after hearing the counsels for parties for two days, upheld the SHC's division bench order.

Advocate Khalid Anwar and Advocate Raja Mohammad Akram represented MCB. Syed Sharifuddin Pirzada and Anwar Mansoor represented AICL. The counsels representing MCB contended that its client had not violated the companies law and had the right to take part in the elections of AICL directors.

They said they had been attending AICL meetings and no objection was raised. It all started when they annouced to participate in the elections of AICL directors.

The petitioner company's lawyers argued that if such an act was allowed it would create an uncontrollable acquisition of stocks by banks and investment companies of specialized and profitable units, which in fact, was not the job of the banks.

Business Recorder said that SC may not have considered the 2002 take-over law.

The Supreme Court decision last week in favour of MCB has raised the chance for the first ever 'hostile take-over' in the corporate history of Pakistan.

Since the off-loading of Adamjee's shares by foreigners (in the post-nuclear scenario) and few of the sponsors in late 90s, Adamjee Insurance has been under various attempts of take-over.

As the availability of shares in the stock market was far higher than the holding in the hands of once-strong Adamjee family, many have attempted to take over the company but failed in the absence of any effective law.

Mansha Group with a diversified portfolio in the field of textiles, cement, and bank, started accumulating Adamjee's share after the local stock market settlement-driven crisis of May 2000.

The legal battle between Adamjee and Mansha Group started in 2002, when the High Court disallowed Mansha Group to participate in the voting in AGM. Later, the court also postponed the AGM in 2002.

Later in 2002, Take-over Law was enacted but we think that the recent ruling by the Supreme Court has not considered that law.

Firstly, the argument to consider the takeover law was for the petitioner’s counsel to make. If Adamjee’s counsel didn’t make the argument before SC, hard for SC consider it.

Secondly, Listed Companies (Substantial Acquisition of Voting Shares and Take -overs) Ordinance, 2002 aka Takeover Law came into effect in October 2002.

As per Chapter III of the Ordinance, no acquirer can acquire more than 25% of the voting shares of a listed entity without making a tender offer to the general public. However, there was no provision for applying it retrospectively. The Ordinance was enacted in October 2002 whereas Mansha Group already owned ~40% of the shares of Adamjee in May 2002 when it was planning to take over Adamjee’s board in the AGM. Hard to see how takeover law would have made a difference here.

May 2004

After a 16 month stay, AGM was held in May 2004 and Mansha group was able to take over Adamjee by having its 6 members elected on a 9-member board.

Mansha group takes over AIC - Newspaper - DAWN.COM

The Mansha group on Saturday managed to wrest control of Adamjee Insurance Company Limited, marking the first successful 'hostile takeover' bid in the country's corporate history.

For the past two years, the group had set its sights on Adamjee Insurance, the largest insurance company in Pakistan commanding nearly 40 per cent share in the total non-life insurance business in the country.

The annual shareholders' meeting of Adamjee Insurance was held on Saturday, after a 16-month-old stay against the holding of the meeting was set aside by the Supreme Court of Pakistan on March 15.

Six seats on the nine-member board of directors were secured by the Mansha group at the end of four-hour long shareholders' meeting and counting of votes. The Adamjees retained three.

Four of the 19 contestants withdrew their names before the elections. The fact that among them was the company's chairman, Mohammad Hanif Adamjee, signalled that the erstwhile owners had given up hope even before the votes were cast.

The three members of the Adamjee clan who were voted to the board included: Abdul Hamid Adamjee, Abdul Razak Adamjee and Mohammed Choudhury. The last-mentioned has been holding the post of company's managing director for many years.

Just before the race began on Saturday, the Mansha group was officially in possession of 38.5 per cent shares in Adamjee Insurance comprising 29.5 per cent stake by the group-controlled Muslim Commercial Bank and 9 per cent owned indirectly: 4 per cent through MCB Employees Provident Fund and 5 per cent by MCB Employees Pension Fund.

But punters believe that the group had accumulated another 8 per cent of the 20 million floating stock from the market. With about 46 per cent shares already in their pocket, the corporate raiders had only to gather 5 per cent 'proxies' from the 30 per cent stock held by individuals.

"That was why the kind of proxy war that was expected did not take place," said one shareholder. A strong force of some 170 small shareholders had come to attend the meeting, but the majority were noticed to have retired to the tea tables even before the results were announced.

And this was the story of how Mansha Group was able to conclude a hostile takeover of Adamjee Insurance.

July 2004

The 2003 accounts were published after the new Board of Directors had been elected in the AGM. I have highlighted Mansha Group’s representatives.

