Issuing and managing Central Bank Digital Currencies (CBDCs)

Legally SBP can issue CBDC today. Should it?

CBDC isn't revolutionary

While there doesn't exist an established definition of CBDC, CBDC can be broadly considered to be deposits maintained at the central bank denominated in the existing unit of account and serving as both store of value and a medium of exchange. As per this definition, reserves maintained at the central bank by commercial banks can also be considered as CBDC. The current discussions of CBDC revolve around allowing access to everyone i.e. individuals, corporations, etc to maintain accounts at the central bank. Thus when it comes to Pakistan, a CBDC would mean accounts maintained by you and me at the State Bank of Pakistan.

Types of CBDCs

CBDCs can be classified into two types based on how the verification will take place:

Token-based CBDCs

Account-based CBDCs

Notes, coins, and cryptos are a form of token-based currency where one needs to verify that the currency is genuine. The risk in token-based currency is to guard against counterfeit notes or in the case of cryptos a case of double-spend. The payee and payor can remain anonymous. In an account-based system, the currency is mainly in the form of accounts and the verification is of the account holder. The risk in account-based currency is identity theft i.e. money is not being withdrawn from the account of the payer or credited to the payee fraudulently.

Most of the discussions around CBDCs have been about account-based CBDCs.

Legal Authority of SBP

As people who have been following this blog would know by know, Section 17 of the SBP Act 1956 describes the business that the central bank can engage in. The first clause of the Act describes the accounts that SBP can maintain i.e. or the entities from whom SBP can receive deposits from:

The Bank is authorised to carry on and transact the several kinds of business hereinafter specified, namely;

(1) The accepting of money on deposit from, and the collection of money for the Federal Government, the Provincial Governments, Local Authorities, banks and other persons: Provided that no interest shall be paid on deposit received from the Federal Government, a Provincial Government, or a Local Authority.

The Act already allows SBP to open accounts of persons. The Act does not define "persons" so unless advice is provided to the contrary, the account can be opened both for natural persons i.e. individuals, and legal persons i.e. companies. In addition, SBP can pay interest on CBDC accounts of individuals. I don't know if the law in Pakistan treats entities such as Trusts, non-profit or charitable organizations, etc as persons. If not, then the SBP Act may need to be amended to allow such organizations to open a CBDC account if the intention is to offer access to all types of persons.

Thus from a legal standpoint, SBP can launch CBDCs and allow the general public to open accounts with SBP.

Advantage of CBDCs

The two advantages of CBDCs that receive the maximum coverage are financial inclusion and faster and cheaper payments.

Financial inclusion

The main argument usually given in favor of CBDC is that it will increase financial inclusion. The unbanked exist as they find it cumbersome to open and maintain an account at commercial banks. The commercial banks aren't exactly rolling out the red carpet to the unbanked either. Now that almost everyone owns a mobile phone or a computer or has internet access, it is possible to extend CBDC accounts to say everyone in Pakistan over 18 with a NADRA card, with SBP. However, if a significant size of the population doesn't have access to these technologies, the discussion is academic as CBDCs won’t be including the unbanked.

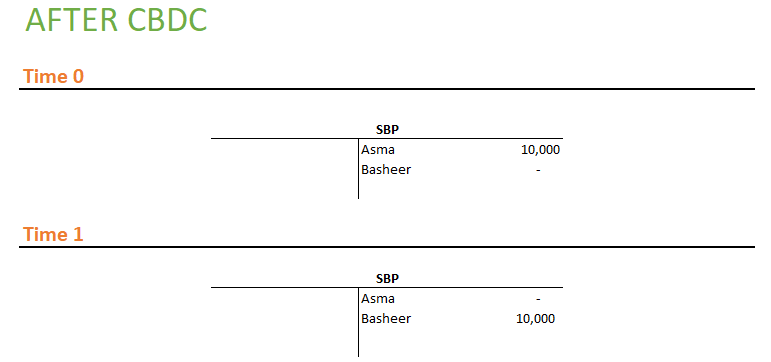

Faster and cheaper transfers between accounts

Commercial banks maintain accounts with the central bank called reserve accounts. When Asma who maintains an account at Allied Bank Limited (ABL) transfers Rs.10,000 to Basheer1 who maintains the account at Bank of Punjab (BOP), the settlement does not take place with a Brinks truck carrying Rs.10,000 from ABL to BOP. The action takes place in the reserve accounts maintained at SBP where SBP transfers Rs.10,000 from the ABL reserve account to the BOP reserve account digitally. Depending on various factors (amount, time of day, customer category, etc), the transfer may not be immediate and charges may be imposed on Asma and/or Basheer for remitting/receiving this payment.

