Daylight robberies by Habib Bank, United Bank and others

Brazen scamming of the common man that the blue-chip corporates of Pakistan are carrying out with the knowledge and encouragement of the corporate titans

UPDATE: This post (published on Friday morning) went viral (or as viral as it could have gone). Security and Exchange Commission of Pakistan (SECP) tweeted a circular late on Friday evening alluding to the issues raised in this post. Considering SECP has a hands-off approach and regulators usually start their weekend early, I am glad this post shook someone at SECP out of their slumber on a weekend night. However, the tweet/circular (which is appended at the end) is just a CYA (cover your ass) attempt by SECP and hints at business as usual at the regulator.

It is surprising that I didn't know about this business model two days ago. As a result of few hours of googling to the online websites of Pakistani banks and insurance companies, I came upon the institutionalized corruption that is taking place in broad daylight while the regulators (SBP/SECP) are sleep and the stock market analysts that should be inquiring about such shenanigans either remain oblivious to it or just busy pretending to be sell side-analysts praising the entities for increasing their profitability not caring where the profitability is coming from.

This substack is structured exactly as I went about learning this stuff. It starts with the tweets that piqued my interest in the topic, which led me to visit the websites of the banks and insurance companies for product and financial information. Anyone could have done it with a bit of spare time on their hands. Without further ado, my journey to enlightenment.

At first, there was the tweet

Then there were the replies

A large number of people responded to that tweet. A few that I have linked below are sufficient to show that there is something rotten about this business model.

Tricks of the Trade

What comes out of these and the other tweets that I didn't copy is that bank staff uses aggressive sales tactics to sell these insurance products. Most of the time, the customer isn’t even aware of what he is signing up for as evidenced by one, where the bank manager asked the customer to answer “Yes” to everything, and two, the young account holder who was shocked to find out that Rs.18,000 was deducted and that too twice from his account.

Why would the bank staff do this? You have to understand how banking works. On a very high level, banks have two sources of income. Interest-based and fee-based.

In the interest-based income, the bank lends money and charges interest on it. The bank is taking a big risk by lending money because if there is a default the bank won't see the loan back much less interest on it. In addition, this money isn’t cheap. The bank has to pay interest to the depositors that provided that money. Assuming bank gives a loan of Rs. 100 at an interest rate of 10% and pays a rate of 5% to the depositor who provided the Rs.100, the net interest income of the bank is 5%. Furthermore, the bank has to take certain provisions, keep reserves at a central bank, etc which will bring down the net interest income of the bank from 5% to a much lower number. This also shows that the bank is constrained by how much deposit it has i.e., to make more loans the bank has to attract more deposits and pay them a rate higher than 5%1.

In the fee-based income, a bank charges a fee or commission for providing certain services such as the fee for making a pay order, fee for issuing an LC, etc. Here the bank isn’t using any of the money that has been deposited with it.

When shareholders or stock market analysts measure the performance of the bank, they measure it through return on capital (ROC) which can simplistically be thought of as

ROC = ( Net Interest-Based Income + Net Fee-Based Income ) / Total Capital 2

Whereas to increase interest-based income, the bank has to take more risks (by giving out more loans) and use more capital (increase the denominator), fee-based income increases without taking more risk and does not require increasing the capital. Hence by increasing fee-based income, bank management can increase the ROC without taking more risks or significantly increasing the capital. This pleases the shareholders and stock market analysts very much. As such, bank management tries very hard to increase the fee-based income.

What has this to do with bancassurance? In traditional fee-based banking products such as pay orders or LCs, the bank is obliged to provide a service for the fee it charged i.e., if the beneficiary presents a pay order or LC for encashment, the bank will have to pay them which will require the bank to maintain overheads such as bank staff to process the payment and cash in the vault to make that payment. In the case of bancassurance, the bank is only acting as a commission agent with all the responsibility of servicing shifted to the insurance company. If the customer has any issue with the policy, the bank management will wash its hands off saying “It’s not my responsibility. Go talk to the insurance company”.

