The Great Oil Hedge Heist of 2020

How Citibank, Standard Chartered and HBL colluded to overcharge Government of Pakistan by $76.5MM with some help from Power Division at Ministry of Energy

If you are receiving this because you have subscribed to this substack. first of all, thank you. Second, as this is a lengthy post, there is a chance that the email may be truncated as this is a long post. If that happens, you may have to visit the blog post to read the post in full.

In April 2020, the oil supply glut resulted in oil prices falling to record lows. The West Texas Intermediate (WTI) benchmark fell to negative $37 for a day with sellers paying buyers to take the inventory off their hands due to lack of storage capacity. Buyers and traders were rushing in to lock in rates. Traders purchased the physical commodity of oil and stored it in storage tanks over land or by chartering very large crude carriers VLCCs to sell it later at a profit when the inventory glut wind downs and prices stabilize.

Pakistan was also considering if it should use this opportunity to lock in lower prices. Purchasing oil in advance requires the country to have the FX liquidity to pay for buying the oil as well as sufficient storage infrastructure to hold this extra quantity, both of which, unfortunately, Pakistan lacked. Alternatively, Pakistan could engage in a derivative transaction.

A summary was moved by Petroleum Division at the Ministry of Energy (hereinafter referred to as PD) to ECC to enter into hedging contracts. Press reports here, here, and here summarized the summary.

The petroleum division has been working with the ministry of finance for the last one month to evaluate the possibilities of hedging some portion of the exposure to Pakistan for import of petroleum products that are directly or indirectly linked to crude prices.

In order to materials the hedging plan, several discussions had been held with the Standard Chartered Bank, Citibank, and a consortium of Habib Bank and JPMorgan to understand the available options and the pricing mechanisms.

The advice from all the three institutions was that since Pakistan was considering oil price hedging the first time, it should start with covering 15-20% exposure. Once this program is operational, it can consider increasing the coverage and making it an ongoing program, the sources added.

The sources added that these institutions had also advised that the oil market had been volatile, therefore, Pakistan should wait for a second phase of stability in the prices because the cost of a hedging program went up in a volatile market.

Considering all the possible hedging instruments, the petroleum division has firmed up two options, which seemed to it as practical to evaluate. First is a ‘straight swap’, where a variable price is converted to a fixed price or a defined volume and a defined period.

The fixed price will, of course, be higher than the current price as longer the swap, higher the price. The second option is ‘call option’, where prices cap is bought for a defined volume and a defined period of time. This call option has a price, which depends on the length at which the call is set up.

However, after initial discussion, the first structure was rejected because though it gave certainty of fixed price, it took away any benefit of low prices if they declined further.

And the second structure was selected because it acted as an insurance policy with a price ceiling—giving the benefit of market prices as long as they were lower than the ceiling. So, if Pakistan targets around 9% per year for two years, around 30 million barrels for two years would be hedged.

However, since only government entities were involved in the LNG sector and the private companies were involved in refineries and oil marketing companies (OMCs), it would be better to allocate it to the LNG. It will help keep prices of LNG at manageable levels.

Against this backdrop, the petroleum division has proposed to hedge price for 15 million barrels of oil for one year, divided in 12 equal monthly amounts, for a strike price of $8 above the current Brent as long as the fee is within an acceptable range.

In second call option, it proposed to hedge price for 15 million barrels of oil for two years, divided in 12 monthly amounts, for a strike price of $15 above the current Brent price, as long as the fee is within an acceptable range.

Currently the Brent price is in the range of $20-25 per barrel. Since the prices of the call options are varying every day along with the prices of Brent, it is essential that the approval granted by the ECC is for a range of call option prices in order for the finance ministry to lock it the day an acceptable offer is put on the table by the relevant banks. A fixed price approval will become irrelevant the next day as the market moves.

The petroleum division has also proposed to give guarantee to the Pakistan State Oil (PSO) if it was involved in oil price hedging. It further proposed that a committee be formed under the finance secretary, and including the secretaries of petroleum, law and planning divisions and the PSO managing director to timeline the call options with the selected banks.

It also proposed that Oil and Gas Regulatory Authority (OGRA) be given a policy direction to include the monthly price of the option in the cost of LNG [or any other oil product chosen] in announcing the monthly prices.

I have written this post to analyze the aforementioned hedging proposal. This is a long post (almost running into 12,000 words) as I want to cover all aspects. It is divided into 8 chapters. In broad strokes, the post is composed of three sections. The first section sets the stage and comprises 4 chapters. Chapter 1 is a crash course in derivatives for those that don't know much about derivatives and hedging. I have kept it intuitive. Chapter 2 describes the players in the local market for derivative transactions. Chapter 3 describes the sales tactics the banks use to sell derivatives. It isn't comprehensive or scientific or prescriptive. Chapter 4 can be thought of as consolidating what was presented in the first three chapters with real-world examples of the derivative transactions. Then we move to the next section which is the meat of this blogpost. This section comprises of just one chapter where we do a step-by-step deep-dive analysis of the oil hedging transaction proposal in light of what we have covered in section one. It is followed by the final section comprising of two small chapters highlighting how the proposal was covered by newspapers and experts. Then it ends with a conclusion.

I hope you enjoy reading it as much as I enjoyed writing it.

Section 1

Chapter 1: Crash Course in Derivatives

If you already know about derivatives, you can skip this chapter and move to the next chapter.

Forward Contract

The simplest derivate is a forward contract wherein two parties agree to buy and sell a specified asset at a specified price on a future date. For example, an airline kitchen can agree in January with a tomato farmer to buy 100 kgs tomatoes in June for Rs.80 per kilo. Come June, the farmer will deliver 100 kgs of tomato to the kitchen and the kitchen will pay Rs.8,000 to the farmer. It doesn't matter what the market price of tomatoes (called spot price) is in June.

Why would an airline do it? It will do it because airlines sell tickets six months in advance and they will have to provide inflight meals. By locking in the cost of tomatoes and other food items, they are locking in their costs at the same time they are locking in their revenues by selling tickets. The airline is thus hedging its costs.

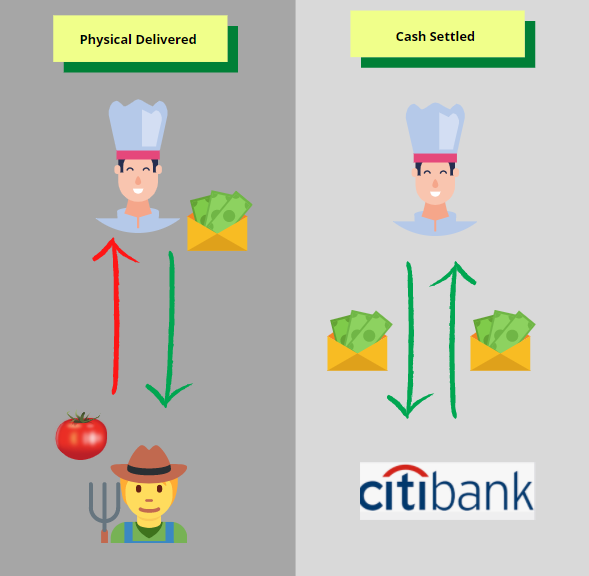

Physical Delivery vs Cash Settled

The counterparty to a forward contract may not be the same as the counterparty to the underlying trade. The above example was of a physical delivery contract where at the end of the contract, the goods are delivered and payment is made. But a farmer may be unsophisticated or may say that I will only sell it at the market price when the tomatoes ripen. In such cases, an airline may enter into a cash-settled contract, which can be entered into with financial institutions or specialized institutions or even on exchanges.

