Takeovers or share purchases appear to be the flavor of the month at this substack. The last two posts were Nishat Group purchasing shares of PakGen Power Limited in breach of Section 111 of the Securities Act 2015 and the 2004-2006 hostile takeover of Adamjee Insurance by Mansha Group. While a takeover is a trigger for this post, it is not about a takeover per se.

This week’s Profit cover story was about Shaheryar Chishty who has orchestrated a takeover of K-Electric. I have a few questions about that but this post isn’t about that.

K-Electric has a new owner. The sale happened quietly, and nearly 14,000 kilometres away in the Cayman Islands, far away from Pakistani regulators and investors. With very little fuss and almost completely out of the public eye, Pakistan’s only vertically integrated utilities company changed hands from the infamous Abraaj Group to a little known company by the name of AsiaPak Investments — an energy investment company owned and operated by Shaheryar Chishty.

The Profit piece is a big one and you should read it on their site to get the full picture. What I am interested in is his running of Daewoo. As per Profit,

“Around this time I had started feeling there was more to be done. For 15 years I had seen economies grow and become massive from nothing. I constantly used to think of how this could be replicated in Pakistan as well,” Chishty tells us. Sitting in his office right next to Daewoo’s main terminal on Ferozpur Road in Lahore, he is calm and affable. “At the same time Daewoo was a very good client of mine in Korea. They had a business in Pakistan which wasn’t a core business for them and they were looking to get out of the country. Now, I was always talking about Pakistan this and Pakistan that with my clients so they told me to put my money where my mouth and to buy them out. And that was when I took the option and bought them out in 2011.”

While one should not read too much into one investment considering Sheheryar Chishty has multiple businesses but the drop head on the Profit piece brought attention to Daewoo.

Transport is a challenging business and time hasn’t been kind to logistics startups in emerging economies. For example, there is only a six months difference between the two news items in the snapshot below.

The Daewoo operating company is unlisted so we don’t have access to its financial information. But thanks to a friend of mine, who should remain nameless as we are treading into dangerous territory with these people who are very well connected, I was able to find information from other sources.

Tundra Investment Case

The frontier investment fund Tundra Fonder invested in Daewoo Express Bus Service in 2017.

From the 3-page investment deck

INTRODUCTION

In September 2016 Tundra Fonder, on behalf of three of its funds, bought 9.4% of Daewoo Bus Services, a Pakistani logistics company. The transaction was done through a so-called pre-IPO (Initial Public Offering) where Tundra buys into an unlisted company pending an intended listing on a stock exchange. Tundra's funds are allowed to invest up to 10% of their assets in unlisted companies, provided these companies plan to list within 12 months. This case report describes an example of an investment where the business case is very closely linked to the ESG analysis.

A few paragraphs later

RATIONALE FOR TUNDRA's INVESTMENT

Daewoo is an example of how underlying ESG-issues becomes central to the attractiveness of the investment. There is a lack of organized, safe transportation in Pakistan. As the consumption capability of ts citizens increase we believe they will increasingly choose more organized transports, as in other more developed countries. Removing the safety concerns will also expand the potential traveller base to include children and women travelling alone. Overall we see a strong structural growth potential for the services that a company like Daewoo provide. The investment was made in order to facilitate an early investment in new buses needed for the company’s expansion. The company is expected to list in the first half of 2017 and we expect to be a profitable investment for our unit holders.

COMPANY FACTS

Daewoo Express is the largest, and one of the few organized, transportation companies in Pakistan, incorporated in 1997. The company has been rendering inter-city transport services for more than 15 years and currently operates with a fleet of around 350 buses. Daewoo Express has presence in all major cities of Pakistan and is focused on expanding its footprint in other associated services

The Company is also operating City Bus Service providing bus services within Lahore. The same is being replaced with a provincial governmental project which will guarantee a minimum fixed return to the company. The Company has also been selected to operate a metro bus project within city of Multan. The Company is in an expansionary phase looking for new opportunities. Daewoo recently launched Daewoo Cab, a subsidiary which currently has 46 cabs, targeted to grow to 250 by end 2018. The company also plans to develop a multipurpose bus terminal/mall on land allocated by provincial government which is targeted to come online by 2019. As per last audited financials the company has an aggregate workforce of over 4000 employees and caters to around 6 million passengers annually, representing a growth at a CAGR of 7% over the past 5 years.