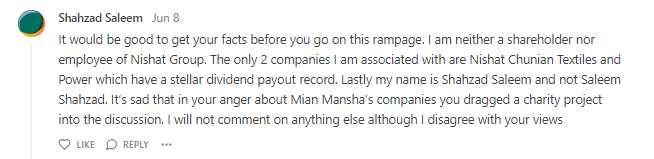

See the name of Shahzad Saleem. Below is the comment he left three weeks ago in my earlier post: Nishat Group #1: Unapologetic Capitalist

Despite his claims, hard to see Shahzad Saleem as having nothing to do with Mansha/Nishat. But I digress…

The new board immediately minced no words in the 2003 annual report about the lack of governance under the old board. Resorted to naming and shaming them. From the 2003 report

Despite recognition of serious problems with the UAE operation in 2001, the then Board of Directors and Company Management did not install adequate and robust controls at all necessary levels. Though some minor administrative measures were taken, these were grossly insufficient and inadequate to stem the heavy losses of the UAE operation. The lack of responsibility and breach of fiduciary responsibility by the then Directors, and failures of both omission and commission by the Head Office and UAE Company Management continued to produce heavy losses in 2002 and 2003 as well. It is now abundantly clear that no serious management strategy or controls were implemented to stop this clearly avoidable erosion of shareholder value. Thus, losses continued to mount in subsequent years. The whole matter exemplifies shameful corporate governance and highly unprofessional management practice. The Company, in the aggregate, suffered colossal loss of Rs.1.634 billion during the period 2000 to June 2004 from its UAE operations, the break-up of which is as under:-

During the above period, the following persons, as the directors of the Company, were responsible for the management of the Company’s affairs:

Following election of directors on May 29, 2004, the new Board took over the Management of the Company on June 12, 2004 and immediately took various measures to improve the UAE situation

October 2004

A few months later, in October 2004, the three members of Adamjee family still on the board filed a constitutional petition in Supreme Court challenging the takeover.

Notices were issued to Attorney General of Pakistan, Securities and Exchange Commission of Pakistan (SECP), Mansha Group, MCB and other respondents for November 24 in a constitution petition challenging alleged illegal Takeover of Adamjee Insurance Company. Hameed Adamjee, Ashraf Adamjee and three other controlling shareholders of Adamjee family filed the petition. The petitioners impugn alleged illegal transfer of controlling shares and take over by the new purchasers.

The matter came up before a division bench of Sindh High Court (SHC) comprising Justice Sarmad Jalal Osmany and Justice Amir Hani Muslim on Tuesday, which after hearing initial arguments by the counsel for petitioner while issuing notices to respondents also ordered Adamjee Insurance secretary to keep record of annual general meeting held on May 29 with him and not to part with the same.

October 2010

Six years later, dejectedly, the Adamjee family unilaterally withdraws the lawsuit.

KARACHI: The controversy about takeover of Adamjee Insurance is finally over, as the Adamje family that founded the company has unconditionally withdrawn its petition against the MCB group.

"Yes, we have unilaterally withdrawn the case because six long years have passed without any outcome and we are no more interested in pursuing the case," said Ashraf Adamjee, a family member who had been managing the company before the takeover.

He said that they fought for many years for their right, but justice was not served. "This is a unilateral and unconditional decision and does not involve any financial or commercial settlement.”

The irony in this saga is that when MCB was initially privatized by Nawaz Sharif in the 1990s, Adamjee along with Lucky Group was the highest bidder, followed by Tawakkal Group as the second highest, and National Group headed by Mansha as the third highest. It wasn't given to Adamjee/Lucky as according to Minister Sartaj Aziz, he didn't know what the source of funds for Adamjee/Lucky will be. This was all the more surprising considering that this country runs on amnesties and undocumented money. Anyway, Mansha was asked to match the highest bid, which he did, and became the proud owner of MCB. The rest, as they say, is history.

To quote from the song in Namak Halal

شکاری خود یہاں شکار ہو گیا یہ کیا ستم ہوا یہ کیا ظلم ہوا یہ کیا غضب ہوا یہ کیسے کب ہوا نہ جانوں میں نہ جانے وہ

For those who like to see the song visually

If you liked this post, please smash the like button and share it with your nearest and dearest friends.

My previous two posts in this Nishat Group Series

Nishat Group #1: Unapologetic Capitalist

I must have gotten up on the wrong side of bed, to churn out another substack post a few hours after the last one. The below tweet was the trigger. Rather it wasn’t the tweet. It was “Unapologetic Capitalist” in the name. Before we proceed, just to remind you that in the US, due to tax reasons, companies prefer to do share buybacks and not dividend payou…