If using a cash-settled method of hedging, the kitchen will enter two contracts. One contract with the farmer to deliver tomatoes at the spot price. A second contract will be a forward contract between the kitchen and Citibank for 100kgs of Tomatoes at Rs.80 per kilo on a "cash-settled basis". Come June, the spot price will determine the payment. If tomatoes are trading at Rs.90 per kilo, the kitchen will buy the tomatoes from the farmer at Rs.90. Besides, Citibank will pay the kitchen Rs.10 (the difference between the spot price and forward price). The net cost of the kitchen is Rs.80 as it paid Rs.90 to the farmer and received Rs.10 from Citibank. Alternatively, if the market price of tomatoes is Rs.70, the kitchen will pay Citibank Rs.10. The cost of tomatoes to the kitchen will still be Rs.80 as it will pay Rs. 70 to the farmer and Rs.10 to Citibank.

The farmer doesn't know nor cares about nor is a party to the contract between the kitchen and Citibank.

Hedging vs Speculation

The kitchen is engaging in hedging i.e. it is trying to manage its costs or minimize its risks. Companies/individuals enter into forward contracts also for speculation. Let’s say I work in textiles. A friend of mine who works in farming tells me that due to mismanagement or hoarding, the price of tomatoes is expected to increase in June.

I have nothing to do with tomatoes but I want to play in this market. I can enter into a forward contract with Citibank for tomatoes at Rs.80. Come June, the price of tomatoes increases to Rs.150 per kilo. Citibank will pay Rs.70 (the difference between spot Rs.150 and forward contract price Rs.80) to me. That's a tidy little profit. My transaction is purely for speculation and has nothing to do with hedging.

Forward vs Futures

Forward contracts settle on maturity and are customizable i.e. they can be for any underlying and any size of the transaction between two parties. Such contracts are called over-the-counter (OTC). Supposed I had entered a forward contract with Citibank for the underlying at Rs.80 in June. If the spot price of underlying falls to Rs.50 in June, I will have to pay Rs.30 to Citibank. I can decide to withhold the payment or default. I am a counterparty to Citibank in this transaction and this risk of default or delay is called counterparty risk. It is eliminated when the transaction takes place on an exchange (similar to a stock exchange for stocks). The contracts on the exchange are standardized i.e. for a limited number of commodities and standard sizes and are called a Futures contract. For example, an exchange may not have futures on tomatoes and only wheat. Each contract will be for 1000kgs. To manage the counterparty risk, the Futures contract is marked to market daily and any gain or loss on the contract is settled daily.

The takeaways from this heading are

A forward contract is an OTC contract between two or more parties and it can be of any size for any commodity and it does not have to be settled daily. But there is counterparty risk in such a transaction.

Futures contracts take place on an exchange so the prices are transparent. Forward contracts or OTC contracts and the pricing is opaque. The buyer of a forward contract may not know if he is getting the best price.

Swaps

The kitchen can engage in a series of forward contracts with Citibank each for 100 kilos settling on the 30th of June, July, August, and September for tomatoes at Rs.90 per kilo. The payment will be based on the spot price on those dates. If the spot price on June 30 is Rs.80 per kilo, the kitchen will pay Rs.10 to Citibank. On July 30, if the price is Rs. 120 per kilo, Citibank will pay Rs.30 to the kitchen on that date. And so on. The price of tomatoes for the kitchen is fixed at Rs.90 due to its contract with Citibank. This structure can be thought of as composed of a portfolio of forward/futures contracts and is called a swap and is transacted OTC.

Call Options

Unlike swaps where the kitchen is bound to pay Rs.90 for tomatoes, a call option gives the right but not an obligation to buy the underlying at a specific price called strike price on a specific date or by a specific date. To give an example, the kitchen can purchase two call options from Citibank that allows it to buy tomatoes at Rs.90 per kilo in June and July. If in June, the price of the tomatoes goes up to Rs.100, the kitchen will exercise the option and get the difference of Rs.10 from Citi. If in July, the price of the tomatoes falls to Rs.80, the kitchen will not exercise the option (let the option expire un-exercised) and buy the tomatoes from the market at Rs.80.

A call option is like an insurance policy. As a premium is required to be paid for the insurance policy to be valid, similarly, the kitchen has to pay an option premium to buy an option. In the aforementioned example, the option premium may be Rs.4. Thus in March, when the kitchen bought the options, it will pay Rs.4 per kilo to Citibank for the June option and another Rs.4 per kilo for the July option. Thus for the tomatoes bought in June, the net cost for will be Rs.94 (Rs.100 tomatoes from the market minus Rs.10 received from Citibank for exercising the option plus Rs.4 the option premium). For July, the net cost for the restaurant will be Rs.84 (Rs.80 tomatoes bought from the market plus the Rs. 4 option premium). Option premium has to be paid usually in advance to buy the option and there is no refund when the option is not exercised similar to there being no refund if someone pays for car insurance and then doesn't file a claim.

Swap vs Call Option

A swap/forward is cheap as there is no upfront cost to enter the swap agreement (though this cost may be built into the swap rate). The disadvantage is your cost is now fixed.

On the other hand, a call option gives the best of both worlds. If the prices rise of the underlying i.e. tomatoes, the buyer can exercise the option and receive the difference from the option seller (Citibank in our examples). If the spot price falls, the buyer lets the option expire unexercised and buys the goods from the market.

If options are such a good deal, why don't companies buy them for everything? Options are not cheap. Option premiums make the options expensive. Moreover, option premiums are required to be paid in advance. For example, if the company buys an option in March for settlement in September, the premium has to be paid in March. If the option expires unexercised, the large expense of option premium appears unjustified. This is why companies do not enter into option trades for every purchase.

Risk: Product/Quality Basis

This risk arises when the product in the hedge contract is different from the one that is being hedged. Let's say in the above example, Citibank says that due to a small market in Pakistani tomatoes, Citibank is not offering a contract on Pakistani tomatoes. However, due to the large Indian market, a forward contract is available on Indian tomato prices. The kitchen may decide to engage in a forward contract referencing Indian tomatoes saying that the price of Indian tomatoes and Pakistani tomatoes move in tandem. Added comfort may be derived from the fact that farming areas in both countries face similar vagaries of monsoon weather.

However, it may happen that due to mismanagement or supply bottlenecks, the price of tomatoes in Pakistan may rise significantly higher than in India. As Citibank will be paying the difference based on the price of Indian tomatoes, the payment from Citibank will not completely offset the increase in the spot price of Pakistani tomatoes. Thus despite entering a hedging contract, the risk isn't 100% hedged due to quality or the product that is referenced in the hedge contract is not the same product that the kitchen is buying. This is called product basis risk or quality basis risk.

