Lying with statistics: Lessons from State Bank of Pakistan

Discount rate, housing finance targets, and Goodhart's law

I was working on a post on fiscal and quasi-fiscal activities (QFAs) in light of the SBP Amendment Act but SBP released a circular yesterday that investments in REITs will be counted towards meeting the housing finance targets. I have put the QFA post on hold to quickly write this post.

This post is about how the numbers reported by Naya SBP don’t portray what we expect them to portray. This post is divided into three sections. The first section sets the stage that this started when Reza Baqir finally gave in to PM’s pressure to decrease the discount rate. The next section talks about how the construction and housing finance numbers being reported don’t portray the true picture. The final section speculates on how the latest circular again allows the SBP to report mission accomplished without achieving the objectives that it was supposed to achieve.

Goodhart’s Law

Goodhart’s law will come in handy for reading this post. In Wikipedia’s rephrasing, Goodhart’s law implies:

when a feature of the economy is picked as an indicator of the economy, then it inexorably ceases to function as that indicator because people start to game it.

Section 1: Discount rate and inflation statistics

I had covered in my previous post the fall and rise of voodoo economics at SBP that despite having no capacity to control inflation because inflation in Pakistan is neither bank-credit-driven nor employees or wage earners read up on SBP policy statements to form their beliefs about inflation, SBP continues to have a high opinion of its monetary policy effectiveness. Yet the SBP governor was compelled to decrease the policy rate, citing statistics which neither he nor MPC members believed in, a step that challenged their firm belief in the efficacy of higher interest rates to control inflation.

SBP governor didn't want to decrease the policy rates because it was bringing in hot money, a feather in his cap. He did it despite the fact that it was also opposed by other members of the monetary policy committee.

Initially, SBP reduced the rate by 75bps on March 17. This is what AKD Securities said about this

SBP's MPC justified this in a survey by The Profit:

Asad Zaman, member of the Monetary Policy Committee of the SBP, said that he thought the SBP did what needed to be done. Regarding the interest rate cut, he said: “Even some economists were arguing that the interest rate needed to be 8%. The interest rate needs to be higher than the inflation rate, for the real interest rate to be positive — for an economist to suggest otherwise is really an outrageous political statement.”

Asad Zaman is supporting the rate cut in espirit de corps with MPC as he wasn’t part of the MPC that decided the rate cut.

The sources said two external members of the MPC, Dr Naved Hamid and Dr Asad Zaman, did not attend the meeting but their votes were counted. The central bank spokesman has confirmed this development but said the regulations allowed the MPC to count their votes. “Two of the external members were not present but voted,” said the SBP spokesperson Abid Qamar. He said that **“under the MPC regulations, any member unable to attend a meeting can convey his/her vote on the policy decision to the governor which will be counted as part of the decision voting.”

However, it seems that the members are not aware of any such regulations.“To my knowledge a person who does not attend the MPC meeting cannot cast a vote,” said Naved Hamid. The Express Tribune had requested Dr Hamid to comment why he cast his vote when he was not present in the MPC meeting.

I described the above event as 'ballot stuffing' by SBP governor and this is what I had written about it at the time.

This is sad and hilarious. If one parses it, as per SBP spokesperson, SBP governor voted on behalf of absent members as they had conveyed their decision to him. However, members appear surprised, which implies they didn’t convey their decision to SBP governor. This makes you wonder why SBP governor is ballot stuffing for a measly 75bps cut and why is Asad Zaman defending it in Profit interview.

Despite the fact that inflation continued to remain high, within another 30 days, SBP reduced the rate twice by holding emergency meetings.

This is what Anjum Ibrahim wrote on April 27, about the statistics that SBP had been using/citing to justify the rate cuts.