See below from the UBL Bancassurance page

For the bank management, what is not to like: the bank sells a product on commission and has absolutely no responsibility as it has given a disclaimer that the bank is only acting as a distributor. The same branch staff that is responsible for increasing deposits and selling other fee-based income products is given aggressive targets to “cross-sell” these bancassurance products. There is no increased overhead either for hiring sales staff to sell these products.

Toothless SECP

It is surprising that this continues to happen more than a year after SECP penalized one of the insurance companies in 2019. It appears insurance companies are not taking SECP seriously. The below report reads like a charge sheet.

ISLAMABAD: The Securities and Exchange Commission of Pakistan (SECP) has taken note of malpractices in selling of insurance policies through bancassurance agents, initiating action against all companies involved in their sales.

The SECP had received a large number of complaints regarding insurance products sold through bancassurance distribution channel.

Bancassurance combines savings with insurance to offer a unified product for both services. Bank branches have been aggressively marketing these products to their customers for a number of years now.

The SECP has found that bancassurance agents misled the policyholders by selling insurance policies in disguise of highly profitable investments without disclosing that the company will deduct frontend commission and other charges.

Many customers find that they have not been fully informed of all the charges that are applicable when they purchase the product, and the fine print in the agreement carries conditions that severely constrains the payouts that the customers have been led to believe they will be entitled to.

The bancassurance market works by bringing banks and insurance companies together to form a unified product. The details can change from one bank to another, but all insurance companies have now built partnerships with multiple banks to develop offerings such as these and mobilised their branch staff to aggressively market and sell these products.

Given the complexity of the product and the vague nature of the sales pitch, customers are easily misled into thinking they are buying into a secure and high yielding savings product that will also provide them with some sort of insurance cover. But in reality, customers learn that after deductions and qualifications are applied, the returns are far smaller and the insurance cover much narrower than what they had been led to believe.

In the wake of several complaints, the Insurance Division of the SECP has penalised an insurance company for violating regulatory injunctions.

The regulator, while concluding its proceedings, directed the insurance company to refund full amount of premium to 19 policyholders. Moreover, the insurance company was also directed to claw back the commission paid to banks in these cases.

To eliminate any element of mis-selling, the SECP also instructed the company to bring transparency in the sales process and provide maximum disclosure and information about the insurance products to the policyholders. The company was also asked to warrant compliance of bancassurance staff with prescribed code of conduct.

In a statement, the SECP has called upon the aggrieved citizens to register their complaints against any insurance company at the SECP website as the corporate sector regulator does not only have the mandate to develop insurance sector but is also responsible for protecting the interests of the policyholders.

Therefore, strict action would be taken against the insurance companies indulged in mis-selling, the SECP warned while a tightening of Bancassurance Regulations is also being considered to curtail the issue of mis-selling.

It appears that the slap on the wrist and asking the insurance company to refund all 19 of the premiums wasn’t a sufficient deterrent for insurance companies. Most likely the insurance company mentioned in the above report made an employee a scapegoat and fired him. As the next section will show that it is business as usual with insurance companies. Probably insurance companies consider the meager SECP penalty as a cost of doing business.

Bancassurance is THE channel of distribution

Some of the insurance companies are selling life insurance mainly through banks.

Adamjee Insurance

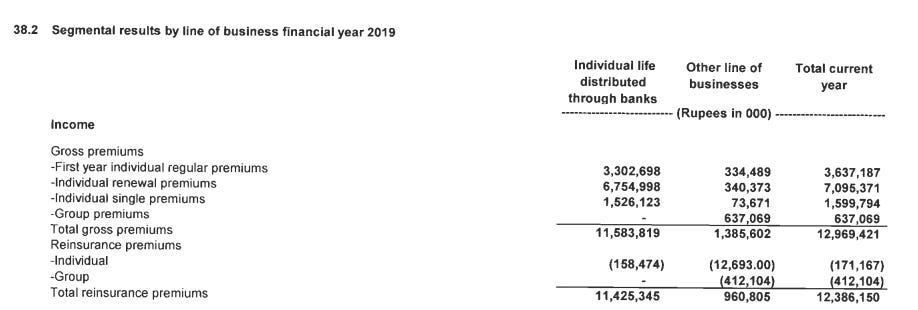

In 2019, 93% (11.4 billion out of 12.3 billion) of the total revenue that Adamjee Insurance earned came through individual life distributed through banks.