Risk: Calendar Basis

The risk that arises when a hedging contract does not reference the same dates as the underlying exposure is called calendar risk. For example, let’s say the kitchen buys the tomatoes from the market every week i.e. 7th, 14th, 21st, and 28th of every month. However, the contract from Citibank references the price of tomatoes in the market on the 15th of every month. It could be that the price of tomatoes in the market may be lower on the 15th due to some vagaries in the supply chain compared to the days when the kitchen purchased the tomatoes. The result will be that the contract is not perfectly hedging the risk due to the dates on the contract not matching the dates of the purchases. This is called calendar basis risk.

Thus when negotiating an OTC contract forward or futures or options, it behooves the buyer to minimize the product and calendar basis risk.

If you are wondering why I am using airline and Citibank in my examples, it is because they are major players in this blog post. Ok. But why tomatoes? I wanted to use the below meme. I believe Abdul Hafeez Shaikh had entered a physical-delivered forward contract where he was buying tomatoes at Rs.17 when tomatoes were selling in the market for Rs.80.

Chapter 2 - Local Market Players

This chapter provides a brief overview of the players in the market. The takeaway here is that foreign banks are put on a pedestal in the local market due to their expertise, and corresponding lack of expertise of local banks as well as the colonial hangover of the local population.

Treasury departments of local banks

Local bank treasuries are perfectly happy and content with the status quo: charging few paisa spreads on purchase and sales of foreign currencies for settling import/export payments and investing all the liquidity in PIBs. No meaningful product development happens in local bank treasuries. The maximum they did was forward rate agreements or interest rate swaps in 2004 - 2007. When local bank treasuries did offer a slightly complex product, they received the product from Citi/SCB, slapped a small spread on it, and sold the instrument to local businesses.

With the profits that the treasuries bring in just by investing in PIBs and charging a spread to importers/exporters, neither the management nor the Seth owners of the bank feel any need for product development in treasury or banking generally. The banks have made record profits this year most of it coming from investment income. Why ruin a good thing with creativity and product development?

Standard Chartered Bank (SCB) / Citibank (Citi)

Product Development

International banks in Pakistan such as Citibank (Citi) and Standard Chartered Bank (SCB) have very large product development departments in their head offices and regional headquarters that develop new products in all facets of banking such as retail, commercial, corporate, treasury, cash management, trade finance, etc. We will focus on the treasury right now. Whenever the product development department develops a treasury product, the treasury teams world over receive instructions to market and sell these products. Treasury dealers in these banks are not only assessed for the profit they made but also on how many other products they cross-sell. To help the dealers market these products, the dealers at Citi and SCB are provided

Training and access to the online global knowledge base of the new products,

Access to regional and international product experts that can fly in to help the dealers when they meet with potential clients to market these products and

Access to treasury offices at head officers as well as regional headquarters that can access global securities and commodities on international exchanges.

In contrast, both HBL and UBL due to their own mismanagement had to pay penalties in hundreds of millions of dollars to US regulators and shut down their US branches thus losing access to a dollar base.

Duopoly

Citi and SCB is a duopoly when it comes to offering complex products. These two know that local banks have no one else to turn to when dealing with complex transactions. As such, they don't compete on pricing when offering products to local banks. With a large number of local banks and only two foreign banks (there are other foreign banks but those don't have the footprint of these two), whenever local banks need a service or product from Citi or SCB, there is little to no negotiation or competition. The local banks are compelled to take the price that Citi or SCB dictates. Local banks are price takers. Citi and SCB may not collude but they don't compete either.

Compensation of Treasury dealers

Unlike relationship managers in corporate banking and commercial banking who usually give loans of long tenors and hence are judged on their performance over a period, treasury dealers both in the local and international banks have daily P&Ls. It is a cutthroat world and treasury dealers have no empathy for the clients. Besides, they get compensated well for it. The bonus compensation for treasury dealers in Citi and SCB in Pakistan is in US dollars and bonuses of up to six figures in dollars are not uncommon.

Local businesses

When it comes to selling financial products, local bankers have a hard time selling new products to Seths and business owners. Coming from local banks, the owners will treat us as "Ghar ki murghi" negotiating over every paisa and basis point and making a fuss over every clause in the loan agreement. But when it came to dealing with a foreign bank, they may not bend over backward but they will comply with every condition just because a foreign bank wouldn't lend otherwise. When ABN Amro (ABN Amro existed on a standalone basis at the time) decided to go down market in 2006-2008, I had seen businessmen flattered that ABN Amro had called on them, and some businesses agreed to terms that they wouldn't agree to otherwise with a local bank just because they wanted to be known as ABN Amro's customer. Makes you wonder if the rupees we dispensed were watermarked with a different color than the ones dispensed by ABN Amro.

Chapter 3 - Tricks of Trade

This chapter just provides my understanding of the sales tactics that banks use to market their products.

Decoy Pricing

Dan Ariely describes this famous example in his amazing book Predictably Irrational. He came across the following subscription offer from The Economist, the magazine (he’s also explaining this in his TED talk):

Both the print subscription and print & web subscription cost the same, $125 dollars. Ariely conducted a study with his 100 bright MIT students. In it, 16 chose option A and 84 chose option C. Nobody chose the middle option.

So if nobody chose the middle option, why have it? He removed it, and gave the subscription offer to another 100 MIT students. This is what they chose now:

Most people now chose the first option! So the middle option wasn’t useless, but rather helped people make a choice. People have trouble comparing different options, but if two of the options given are similar (e.g., same price), it becomes much easier.

The middle option is decoy pricing whose sole purpose is to make the last option look good.

Hedging to Speculation

This is the trick we, the local bankers, also used to get the local businesses to contract our forward rate agreements or swaps. If we tried to sell these instruments for hedging, local businesses didn't buy them. These were mostly interest rate contracts. Let's say we are in March and 1 month Kibor is 5%. We would try to sell a forward rate agreement to fix the 1M KIBOR for June at 5.5%. The businessmen wouldn't bite. They will say that "we have been in this business for decades, never felt the need to hedge the interest rate risk and have done just fine. Why should we enter this needless agreement now?" The trick to convincing him was to flip the script and market the same instrument as a profit-making (speculation) instrument instead of a hedging instrument. Now the businessmen did bite. We would market them saying that there is a likelihood that KIBOR is expected to be 6.5% in June (the numbers here are for illustrative purposes). If you buy this contract for a notional loan size of Rs.100M, you can make a profit of Rs. 83,333 in that month (Rs.100M x (6.5%-5.5%) /12 months). We are marketing the same product but now instead of marketing it as a hedging transaction, it has been marketed as a profit-making transaction. The businessmen bought them by truckloads.

Paying a small price now for a bigger profit later

As these were new products, initially businessmen were afraid to enter these. The trick is to help them make a small profit in the first transaction. The bank's treasury absorbs this cost (if unhedged) as the price of making a huge profit later on. Once the businessmen get confidence by making a small profit in the first transaction, then he makes a bigger bet in the next transaction and this is where the treasury of the banks screw them over.

Killing them softly with complexity

This is where Citi and Standard Chartered ruled the roost offering exotic products i.e., cross-currency multi-commodity hedges with KIKO (knock-in knock-out) options and whatnot. We, the local bankers, didn't know such products existed much less offer them. Local banks' offerings were limited to plain vanilla forwards and swaps on the interest rate or FX rates. The foreign banks will bring their colorful presentations and product specialists from Dubai/London/Singapore office to explain these products to the businesses. Businessmen found it flattering that a product specialist traveled from Singapore to specifically make a presentation to them and explain this new product to them which referenced LIBOR, international currencies, and commodities.

