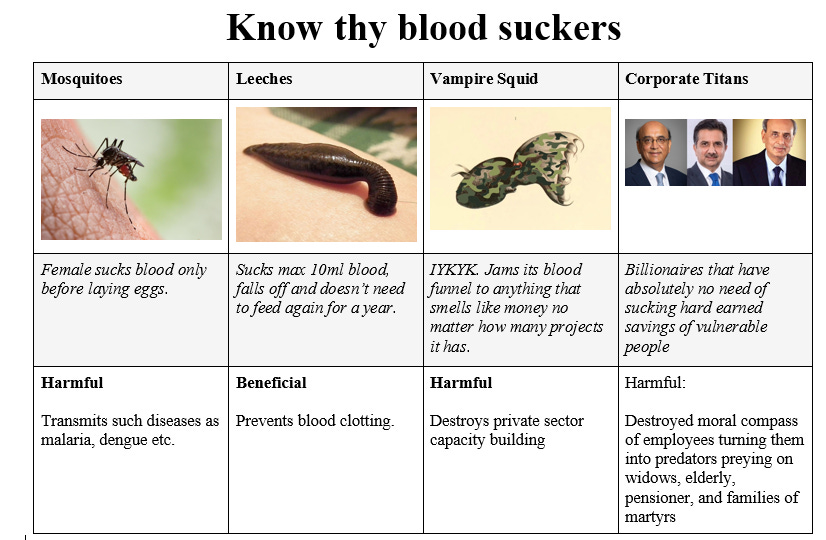

Bancassurance #4: Pakistan's equivalent of Wells Fargo account opening scandal: Sultan Allana, Mian Mansha and Zameer Chaudry MBE should resign and be fined.

Training the next generation of banking predators, I mean leaders, at HBL, UBL and MCB that feel no remorse scamming the widows, the pensioners and the families of martyrs

If you made it to this post because you are looking for relief, justice, or compensation because bancassurance products or insurance products were used to scam you, you can reach out to

Federal Insurance Ombudsman - Complaint form

Security and Exchange Commission of Pakistan - Complaint form

I recommend the Ombudsman, as they try to reach a resolution in 60 days. You can also submit a complaint in person at their regional office on a plain piece of paper and attach a copy of your CNIC. The regional office addresses can be found here.

If you are receiving this over email, it may have been clipped. Please click on the title above to read on the website.

Executive Summary

First, a real case study

Syeda Fatima Zaidi (hereinafter referred to as the complainant) filed a complaint against M/s. Jubilee Life Insurance Company Limited (JLIC) at SECP which was forwarded to Federal Insurance Ombudsman. The complainant is a widow of Syed Zaigham Ali Zaidi (Chief Electrical Engineer GM at Pakistan Civil Aviation Authority) and had deposited Rupee One Crore in Habib Bank Limited, KDA Market Branch. This amount was received by her after demise of her husband and the same was deposited in a savings account with monthly profit. After one year the then Bank Branch Manager Mr. M. Pervaiz Zai & Operational Manager Ms. Aisha held a meeting with her and told her that her amount is being divided into two buckets stating that the profit from the existing account is less as per the State Bank Policy compared to what she can receive through JLIC. Subsequently her amount was split in half and 50 lac were deposited with JLIC for one year. After one year, an amount of Rs.1,000,000/- was deducted from her account without any intimation and she came to know this deduction through SMS. She contacted the concerned branch to enquire about the deduction where Mr. Zai Branch Manager informed that this amount is the premium of the JLIC and if she continues this for another year she will get around Rs.3,000,000/- of profit. She further stated that after two years when she contacted the bank to draw the amount she was told that this deal spans to 10 years and cannot draw the amount else 18 lacs will be deducted from her own amount with no profit at all. When she discussed the matter with the present Bank Manager, Mr. Ashraf Ali, he showed no knowledge of the case while the ex-Manager Mr. Zai on contact also refused to assist in the matter saying he is no more part of HBL Bank. The complainant further added that she is a single parent of one daughter who is an under graduate student of a private university. Her late husband’s funds is all she has as the only means of their livelihood. She stated that she trusted HBL Bank in the best interest of their future but unfortunately she has been left in great dismay. She was utterly and intentionally misguided by the bank officials in the matter observing that she was an innocent and unguarded lady. Had she known the policy tenure and annual fee of Rs.1,000,000/- she would have never gone for it as it is beyond her affordability. She is now in dire need of money and requested the ombudsman to get released her funds from the JLIC.