ESG appears to be the justification for the investment

DIALOGUE WITH DAEWOO EXPRESS

The following information has been retrieved from a detailed response to Tundra's ESG questionnaire and monthly meetings with the company. Environmentally, the company reportedly complies with ISO 14001:2004 and OHSAS 18001:2007 and keeps a track of its greenhouse gas emissions. The company has purchased buses that are Euro 3 compliant and continuously aim to incorporate environmentally friendly technologies. Socially, one of the main concerns related to the company was the sexually abusive behaviour rampant in the public transportation sector. In response, the company assured us that it has a strict stance against such actions along with other harassment of any kind. The company has a thorough process of recruitment which ensures that candidates for positions within the organization fulfil a range of criteria. All staff is routinely monitored and given refresher training sessions of policies and procedures relating to health and safety, dealing with hazardous materials, rescue and bomb disposal and driving under stressful conditions, to name a few. Since all employees require a national identity card (which can be applied only after the age of 18) to be eligible, incidents of child labour are successfully avoided. Further, hopeful candidates need to pass screenings (conducted by the company) for contagious diseases such as tuberculosis to even be considered for employment. As far as governance is concerned, the company has a zero-tolerance policy on matters relating to bribery, transparency and money laundering.

During one of the monthly updates by the company, a question was raised by the ESG team regarding an accident that occurred on the Lahore highway due to foggy weather conditions involving a Daewoo bus. The company clarified that it was not a Daewoo Express bus, but a vehicle from another company that had purchased the bus from a local distributor that manufactures commercial vehicle brands such as Daewoo, JAC, King Long, etc. When asked about the company's policies on driving in dangerous weather, those conditions the focus is on daytime driving, and night shifts are curtailed. In case of sudden bad weather, the drivers are told to drive carefully to the next possible stop.

The rest of the report is fluff. Not saying that the above isn’t fluff. Never have I seen an investment case that doesn’t mention hard numbers such as revenues, expenses, profitability, growth, or financial statement even in broad strokes. Maybe this is how ESG investments are made. I understand Tundra has seen the audited financials but how can they make a case without mentioning any numbers?

The deck includes the below pictures. It appears Tundra was really going for the “frontier market image” if there is such a thing for making an investment case.

Tundra Write Downs

As per Tundra 2016 Annual Report, Tundra purchases 6,121,000 shares of Daewoo Pak Express for Rs.33,818,757. This translates into Rs.5.53 per share.

The value remains the same in the 2017 Annual Report. In the 2018 Annual Report, Tondra writes down the value of the investment or PKR 9,448,936 i.e., Rs.1.54 per share. That is a writedown of 78%.

There is a detailed note1 on the unlisted holdings in the 2018 report highlighting the risk of such investments. Surprisingly, rather shockingly, the risks highlighted in the above note are missing from the 2016 Investment deck.

In the 2019 Annual Report, there is a further write down such that the investment is now valued at Rs.1,517,334 i.e., a per share price of Rs. 0.25 (or as we say in Urdu, “chaar aanay”).

We are talking about values in Pakistani Rupees here. The impact of devaluation etc. hasn’t been considered. In rupee terms, Tundra has recorded 95% impairment in its investment in Daewoo so far.

The 2020 report doesn’t explain it but it appears that Tundra increased its shareholding by a third. The number of shares increased to 8,292,000. However, the per-share value now is even below chaar aanay at Rs.0.21 per share.

The value in the 2021 report is almost the same. In the 2022 report, the per-share value falls to a measly PKR 0.19 per share.

Over a period of 6 years (2016-2022), the value of Tundra’s investment in Daewoo has been impaired by more than 96%. The carrying value is almost 3.4% of the original investment. I don’t even want to calculate the impairment in foreign currency terms.

The first 78% write-down was recorded by Tundra in 2018. One can’t even blame VONC for this writedown. To be fair to Sheheryar, the shares of the company are unlisted. Any impairments taken by the fund may not be reflecting the true picture and the fund may just be using the worst-case scenario by playing with assumptions on its spreadsheet.

Elahi Group enters the picture

I will be the first to admit that I don’t know much about Elahi Group. However, everyone I talk to, tells me in hushed tones, that Danish Elahi, the head honcho at Elahi Group, is Pakistan’s largest loan shark but nobody wants to go on record or provide additional details. So without any documentary proof substantiating the claim, all I have is rumors.

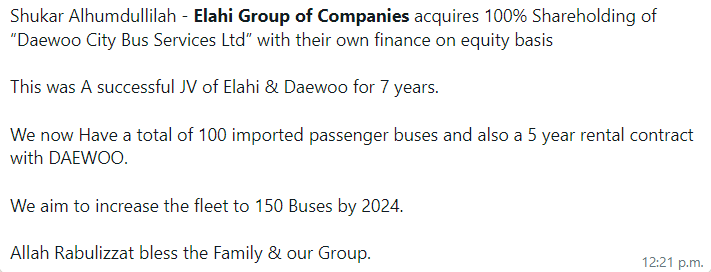

On June 12, 2023, Danish Elahi broadcasted the below message over WhatsApp.