The foreign banks were experts in collectively applying all the aforementioned tricks and royally screwed the local businesses which can be seen in the next chapter.

Chapter 4 - Real-World Examples

Let me give you few examples of how the foreign banks use the tricks of the trade that we discussed in the previous chapter to screw their clients.

Nigeria

I don't have access to the presentations or term sheets that Citi and SCB made to local businesses but they wouldn't be dissimilar to the one received by a classmate of mine who was working for an oil company in Nigeria. He sent me the following email in 2009:

My company (based in Nigeria) is about to enter into an interest rate swap deal with a London bank and they have proposed indicative pricing levels as follows:

Is anybody able to help me with a view on what 3mL forward curve is likely to be over the next 5 years in order for me to properly negotiate the barriers?

Also, based on below, is there anything you will suggest I look out for before signing any deal.

Thanks for your help.

The bank in London has sent him is a complicated term sheet where he is required to bet on a 3M LIBOR forward curve over the next five years. If it looks complicated and in Greek to you, rest assured, it looks the same to 99% of the people. The way this transaction works is that client receives 21.50% of the Nigerian Naira loan principal from the bank every quarter. If the 3M GBP LIBOR is within the upper and lower barriers in that quarter, the client pays the bank 17.50%. Thus the client receives a net 4% (21.50% - 17.50%). However, if the LIBOR is outside the barriers, the client pays 28.50% i.e. client ends up paying 7% (28.5% paid - 21.5% received) to the bank. This will be a cash-settled transaction.

The way to understand it is that client will have a separate loan with a local bank priced at the local interest rate. Let’s assume the rate on that loan is fixed at 20%.

If the client is lucky i.e. LIBOR is within the barriers, he will get net 4% from the UK bank. His total cost on the local loan will be 16% i.e., 20% that he pays to the local bank minus 4% that he gets from the UK bank.

If the client is unlucky, LIBOR ends up outside the barriers, the client will not only pay 20% to the local bank but will also pay 7% to the UK bank. Thus making the total cost of his loan 27%.

The questions that arise here

1. What sort of swap is this? The purpose of swap is usually to fix the rate (there are transactions where a client swaps his exposure from fixed to a variable but I asked the colleague and he told me that wasn't the intention here). Here the swap is introducing more volatility i.e. client's cost can range from 17.50% to 28.50% (a variability of 11%) i.e. the client is short volatility.

2. Client's local loan is in Nigerian Naira. The interest rate on the loan will be the Naira interest rate. Why is the client betting on 3M GBP LIBOR?

If you don't understand much of what I said above, don't worry, it turned out that my classmate didn't either. However, he was made to feel sophisticated by the bank and he was willing to forecast the range within which 3M LIBOR will fluctuate over the next 5 years which he had no expertise in nor business doing.

If you believe such transactions only happen with Nigerians and Pakistani corporates will not fall for such tricks by Standard Chartered or Citibank, let me dispel that belief.

Towellers Limited

This is from the 2013 financial statement of Towellers Limited

You can read the description of Cross Currency Interest Rate Swap in note 28.1. It is not dissimilar to the Nigerian example. The company is receiving an interest rate based on KIBOR on rupee notional amount and paying interest rate based on USD LIBOR on dollar notional amount plus also paying differential of USD/PKR exchange rate. The company entered 4 such agreements. The company's total interest payment for its financing in 2013 is around Rs.20M (markup/interest on short term borrowing + long term borrowing) and the payment that Towellers ended up making on the settlement and unwinding (read loss) of "hedge" is almost Rs.100M i.e. 5 times their annual financing cost. This is how these foreign banks make their clients dream of England.

International Industries Limited

Towellers can be forgiven as they aren't as sophisticated as International Industries Limited. IIL was my client and they wouldn't buy a plain vanilla swap from me but when a foreign bank came knocking and tried their cross-currency swap tricks on them, IIL ended up paying Rs.127 million in 2015 on account of a hedging transaction they entered with Standard Chartered Bank. Makes you wonder what sort of hedging transactions these entities were entering.

Lucky Cement Limited

Lucky Cement was also my client. They drive very hard bargains with local banks. Normally a local bank may charge a spread anywhere from 0.05% to 0.1% or even more when buying or selling foreign currency to importers and exporters. But these memons at Lucky Cement had an arrangement with memon (ok Khoja) owned Bank Al Habib and Metropolitan bank where they will bring both their export and import payments to the banks on the same day and allow the bank to only make a spread of 0.02%.

Then Citibank came calling with their fancy presentations and scammed the shrewd penny pinching memons out of more than Rs. 1 billion. From Lucky Cement's 2009 annual report

An Rs.1.3 billion loss on a cross-currency swap over two years i.e. Rs.419 million in 2009 and Rs.896 million in 2008.

Note: I am a big fan of Lucky Cement and its shrewd business acumen. I was stereotyping them to show that when it comes to the foreign banks playing their tricks, all the shrewdness goes out of the window.

Alhamdulillah after these transactions, all these local blue-chip corporates have sworn never to enter an exotic hedging transaction every again. These were not cheap lessons.

There are just three examples from Karachi. SCB and Citibank scammed businesses nationwide. I am drooling thinking of the 5 to 6 figure bonuses the treasury dealers from SCB/Citi would have earned for selling "hedging" instruments. In the three listed companies I mentioned, SCB and Citi collectively afflicted Rs.1.5 billion loss. No mean feat considering they are one of the shrewdest businessmen of Pakistan.

PIA

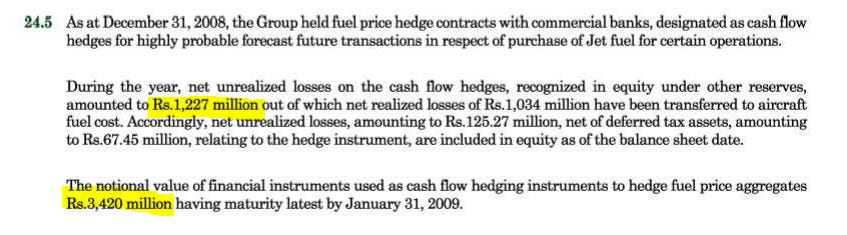

This example has all the topics that I am interested in.

There was a major episode when GoP banned PIA from ever hedging fuel costs again but it is hard to find out what was the nature of the transaction from the clues available in the financial statements.

Public Accounts Committee of National Assembly on Thursday clamped a ban on Pakistan International Airline for fuel hedging in the future, which it observed inflicted huge financial loss to the entity. Chaudhry Nisar chaired the committee meeting, which reviewed the Ministry of Defence Audit Report for the year 2008-9. The committee chairman claimed PIA operated the Haj flights by hedging fuel, which inflicted Rs 120 billion colossal losses to the public exchequer in 2008.

The Managing Director explaining his position said fuel hedging was his own decision and he was ready for any kind of accountability. He claimed that government hailed this decision as it had been taken at a time when oil prices in international market were showing upward trend.