— Case Study #1, Page 40, Annual Report 2020 of Federal Insurance Ombudsman

The case study goes on to state that the Ombudsman was able to get JLIC to repay Rs.5,900,000 to the complainant, which JLIC stated that they are paying “purely on compassionate grounds”.

It is obvious from the aforementioned story that it is the bank staff, the branch manager in the aforementioned case, who TRAPs the customers on behalf of the insurance company by making false claims and promises.

Another Case Study

Mr. Muhammad Hafeez (hereinafter referred to as the complainant) has filed this complaint against M/s. Jubilee Life Insurance Company Limited (JLIC). The complainant has stated in his complaint that he is maintaining an account in the Habib Bank Limited. His sister remitted an amount of Rs.63,00,000/- in his account from England for the purchase of a house and asked him to deposit this amount in a fixed deposit scheme for three years. The complainant went to the bank and asked the Manager to deposit the said amount in a fixed deposit scheme. The bank manager advised him to purchase an insurance policy from this amount for two years, and he will get a handsome profit on it. The complainant has requested this Forum to help him in getting back his paid premium.

— Case Study #5, Page 47, Annual Report 2020 of Federal Insurance Ombudsman

The ombudsman was able to get JLIC to refund the premium paid by the customer.

As we will learn throughout this post, it is always the branch manager who misleads and misguides the customer towards the insurance product.

One more case study

Mr. Liaquat Ali s/o Gul Muhammad, resident of Multan, lodged a complaint against M/s Jubilee Life Insurance Company Ltd. (JLIC) for not refunding his total paid premium amount of Rs.3,500,000/- in respect of an insurance policy. According to the Complainant, when he visited UBL Katchehry Road Branch, Multan and deposited Rs.3,500,000/- in order to meet out expenses of marriage of his daughter in future. At that point of time, a lady sales agent persuaded him to purchase a profitable scheme of Bank, with huge profit. According to Complainant, he was ignorant with the intricacies and ins and out, therefore, he agreed and signed some papers in good faith. After some time when he tried to withdraw his deposited amount back from the Bank, it was revealed that he was defrauded by the sales agent, and an insurance policy was made in his name without his consent and knowledge.

— Case Study #7, Page 51, Annual Report 2020 of Federal Insurance Ombudsman

Once again, the ombudsman was able to get JLIC to refund the premium.

These stories are just the tip of the iceberg and pertain to only those where the affectee was able to reach out to Ombudsman directly or through SECP or SBP. There are many people who may still be running from pillar to post as they don’t know who to reach out to.

The affectees are elated at getting their principal amount or the premium paid amount back. Meanwhile, the bank/insurance company earned interest on the float for months or years and get away by just giving back the premium amount.