…what is ironic is that inflation has been witnessing an upward trajectory since the two economic team leaders were appointed in late April early May 2019 as headline inflation in May last year was less than 9 percent and has been steadily rising as per the Pakistan Bureau of Statistics: a little over 11 percent mid September 2019, over 12.5 percent in December 2019 and 14.5 percent mid January 2020. It then began to decline sharply — to over 12.2 percent in February and 10.4 percent in March 2020 or subsequent to the onset of the pandemic. It is unclear whether the decline is due to keeping 27 out of the 51 components of the Sensitive Price Index constant (with lockdown in place it is doubtful if PBS is able to verify this) with a price decline in only 8 items and a rise in 16 items.

The resident representative of IMF had this to say about inflation on April 21,

Teresa Daban Sanchez, IMF Resident Representative, also said that inflation in Pakistan would remain in double digits this year due to inflationary expectations and expected revision in prices.

Business Recorder reports that pressure continues on the SBP governor.

PM irked by non-compliance of his directives?

Prime Minister Imran Khan is reportedly annoyed at being deliberately misguided by his cabinet colleagues and non-ompliance of his directives by various ministries and organizations.

Informed sources told this newspaper that the Prime Minister is disappointed by governor State Bank of Pakistan (SBP) Dr. Reza Baqir's purported failure to lower the discount rate to 7 percent, a step that he had ostensibly pledged to take during a briefing.

Eventually, citing whatever statistics that may have been deemed fit, the rate was reduced to 7%. There again, SBP Governor played with the statistic by timing the reduction day before GoP was taking a step that would have increased inflation.

Summary

SBP governor, under pressure, fixed the square peg (rate reduction) in a round hole (while inflation was increasing or still high) citing made-up or unusual statistics even while the governor himself and the MPC members themselves were against the reduction in rates.

Needless to mention that Such Gup isn't to be taken seriously but it does hint at a deeper truth i.e. how SBP's independence keeps getting undermined. This is what Friday Times reported on June 2020 in its Such Gup column.

We hear The Great Khan is in high dudgeon these days. Our mole in Bunny Gala informs us that he recently summoned the imported Guv of the bank of the state and gave him a hefty dressing down. He blamed him for many of the economy’s disasters, the rupee’s slide, and what have you.

It is not only with discount rate. Let's talk about this housing finance mandate.

Section 2: Housing and Construction Statistics

Housing is one of the flagship projects of the PTI government. The government is pushing very hard for a long time for banks to start deploying funds but banks have been dragging their feet for one reason or another.

This is from March 2019 when “former former” Finance Minister Asad Umar talks about fiscal incentives given to banks on incremental lending to housing finance, a lower tax rate of 20% as compared to 35% on normal banking profits. He even jokes that if it doesn’t work, we may even consider increasing the tax rate on PIB investment returns to 70%.

As the finance minister rightly feared, the banks didn't budge.

On July 15, 2020, SBP released a circular that mandated all commercial banks to have 5% of their portfolio in housing finance by December 2021.

Mandatory Targets for Housing and Construction Finance

1. With a view to promote housing and construction of buildings (Residential and Non-Residential) in Pakistan, State Bank of Pakistan (SBP) has decided to advise mandatory targets to the banks. Accordingly, each bank shall ensure that the financing for housing and construction of buildings (Residential and Non-Residential) shall be at least 5 percent of their domestic private sector credit by December, 2021.

2. Banks are advised to gear up their infrastructure and capacity to ensure compliance of meeting these targets. Accordingly, each bank is required to develop a concrete action plan with detailed measures and their timelines to achieve its housing and construction finance targets. This action plan should contain breakdown of overall targets into quarterly targets, development of suitable products, launching of media campaigns, development of internal technology, capacity building of staff, and other actions needed to ensure the 5 percent target is met. Banks are advised to submit their concrete action plans to this department within 15 working days from date of issuance of this Circular. Banks will be required to report data of approvals and disbursements against these targets on monthly basis starting from September 2020.

3. SBP will keep a close monitoring of progress on the mandatory targets. Non-compliance in meeting the targets shall attract punitive action under the relevant provisions of the Banking Companies Ordinance, 1962.