He said on the request of flag carrier, Citibank (Pvt) Ltd and Standard Chartered Bank (Pvt) Ltd made hedging arrangements for 425,000 barrels at $120 per barrel. He said the Ministry of Religious Affairs persuaded the PIA management for fixing Haj fares of 2008. The ministry wanted the exact amount of Haj fares prior to announcement of Haj Policy. "The PIA board decided to go for fuel hedging to give a ticket price in Haj policy 2008," he said.

He added that as services of oil hedging experts were very costly in international market, therefore, they had to depend on the banks. Defence Secretary Lieutenant General Ather Ali (Retd) said he is not satisfied with the hedging arrangements and would discourage this practice in future even in case of Haj operations.

Let's take it step-by-step. To give the background, the prices were rising in 2008 when the hedge was entered and the prices fell in 2009. If the hedge was a straight swap, PIA would have ended up paying more for fuel than had they bought the fuel from the market.

A few points:

On an overall level, it shouldn't have caused a loss on the hajj flights (for which the hedge was entered into) as the fuel price costs would have been offset with the fixed ticket revenue from hajj flights.

The audit report by the Ministry of Defence, most likely representatives of the holy cows, claim that the loss to the national exchequer was Rs.120 billion. What is going on here is MoD instead of looking at the hedge against the hajj ticket prices is looking at the transaction against how much money the country would have saved. This isn't how you analyze a hedge. The efficacy of the hedge is measured against the costs it is trying to hedge. But who is going to tell this to the holy cows?

The Defence Secretary who is a retired Lt. General says he is not satisfied with hedging arrangements. I wonder what expertise he has in analyzing hedges.

We have the usual culprits here again: Citibank and Standard Chartered. They would have told PIA that international hedging consultants are expensive and you should go with us. Oil hedging isn't that complicated and a request for a proposal for hedging consultants would have brought competitive proposals from advisors for their services. But if you go with the duopoly of Citibank and Standard Chartered, you are bound to be taken to the cleaners. I am 90% sure that Citibank and Standard Chartered would have given PIA the script that "international consultants are expensive."

Now the most amusing part. I don't know what sort of hedge was this. The hedge was fixed at $120 per barrel for 425,000 barrels. The rupee was hovering around Rs.80 at the time. Assume that the hedging instrument was a pure swap that fixed the cost at $120 whatever the international price was. Even making the ridiculous assumption that oil price in the international market had fallen to $0, the maximum loss to the national exchequer would have been Rs. 4 billion ($120 per barrel x 425,000 barrels x Rs. 80 per USD). How is the MoD claiming a loss of Rs.120 billion? Standard Chartered Bank and Citi either sold a really convoluted hedging structure or MoD is grinding some ax without having any idea of what happened.

The entertainment doesn't end here. Let's see how PIA reported it in its 2008 financial statements. As per PIA, the total unrealized loss was Rs.1.2 billion.

The below is from the following year i.e. 2009 which says that PIA saved Rs.500 million from the hedge and BoD has increased the limit from 20% to 40%.

2009 report also mentions PIA isn't engaging in any more hedging transactions which are kind of weird considering that the same report also says that PIA saved Rs.500 million and BoD has increased the authorization from 20% to 40%.

To summarize, PIA entered into a fuel price hedge with Citi and SCB as reportedly international consultants are expensive. As a result of the competitive hedge offered by Citi and SCB, PIA incurred a loss of Rs.1.2 billion in 2008 which somehow turned into a profit of Rs.500 million in 2009 (weird considering oil prices crashed in 2009), and in 2010 MoD reported that the actual loss due to the hedge was Rs.120 billion.

Bonus Feature - Airline fuel hedging

This has nothing to do with the current blog post and you can skip it and move to the next section if not interested. Airline fuel hedging can be hard. The difficulty is not due to the complexity of entering into a hedge rather due to the volatile nature of the airline business. If airlines had entered into hedges in 2019 for 2020, the hedges would have resulted in significant losses as airplanes just couldn't take off due to COVID19 restrictions. All those hedges would have been for naught.

‘Overhedging’ Oil Prices Lands Some Coronavirus-Battered Global Airlines in Further Trouble - WSJ

As global airlines reel from the huge drop-off in business caused by the coronavirus, some face a second hit from this year’s historic plunge in oil prices.

Some international airlines use financial instruments known as hedges to lock in years of fuel costs, a method aimed at smoothing out turbulence in the energy markets and providing guidance on one of the industry’s biggest expenses.

However, the collapse in energy prices this year has left companies “over-hedged,” effectively meaning they have bought more insurance than they can now use. This is another trouble spot for airlines already slashing capacity to adjust to a new world of closed borders, empty planes and fearful travelers.

Earlier this month, British Airways‘sparent company, International Airlines Group, took a €1.325 billion charge on overhedging. Air France-KLM, one of its main European rivals, has recorded a similar hit totaling €455 million.

In January, Singapore Airlines said it had hedged the bulk of its expected fuel costs out to March 2025. For the four years from April 2021, it had hedged more than half of its fuel needs based on Brent crude at $58 to $62 a barrel, plus some extra protection based on jet fuel.

Airlines sometimes buy longer-dated hedges based on Brent, the global oil benchmark, because this market is bigger and more liquid than jet fuel.

Singapore Airlines said it expected to see further hedging losses, and marked down the fair value of its other hedges by $1.47 billion. Its remaining hedges include some for the current financial year that are still deemed effective, a spokesperson said, and others for future years.

Section 2

Chapter 5 - Analyzing the Hedging Proposal

Now we come to the main part of the post. I will summarize the main points as excerpts and present my commentary. I will refer to the Ministry of Energy (Petroleum Division) as PD hereon. The actual summary is attached in the footnote so that you can peruse it at your leisure.

The PD has been working with Ministry of Finance (MoF) for last one month to evaluate the possibilities of hedging some portion of the exposure to Pakistan for import of Petroleum products that is directly or indirectly linked to crude prices. This includes crude oil, motor gasoline, high speed diesel as well as LNG.

It should be a weeklong exercise at most. Hedging products are standard. The PD should already know what their import requirement is. But considering the ministry going down this route for the first time, it may have taken them some time to come up to speed. Also, they would have to take everybody on board as not to end up on NAB's list, if things go wrong.

In this process several discussions were held with Standard Chartered Bank, Citibank and a consortium of Habib Bank with JP Morgan to understand the options available and pricing mechanisms.

PD avoiding reaching out to expensive international consultants and going with the competitive duo of SCB and Citi again. But we have HBL this time too. If you are thinking HBL, a local bank, as part of a consortium will bring some rationality in pricing then you are wrong. The top dog in the HBL treasury is ex-SCB and he or she knew that SCB and Citi will be raking in the moolah for this transaction and he/she knew all the tricks coming from the same institution. But HBL does not have access to the infrastructure that Citi/SCB has. This is where Aurangzeb's JP Morgan contacts come in. Instead of two international institutions giving the shaft to GoP, this time the profit will be divided three ways and HBL will share it with JPM.

The advice from the three institutions was to start with 15-20% of exposure. Once program is operational, it could be increased and made a regular program. Indicative prices were given but it was clearly advised, as prices change hour to hour, it being a volatile market, to not try to time the market and wait for some level of price stability.

Reasonable advice so no qualms here.

It was decided to target only 9% of exposure for 2 years. Pakistan imports equivalent to 175 million barrels p.a. equivalent every year. 9% of it will translate into around 15 million barrels per annum. Hedging over two years will require a hedge covering 30 million barrels equivalent.