If both Asma and Basheer maintain a CBDC account at SBP, the transfer may be immediate and may also be costless.

Central Bank accounting 101

We will start with how commercial banking deposits are created as people are usually familiar with it and then contrast it with how deposits (reserve accounts or CBDCs) are accounted for by SBP.

Let’s take the example of Asma and ABL. When there is Rs.10,000 in Asma's account, there are 4 ways that money could come into Asma's account.

Asma deposited cash in her ABL account. This will be reflected by cash of Rs.10,000 on ABL's asset side.

Another ABL customer transferred money from his account to Asma's account. Nothing changes on the asset side.

Basheer remitted money from BOP to Asma's account. As shown in the earlier example, ABL's reserve balance at SBP will increase.

ABL extended a loan to Asma. A loan is created on the asset side of ABL's balance sheet.

The T-accounts will be as follows:

In example #3 above, Reserves at SBP appear on the asset side of the balance sheet of ABL. Such reserves are reflected on the liability side of the SBP balance sheet as we had seen in the first example at the beginning of the post when Asma remitted money to Basheer.

In example #1 above, cash appears on the asset side of the balance sheet of ABL and therefore it will appear on the liability side of the balance sheet of SBP.

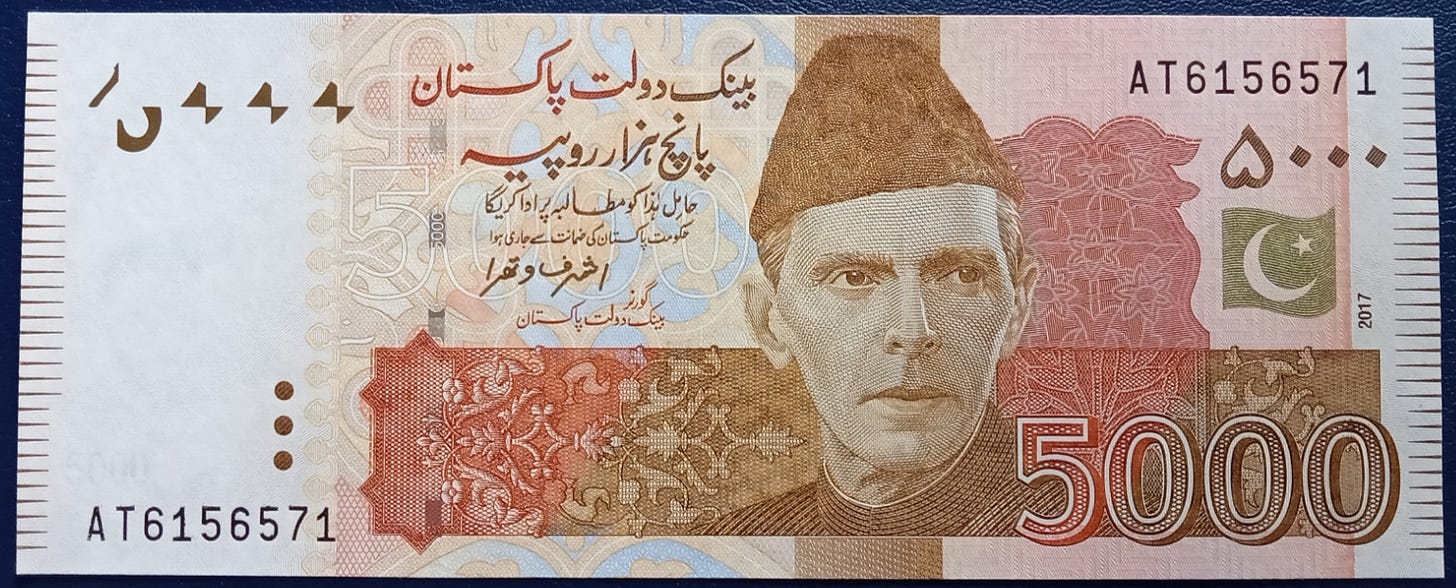

This is how the central bank is different than the commercial banks. In commercial banks' books, cash always appears on the asset side whereas, in a central bank's book, it is the liability of the central bank and appears on its liability side. See the 5000 note below. It states that the State Bank of Pakistan will deliver Rs.5,000 to the bearer of this note. In the case of gold-backed currencies, the central bank would promise to hand over the equivalent value of gold in exchange for it. Since it’s fiat currency, SBP is promising to you that when you submit this, it will replace it with another 5,000 note or a denomination of notes totaling Rs.5,000.

In the balance sheet of SBP, banknotes in circulation are appearing on the liability side. The keyword is "in circulation".

When Asma deposited Rs.10,000 in ABL, it increased the cash balance of ABL. However, when Basheer deposits Rs.10,000 cash in his SBP CBDC account, the banknotes in circulation will decrease as the notes are no longer in circulation.

If it is hard to understand, think of the extreme scenario: Pakistan goes completely cashless and everyone comes to SBP to convert their physical notes into CBDC accounts. The notes in circulation will go to zero replaced by an equivalent balance in everyone CBDC's account i.e. notes in circulation will be replaced by CBDC accounts.