EFU

For EFU, both in 2019 and 2020, almost half of the premium income was received through the bancassurance channel.

Jubilee Life Insurance (JLI)

Finally, for Jubilee, which is the largest in terms of revenue amongst the three insurance companies that I have chosen, bancassurance comprises 85% of the source of premiums in 2020.

Other insurance companies will most likely have a similar breakdown. The banks have become a major to a sole distribution channel for these companies for life policies. This would have led Adamjee and JLI to cut down or eliminate their salesforce as they don't need a sales staff anymore to sell insurance. As a result, staffing expenses of insurance companies would have decreased resulting in these insurance companies achieving a higher return on capital and pleasing their shareholders and the stock market analysts.

If you are wondering why banks are taking this responsibility of marketing these insurance products then wonder no more.

What’s in it for the banks?

HBL - 14% of the income in 2019

HBL made a total profit of Rs. 30 billion and Rs. 15 billion in 2020 and 2019 and bancassurance provided 4% and 14% of the net income of HBL in 2020 and 2019 respectively. Thus it is a very significant source of income for the bank. HBL’s income from bancassurance halved to Rs.1.2 billion in 2020 but that is most likely due to Covid-19 as bancassurance is sold through the branches and the branches and account opening activity were much reduced in 2020. Do recall what I mentioned about bancassurance requiring little or no capital allocation or service from the bank except for selling it. This is not an insignificant income.

UBL - 8% of income in 2019

UBL hasn’t released 2020 financials. In 2019, UBL had a total income of Rs.19 billion out of which Rs.1.6 billion came from bancassurance translating into 8% of income.

Bank Al Falah - 4% on income in 2019

Bank Al Falah was getting 4% of its income in 2019 from bancassurance commission.

Other banks may also be earning similar income from bancassurance. I selected these three as they were mentioned most frequently in the tweets.

Thus, bancassurance is a significant source of revenue for these banks. Where else can they get 8-14% of income for pushing a product to a customer without any of the associated costs as HBL and UBL are getting? This is the reason that HBL staff is most aggressive in pushing the bancassurance products.

If you are wondering why are insurance companies paying such huge commissions to the bank or os it not more efficient for the insurance companies to hire cheaper sales staff or how can insurance companies afford to pay such huge commissions them wonder no more.

Who is paying commission to HBL/UBL?

If you ask the banks, the banks may say that insurance companies are paying them a commission to sell these products. That may be true in accounting terms. However, in reality, the customer is being charged an arm and a leg and he is paying through the nose3.

But before we go down that route, let’s understand how do insurance companies earn the income that they pay policyholders? Insurance companies charge their policyholders a premium for the insurance policy. This premium is invested in a portfolio of securities (a mix of debt and equity). That portfolio earns a return. Based on the terms of the policy, policyholders are either paid the investment value which is equivalent to the returns on the invested premiums, or another value as per the agreement. This is a very basic description without going into the nuances.

The return the policyholders get is based on two factors.

The rate of return on investments: If the money was invested in stocks and the stock market crashed or continues to go down, the return on the policy will be significantly less. When HBL or UBL sell the bancassurance products, they will be forecasting the value of the policy as if the return on the investments will be 20% per annum for 5, 10, or 20 years which will be unrealistic assumption. Rosy projects are the only way to convince customers to buy these products.

