Bancassurance #5: SECP as an agent of insurance companies

Like most posts on this substack, a tweet is a reason behind this post.

I am DUMBFOUNDED that SECP chose to ignore the fraud, misselling, scamming, and ripping off of the widows, elderly, pensioners, and families of martyred soldiers, and chose to reply to a comment about commission only. And there too it tries to mislead. Makes you question if SECP is the regulator of insurance companies or their lobby group.

First, it tries to justify the current premium levels, saying that they are comparable internationally.

Two, it portrays that the commission will be reduced from 50% to 35% which is clearly not the case as we shall find out later in the post.

CIAR 2020

So I went down the rabbit hole of the SECP Corporate Insurance Agents Regulation, 2020 (CIAR 2020). It is 2022 and Pakistani regulators are still uploading scanned documents. I don’t have OCR software, so I had to go paragraph by paragraph, as running a CTRL+F function on such PDFs is not possible.

Definitions

A few definitions from CIAR 2020 set the stage.

Corporate Insurance Agent: Based on the below definition, the bank is acting as the corporate insurance agent.

Direct Sales Model: When it is the bank manager or any other employee of the bank selling the insurance, it is known as the Direct Sales Model (DSM).

Referral Model: When the bank manager passes on the details of the customer/depositor to an insurance company employee, it is called the referral model.

To summarize, in the bancassurance model, the bank is acting as Corporate Insurance Agent. If the Bank manager or any other bank employee is selling the insurance to depositors, it is the Direct Sales Model. If there is an employee of the insurance company in the branch to whom the bank manager refers to sell the insurance, it is called the referral model.

Two Conditions in CIAR 2020

Condition 1: The minimum allocation of premium to the investment account

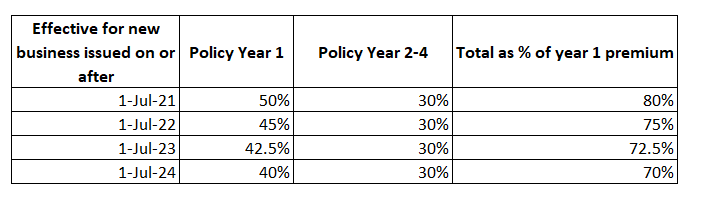

Let’s take the first line. For someone signing up for bancassurance after July 2021, up to 50% of the premium can be allocated towards paying expenses and commissions with the balance 50% allocated to investment. In the next three years, another 30% cumulatively can be paid towards meeting commissions and expenses. Thus, a total of 80% of the gross annual premium can be allocated toward other expenses.

This maximum reduces to 75% the following year, 72.5% after July 2023 and finally at 70% of the one-year premium after July 1, 2024.

This will become clear with an example. Let’s say a bank manager deceives you into signing up for a bancassurance product based on the aforementioned terms on July 2, 2021. The annual premium is set as Rs.100,000. As per the first line, the insurance company can use Rs.50,000 of the first year premium towards paying the commission and other expenses. Only the balance Rs.50,000 will go towards investment. Similarly, from the Rs.300,000 premium paid in the next three years (Rs.100,000 annual premium x 3 years), another Rs.30,000 can be paid towards commission and other expenses. While you may be counting your chickens assuming Rs.400,000 have gone towards the investments, in reality, only Rs.320,000 would have gone towards investment with the balance going towards paying commissions and expenses.

If you signed for a 10-year policy on July 2, 2021, after ten years you would have invested Rs.1,000,000. However, only Rs.920,000 would have been invested, with the rest going towards paying commissions and other expenses.

The below table shows how much of the annual premium paid goes towards paying the commission and other expenses.

In my original post on bancassurance i.e., Daylight robberies by HBL, UBL, and others which was published on April 12, 2021, I mentioned a few policies where the commission on the first-year premium was in the 60% range. After July 2021, they updated their brochures to the new commission structure.

HBL - Jubilee Life - Hifazat

April 2021

60% of the first-year premium was not going towards investment. In three years, a total of 80% of the one-year premium was not going towards investments.

After July 1, 2021

HBL Hifazat New2021 web ENG (jubileelife.com)

Though the first-year premium not going towards investment is reduced by 10% points to 50% to comply with CIAR 2020, HB- JLI added this 10% to the third-year premium such that cumulatively 80% of the one-year premium still doesn’t go towards investment.

UBL - Jubilee Life - BetterLife Retirement

April 2021

60% of the first-year premium was going towards commission, with a total of 90% of the one-year premium not going towards investment.

After July 1, 2021

EFU Better Life Retirement Plan (ubldigital.com)

UBL was charging 90% of the one-year premium as a commission before July 1, 2021, as shown above, and is now forced to bring it down to 80% by increasing the first-year allocation to investment to 50%.

