There has been a revolution at the State Bank of Pakistan (SBP). No, I am not talking about the new regime at SBP. And I am also not talking about the SBP Amendment Act though we will talk about it briefly as it is related to this issue. I am talking about the below from the latest monetary policy statement.

You may say that this tweet isn’t saying much. You will be right if, if, if you haven't been following SBP policies or communications over the years.

I have been expounding for the last couple of years what that sentence implies and I have had Milton Friedman, Friedrich Hayek, Paul Samuelson, IMF working papers (everything but the kitchen sink), etc. quoted to me. So it brings tears of joy to my eyes (I am exaggerating here. 'It brought a smile to my face’ was not that impactful here) that SBP has finally come around.

But what is SBP saying? To my biased, reading-too-much-into-it, and confirming-my-priors view, the above statement reads

Current inflation is supply-side inflation and we (i.e. SBP) cannot reduce it by increasing the policy rate. We have earlier tried or portrayed ourselves as trying to rein in supply side inflation using the policy rate, we shouldn't have done that but when all you have is a hammer... what else can you do? The fans loved it though.

Whoa! Are you sure that is what SBP is saying?

I might have gotten a bit carried away at the end but yes.

The Theory

[This can get pedantic. You can skip it if you are familiar with the Econ101 concept of inflation and monetary policy.]

There are two main mechanisms through which the impact of monetary policy is transmitted to manage inflation broadly classified as income statement effect and balance sheet effect.

Income statement effect: When the central bank raises the policy rate, it will lead to commercial banks increasing the rate they charge to borrowers. The interest expense of borrowers goes up. For businesses, this means fewer profits. Businesses are expected to reduce their activity, bring down working capital and borrowings to save on interest expense resulting in businesses having less money to re-invest or pay dividends. This will reduce businesses’ demand for goods and services. Businesses may also shut down certain plants and fire employees. In societies with high mortgage penetration, higher interest rates will result in the population's mortgage payments increasing leaving it with less disposable income. The demand for goods and services will fall. Thus in indebted societies, increasing the interest rate reduces demands for goods and services, which may translate into lower prices and lower inflation.

Balance Sheet effect: The interest rate is an input variable in calculating the present value of assets. A higher interest rate will reduce the present value of assets resulting in people and businesses feeling that they are less wealthy (wealth effect). They will cut back on spending. Less demand for goods and services will mean that price of goods and services will decrease.

There is also an expectations theory which states that when there is high inflation, workers will ask for higher wages from employers. But if they see that the central bank has increased the rates, they will know that the central bank is serious in controlling inflation and may delay the request for raise, expecting the inflation to come down. Thus, through expectation transmission, the central bank can delay a rise in wages that will translate into lower inflation.

The aforementioned are means of controlling inflation if caused by demand-side factors. The central bank is reducing income of businesses and consumers hoping that this will reduce demand for goods and services resulting into lower prices and thus reduced inflation.

That is the theory, in any case.

We also have supply-side inflation. Let's say the price of oil internationally increases. This will lead to an increase in the price charged at the petrol pump to the transporters. Transporters will increase the transport charges which will lead to an increase in the price of goods transported. The central bank has little to no sway over this inflation. The increase in the discount rate will not lead to a reduction in prices at the pump or make the transporter charging lower rates. On the contrary, if the transporter is driving a leased vehicle, he may increase the transportation charges further thus adding to the inflation.

The Reality

Mortgage penetration in Pakistan is quite low (0.25% compare to 3% in Bangladesh and 11% in India) even compared to the region.

Moreover, mortgages are targeted at the higher end of the socio-economic classes. Increasing the interest rate on their mortgages will not have any impact on the overall demand in the country.