Digression: What Section 17 giveth, Section 20 taketh away

You can skip this subsection if you are tired of reading about Section 17 and Section 20 of the SBP Amendment Act. This was supposed to be part of my QFA post.

In brief, there are two sections in the SBP amendment act that are of concern here. One is Section 17 which describes what action can the central bank undertake. The other is Section 20 which lists the actions that the central bank cannot take.

As per the latest communication from SBP, Section 17 will be amended to allow additional types of securities to provide refinancing activities. Meanwhile, this is what Section 20 says,

SBP will not undertake any quasi-fiscal operations and development finance activities where development finance activities mean any activity undertaken to promote any priority sector such as agriculture, SMEs, housing, and other sectors. The act does not define quasi-fiscal activities but as the language is reportedly at the behest of IMF, let’s see how IMF defines quasi-fiscal operations:1

Quasi-fiscal activities are any activities undertaken by state-owned banks and enterprises, and sometimes by private sector companies at the direction of the government, where the prices charged are less than usual or less than the “market rate.” Examples include subsidized bank loans provided by the central bank or other government-owned banks, and noncommercial public services provided by state-owned enterprises.

The International Monetary Fund has provided the following outline of different types of quasi-fiscal activities, to which some examples are added to clarify how they might work2 Operations related to the financial system

Subsidized lending, where state-owned banks provide subsidized loans to state enterprises or the private sector.

Under-remunerated reserve requirements, where banks are required to hold reserves on which they gain a reduced profit from that which they could earn by investing the funds.

Credit ceilings, where banks are subject to a limit on the amount of credit which they are allowed to issue.

As refinancing is nothing other than subsidized lending, what section 17 reportedly giveth in the form of accepting wider collateral for refinancing activities, Section 20 taketh away by explicitly forbidding quasi-fiscal operations and development finance activities.

Under the proposed SBP Act amendment, SBP is explicitly prohibited from issuing such circulars as setting mandating 5% target for housing finance as it falls into an activity promoting housing finance which is defined as development finance activity. If SBP won't be able to issue such circulars anymore, can the banks refuse to follow such ultra-vires instructions from SBP? It gets a bit complicated and probably legal minds can better opine on it. Banks are established under Banking Companies Ordinance 1962 as modified up to 2 April 2011 (BCO) and this is what it says under Section 25,

25. Power of State Bank to control advances by banking companies.

—(1)Whenever the State Bank is satisfied that it is necessary or expedient in the public interest so to do, it may determine the policy in relation to advances to be followed by banking companies generally or by any banking company in particular, and, when the policy has been so determined, all banking companies or the banking company concerned, as the case may be, shall be bound to follow the policy as so determined.

—3) If any default is made by a banking company in complying with the policy determined under sub-section (1) ...., every director and other officer of the banking company and every other person who is knowingly a party to such default shall, by order of the State Bank, be liable to a penalty of an amount which may extend to twenty thousand rupees and, where the default is a continuing one, of a further amount which may extend to one thousand rupees for every day after the first during which the default continues.

Under section 25(1), the State Bank of Pakistan can direct banks to extend advances (i.e. loans) to a particular sector, company, or in compliance with a government policy, and all the banks are bound to follow it. Section 25(3) describes the penalties for not following the directives of SBP.

Two things to note here.

1. Section 25(1) of BCO is in contravention of Section 20 of the SBP amended act. SBP can no longer instruct the banks to finance priority sectors.

2. The penalty for not following the directive is negligible. Rs.20,000 plus Rs. 1,000 per day for the duration of non-compliance. The banks which have made record profits this year in Rs.10+ billion would rather pay this nominal fine rather than do the risky advances of housing finance.

But SBP governor being under pressure wanted to convey the good news to the PM so this is what he says to PM as reported on December 4, 2020.

During the meeting of the NCC on housing, State Bank of Pakistan (SBP) Governor Reza Baqir said that banks had almost met their quarterly targets of house loan disbursement.

