Nishat Group #2: In breach of Securities Act 2015

When will SECP take action against Nishat Group?

This will be a nerdy post again.

Previous posts on SECP and Nishat Group

(This section lists my earlier posts on SECP and Nishat Group. If you have previously read those, you can ignore them and move to the next section).

If you have been following my writing, you would know that I have written about SECP overlooking the loan sharking carried out by “fintech" apps such as Barwaqt and Sarmaya Finance. Below are two of the many posts on the topic in case you are interested in revisiting them.

What will it take for Aamir Khan at SECP to act against predatory lenders?

India Shining It pains me to say this but Indian regulators are leaving Pakistani regulators behind. At least in India, there is realization amongst the regulators of the dangers of these apps. The recent ED press release in India. See the highlighted part of the recent decision by the Enforcement Division. This is exactly what Pakistani fintech apps are …

SECP: Patron saint of predatory lenders aka nano lending fintechs

I was writing a post about a related topic, but SECP tweeted about its Zoom call with heads of CEOs of NBFC. So I quickly turned out this one. Yesterday, SECP tweeted the following

I also asked SECP what will it take for SECP to move against the Bancassurance scam which is happening in broad daylight at banks.

Bancassurance #5: SECP as an agent of insurance companies

Like most posts on this substack, a tweet is a reason behind this post. I am DUMBFOUNDED that SECP chose to ignore the fraud, misselling, scamming, and ripping off of the widows, elderly, pensioners, and families of martyred soldiers, and chose to reply to a comment about commission only. And there too it tries to mislead.

I almost suggested that we should mothball the SECP if it intends to be a weak or non-existent regulator

With respect to Nishat Group, see below my last post, which was about Nishat Group and how they have taken every subsidy and incentive that is available to them and yet continue to whine. [Disclaimer: I have worked at one of the Nishat Group entities for three years and have a soft spot for them. But as peer-o-murshid Quaid-e-Tehreek said, “baat karo haq ki, chaahay hut jaye sub ki”, I don’t let it prevent me from calling spade a spade].

Unapologetic Capitalist: Nishat Group

I must have gotten up on the wrong side of bed, to churn out another substack post a few hours after the last one. The below tweet was the trigger. Rather it wasn’t the tweet. It was “Unapologetic Capitalist” in the name. Before we proceed, just to remind you that in the US, due to tax reasons, companies prefer to do share buybacks and not dividend payou…

It’s not only me saying this. Others say this too.

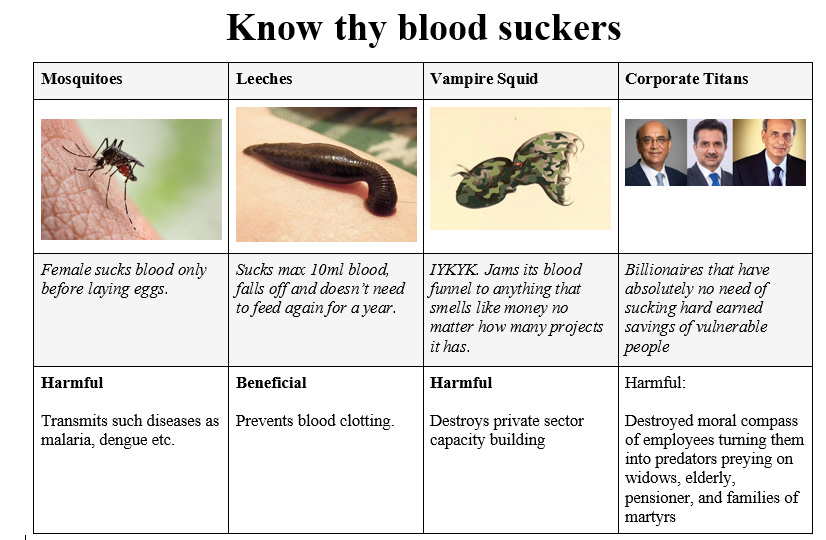

I also wrote named and shamed him for overseeing MCB Bank brazenly engaging in the bancassurance scam

Bancassurance #4: Pakistan's equivalent of Wells Fargo account opening scandal: Sultan Allana, Mian Mansha and Zameer Chaudry MBE should resign and be fined.

If you made it to this post because you are looking for relief, justice, or compensation because bancassurance products or insurance products were used to scam you, you can reach out to Federal Insurance Ombudsman - Complaint form Security and Exchange Commission of Pakistan -

The challenge is I can only highlight the wrongdoings. It is up to SECP to take action and enforce its writ. Now Nishat appears to be engaged in breaching the Securities Act 2015 and SECP appears to be looking the other way.

Nishat’s acquisition of PakGen

A few days ago, I was tagged in the below tweet thread

The tweep is claiming that Mansha Group’s acquisition of additional shares of Pakgen Power Limited is in breach of Section 111 of the Securities Act 2015. Let’s see what Section 111 of the Securities Act 2015 says:

111. Acquisition of voting shares beyond prescribed limits or control of a company. No person shall, directly or indirectly,

(a) acquire voting shares, which (taken together with voting shares, if any, held by such person) would entitle such person to more than thirty per cent voting shares in a listed company; or

(b) acquire additional voting shares in case the acquirer already holds more than thirty per cent but less than fifty-one per cent of the voting shares of a listed company: Provided that such acquirer shall not be required to make a fresh public offer within a period of twelve months from the date of the previous public offer; or

(c) acquire control of a listed company, unless such person makes a public offer to acquire voting shares of the listed company in accordance with this Part.

The key clause to focus on is subsection b (highlighted in bold above). It states that when a shareholder already owns between 30%-51% of the voting shares of the company, it can not acquire additional shares without making a public tender offer.

Below are the EOGM agenda for Nishat Mills and Adamjee Insurance (both Mansha entities) for the end of FY 2022 authorizing the further purchase of PakGen shares.

The below table shows that Mansha Group has increased its shareholding by 2% since then i.e., from 154MM shares to 161MM shares.

This is a clear breach of Section 111 subsection (b) of the Securities Act 2015.

The question is why isn’t the SECP taking any action against Nishat Group? Nishat Group should not be acquiring the shares from the market and making a tender offer.

One fear is that if SECP keeps looking the other way, Nishat Group will accumulate enough shares to increase its shareholding beyond 51%. Once the Nishat Group shareholding goes beyond 51%, there will be no requirement to make a tender offer for acquiring additional shares.

I have asked this SECP earlier with respect to bancassurance and loan shark apps but here it goes again.

This breach of Section 111 (b) isn’t hurting the poor and the elderly (at least not in the way bancassurance and loan shark apps were hurting them) but rules are rules. If SECP doesn’t take any action, then SECP’s rules will be more honored in the breach than in observance.