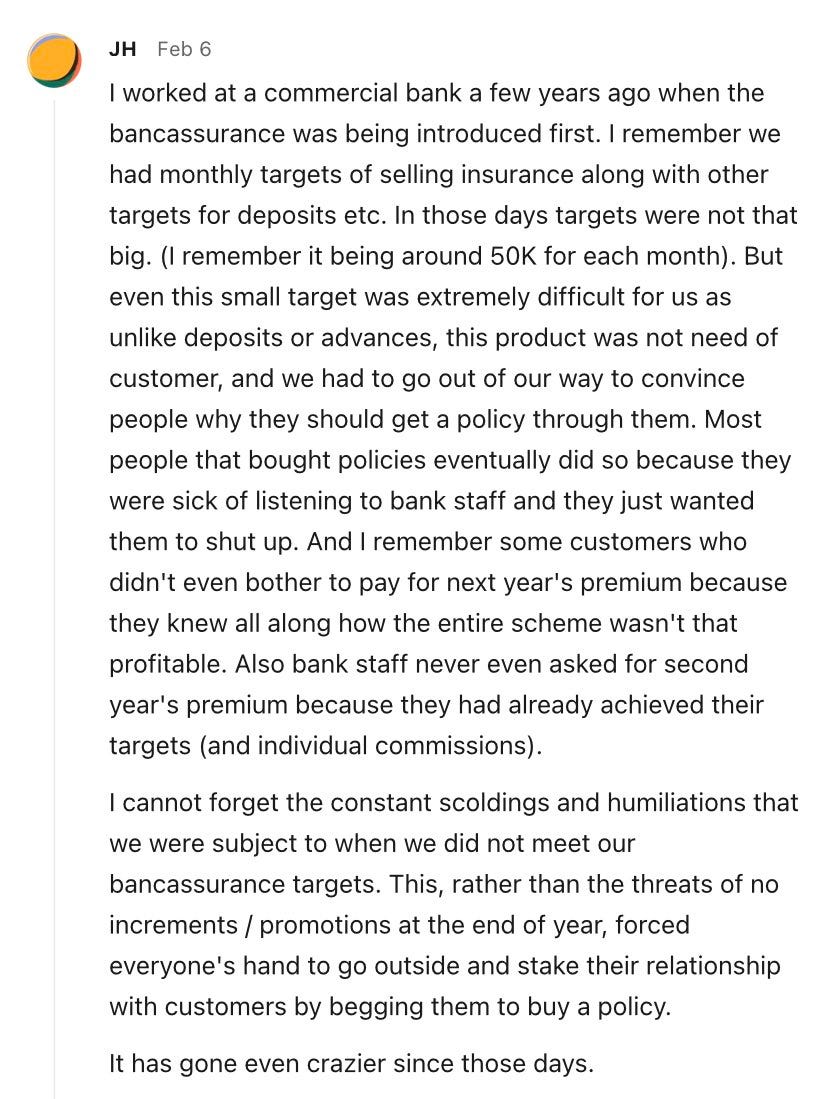

Why do bank staff do it?

They are pressured by the senior management.

Bank management allocates exorbitant targets

management of Banks allocate exorbitant targets to the Branch Managers for selling the insurance products due to which they recklessly misuse Banking Industry’s trust with Account holders by misselling life insurance policies showing high profit bearing Bank products. During this process, they violate with impunity, the law, rules and regulations prescribed by regulators including SECP and State Bank. Federal Insurance Ombudsman Report 2020 - page 36

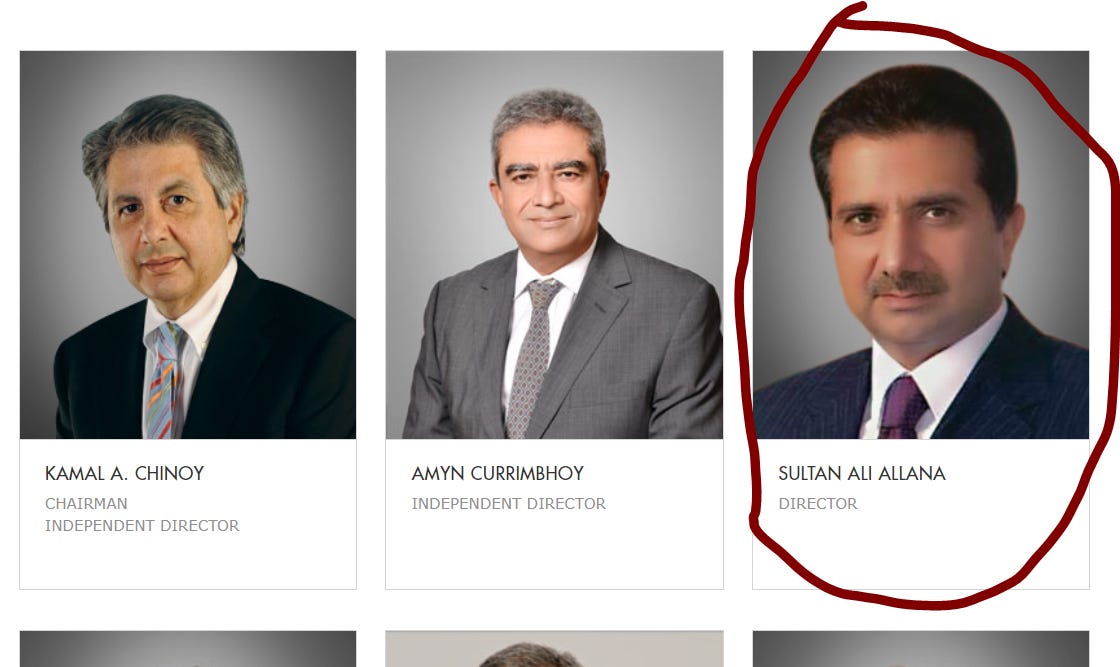

To put a name to the abstract “senior management”, please think of them as Sultan Allana, Mian Mansha, and Zameer Choudhrey CBE

One

Two

— source Facebook via Twitter

Three

Four

Wells Fargo Account Opening Scandal

Exactly the same thing was happening in the US where Wells Fargo gave their branch staff excessive “cross sales” targets promising them financial compensation. When the scandal broke out, the management tried to blame the branch staff, even firing them.