The amount that is invested: For example, if the amount of premiums invested is doubled, theoretically speaking, the investment value of the policy will also double. Please note that I am talking about the premium invested and not the premium deducted from your account. There is a key difference which will become clear in the below section where I have extracted the premium allocations from the various bancassurance brochures.

Where is the premium going?

Of the amount that is deducted from the policyholder’s account as a premium, not all of it goes towards the investment portfolio.

Alfalah Sukuoon - EFU

In Alfalah Sukoon, Of the premium you pay the first year, only 45% goes towards investments. The 55% goes toward payment of bank’s commission and expenses if any. If you go to the insurance company day after the money is deducted from your account and ask them to return the money, they can only pay you 45% of the funds4 as the rest has gone to pay commission to the bank. If you know a bit of maths, you will also know that the return on your investments needs to be more than 100% in year 1 if your 45% investment is to be made whole. Something that is very unlikely to happen.

From the following year’s premium, again 20% is deducted as commission. Thus the poor 20-year-old boy in the earlier tweet from whose account Rs.36,000 were deducted, around Rs. 13,500 went to pay commission. Only Rs. 22,500 were invested. If he asks for his money back, he will get around half of it back.

MCB Save and Assure - Adamjee

This brochure provides an additional column of the surrender charges which is not shown in other brochures. Not only 55% of the first year premium go towards paying commission, but if the customer requests the insurance company for surrendering or encashing the insurance policy, Adamjee will charge 100% of investment value as surrender charges in year 1. The customer will not get anything back in the first year. The product is known as MCB Save and Assure (the irony). If the customer waits another year, he will get only 50% of the investment value (not the premium the customer invested) and the rest will be adjusted as surrender charges. It is only from year three that the entire premium goes toward investing and surrender charges fall to zero.

HBL Hifazat - JLI

If you have thought 55% of the first year’s premium going to commission is exorbitant, prepared to be surprised. HBL Hifazat is charging 60% of the premium as a commission with only 40% going towards investment. What is being protected (Hifazat) here? It's not the customer's savings that are going towards paying the premium.

HBL Samar - JLI

Just putting it here to show that sometimes the commission deduction can extend till the third year. I presume the "Samar" means fruit implying HBL is getting a higher commission as fruits of their branch staff's labor by shafting the policyholder with these exorbitant charges.

UBL BetterLife Retirement - JLI

The only better life and retirement that anyone is getting over here is UBL senior management. Those are mouth-watering commission charges i.e. 60% of the premium first year, 20% the second year, and 10% the third year. I have chosen the wrong line of career. I should have been a bancassurance commission agent.

Above I have selected a few products that I clicked on. You can visit the insurance companies website and click on the bancassurance link. Each company has designed different products for different banks and you can spend the whole day going through the various creative ways the banks and insurance companies are ripping policyholders off.

Thus it is not the insurance companies that are paying that bancassurance commission to the banks. It is the policyholders whose premium is going towards paying the bancassurance commission of these banks.

That 14% income that HBL (otherwise known as 'tech company with a banking license') made in 2019, came from scamming the young, the old, the widows, the pensioners, and such.

The Fish Rots From The Head Down

It is easy to blame the branch employees for these aggressive sales tactics. That will be naive. The people who should be blamed for this are the top management and board of directors of these companies. If they feign ignorance of what is going on over here, they do not deserve to be heading such organizations. Are you telling me that HBL’s BoD, the audit committee, the risk committee, etc do not care where 14% of HBL's income came from? Does the BoD of JLI do not care where 85% of the revenue of JLI is coming from? Below are pictures of recent BoDs of both entities, the corporate titans, the who's who of Pakistan's blue-chip corporate world.

HBL's BoD

JLI's BoD

But these aren't the only people to blame. MCB and Adamjee are owned by Mian Mansha and he is a micro-manager. UBL's Zameer Choudry is known to be very interfering in UBL insurance. The bottom line is that this ripping off the customers is happening with knowledge, connivance, and most likely encouragement of the top management of these banks and insurance companies.