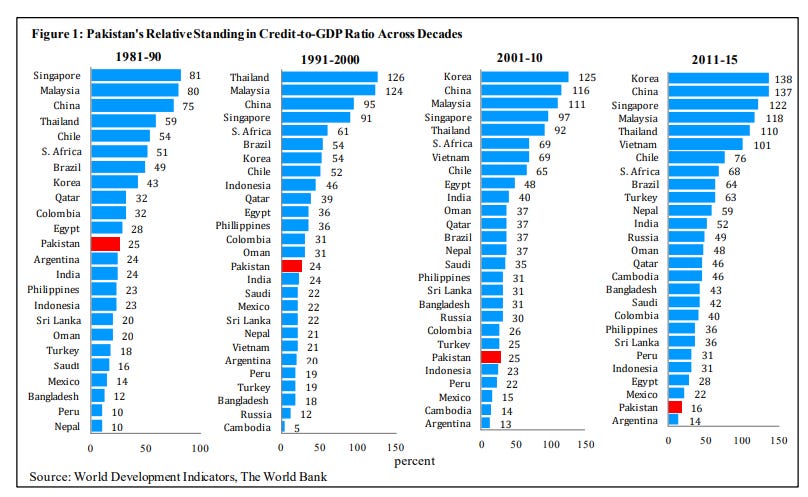

Similarly, credit contribution to GDP is pretty low even when comparing to other countries.

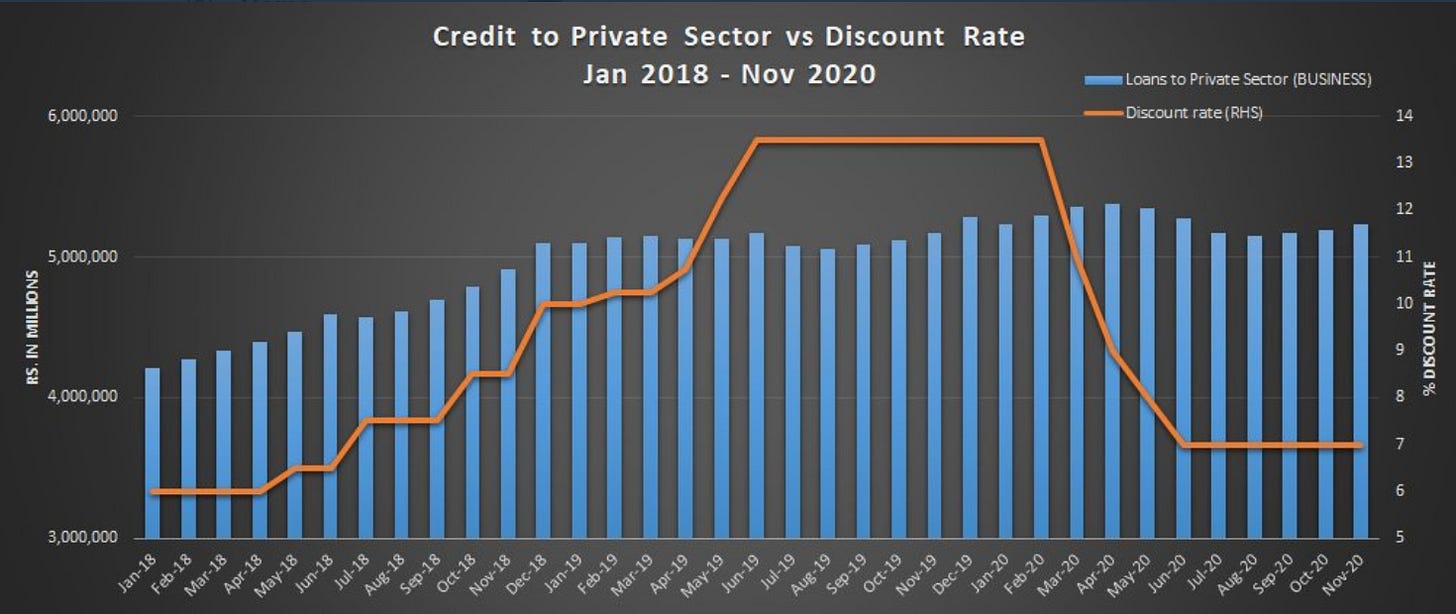

The below chart graphs the discount rate against the credit to the private sector during the period when SBP doubled it to 13.25% and then subsequently brought it back down to 7%. If you squint, you can see that there is a slow down in the growth of private sector credit but credit to the private sector has not decreased. It is not responding to discount rate as the theory says it should i.e. private sector is not able to bring down its borrowing significantly despite the rate doubling. There can be multiple factors for this and research will be required to understand that why didn't private sector reduce its borrowing.