In 2013, rumors circulated that Wells Fargo employees in Southern California were engaging in aggressive tactics to meet their daily cross-selling targets. According to the Los Angeles Times, approximately 30 employees were fired for opening new accounts and issuing debit or credit cards without customer knowledge, in some cases by forging signatures. “We found a breakdown in a small number of our team members,” a Wells Fargo spokesman stated. “Our team members do have goals. And sometimes they can be blinded by a goal.” According to another representative, “This is something we take very seriously. When we find lapses, we do something about it, including firing people.”

Some outside observers alleged that the bank’s practice of setting daily sales targets put excessive pressure on employees. Branch managers were assigned quotas for the number and types of products sold. If the branch did not hit its targets, the shortfall was added to the next day’s goals. Branch employees were provided financial incentive to meet cross-sell and customer-service targets, with personal bankers receiving bonuses up to 15 to 20 percent of their salary and tellers receiving up to 3 percent.

Tim Sloan, at the time chief financial officer of Wells Fargo, refuted criticism of the company’s sales system: “I’m not aware of any overbearing sales culture.”

Nevertheless, in the subsequent weeks, senior management and the board of directors struggled to find a balance between recognizing the severity of the bank’s infractions, admitting fault, and convincing the public that the problem was contained. They emphasized that the practice of opening unauthorized accounts was confined to a small number of employees: “99 percent of the people were getting it right, 1 percent of people in community banking were not. … It was people trying to meet minimum goals to hang on to their jobs.” They also asserted that these actions were not indicative of the broader culture:

“I want to make very clear, that we never directed nor wanted our team members to provide products and services to customers that they did not want. That is not good for our customers and that is not good for our business. It is against everything we stand for as a company.”

If employees are not going to do the thing that we ask them to do—put customers first, honor our vision and values—I don’t want them here. I really don’t… The 1 percent that did it wrong, who we fired, terminated, in no way reflects our culture nor reflects the great work the other vast majority of the people do. That’s a false narrative.

Senator Elizabeth Warren clearly knew where the rot lies when she said this to the CEO of Wells Fargo.

You know, here’s what really gets me about this, Mr. Stumpf. If one of your tellers took a handful of $20 bills out of the cash drawer, they’d probably be looking at criminal charges for theft. They could end up in prison. But you squeezed your employees to the breaking point so they would cheat customers and you could drive up the value of your stock and put hundreds of millions of dollars in your own pocket. And when it all blew up, you kept your job, you kept your multimillion dollar bonuses and you went on television to blame thousands of $12-an-hour employees who were just trying to meet cross-sell quotas that made you rich. This is about accountability. You should resign. You should give back the money that you took while this scam was going on and you should be criminally investigated by both the Department of Justice and the Securities and Exchange Commission.

Following the hearings, the board of directors announced that it hired external counsel Shearman & Sterling to conduct an independent investigation of the matter. Stumpf was asked to forfeit $41 million and Tolstedt $19 million in outstanding, unvested equity awards. It was one of the largest clawbacks of CEO pay in history and the largest of a financial institution. The board stipulated that additional clawbacks might occur. Neither executive would receive a bonus for 2016, and Stumpf agreed to forgo a salary while the investigation was underway.

Two weeks later, Stumpf resigned without explanation. He received no severance and reiterated a commitment not to sell shares during the investigation.

The CEO of the bank was finally fined, barred from participating in the banking industry, and had his reputation in tatters.

The U.S. government announced Thursday that former Wells Fargo CEO John Stumpf has been banned from ever working at a bank again and will pay $17.5 million for scandals in which millions of fake accounts were set up to meet sales quotas.

The notice from the Office of the Comptroller of the Currency said the regulator plans to target other individuals, including former executives, for their role in the scandals.

“The actions announced by the OCC today reinforce the agency’s expectations that management and employees of national banks and federal savings associations provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations,” Comptroller of the Currency Joseph Otting said.

In addition to the $17.5 million fine, Stumpf’s settlement declares he shall not participate “in any manner” at any bank regulated by the OCC or participate or attempt to participate in a bank’s corporate board votes.