Wells Fargo Cross-Selling Scandal

This happened in the US a few years ago and led to a congressional inquiry. The details are eerily similar to what is happening in the bancassurance sector of Pakistan.

In 2013, rumors circulated that Wells Fargo employees in Southern California were engaging in aggressive tactics to meet their daily cross-selling targets. According to the Los Angeles Times, approximately 30 employees were fired for opening new accounts and issuing debit or credit cards without customer knowledge, in some cases by forging signatures. “We found a breakdown in a small number of our team members,” a Wells Fargo spokesman stated. “Our team members do have goals. And sometimes they can be blinded by a goal.” According to another representative, “This is something we take very seriously. When we find lapses, we do something about it, including firing people.”

Some outside observers alleged that the bank’s practice of setting daily sales targets put excessive pressure on employees. Branch managers were assigned quotas for the number and types of products sold. If the branch did not hit its targets, the shortfall was added to the next day’s goals. Branch employees were provided financial incentive to meet cross-sell and customer-service targets, with personal bankers receiving bonuses up to 15 to 20 percent of their salary and tellers receiving up to 3 percent.

Tim Sloan, at the time chief financial officer of Wells Fargo, refuted criticism of the company’s sales system: “I’m not aware of any overbearing sales culture.”

Nevertheless, in the subsequent weeks, senior management and the board of directors struggled to find a balance between recognizing the severity of the bank’s infractions, admitting fault, and convincing the public that the problem was contained. They emphasized that the practice of opening unauthorized accounts was confined to a small number of employees: “99 percent of the people were getting it right, 1 percent of people in community banking were not. … It was people trying to meet minimum goals to hang on to their jobs.” They also asserted that these actions were not indicative of the broader culture:

“I want to make very clear, that we never directed nor wanted our team members to provide products and services to customers that they did not want. That is not good for our customers and that is not good for our business. It is against everything we stand for as a company.”

If employees are not going to do the thing that we ask them to do—put customers first, honor our vision and values—I don’t want them here. I really don’t… The 1 percent that did it wrong, who we fired, terminated, in no way reflects our culture nor reflects the great work the other vast majority of the people do. That’s a false narrative.

If by a remote chance there is an inquiry in Pakistan into these practices, there is a high likelihood that some low-level or mid-level employees will get the boot. Senator Elizabeth Warren clearly knew where the rot lies when she said this to the CEO of Wells Fargo.

You know, here’s what really gets me about this, Mr. Stumpf. If one of your tellers took a handful of $20 bills out of the cash drawer, they’d probably be looking at criminal charges for theft. They could end up in prison. But you squeezed your employees to the breaking point so they would cheat customers and you could drive up the value of your stock and put hundreds of millions of dollars in your own pocket. And when it all blew up, you kept your job, you kept your multimillion dollar bonuses and you went on television to blame thousands of $12-an-hour employees who were just trying to meet cross-sell quotas that made you rich. This is about accountability. You should resign. You should give back the money that you took while this scam was going on and you should be criminally investigated by both the Department of Justice and the Securities and Exchange Commission.

Following the hearings, the board of directors announced that it hired external counsel Shearman & Sterling to conduct an independent investigation of the matter. Stumpf was asked to forfeit $41 million and Tolstedt $19 million in outstanding, unvested equity awards. It was one of the largest clawbacks of CEO pay in history and the largest of a financial institution. The board stipulated that additional clawbacks might occur. Neither executive would receive a bonus for 2016, and Stumpf agreed to forgo a salary while the investigation was underway.

Two weeks later, Stumpf resigned without explanation. He received no severance and reiterated a commitment not to sell shares during the investigation. [2]

Will anything change in Pakistan?

As a result of this substack? No.

For this practice to stop, there needs to be a movement carried out in the mainstream electronic media and newspapers explaining how the common man is being scammed by these institutions. But these banks, insurance companies, and their owners (which have other business interests) are the largest advertisers. Will the electronic media and newspapers have the guts to go after them?

