SSSS: a Subtweet, a suspect Statistic, SBP governor and a Shopping mall.

SBP's chart crime seems a minor offense compared to what is going on with construction finance target achievement reporting

The Subtweet

Over WhatsApp, quite a few people forwarded me this subtweet1 where Khurram is posting SBP’s comments on my post.

SBP and its statistics

Let's talk about the third tweet, where SBP says that banks generally accelerate their efforts towards the end of June and December. That is true. As corporate bankers, we always pushed the borrowers to fully draw down on their credit lines at quarter-end. But this does not work for construction financing as construction financing only finances construction as it progresses, and no borrower can raise a building in a month no matter how much credit limit he has. SBP, rather than admitting that the construction finance metric it has set for itself is not measuring what it is supposed to measure, is doubling down by trying to give its misleading claim legs to stand on with spurious justifications.

Let me quote how construction financing works for the umpteenth time. You can skip it if you have memorized it by now due to the number of times I have posted it.

Cost of the project can be divided into land cost and construction cost (for the sake of simplicity we are assuming soft costs such as architecture costs, municipal charges, approval and permit charges are all included in construction cost). Land usually comprises 25% of project cost with construction cost comprising balance 75%. Banks in Pakistan don’t finance land and limit their financing to around 50% of the total cost of the project i.e. 50% of loan-to-cost (LTC). If a builder wants to finance a building, he will have to arrange money to purchase the land. Plus he will also arrange another 25% for carrying out initial construction cost. Once the builder has financed 50% of the project from his own sources (equity, borrowing from friends, family, associates, purchaser deposits etc), then the bank will start financing balance of the cost. The bank will not hand over the 50% loan amount in lump sum. Instead the bank will receive a monthly report from Quantity Surveyor outlining the amount of work that has been done that month and will release only that amount of the loan.

Let’s take an example. Assume cost of high rise is Rs.1 billion. 25% land cost means the construction cost is Rs.750 million. Say it will take 3 years to construct the building from the date excavation is started. Thus, every month approximately Rs.21 million construction cost will be incurred on project (Rs.750 million construction cost / 36 months). If the bank is financing at 50% LTC, it means bank will only finance the final Rs.500 million of the project. The builder will have to arrange the initial Rs.500 million from own sources: the builder will initially pay Rs.250 million for the land. Then he will pay Rs.21 million every month towards construction for the next 12 month bring the total cost incurred on the project to Rs.500 million. When the 50% milestone is achieved, now the bank will enter the picture. As stated above, the bank will not hand over Rs.500 million to complete the project. Rather bank will release only Rs.21 million. In the next month, Quantity Surveyor will present a report to the bank that Rs.21 million that was disbursed last month has been used in the project as required. Then the bank will release the next instalment of Rs.21 million. This is done to minimize leakage i.e. prevent the builder from diverting the bank’s loan for non-project related costs.

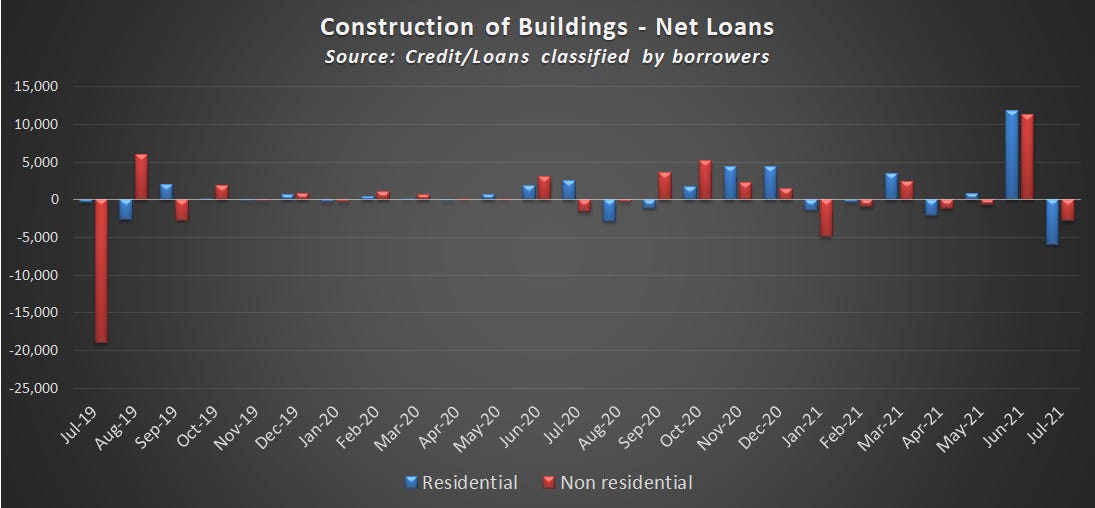

If you have constructed a house or a factory or a plant, you know that once you start construction, cash outflow usually increases. Initially for excavation, then for foundations, substructure, grey structure, finishing, fixtures, etc. The advantage of financing a project from a bank loan instead of one’s own sources is that there are no liquidity issues. The loan is committed, and the bank releases the funds every month based on the quantity surveyor's report. If as per June 2021 SBP report, Rs.23 billion disbursements in one month is genuinely construction finance, then as the above excerpt shows, we should have similar or roundabout disbursements every month for a few years. Let's see what happened in July 2021. Lo and behold, after net disbursement in June 2021 of Rs.23 billion, there is net repayment of Rs.9 billion in July 2021. This is not how construction financing works. Yet, SBP is using the category to justify the achievement of the 97% target in June 2021.