As we learned in the refinancing post, reserves on the liability side of the balance sheet of SBP are supported by loans/refinancing to commercial banks on the asset side. Similarly, Banknotes in circulation liability is supported by the following assets listed in 21.1:

The largest component is Investments and those mainly comprise federal government scrips such as PIBs and Treasury bills.

When SBP issues banknotes, it can't do it at will as it can do with the refinancings. SBP Act requires it to issue Banknotes against certain assets. Banknotes are issued by the Issue Department of SBP which is completely separate in terms of assets and liabilities from the Banking Department. The banking department is usually responsible for the stuff we normally follow SBP for (banking supervision, policy rate, FX market intervention, money market operations, refinancings, etc). From the SBP Act

26. Issue Department.

(1) The issue of bank notes shall be conducted by the Bank in an Issue Department which shall be separated and kept wholly distinct from the Banking Department and the assets of the Issue Department shall not be subject to any liability other than the liabilities of the Issue Department as hereinafter defined in Section 32.

SBP's balance sheet has a large number of line items in the liabilities section. But as per SBP Act, Issue Department liability is limited to Banknotes in circulation.

32. Liabilities of the Issue Department

(1) The liabilities of the Issue Department shall be an amount equal to the total of the amount of the bank notes for the time being in circulation.

On the asset side, these liabilities should be backed by specific assets

30. Assets of the Issue Department.

(1) The assets of the Issue Department shall not be less than the total of its liabilities

And then the clause goes on to list the assets that will qualify as assets (it is a long list which I am not copying here). The assets that currently back the banknotes in circulation are

I have highlighted in the balance sheet below where the assets backing the banknotes are. 2

CBDC design considerations

The above dry digression about T-account and Issue Department (I find it fascinating but to each his own) helps us to consider the design challenges of CBDC.

1. Law of issuing CBDC

Issue Department can only issue banknotes. As CBDC is supposed to be digital cash, the Act needs to be amended to allow Issue Department to issue CBDCs.

The Act also needs to define if Issue Department will issue new CBDCs, or it can do helicopter drops in times of crisis by crediting every CBDC account with money, or will it only issue CBDCs when someone brings cash to the SBP to deposit in their CBDC account.