The MO of Danish Elahi, based on the unsubstantiated rumors, appears to be to lend money against property documents and other hard collateral at exorbitant interest rates and then take over the property/collateral when the loan isn’t repaid. If I were to guess, I would presume that Daewoo was facing cashflow problems and they reached out to Elahi’s for a loan, and then one thing led to another eventually ending with Elahi Group taking over the collateral. [But this is pure speculation]

As per Tundra reports, Daewoo has 350 buses and Danish here is talking about 100 buses. Based on very unscientific back-of-the-envelope calculations, and assuming that WhatsApp has a grain of truth in it, Elahi Group has acquired 28% (100 buses out of total 350 buses) of the Daewoo business of the Shaheryar Chishty.

As per Form A available for Daewoo City Bus Services (Pvt) Limited dated May 19, 2023 (a month before the above WhatsApp message was sent out), Danish Elahi owned 50% of Daewoo City Bus Services with the other ~50% owned by Daewoo Pakistan Express i.e., the entity where Tundra has its shareholding.

Thus, if the WhatsApp message is true, Tundra and Daewoo Pakistan Express now only have 250 buses as Danish/Elahi Group now owns 100% of Daewoo City Bus Service (which has 100 buses).

I wonder what this will do to Tundra’s shareholding in Daewoo or if the next report from Tundra will provide additional details on this.

Saad Faruqui had filed a complaint with SECP

It would have been interesting to see the shareholding structure of the holding entity where Tundra has shareholding i.e., Daewoo Pakistan Express. Unfortunately, SECP doesn’t provide details on it as there is litigation pending against it.

The only litigation we could find was one filed in 2018 by Daewoo Pakistan Express against SECP for issuing an Inspection Order on the complaint made by Saad Faruqui, CEO of Ithaca Capital, who was also the shareholder in that entity, to the SECP.

Daewoo argued that SECP has no right to appoint inspecting officers purely based on allegations stating that if SECP starts investigating based on allegations, the companies won’t be able to carry out their businesses as they will be busy responding to allegations/SECP inspections all the time. The court agreed with Daewoo and allowed the petition made by Daewoo setting aside the SECP inspection order.

This judgment was issued in March 2020. It has been more than 3 years and SECP still doesn’t allow us to access the Form A of Daewoo Pak Express. You can read the judgment sheet here.

If any of you can share the shareholding structure of Daewoo Pak Express or can reach out to Tundra for their views on this entire saga, I will be grateful.

[In case, anyone from the Elahi family, Chishty family, Ithaca/Faruqui family, or Tundra family of funds wants to reach out to me to set the record straight, you can DM me on Twitter @2paisay or send me an email at 2paisay at gmail dot com or leave a comment below this post.]

If you know the people mentioned in this post, please share it with them.

Footnotes

In accordance with the UCITS regulation, the Fund may invest up to 10% in unlisted securities if these are to be listed within 12 months. Historically, a limited number of such investments have been carried out on behalf of some of the fund. Since 2018 however, no additional investments are made in unlisted securities. If unlisted securities are not listed within 12 months, the Fund should divest the securities in a way beneficial to the unitholders. Due to the nature of unlisted holdings, the process of selling those securities may be prolonged for a significant time. Tundra Pakistan Fund held one position, Daewoo Express, as of December 31st 2018 whose listings/divestments has been delayed beyond the 12-month stipulated time period due to reasons outside the funds’ control. The portfolio weight of this holding constituted 3.27% of the fund’s net assets. Negotiations for divestment are ongoing but there are risks of significant further delays until the assets are either sold or listed. The Fund Company has gradually reduced the assigned valuation of the holding as repeated delays indicated the chances of a successful listing or divestment has gradually decreased. It should in particular be highlighted that there are several layers of uncertainties. Even an agreed transaction between two parties could mean the realized value might not be possible to repatriate since Central bank approval of repatriation is needed and it is not certain that such approval is given. This risk has during 2018 increased significantly given significant strains on Pakistan’s foreign currency reserves experienced during 2018. In addition, it is further not unusual to see a transaction being contested within the Pakistani court system, sometimes due to legitimate concerns by a third party whose rights might be affected, sometimes as a form of blackmail. The structure of the Pakistani court system is such that even a perfectly legitimate transaction, through stay orders, can be delayed for several years and ultimately fail as a result of third party intervention. Such delays can meanwhile impact the financial viability of the company for example through non-availability of credits etc, which might eventually mean assumptions of financial forecasts are incorrect. These layers of uncertainty mean that absolute certainty of what value will be realized can only be achieved once funds are repatriated. Should the transaction be successful or should the company become listed it could however result in a positive one-time effect on the NAV of the funds……Daewoo Express is the largest and one of the few organized transportation companies in Pakistan. The company offers intracity services as well as long-distance transportation throughout Pakistan. More information about the company: www.daewoo.com.pk.