He said that more than 100 officials of the SBP conducted “mystery shopping” by visiting different banks on a daily basis to ascertain the on-the-ground situation and monitor the facilities being provided to house loan-seekers.

Yet when I looked at data on the SBP website on that date, all the increase is coming from banks extending loans to their staff, which makes you wonder what are the mystery shoppers of SBP reporting. Is everyone in on the misrepresentation from top to bottom at SBP?

If you think the data is dated, I have another piece of information that confirms what I have written. This was the email sent out by Pakistan Banking Association to member banks on December 2, one day before the statement by the SBP governor.

You can feel just how much pressure the SBP governor is under. He knew a day ago that banks aren't meeting the target but told a white lie to the PM the next day.

Earlier on November 21, Bank Al Habib had also joined in claiming such brownie points

The SBP governor said that 50 per cent branches of banks in the country had established special desks for house loans.

Bank Al Habib informed the meeting that it had so far disbursed Rs6bn housing loans.

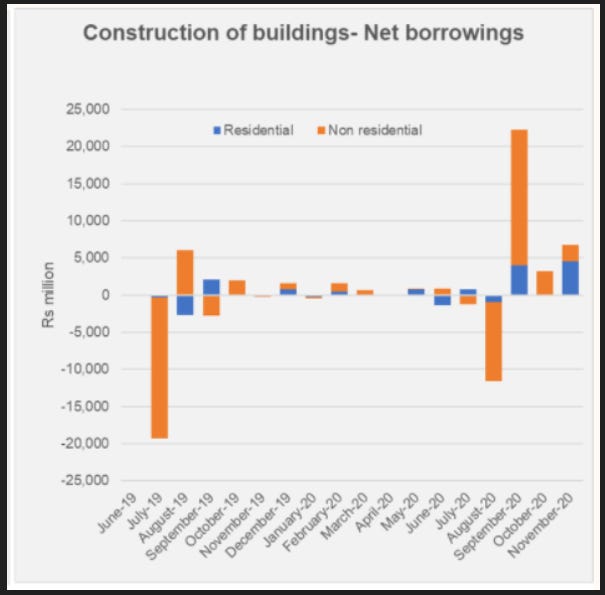

Presumably, SBP did some magic with how it reports the “Advances Classified by Borrowers” report and there was an increase of Rs.28 billion in construction lending in one month i.e. September 2020.

I wrote a very detailed post How to measure the impact of construction amnesty? that this isn’t how construction works i.e. lumpsum disbursement in a single month. Construction financing slowly builds up as construction ramps up. It is not impossible but highly improbable that Rs.28 billion was doled out for construction in a single month. It appears to be a case of Goodhart’s law: activities that were classified against different types of borrowers are now being classified as borrowing for construction activity by SBP and the banks to achieve the target.

But the PM does not release the pressure he is putting on the SBP governor. This from a satirical column by Anjum Niaz this week states that the SBP governor is being pressured by PM to engage in quasi-fiscal activities (needless to mention, not allowed under Section 20 of SBP Amended Act).

"Well, The Khan has directed the other wheel [SBP governor] to make the borrowing cost for house loans even cheaper...so much for autonomy hunh! I told you it doesn't matter what it says on paper the facts on the ground will remain the same...."

Summary

If the SBP governor is asking for independence, he is not being unreasonable. Hard to do your job to the best of your abilities if the PM keeps pushing you to do something that you don't believe in.

Section 3: How to lie with statistics 101

Now we come to the raison d'être of this post. On April Fool’s day 2021, SBP released the following circular

Mandatory Targets for Housing and Construction Finance

Please refer to IH&SMEFD Circular No. 10 of July 15, 2020 whereby banks and DFIs were advised to achieve mandatory financing targets for housing and construction of buildings (Residential and Non-Residential) equivalent to at least 5 percent of their domestic private sector advances by December 31, 2021.