It isn't that the discount rate didn't have an impact. By reducing profitability, the discount rate devastated the Large Scale Manufacturing (LSM) sector during this period. But it didn't have any impact on inflation as it was the supply-side inflation.

The below chart implies that there is a correlation between inflation and policy rate but correlation does not imply causation. There is no way for the discount rate to affect inflation. If inflation is going down, it is not the discount rate that is responsible for it.

Inflation in Pakistan, most of the time is not demand-side inflation. Even if it is, it will be naive to believe that SBP can control demand-side inflation.

To give an example. The government has approved the construction amnesty (aka money laundering package). So far the registered projects are Rs.300 billion but the government expects around Rs.1 trillion of projects to be registered by the due date. All or at least most of these projects will be financed through undocumented money i.e., the majority of these projects will not be constructed using borrowings from the banks rather undocumented money will be whitened by building these. Rs.1 trillion of projects will lead to an increase in the consumption of construction materials, hiring of construction workers, and increases in wages. These wages will result in workers demanding more goods and services. This will lead to an increase in the prices of goods and services. Once again, to cool down this inflation, the central bank will bring out the hammer i.e. increase the discount rates. This is will have no impact on the majority of the activity as no one is borrowing from commercial banks for this. There may be some impact on cement and steel prices as the manufacturers of these goods borrow from the banks but we don't if there will be an impact of this increase on construction activity, wages, or inflation.

Next year, we will have inflation due to the support price of wheat increased to Rs.1800. International oil prices are rising which will also add to the transportation costs of goods. In addition, “if the Circular Debt Management Plan is brought in action, and the tariff rationalization is done as per the laid-out rates and time – the power consumers face never-seen-before increase in tariffs in such a short span.”

All this will add to the inflation of the country and SBP will be incapable to do anything about it. Increasing the discount rate or running Open Market Operations (OMOs) will not dent this inflation.

SBP on its website mentions that by increasing the interest rate it may not be able to control supply-side inflation, however, it can prevent labor wages from increasing which may lead to a fall in inflation by managing expectations.

The argument, to me, appears very weak. I believe this is what should be called “voodoo monetary economics”. If it works as promised (a big if), it will only control wages in companies that borrow from commercial banks which is a very small segment of the businesses in the country.

Conclusion

SBP does not have the tools to control supply-side inflation. SBP also does not have tools to control demand-side inflation if the inflation is generated in the undocumented economy. SBP can only control inflation which is generated by the increase in private sector borrowing or consumer financing but that is a rare phenomenon in Pakistan.

When the latest monetary policy statement was announced, I believed that SBP finally realized that it is helpless to control inflation. It was a revolution because for the last many years and especially the last two years, SBP had been communicating its complete faith in using the discount rate to control inflation. SBP had finally adulted. It was something to be celebrated and hence, tears of joy.

SBP Act Amendment

Unfortunately, the joy didn't last too long. A new SBP Act (Amendment) is making its way to the parliament. It boggles the mind that why price stability (inflation targeting) has been made the primary objective of SBP when SBP doesn’t have the capability to control inflation. The fault isn’t with SBP. The economy of Pakistan with low credit penetration, low contribution of private credit to GDP, negligible (0.2%) mortgage penetration, large undocumented economy, and significant control of pricing in the hands of cartels and mafias, is just not suited for the central bank to manage inflation.

We have been told that we are importing best practices as many central banks around the world have inflation targeting as their mandate. The best practice to import should have been an open and thinking mindset that could have wondered or inquired if SBP has the tools or the capability to control inflation. If not, then price stability should have been a secondary or tertiary target.

There are other questions:

What is the inflation target? 2% like developed countries?

Who will set the inflation target?

Which benchmark will be used to target inflation: headline inflation, core inflation, inflation as depicted by CPI or SPI or any other benchmark etc.?

Has any research been done which shows that SBP has any ability to affect this inflation by playing with the hammer (discount rate)?