2. Convertibility with commercial bank liabilities

We saw that the SBP balance sheet size does not change when Basheer deposits cash with SBP in his CBDC account. SBP reduced banknote in circulation and increased Basheer's CBDC balance with an equivalent amount. However, what if Basheer takes a loan from BOP and then asks BOP to remit this balance to his CBDC account. Will this be allowed? Two scenarios:

If SBP will not allow commercial banks’ liabilities to be converted to CBDCs, then CBDCs will be like banknotes. The amount is fixed. As we discussed in the earlier post, commercial banks face a funding constraint in expanding their balance sheet. There is a reason banks open branches throughout the city and the country and raise deposits as this cash allows them to overcome the funding constraint. A lot of this cash comes in the form of cash deposits (as Pakistan is a cash-using country). If people move all their cash to SBP for CBDC, and this CBDC is not convertible to commercial bank liability (similar to how depositing SBP banknotes in your local bank branch creates a deposit liability) commercial banks will not be able to extend as many loans as they do now because they will be facing large funding constraints. Moreover, whereas commercial banks have the option whether to invest in PIBs or make loans, SBP Issue Department is limited to mainly investing in PIBs, i.e., SBP cannot extend the credit to the private sector now that commercial banks are no longer able to do so.

If SBP allows for commercial bank liabilities to be converted to CBDCs as Basheer wanted, this will make the CBDC Asset Liability Management (ALM) complicated for SBP. All the liabilities of the Issue Department (whether banknotes in circulation or CBDCs) are required to be backed by specific assets, the issue department will be required to purchase assets from the market to back the CBDCs that are coming onto its balance sheet. Initially, it may be PIBs (this will bring down the yields on PIBs) but when there aren't enough PIBs in the market, the central bank will be forced to amend the Act to purchase other assets such as TFCs or mortgage-backed securities (if they are ever launched in Pakistan), etc to balance its balance sheet. On the flip side, if people start converting their CBDCs to commercial bank deposits, SBP will have to dump the PIBs and other assets into the market.

Other Points to Ponder

KYC / AML

Right now commercial banks are responsible for completing KYC/AML for all their customers. Moreover, commercial banks are also responsible for monitoring the transactions in the accounts, raise Suspicious Transaction Reports (STRs), and closing down accounts if inactive or engaged in suspicious activities. Moreover, they also have to deal with FBR and court judgments with respect to attaching the accounts. If SBP allows CBDC, SBP will have to undertake all these activities.

Infrastructure

Compatibility

It is a digital currency. Access to SBP's website or ledger should be available to all that want to access it or maintain an account with it. Not everyone will have the latest gadget or a smartphone. Thus SBP website should be compatible with all sorts of devices that the population of the country will use to access the account.

Identity Theft and Cyber Security

A number of Pakistani banks have been attacked by hackers who have stolen data. SBP needs to introduce a robust mechanism for identity verification and how to handle issues of identity theft.

IT infrastructure

Needless to mention, significant expenditure will need to be incurred to set up an IT infrastructure to open and maintain these accounts. In addition, thought needs to be given to how APIs will be developed to give access to banks, fintech, payment providers, and other entities to develop products to work with CBDC. However, keep in mind that the purpose of CBDC is to disintermediate commercial banks, fintech by providing customers access to the central bank balance sheet. Bringing them back in with APIs etc we are reintroducing intermediation.

SBP may require a dedicated call center to resolve problems that the account holders may face. Consider the size of the population that will be maintaining those accounts and what size call center will be required to answer their calls.

24/7/365 availability

Right now SBP may be used to its system working on weekdays and during banking hours only. It is usually inaccessible during bank holidays. If CBDCs are introduced, the SBP system needs to be up and running 24/7/365.

Policy Instrument

It is expected that at minimum, CBDC will be used for payments between account holders and allow for retail payments. This will disintermediate the payments business and the associated income of commercial banks. In addition, those who keep their funds in current accounts for religious reasons may find it preferable to keep their deposits with the central bank. This will have a significant impact on the cost of funds of commercial banks as they may lose access to low-cost deposits.

CBDC can be a simple deposit account for making retail payments as we have been considering so far or it can be an interest-bearing account (which SBP Act allows for). If CBDC is an interest-bearing account, it will compete with other financial products such as saving accounts maintained at commercial banks and money market funds. Investors and corporations may find it preferable to invest funds in CBDC accounts backed by the guarantee of GoP than to invest money in treasury accounts with commercial banks or money market funds. If the rate of return on CBDC is attractive, commercial banks will have to increase the rate on deposits to attract and retain them.