SECP, SBP, and the banking ombudsman should be shutting down this channel. JLI and Adamjee are getting around 90% of their revenue from the bancassurance channel. They do not have a sales force anymore to sell life insurance products. They will fight tooth and nail to keep this channel open.

Assume a rational customer. If he is told that half of his first-year premium is going towards paying commissions and only half will be invested and that investment value will depend upon what most common people deem a gambling den i.e. Pakistan Stock Exchange, I don't think anyone will sign up for these insurance products in bank branches. There are much better and efficient products to save money and invest in stock market if one is so inclined.

BOTTOMLINE

To repeat what I said in the beginning, this is brazen daylight robbery of the common man that the blue-chip corporates of Pakistan are carrying out with the knowledge and encouragement of the corporate titans of Pakistan while the regulators both SECP and SBP are asleep or look the other way.

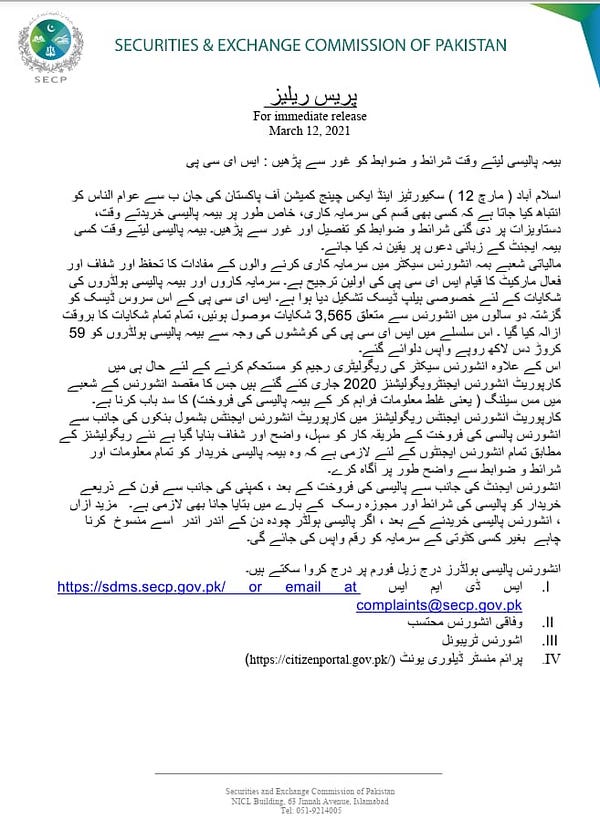

UPDATE: SECP Shrugging off responsibility

I am flattered that the post rattled the regulator i.e. SECP tweeted the below late on a Friday evening. However, this is SECP copping out by shifting the responsibility to the policyholders. As this entire post makes it clear, the policies are sold by using aggressive sales tactics. Most of the victims are the young, non-financially savvy, widows, senior citizens, and pensioners. I didn’t know SECP issued this tweet till someone tagged me on it. I am sure none of the present and future victims will come across this circular. I don’t think it will have any impact on the sales practices of the banks and insurance companies.

These products need to die. I can bet that not a single person will invest in a bancassurance product if he is told that half of his premium is going towards paying commissions and the returns are not based on the projection charts but how the managed portfolio invested in Pakistan Stock Exchange will perform.

As the Wells Fargo episode showed, senior management and CEOs of these institutions will feign ignorance but as we know, the fish rots from the head down.

The below tweet best summarizes the SECP response

SECP and a couple of tweeps are defending the malpractice saying that a verification call is made. But this is how the bank managers ask to reply on the call.

If you enjoyed this, I encourage you to read another piece of mine where I showed how last year Habib Bank Limited along with Standard Chartered and Citibank tried to overcharge the Government of Pakistan by $76.5MM for selling oil hedging derivatives.