Who is going to go after our corporate titans? Will the toothless SECP and SBP go after them or just keep on issuing useless circulars? As we will see at the end of this post, we are already making them look like patriots and philanthropists.

Who are the victims?

The sufferers are not only the businessmen but also poor widows, clerks, drivers, house-wives, villagers, small farmers, laborers, overseas Pakistanis, and families of armed forces’ martyrs.

Even the families of the armed forces’ martyrs aren’t safe from these predators.

Imagine a person laid down his life defending the country. He is someone’s father, a husband, or a son. That someone receives some compensation. The grieving orphan, the widow, or the parent who has lost his child goes to the bank. They are going to entrust the bank with the compensation. They are grieving and have their guard down. Meanwhile, the branch manager, an expert predator who has sharpened its claws and teeth over the years guiding the innocent depositors towards the sacrificial area, sees an easy and vulnerable prey that can be led to the altar and encouraged to invest in a bancassurance product. After losing a son, a husband, or a father, the depositor is now about to part with the compensation so that the bank staff can meet the aggressive targets assigned by the senior management and earn that trip to Thailand/Russia etc.

This is the next cadre of senior management that these corporate titans are training with a moral compass that permanently points south. My blood boils reading about this product.

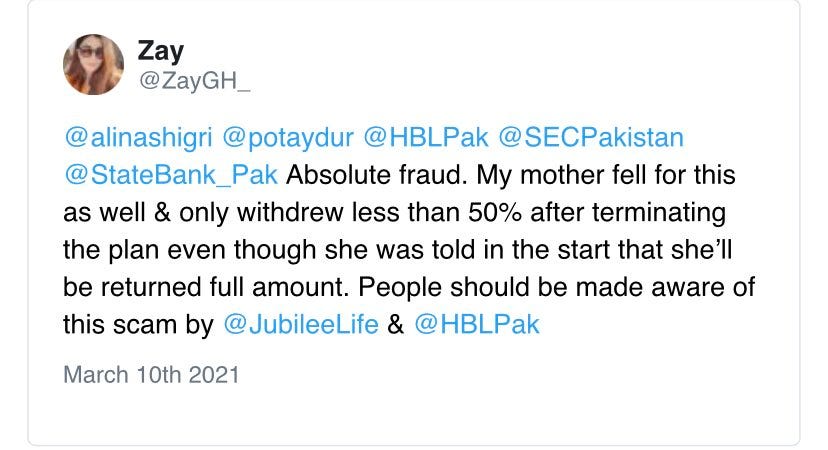

Preying on women (widows, housewives, pensioners)

Women appear to be the favorite target of the branch staff.

One

Two

Three

Four

Five

Six

Not everyone is lucky enough to make it to SBP or Ombudsman. Some keep getting the runaround

Two

How are these products sold?

The banks misuse the trust the depositors’ place in them.

It has been observed that the ordinary Bank Account holders are suffering the most troubles because of that the management of Banks recklessly misuse Banking Industry's trust with Account holders by misselling life insurance policies showing high profit bearing Bank products. The Account holders. not suspecting any misuse of their trust in Banking industry, readily fall a prey to such offers of better profits then are available for their deposits in ordinary Bank Accounts.

The bank manager shortlists the clients to sell bancassurance to and lies to them

Under the Bancassurance it so happens that a bank manager knows as to who among his clients of last 8 to 10 years has a profitable and better account performing well during the year. Such clients are contacted and good relations are established with them. This is done to pursue a target given to them by their bank. Now if supposedly a target of 10 Million Rupees is given, they pick such ten prospects and achieve their target. In the process to convince the prospects it has been seen that sometimes enunciations are made like doubling their money in three years but this does not happen.

— FIO interview to PTV as reported in Federal Insurance Ombudsman Report 2020 - page 29

Bank Manager “traps innocent customers”

He lamented that a bank manager has become a sales agent of insurance policies under the scheme, which is not part of his job description. It is also highly unfortunate that a bank manager misstates facts to banking customers regarding the insurance schemes to trap innocent customers.

…the top performers are offered foreign trips by the bank management with the support of the insurance companies.

Bank and insurance companies are hand in gloves in misrepresentation

The essence of banking is to maintain secrecy, but to sell the bancassurance product, bank officials and representatives of insurance companies are both hand in gloves in misrepresentation and selling of policies.