MCB - Adamjee - Save and Assure

April 2021

55% of the first-year premium was not going towards investment, with a total of 70% of the one-year premium not going towards investment in two years.

After July 1, 2021

Don’t know what their brochures say, but as per MCB’s website, MCB and Adamjee are in GROSS VIOLATION of SECP rules. A minimum of 50% is to be allocated to investments as per CIAR 2020, but MCB is only allocating 40% of the first-year premium. Says a lot about the enforcement capability of SECP.

Condition 2: The commission payable to the bank i.e. corporate insurance agent

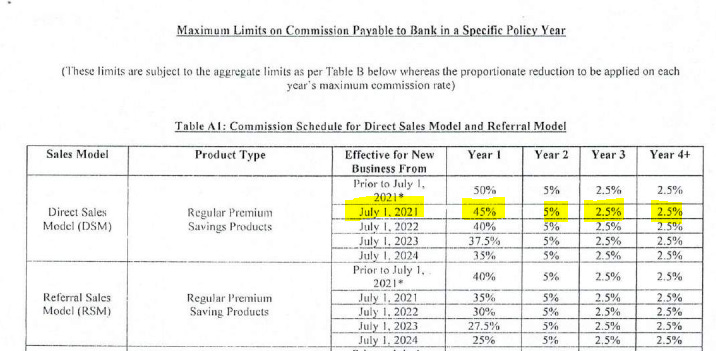

Condition 1 stated the share of the premium that does not go towards investment. Condition 2 is the limit SECP has imposed on the commission that can be paid to the bank. The difference between Condition 1 and Condition 2 is probably for the insurance company to meet other expenses.

Let’s look at the first highlighted row. For the business signed after July 1, 2021, under the direct sales model (where the bank manager acts as an insurance salesman), 45% of the premium can go towards paying commission to the bank. The following year it is 5% and if it is a 10-year policy, 2.5% for the remaining 8 years. Hence, the total commission paid to the bank comes to around 70% of the one-year premium if the business was written between July 1, 2021 and June 30, 2022.

For the business written after July 1, 2024, under the direct sales model, the total commission paid to the bank on a 10-year policy comes to around 60% (35% in year 1, 5% in year 2, and 2.5% in year 3 to year 10).

Combining the two conditions

What is happening is that the insurance company is deducting 80% for the business written on or after July 1, 2021, and paying 70% to the bank as commission over the period of 10 years.

Deception by SECP

This is where the deception (can I use “gaslighting” here?) of the SECP tweet becomes obvious. Let’s revisit the SECP tweet

As the table in the last section shows, the total commission paid to the banks is being reduced from 70% to 60% under condition 2 and not 35% as implied by the SECP tweet. What is being reduced to 35% is only the first year premium (see highlighted cells below) and we have seen in the HBL - Jubilee Life- Hifazat case, that the banks and insurance companies are shrewd enough to shift the balance to the following years.

A widow/pensioner/family of a martyred soldier cares about the amount going towards investment. SECP is deceptive by focusing on the bank’s commission rather than the amount not allocated towards investment, which is an amount higher by 10% as per the table in the previous section. By focusing on the commission and that too on the first-year commission, SECP is acting less as a regulator and more as a deceptive salesperson for the insurance companies.

Three more things

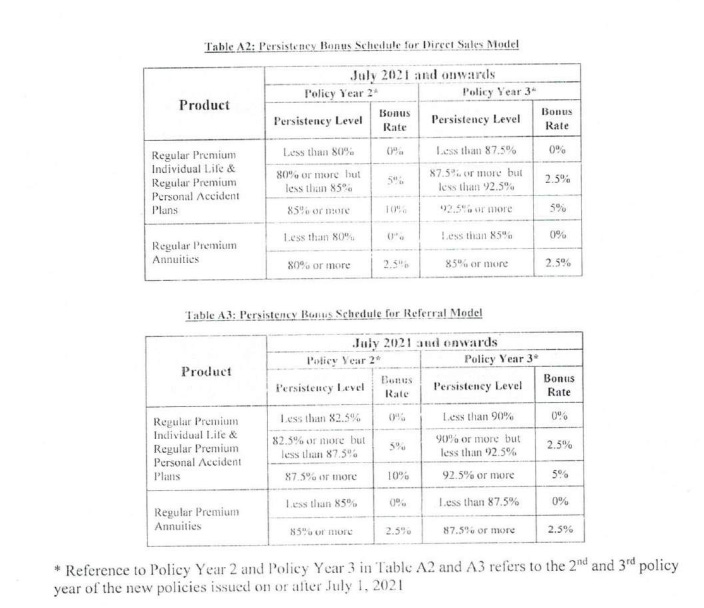

Is the insurance company pocketing the remaining balance of 10%? Not necessarily. The insurance company may be using it to pay the production bonus, persistency bonus, and share in the investment management charge to the banks.