Reasonable approach. No qualms here either.

Now the games begin.

First option considered was a straight swap but it was rejected because while it gives the benefit of fixed price, it takes away the benefit of the low market prices if prices decline further. The fixed price will of course be higher than the current price and will keep increasing the longer the swap.

What is not mentioned here is that swaps are the cheapest. They could have easily been locked at a price that would have been slightly higher than the current price but it would not have meant as much commission and bonuses for Citi/SCB/HBL/JPM consortium. Note the bold part, which was included in the summary. It isn't wrong but it doesn't mention how high compared to the current price. Was it as little as a dollar per barrel higher than the current price? They don't even quote the swap rate, which is much easier to quote than a call option rate. Must be part of the SCB/Citi script.

Secondly, and this is the important point. PD is hedging only 9% of exposure. 91% of your exposure is unhedged. If the prices decline further, the benefit of the reduced price will be available on the 91% unhedged portion. The purpose of mentioning the swap here appears to be a decoy sale i.e., push everyone to the next choice. I tip my hat to SCB/Citi that they taught PD well.

After rejecting swap on principle, it was decided to purchase call options as they act as insurance policy. They allow the purchaser to benefit if the prices decline while at the same time putting a ceiling on the maximum price that can be paid.

Textbook definition of call options. No objection here.

Two call options will be purchased for 15 million barrels of oil each. First option will be for the 15 million barrels for one year divided in 12 equal monthly amounts. The second option will be for another 15 million barrels for two years divided in 12 equal monthly amounts.

Woah Woah. Did anyone try to graph it out? The above structure makes for a very un-equal hedge. 15 million barrels divided into 12 installments translate into 1.25 million barrels per installment. Let me graph them for you.

As per the current structure, in the first year, we are hedging 1.25 million barrels one month and 2.5 million barrels next month. In the second year, we are hedging 1.25 million barrels every other month.

Not blaming Citi/SCB/HBL here for this, as their job is to just sell the product. It took PD and MoF one month to come up with this structure. Unbelievable. Also, this structure means that 75% of hedging is done in year 1 and 25% of hedging in year 2. Who agreed to this structure?

The payoff from the call option can be allocated to any particular product, however, since in LNG sector only government entities are involved while private companies are involved in refineries and OMCs, it will be better to allocate it to LNG.

I am surprised that government to government (which Business Recorder calls G-to-G) is the justification to allocate the hedge to LNG. The best reason to allocate the hedge to LNG is that Qatar LNG references Brent. Hedging Qatar LNG with a call option on Brent price means that there will be no product basis risk. The prices of other products such as hi-speed diesel (HSD), crude oil, jet fuel that Pakistan imports are not pegged to Brent. Pakistan will be taking on a basis risk by hedging HSD, crude oil, and jet fuel imports with Brent. Options based on Brent benchmark will not be fully hedging exposure of non-Brent pegged oil products. However, options on Brent are one of the most widely traded options globally for hedging crude oil, jet fuel, HSD, etc. despite leaving one exposed to basis risk. PD just needs to be mindful that there will be product basis risk if other products are hedged with Brent. PD is doing the right thing here but justifying it by giving the wrong reason. Oh well...

The option premium for 1-year call option is $3 million per month when they were considering strike price $10 per barrel over current price. Option premium for 2 year call option is $5 million per month for a strike price $15 per barrel over current price. However, banks have agreed to instead of taking the premium in advance, take it over the period of the hedge and there.

Staggering the premium payment over the hedged period is a good move. However, the premium on the two-year call option is exorbitant. Considering the hedge is 24 months long, the option premium for call option 2 is adding $8 per barrel to the cost of each imported barrel. With the price of Brent at $35, the cost of option 2 is almost equal to 25% of the cost of the barrel.

Moreover, for a summary that is being moved to ECC, this is an absurd way to announce the cost of the options. Are they trying to not show that the total cost of engaging in this exercise is $156 million? Was there a possibility when the country was celebrating every little current account surplus, announcing such a high-cost hedge would have resulted in it not being approved by ECC?

Assume the price was $35 per barrel when the hedge was entered. The strike price of the 1-year call option will be $45 per barrel ($10 over the current rate) as per the example above. PD will be under the impression that the option will break even when the oil price rises above $47.4. Assume the spot price is $47.4 per barrel, GoP will exercise the option. SCB/Citi/HBL will pay GoP $2.4 ($47.4 - $45) as option pay off. However, GoP will be paying a $2.4 option premium for this month for the 1-year option. This option premium will offset the payoff. GoP will get nothing. But if the price goes over $47.4, will GoP start getting something? No. Because of the convoluted structure negotiated by PD with SCB/Citi/HBL, GoP will also be paying the option premium for the 2-year hedge i.e. $8 per barrel. Thus the spot price of oil has to increase to $52.7 (An average of $47.4 breakeven for a 1-year option plus $58 breakeven for the 2-year option) for the option to break even. These are very expensive options. I wonder if anyone in PD calculated this. I wonder if the straight swap could have been much cheaper than this.

This breakeven calculation is for the month on which both 1 year and 2-year option is effective as per the graph. There are months where only 1-year option can be exercised but the premium will have to be paid for both options. The break-even price on that month will be higher. In year 2, there are months when the option isn't available (every other month) so should on the months on which we can exercise the options should we add $8 twice for calculating the breakeven?

PD sought an approval from ECC to purchase a 1-year option at $8 over current Brent price and 2-year option at $15 over the current Brent price as long as the fee (read option premium) is in an acceptable range.

Who will determine if the option premium is in an acceptable range? PD isn't telling the total cost of the hedge? Will SCB/Citi/HBL educate PD on what is an acceptable range of the fee?

OGRA to be given policy direction to include the monthly price of options in the cost of LNG (or any other oil product chosen).

Two points on this one:

A lot more is required than giving a policy direction to OGRA to include the monthly price of the option in the announced LNG prices or any other oil product chosen. “OGRA is required to work out oil prices on the basis of existing tax and petroleum levy rates notified in the Gazette of Pakistan by the federal board of revenue and director general oil of the petroleum division, respectively. No other instrument or a letter from finance ministry could be a replacement to gazette notification. The government has the prerogative to increase the rate of tax or petroleum levy anytime through gazette notification.”

While the consumers will be paying the cost of the option, there appears to be no plan in the summary to benefit them when the option is exercised. When SCB/Citi/HBL pay GoP, will GoP show it as remittances or profit and not pass its benefit to the consumers who are paying the price of this option through higher bills?

I had written an article analyzing the hedge to be published by an institution at the time but then decided against publishing it. I tried to estimate the cost of the hedge as of 15th May. I am just copying pasting the section of that unpublished analysis below:

As of writing this (May 15), the spot of Brent is trading at $36. The prices of the options is taken from https://www.barchart.com/futures/quotes/CBN20/options/ which quotes the option price on ICE (intercontinental exchange).