The bank acts as an agent of the insurance company. No need for hiring and training insurance sales agents

A decade ago, insurance companies had their offices nationwide manned by their agents encouraging the public to buy insurance. But now this system has ended and replaced by giving targets to branch managers to encourage the depositors to buy insurance. The primary reason is that depositors trust the branch manager with their money. The branch manager slyly and shrewdly encouranges the consumer to buy insurance by concocting stories. I fell victim to this too when for a policy I was told that I will have to pay premium only for three years and I will get exemption for the remaining seven years. It was misrepresentation. This happens that of the first year premium of the subject insurance policy, the bank takes 60% with the balance 40% going to the insurance company. The bank manager is rewarded with trip to Dubai and Sharjah along with cash prizes and shield awards. This is the root cause of the problem

— interview of the FIO in Akhbaar e Jahaan Dec 2020 (see page 80)

The Bank - Insurance company nexus

HBL / JLIC - Sultan Allana

Both entities are owned by the same group and represented on the board by common directors who know what going on here.

MCB / Adamjee - Mian Mansha

For a long time, I had a soft spot for MCB and Mian Mansha as my banking career took off at MCB. However, as I learned about the bancassurance product, the feeling is lost. Those who have worked at MCB and Adamjee, know that Mansha is a micro-manager and exactly knows where the money is coming from MCB and Adamjee.

UBL - Lord Zameer Choudrey CBE

If Mansha was the micromanager of yesteryear, the mantle has shifted to Lord Zameer Choudrey CBE today, who knows exactly how the sausage is made at both the bank and the insurance company. UBL Insurance hasn’t entered the life insurance business, but UBL bank earning significant bancassurance income with other insurance companies.

This section is to give a face to these institutions. People want to blame the branch manager or senior management, but the fact of the matter is, that the fish rots from the top, and it is these owners/directors of the banks and insurance companies that have put in place policies and targets that compel the bank staff to scam innocent people.

Do the banks need bancassurance income?

In 2021, the total income of UBL, mainly from lending to the Government of Pakistan, was Rs.30 billion. This is 50% more than the income earned by UBL in 2020. Of this, Rs.1.5 billion (5%) came from bancassurance income

MCB also earned Rs.30 billion in 2021 with Rs.1.5 billion (5%) coming from bancassurance.

HBL, the largest bank, earned Rs.35 billion in 2021 with around Rs.1 billion (2.5%) coming from bancassurance.

Rs.30+ billion profit is an unfathomable number for us mere mortals. Does MCB/UBL/HBL really need to scam the widows, the pensioners, and families of martyrs out of their hard-earned savings? Realistically, no. But when you start measuring everything in money, every penny matters.

You jump enough hoops, you learn to play the system, and stop caring where the money comes from.

The long-term ramifications of this behavior are that an entire cadre of management has been trained at UBL, HBL, and MCB that has survived and thrived by selling these products. These are our future banking leaders who have no remorse or feel no shame, in scamming the vulnerable.

Corporate Social Responsibility - Hypocrisy of robbing Peter to pay Paul

UBL 2021 annual report has the following picture and statement.

In 2021 UBL was very active in the areas of Environment, Social & Governance (ESG) through not only its Sustainability agenda but also through various other activities and initiatives. The Bank donated to various institutions, an amount over PKR 130 million, during 2021

So after making Rs.1.5 billion in bancassurance commission, UBL gave away Rs.130 million (less than 10%) for charitable causes.

As per HBL 2021 annual accounts Note 28.3, as part of CSR activities, HBL donate around Rs.500million for various donations which is 50% of the income earned from bancassurance.

MCB which had a big CSR section in its annual report donated a grand total of around Rs.8 million (less than 1% of the amount scammed from bancassurance). At least MCB is honest in this way that not trying to go for fancy CSR activities to cover up for their scams.