A similar pattern emerges in SBP’s "credit to private sector (by type of finance)" report of construction financing across the entire private sector.

After the disbursement of Rs.40 billion in June 2021 for construction financing across the entire private sector, there is a repayment of Rs.8 billion in July 2021. We know now that this is not how construction financing works.

Who is SBP trying to fool. Us or itself?

In my earlier post lack of imagination in the Pakistani banking sector, I wrote about how SBP is giving the banks all the loopholes to manipulate the construction financing statistic, thus rendering the target moot.

The irony here is that SBP itself is providing banks opportunities and loopholes to achieve the mandate. I have covered them in detail earlier so only summarizing those here with a touch of snark.

From the lack of progress of the banks, one may presume that the SBP’s mandate is for mortgages for low-cost housing only. It is not. A bank can meet the target by providing mortgages to only ultra-high-income individuals. The mandate is not even limited to mortgages. It is for mortgages and residential construction financing i.e., a bank can finance residential construction only, provide zero mortgage and still meet the mandate. Oops. I just re-read the circular. Construction financing is not restricted to residential. All manners of construction is included. Thus a bank can provide zero mortgages, zero financings to residential construction, and just finance non-residential construction (a factory, a banquet hall, or a shopping plaza) and it can still meet the target.

The only thing left is for the SBP to allow car financing to be counted towards the achievement of the target.

This is not all. SBP subsequently issued a circular stating that if banks provide loans to REITs or invest in shares or bonds/sukuk of REITs, this will also be counted towards meeting the mandate. If the commercial banks are purchasing these instruments from the secondary market, then the banks are not actually financing construction. But SBP doesn't care.

Taking it to the extreme, SBP is even allowing investing in PMRC's sukuk/bonds to be counted towards meeting the mandate as long as the same bank is not availing financing from PMRC. To wit, say Bank Al Falah provides Rs. 1 billion of mortgages. PMRC refinances these mortgages by issuing Rs. 1 billion bonds. If Habib Bank invests Rs.1 billion in buying these bonds, SBP will be counting Rs.2 billion towards meeting the target: Rs.1 billion for Bank Al Falah for providing the mortgages and Rs.1 billion for Habib Bank for investing PMRC's bond.

There is more. To further entice the banks to invest in REITs (as clearly banks aren't inclined in investing towards mortgages or construction financing), in June 2021, SBP issued another circular stating that if the bank's investment is in shares of REITs, the risk weight will be 100% versus a risk weight of 200% for investment in shares of all other entities. Moreover, investment in REIT shares will be classified in "Banking book" and not "Trading Book" i.e. banks will not have to mark-to-market the investment in REIT shares daily.

We can safely draw two conclusions:

SBP is taking all of us for fools that we can not differentiate between the workings of term loans/working capital loans and construction financing loans. Construction financing is unlike other forms of financing as, by its very design, it has to be disbursed gradually, in installments, over a period of time.

SBP’s objective in defining construction finance is not to encourage construction. Instead, the objective of the target appears to be to allow SBP to announce that the target has been achieved, regardless of how the achievement is measured. How else would one explain SBP allowing investment in outstanding REIT shares, REIT bonds, or double counting the mortgages through investment in PMRC Sukuk/bonds when it is not construction financing.

The Shopping Mall

You may very well say that while these are logical arguments and make sense but where is the proof. That is a challenge, my friend. The reality is that there is a collusion between the banks and SBP here. Commercial banks are incentivized to report higher construction financing, and SBP has provided the banks with a number of loopholes to achieve it. SBP will not look at it too closely, as SBP wants to be in the good graces of the PM by claiming that it has achieved what it set out to do by announcing the target. No one has an incentive to verify whether actual construction financing is being financed. However, your brother isn't without resources either.

In June 2021, the Syndicated Term Finance Facility of Nishat Hotels and Properties Limited (NHPL) was closed for Rs.13.2 billion. Not a penny of Rs.13.2 billion was used towards financing new construction, rather all of it went to refinance existing long and short-term loans of NHPL.

Based on my “channel checks”2, this Rs.13.2 billion refinancing of existing loans has been reported as construction financing by commercial banks.

Thus, when SBP claimed that the 97% target was achieved in June 2021, it was counting a transaction that is not construction financing as construction financing.

There you have it. Chart crime seems a minor offense compared to what is going on with construction finance target achievement reporting

Repeat Offender

This is not the first time SBP has done this. Two previous such incidents are presented below.

Mystery shoppers

When SBP governor told the PM that mortgage financing targets are being met, while PBA was sending out emails to banks that their performance in giving out mortgages is unsatisfactory.

Refinance winding up

When I said that the new SBP Act does not allow refinancing. Both MoF and SBP denied that. Later, Khurram wrote an oped corroborating my claim.

Khurram hints at how both SBP and MoF kept denying that was the case.

To conclude,

1. One should be wary of the claims made by Reza Baqir/ SBP as he has a tendency to massage the numbers to please the PM.

2. The construction financing statistic and target is useless as it is being manipulated by commercial banks as SBP itself is encouraging it.

3. Just because SBP insists, whether through press conferences or calling journalists for subtweeting3 its point of view, don’t take its word for the truth.

It may not be subtweeting, but calling it as such allows me to have a nice title for the post.

Business Recorder uses this term. What I mean by it is I made a few calls or a friend helped me out.

I am having fun here. No ill intent was implied.