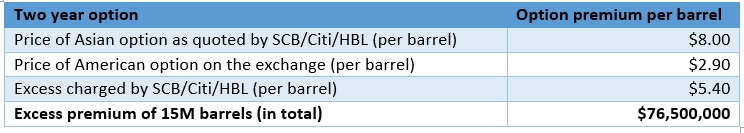

August 2020 Brent Crude call option (American) with a strike price of $ 44 ($8 spread over current sport price) is trading at $0.32 and August 2021 call option (American) with the same strike price of is trading at $5.45. Though the relationship isn’t linear however we can roughly estimate the cost of 12 monthly call options covering one year to be the average of $0.32 and $5.45 i.e., in the range of $2.9.

August 2020 Brent Crude call option (American) with a strike price of $ 51 ($ 15 spread over current sport price) isn’t trading. Let’s take the next nearest one with a strike price of $ 49 ($13 spread over current spot price). It is trading at $0.21 for August 2020 and August 2022 call option (American) with a strike price of $49 is trading at $5.56. Again though the relationship isn’t linear, we can estimate the cost of monthly call options to be around the average of $0.21 and $5.56 i.e., in the range of $2.9 per barrel. The option premium of 2-year option is low despite being an option of 2 years as the spread of $13, makes the option deep out of money. Options with spread of $15 should trade even lower.

These are American call options (which are more flexible than the options being purchased by Ministry of Energy) as American call options can be exercised at any time before maturity and therefore are more expensive. The price that should be paid by Ministry of Energy for the call options which are exercisable in specific months only should be less than American call options.

1-year-option: the below table compares the price quoted by SCB/Citi/HBL to the market price of a similar option trading on ICE at the time. The price appears to be reasonable considering the option priced at $2.9 is more flexible.

2-year-option: this is where SCB/Citi/HBL really rip off GoP. On the exchange the price of 2-year option isn't much different than the 1-year option because the strike price of 2-year option is almost 50% more than the current price making it deep out-of-the-money and that makes it very cheap at $2.9. Citi/SCB/HBL quoted this option at $8 per barrel. At 15 million barrels, Citi/SCB/HBL were overcharging GoP by $76.5 million.

Finally, it is absurd that PD has spent one month studying the option and it is still not clear where to apply the option i.e. LNG or any other product. I fear there is calendar basis risk in this transaction and PD isn't aware.

In case of Qatar LNG, the terms of agreement are that LNG arriving in Pakistan in a particular month will be priced at 13.37% of the preceding three months’ average price. Whereas in case of POL imports, POL prices are linked with Pakistan State Oil (PSO) actual import price of preceding two weeks. In case of non-availability of PSO import prices, the ex-refinery price is determined as per existing Import Parity Pricing (IPP) formula. Import Parity Pricing is determined after taking an average of past 30-days international prices as published in the Platt's Oilgram.

As PD is saying that amounts received can be allocated to any product, my fear is that PD hasn't even checked what Brent price the options reference i.e. average price of the month or the average of preceding three months.

Coming back to the PD summary to ECC.

Comments of SBP, Finance Division, Planning Division, OGRA and PSO are at Annex - 1 (to be attached on receipt).

I really hope that someone shares with me the comments received from the aforementioned august institutions on the structure. It would be great to know if anyone at SBP, Finance Division, Planning Division, OGRA, and PSO highlighted the issues that I am highlighting here.

If you think that SCB/Citi/HBL wouldn't be ripping of Pakistan Government in broad daylight like this, you have already forgotten the examples I gave in the previous section.

Who is going to tell the government that it is being ripped off? PD is lapping everything up what SCB/Citi/HBL is telling it. The best part. The price of a 2-year option is the same as the price of a 1-year option because the strike price of the 2-year option is significantly high i.e. it is deep out of the money. However, SCB/Citi/HBL has somehow convinced the PD that since it is a two-year option, its price will be 3 times the one year option. I bow down to the sales skills of Citi/HBL/SCB.

I am drooling thinking of the bonuses the treasury team at SCB/Citi/HBL would have gotten if this transaction had gone through. I don't know why it didn't.

Section 3

Chapter 6 - Coverage in the Newspapers

One has to feel for the local press. Unlike WSJ or Financial Times, where they have different reporters/analysts covering different regions and products, the business section of the local press (which is dying anyway) has a few reporters and they have to report on everything from inflation to commodities to the central bank to Q block to what not. Most of the oil hedge reporting was limited to reproducing the summary. There were a couple of exceptions, which I cover below.

Dawn had a misleading headline but it reached out to a previous MD of PSO for its comments.

Petroleum ministry seeks oil purchase at higher rates

In a risky move, the petroleum ministry is seeking purchase of oil at $8-15 per barrel higher than the current low price for hedging of about 20 per cent of its total oil imports and pass on the cost of this higher rate to consumers.

A former managing director of the Pakistan State Oil (PSO) said the proposal would entail that Pakistan and its consumers would not take the full benefit of the prevailing market crash in case of petroleum products and LNG while some smart hedge managers would move away with a quick buck.

He said a better idea would be to allow oil companies, particularly the PSO, to move a part of their purchases to spot market to take full benefit of low prices in a balanced basket. The proposed hedge tag of $8 and $15 per barrel is too high.

PD isn't buying at a higher price. It is locking in an option at that price. The previous PSO MD made a correct comment that some smart hedge managers would move away with a quick buck. Quick buck of around $76.5 million that SCB/Citi/HBL will end up making.

Business Recorder went in the completely opposite direction .

Oil Hedging On The Table - Take it! - BR Research - Business Recorder

The Ministry of energy (petroleum division) is proposing a bold decision to hedge imported oil in days of low prices. Hedging is not a simple decision in a volatile market as the hedging cost is volatile too. The complications increase in a country where unnecessary politically motivated accountability is a norm. Credit goes to Nadeem Baber and team for coming up with a not-too-expensive call option.

This was the lede. Can you believe it? Bold decision. Credit goes to. No too expensive. Oh well...

The proposal is to have a strike price of $8 above current Brent for 15 million barrel of oil for one year. Pre-COVID, Brent price averaged at $63.6/barrel in Jan20 before falling to $55/barrel in Feb and nosedived to $23.3/barrel in April. Currently, the price is hovering between $25-30/barrel (and moving up). If the government can have a deal at strike price of $38/barrel, it is making money as long as oil prices remain higher than $40.4/barrel (assuming option cost is $3 million per annum for 15 million barrels). It seems to be a good buy. Just go for it.

A similar proposal is offered for two years but at a higher premium. Remember, longer the time of option, higher is the cost. Here the call price would be around $5 million per month for 15 million barrel for two years at strike price of $15 above the current rate. The cost would be $4/barrel and if the oil prices remain higher than $49/barrel (assuming current at $30/barrel), this option will make money. It is a little risky and the government can avoid it.

The best option is to buy one-year option for 30 million barrel. Let’s test the water with around 20 percent of oil import for one year. This can be rolled over after the termination of contract.

Just focusing on the bold parts.

The option cost of 1 year option isn't $3M per annum. It is $3 million per month. A total of $36 million per annum i.e. 12 times the cost the newspaper is mentioning. I wonder does the newspaper still find this option no-too-expensive (the 1-year option price is actually fine).

The longer the time of the option, the higher is the cost? While theoretically true, I just showed that the option is so out of the money, the cost is the same as one year option.

There is no rollover like futures. The options expire. You enter a completely new arrangement for the next hedge.