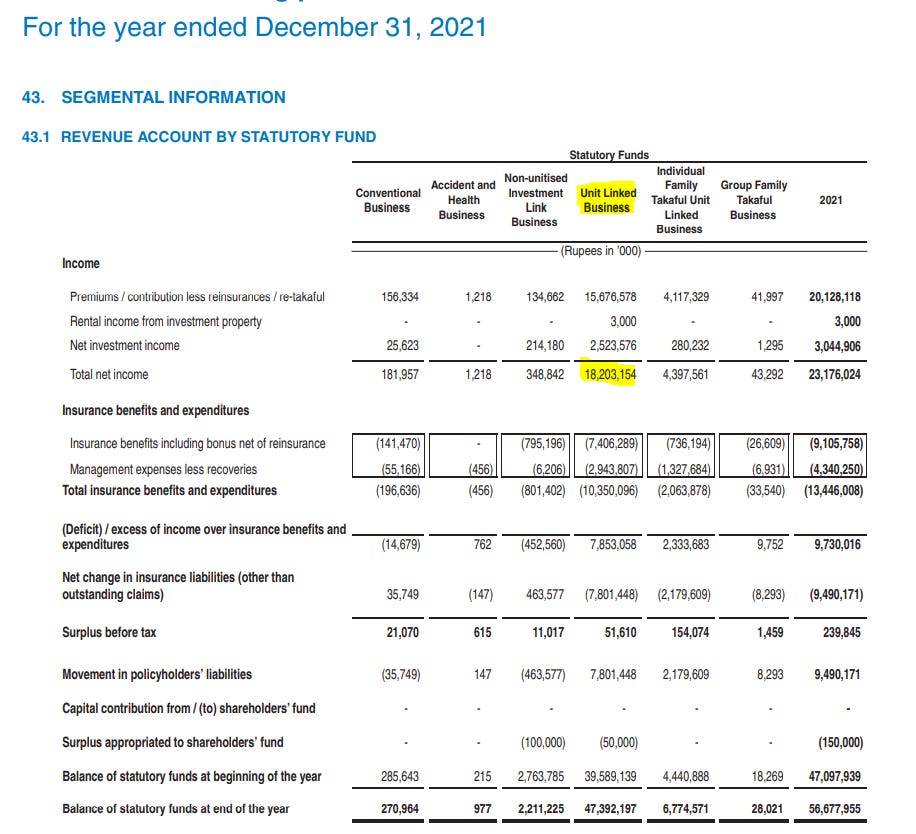

How much do insurance companies sell through banks?

Adamjee Life

Let’s look at the biggest offender in percentage terms. Of the total income earned by Adamjee insurance (page 112 of Adamjee Insurance report), almost 80% (Rs. 18 billion out of the total income of Rs.23 billion) of the income comes from Unit Linked Business. Unit Linked Business is “an insurance plan that offers the dual benefit of investment to fulfill your long-term goals, and a life cover to financially protect your family in case of an unfortunate event.” — exactly the product that is sold through bancassurance.

Of the premium written by Adamjee insurance, 90% was written at the banks (page 112 of Adamjee Insurance report).

It is as if Adamjee has given up on all other businesses and is selling only bancassurance products.

At one point, 85% of Adamjee’s bancassurance business was generated by MCB Bank (page 36 of Adamjee Insurance report).

Jubilee Life

Though the share of gross premium of unit-linked product at 61% of total gross premium isn’t as high as Adamjee, on account of being the largest insurance company, Jubilee Life underwrote the highest premium at Rs.30billion through bancassurance (Page 208 of JLIC Annual 2021 report) which is 67% higher than Adamjee.

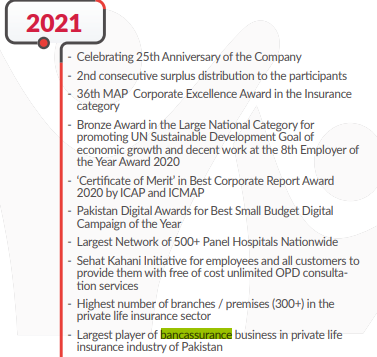

As per their annual report, JLIC is the largest player in bancassurance (Page 13 of JLIC Annual 2021 report)

The other large insurance company EFU Life approximately half of its gross premiums from the bancassurance channel (page 153 of EFU Life 2021 report).

Thus, bancassurance has become a major source of income for insurance companies, comprising one-half to four-fifths of their premium.

The problem is Adamjee has almost done away with its sales force by relying on 80% of business from bancassurance. JLI earns 60% of the premium while EFU earns 47% from bancassurance. Bancassurance has become a key channel for these insurance companies. This posits the question if the majority of the business of these companies comprises of ripping off customers, are they adding any value in the life insurance segment of the country. I can shame them all they want, SECP and SBP can continue issuing their lame circulars which are mostly about “buyer beware”. These insurance companies and commercial banks will fight tooth and nail to keep this channel open.

These entities are the blue chips of Pakistan. And their main product relies on robbing the widows, pensioners, elderly, and families of martyred soldiers.

How much do banks rip off per customer?