The production bonus can be as high as 5% of the first-year policy premium. This is a significant number. It is no wonder that bank managers are deceiving customers left, right, and center to meet production targets. The persistency bonus schedule is given below.

I like the share in NAV. Assuming Rs.100,000 annual premium and going with the maximum 0.75% of AUM as allowed under CIAR 2020, the share in investment management charge can be as high as 35.6% of the one-year premium. Needless to mention, this is based on certain assumptions such as the depositor keeps on paying the premium for 10 years, etc. The actual share of the bank may be lower or higher based on how the NAV performs and whether the investor continues with the policy.

To summarize, while the SECP tweet may imply that the commission will be reduced to 35% by 2024, it is truly not the case. The cumulative commission to the bank will be 60% for the businesses written after July 1, 2024. However, as far as the depositor is concerned, what matters is not the commission that is paid to the bank but the amount that is not allocated to investments. That amount will be 70%. Twice the 35% that SECP mentioned in its tweet.

In addition to the aforementioned commission, the bank can earn a production bonus of 5%, a persistency bonus, and another 35% over 10 years as a share of NAV. Thus, the income of a bank from the bancassurance in the best case scenario (for the bank) can be up to 110% of the one-year premium for business written after July 1, 2021 and come down to 100% of the one-year premium for business written after July 1, 2024.

SECP - the insurance companies’ lobbyist or a lame-duck regulator

While the CIAR 2020 has various conditions with respect to safeguarding the investor, unless SECP starts penalizing the insurance companies heavily, these shameful behaviors by insurance companies and banks will continue.

No enforcement

I have already shown how MCB-Adamjee-Save and Assure product is in violation of SECP guidelines. It is almost a year since the new commission percentages came into effect and the MCB website still isn’t updated.

Insurance needs analysis document. Is SECP sleeping?

I have shared multiple cases of bancassurance scams. SECP has received multiple fraud claims about this over the years. SECP forwards those to Insurance Ombudsman and washes its hands off them. Meanwhile, the number of complaints to the insurance ombudsman has increased manifold.

Did SECP, being a regulator, ever feel the need to inquire how the insurance need analysis document was filled when a large number of depositors are claiming they have been scammed into it? What is the use of putting these conditions in CIAR 2020 when SECP is never going to see if they are being followed through? Is it just another empty checklist that the bank manager fills himself or herself without any fear of repercussion from SECP? It appears like it.

Lame Penalties

A measly fine of Rs.1 million when banks are scamming depositors with commissions running into Rs.1.5 billion per bank in 2021. If there is a disqualification under the second clause, it will be limited to the bank manager or the insurance sales agent. Wells Fargo accounts opening scandal showed that the branch staff is given unreasonable targets by top management. If anyone deserves to be disqualified, it is the CEOs and Chairpersons of banks and insurance companies. The higher-ups very well know what is going on here. The income of the banks from bancassurance is multiple times of the income from investment banking. The higher-ups cannot feign ignorance of what is going on in the branches.

With limited to zero enforcement, useless checklists such as insurance need analysis document which no one gives a damn about, and the measly penalties, no wonder that the frequency of bancassurance scams keep on increasing.

The bancassurance model is broken and prone to misselling yet SECP continues to promote it.

It is incomprehensible to me why SECP is acting as an agent for insurance companies for promoting bancassurance as it has been clear that the model is broken and abused freely. Let me quote the regulators and the ombudsman.

SBP

banks often offer or sell other financial products that are provided by other financial institutions, generally referred to as bancassurance or third party products. Such offers are often prone to misdeclaration about the quality or pricing of products.

SECP

SECP sensitizes people to carefully read the terms and conditions of insurance policies

Reliance may not be placed on verbal promises made by insurance agents unless stated in the policy documents

Federal Insurance Ombudsman (FIO)

FIO is the only institution that is trying to provide some relief to the investor. Both SECP and SBP have transferred all the responsibility to the ombudsman. Ombudsman has been very vocal about the abuses of the bancassurance model. Below I have selected three of his statements.

bank officials and insurance company reps are hand in gloves in misrepresentation

The essence of banking is to maintain secrecy, but to sell the bancassurance product, bank officials and representatives of insurance companies are both hand in gloves in misrepresentation and selling of policies.

Fraud is committed in banks in the name of bancassurance

The insurance ombudsman has requested the State Bank of Pakistan to remove the bancassurance from performance targets as fraud is committed in the banks in the name of bancassurance

You can’t get more damning than this but SECP and SBP couldn’t care less.

80% of the complaints are about bancassurance

80% of the complaints that the FIO received are about bancassurance where the bank staff has sold them the bancassurance by making false claims

Normally, for bancassurance, I direct my anger at SBP as bancassurance fraud happens in the bank branches with the unreasonable targets provided by the bank higher-ups. However, this post is dedicated to SECP.