Chapter 7 - Experts

Pakistan boasts a large number of experts. CFA Society holds awards every year. LinkedIn is full of people with FRMs in their titles. Some of them could have looked at it. The Profit did reach out to local experts and analysts and it makes for a wonderful reading.

The perfect title to the piece.

Experts explain govt's decision to hedge oil prices - Profit by Pakistan Today

Adnaan Sheikh, a market analyst says, “It’s about time the government matured enough to hedge oil, however, it is disappointing that the government has to rely on a consortium of international bankers and cannot rely on local or regional banks, due to the unprecedented nature of the task for Pakistan.”

Hahaha. Local banks neither have the infrastructure nor capacity. Companies world over deal with a consortium of international bankers. However, companies usually hire a consultant or if they have internal expertise, hold a beauty parade asking for the most competitive offers from international agents. Seriously, why am I wasting time on this superfluous comment? Moving on.

“At a time when the IMF is said to be pushing for new taxes and expected current account imbalances due to slowdown in remittances and exports, hedging oil now will not only provide an external account cushion but also fiscal support to maintain the monetary easing stance of the government and will help recover GDP in the fiscal year, explains Baqar Jafri, Economist & CEO at Investors Lounge. “It’s not a novel idea. Oil importing countries around the world have already started working on it. Pakistan will be very unfortunate, not to fully capitalize on it,”

I mean the whole first sentence is absurd. This is a hedging instrument. It costs $156 million and if oil prices don't rise, it will be an expense of $156 million. I don't know how he thinks that oil hedge will help recover GDP and provide fiscal support. This is a hedging transaction and not a speculative transaction where one tries to make a profit by betting on the magnitude and direction of the move.

As per Qasim Anwar, a technical analyst at AKD Securities, “I think crude is still in a recovery mode. In my opinion, Brent crude can recover up to $37 to $38 by the first half of June 2020. The said target meets the 38.2% Fibonacci retracement of last interim fall from $71.85 to $15.98”.

Hard to argue with someone who refers to Fibonacci retracement and quotes numbers up to two decimal places. Must definitely know this stuff.

Maha Kamal, an International Public Policy Specialist states, “it is a sensible proposal to have multiple call options and hedge prices at a figure that smoothens the overall impact to Pakistan’s economy.” She adds, “policymakers must be incredibly cautious about what they hedge to — waiting for the price to bottom out seems like a good idea on the surface, but it can be risky to lose the deal altogether. Waiting for a semblance of price stability is sensible, so that reasonable forecasts may be made. Hedging for a price between $20-40 may be the best-case scenario.”

Spoken like a true development professional and policy specialist.

Tahir Abbas, Head of Research at Arif Habib Limited, “Considering how Pakistan imports approximately 75-80 pc of its energy needs, the decision to hedge would be positive if the spot prices are higher than the price hedged at.”

Just brilliant.

Fahd Sheikh, an Investment Banker reiterates the government’s cautious stance while hedging prices. He says, “The government is surely on the right track and taking brave yet smart moves, however, exposure of 15-20 pc is certainly not enough. In order to reap larger gains, the government can revisit in a month and push up the hedging exposure to 50 pc.”

This is a hedging transaction. There are no gains here. I also wonder if this is a brave move.

Dr Abid Suleri, Executive Director of the Sustainable Development Policy Institute opines, “In the past, governments were reluctant to hedge POL prices because they thought it was too risky to hedge. GOP should go for 2 years all option, rather than straight swap which may be more adventurous for GOP.” He adds, “If PIA were a profit-making airline, then it was the best time for it to hedge for fuel prices.”

The straight swap would have been very cheap. GoP is getting ripped off in a 2-year option. It really doesn't matter if PIA is a profit-making airline. As long as PIA is flying, it needs fuel, and fuel costs can be hedged.

Umer Farooq, Investment Analyst at AKD research says that the government should conduct preliminary cost-benefit analysis.

I don't know what to say here.

Dr SM Naeem Nawaz, Head of Macroeconomic Analysis & Energy Economics at the Punjab Economics Research Institute explains how the finance ministry should ensure to take a financial point of view before progressing. He opined, “Economically, it is a good idea but the Ministry of Finance should involve a financial expert on hedging who is not available yet. It may not be practically possible. Market dynamics are too complex which do not move with the wishful thinking of any community group.”

He is right that financial experts should be involved. But I don't know why he is saying it is not practically possible. His last sentence leaves me scratching my head.

There you have it. None of the experts that were consulted had read the hedging summary or probably they did but were swayed by the lede in Business Recorder that it was an uncharacteristically bold decision by Nadeem Babar and his team that arranges this not-too-expensive option (where GoP is overpaying by $76.5 million).

They are treating it as a general question. Should we hedge? Sure why not.

Conclusion

For some reason, the whole effort fizzled out and GoP didn't engage in the hedging transaction. The real tragedy would have been if the GoP had entered the transaction and then collected laurels due to luck and no one would have been none the wiser.

Brent Crude today on Feb 11 is trading at $61. Assuming the hedge contract referenced the price on Feb 11 and we entered the hedge when the Brent was trading at $35, both of the options would be in the money today with GoP collecting $15.6 per barrel ($61 - $45 contract price - $2.4 option premium) on the 1-year option and $3 per barrel ($61 - $50 - $8 option premium) on 2-year option. In total GoP will be collecting $2 million from the banks. The newspapers and social media would have been full of people praising Nadeem Babar for his bold and unprecedented move. Shibli Faraz would be holding press conferences as if this is a historical first.

This would have emboldened the PD and next time egged on by the press and social media they would have signed bigger and maybe more expensive hedges for 50% of the import bill. No one would have been wiser.

I am sure you are wondering do Pakistanis don't know anything about hedging beyond textbooks and CFA exam questions? It is not like this. Pakistani businessmen are shrewd to have learned their lesson. They hedge mainly using cheap forwards and futures. They don't go for expensive options or exotic instruments.

Majority of the exporters, when they submit their documents to the banks, lock in 50% of the FX rate. Say a textile exporter exports goods and presents the export documents to the bank. Payment is expected in 3 months for $1 million. The textile exporter will ask the bank to lock in dollars by buying a forward contract for $500,000 (50% of the export proceeds). Thus when the export proceeds come after 3 months, 50% of the proceeds will be converted into rupees at market rates and 50% at the forward rate that was agreed three months ago. Due to the variability of the USD/PKR rate, sometimes textile exporters have a small gain on the contract and sometimes a small loss. Textile exporters aren't looking to making money on the hedge. Just to bring some sort of smoothness to their income. This is similar to straight swap which PD rejected straight away because this is what Citi/SCB/HBL might have told them.

Secondly, textile exporters also engage in a futures contract at international exchanges. The cotton production in Pakistan is decreasing and international cotton prices can be volatile. Exporters have to import cotton to meet production needs and such lock in prices by buying cash-settled futures for Cotton #2 at ICE.

Cotton imports: Black Friday prorogued - BR Research

It appears that the shrewdness of domestic spinners has saved the day. Off the record conversations with one of the largest textile exporters indicates that forward contracts for imports were already entered way back when prices began to stretch in September last year.

Brent Futures also trade on ICE. PD could have reached out to textile exporters and asked them how you engage in transactions on ICE. It would have provided a sanity check for the prices that are being quoted by SCB/Citi/HBL.

I hope you were entertained.