As I covered in my earlier post, Daylight robberies by Habib Bank, United Bank, and others (substack.com), in 2019, 14% of HBL’s income, 8% of UBL’s income, and 6% of MCB’s income were from bancassurance commissions.

Theoretically, this is the insurance company paying a commission to the bank for routing business to it. In reality, this is the amount deducted from the premium paid by the customer. Let me give you two examples.

HBL Hifazat - Jubilee Life

HBL Hifazat is charging 60% of the premium as a commission, with only 40% going towards investment. 20% of the second-year premium also goes to HBL paying its commission. All in all, 80% of one year premium just goes to pay the bank commission. What is being protected (Hifazat) here - HBL’s bottom line?

UBL BetterLife Retirement - JLI

The only better life and retirement that anyone is getting over here is UBL senior management. Those are mouth-watering commission charges, i.e., 60% of the premium first year, 20% in the second year, and 10% in the third year. I have chosen the wrong line of career. I should have been a bancassurance commission agent.

Please tell me, who in their right mind will agree to buy these products. These products cannot be sold without lying and making false promises. As Ammar had shown in the below post.

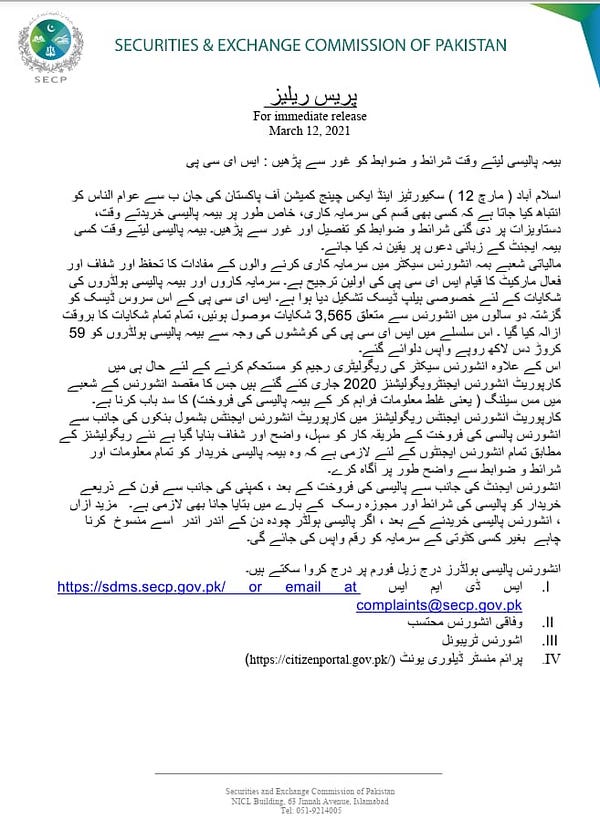

What are the regulators doing? Issuing circulars and washing their hand off the matter

SBP - says the product is prone to mis-declaration.

State Bank issued a circular in August 2021 along with a press release on third-party products, specifically bancassurance products sold through the branches

Such offers are often prone to misdeclaration about the quality or pricing of products. Further, banks also don’t assume any responsibility after the sale of products, which leads to difficulties for customers and disputes. To address such concerns and bring transparency to such transactions, SBP has issued a comprehensively revised set of instructions on the sale of third party products. In addition, these instructions will also facilitate the sale of products through digital channels and promote financial inclusion.

No bank employee should be allowed to receive incentives directly from the third party/ seller of these products. Further, compliance with the instructions contained in BPRD Circular Letter No. 09 of 2017 regarding foreign travel policy should be complied in letter and spirit.

The reality

SECP

SECP is also aware that it is a disastorous product and asks the public to read all terms and conditions and not rely on verbal promises.

There was this absurd tweet by SECP trying to justify the commission that doesn’t add value to the product and goes straight into the pocket of the bank.

People want me to blame the regulator SECP or SBP. I do blame the SBP for it is in the bank branches where this fraud happens with impunity. But most of all, I blame the bank's senior management, the top guys, the corporate titans, who also own/head the insurance companies and are perfectly aware of what is going on here. The product that should not exist. However, it not only continues to exist, all the banks reported growth in the bancassurance business in 1Q 2022.

If I blame anyone, I blame the top management of the banks. I will not apologize for calling spade a spade.

Now I get to read this by Ali Zaidi. Give me a frigging break. If you aren’t above scamming widows, pensioners, the elderly, and families of martyrs, your philanthropic activities arent better than putting lipstick on a pig.