In order to increase funding for housing and construction through capital markets and microfinance banks (MFBs), State Bank has decided to allow counting of following exposures of banks/DFIs towards achievement of their housing & construction finance mandatory targets:

Direct financing to/or investments in bonds/TFCs/Sukuk issued by Real Estate Investment Trusts (REITs) Management Companies.

Investments in units/shares issued by Real Estate Investment Trusts (REITs) subject to compliance with all other applicable regulations.

Investment in Sukuk/bonds issued by Pakistan Mortgage Refinance Company (PMRC), however, investment in PMRC’s Sukuk/bonds and amount of refinancing availed from PMRC shall be netted off towards counting the mandatory target.

Financing to MFBs for extending housing finance to eligible borrowers to the extent of actual disbursements by MFBs. Banks extending financing to MFBs for housing finance will have to report such transactions to SBP separately.

However, the above exposures will be considered on aggregate basis up-to a maximum of 15% of mandatory targets for housing and construction finance of a bank/ DFI on a given date.

Needless to mention, the aforementioned circular will be in violation of draft Section 20 of the SBP Act amendment as it is promoting the housing sector.

The purpose of the 5% mandate was to get the banks to move away from their comfort zone of lending to blue chips and investing in PIBs. The intention of the mandate was to force banks to seek out opportunities for financing construction activities. This would have the added benefit of encouraging developers to become sophisticated to access bank financing as banks will not lend willy nilly just to meet the mandatory target. Banks would rather pay the fine than lend to the unsophisticated builders and lose the principal. Probably progress isn’t satisfactory in this regard (deadline runs out in Dec 2021 to achieve 5% of the portfolio in housing/construction) and SBP wants to show progress in targets, SBP has come up with this additional relaxation through this circular.

First, a brief background on REIT. REITs, the world over, are created for tax advantageous reasons. REITs have a small allocation for development (if allowed by the trust deed) and are mainly for managing rental real estate properties. REIT may use the development allocation for building own rental properties but most of the time REITs issue shares or bonds to acquire existing properties. The rest of this post is hypothetical on how this SBP circular will prove Goodhart’s law i.e. just to show housing finance targets have been achieved.

The REIT can issue shares or bonds to acquire existing buildings. The purpose of the mandate is to encourage construction but if a bank acquires shares/bonds that are issued to acquire an already constructed building, this will be counted towards meeting 5% of mandatory construction targets.

REITs are in the rental business. The rental yield on residential properties is nominal around 4% in Karachi. There will not be many investors for such low-yielding REIT shares. It is highly likely that REITs launched, if any, will be focused on commercial or office space. The mandate is for both residential and non-residential. However, only non-residential will get built or bought. Not the end of the world but also not going towards the objective of the mandate.

Investment in PMRC Sukuk/bond has the potential to be double-counted. Say Bank Al Falah (BAFL) writes Rs.1 billion of mortgages. These mortgages will be counted towards the 5% target. Now Bank Al Falah gets these mortgages refinanced by PMRC which issues a bond to finance the refinance. Assume Habib Bank Limited (HBL) buys that Sukuk. Now for measuring the mandate, SBP will count both BAFL’s mortgages and HBL’s investment in PMRC Sukuk to measure performance towards meeting the mandatory targets. A case of double counting.

The circular says that exposure will be netted-off (i.e. counted once) if it is the same bank getting its mortgages refinanced from PMRC and then investing in PMRC bond. But as this whole post has shown, when push comes to shove, SBP isn’t above counting/not counting stuff to achieve its targets.

Ali Jameel of TPL is a close friend of Abdul Hafeez Shaikh and is on the board of SBP. He had bought Katrak Mansion for a large sum and is about to spend a good chunk of change on renovating it. It is assumed that he will launch a REIT to finance/refinance it. This is pure speculation: a reason that SBP is issuing this circular to make it easy for him to launch that REIT.

Conclusion

IF SBP is asking for independence to do its job diligently, it is a reasonable request as the pressure from the PM to engage in quasi-fiscal activities to help achieve the government’s objectives of growth and housing are forcing the State Bank to manipulate statistics.