SBP's monetary policy is almost completely ineffective for controlling inflation, CBDC can be a better mechanism for managing demand-pull inflation. By offering a higher interest rate on deposits, SBP can compel consumers to withhold their spending and get higher returns on their deposit accounts. This may slow down demand-pull inflation.

Volatility in the banking system

As the aforementioned examples show, CBDC could introduce more volatility in the financial system. In times of stress, large amounts may leave the balance sheets of commercial banks to be deposited with the central bank. This will reduce the balance sheet size of commercial banks rapidly and increase the balance sheet size of the central bank. In good times, the flow will be in the opposite direction. And in times when there is uncertainty, this to and fro will exacerbate the volatility of the system.

Surveillance State

Cash is anonymous. With CBDC, the central bank and thereby the government will know where consumers are spending money to the last paisa. Laws can be passed to bring a veneer of privacy to prevent GoP and SBP from looking too deeply into it but as we know, a certain holy institution is above the state and doesn't care about such minor inconveniences as law of the land. Moreover, for the government, such protections are usually an Ordinance away for usurpation.

China - a trailblazer in CBDC

China has been working on its digital currency for quite some time. China isn’t the first country to issue CBDC but recent developments in China have sent the financial media into a frenzy.

This is how WSJ reported it earlier this month.

A thousand years ago, when money meant coins, China invented paper currency. Now the Chinese government is minting cash digitally, in a re-imagination of money that could shake a pillar of American power.

It might seem money is already virtual, as credit cards and payment apps such as Apple Pay in the U.S. and WeChat in China eliminate the need for bills or coins. But those are just ways to move money electronically. China is turning legal tender itself into computer code.

It goes on to say that it will replace the US dollar as an international reserve currency.

Beijing is also positioning the digital yuan for international use and designing it to be untethered to the global financial system, where the U.S. dollar has been king since World War II. China is embracing digitization in many forms, including money, in a bid to gain more centralized control while getting a head start on technologies of the future that it regards as up for grabs.

“In order to protect our currency sovereignty and legal currency status, we have to plan ahead,” said Mu Changchun, who is shepherding the project at the People’s Bank of China.

Australian Strategic Policy Institute came up with a comprehensive report The flipside of China’s central bank digital currency.

This is a good infographic from ASPI of Chinese CBDC. I have highlighted the section that shows that Chinese CBDC is an account-based CBDC, not a token-based CBDC.

From the summary,

It has the potential to create the world’s largest centralised repository of financial transactions data and, while it may address some financial governance challenges, such as money laundering, it would also create unprecedented opportunities for surveillance. The initial impact of a successful DC/EP project will be primarily domestic, but little thought has been given to the longer term and global implications. DC/EP could be exported overseas via the digital wallets of Chinese tourists, students and businesspeople.

Over time, it is not far-fetched to speculate that the Chinese party-state will incentivise or even mandate that foreigners also use DC/EP for certain categories of cross-border RMB transactions as a condition of accessing the Chinese marketplace.

DC/EP intersects with China’s ambitions to shape global technological and financial standards, for example, through the promotion of RMB internationalisation and fintech standards-setting along sites of the Belt and Road Initiative (BRI). In the long term, therefore, a successful DC/EP could greatly expand the party-state’s ability to monitor and shape economic behaviour well beyond the borders of the People’s Republic of China (PRC).

That is some fear-mongering. But if you are like me who like to go to the references and notes at the end of papers, there is this little nugget

Funding statement: Funding for this report was partly provided by Facebook Inc.

What do you know? Facebook which wanted to upend the global financial system with Libra, Diem, Novi, etc (facebook's currency project has changed names so many times that it is hard to keep track) is behind this report.

If China is sending financial media to frenzy, it was actually Facebook's Libra or Diem or Novi or whatever they decide to name it next that actually stirred the central banks to action. The international central banks aren't worried about Chinese digital currency as China runs a closed capital market, runs huge current account surpluses which makes it hard to accumulate Chinese yuan reserves, and closely monitors investments into Yuan assets.

China’s Digital Yuan Poses No Threat to the Dollar’s Dominance

As the currency of the world’s largest trading economy, the yuan punches far below its weight. According to an International Monetary Fund study published in 2019, data from 2016 suggests that about 93% of China’s imports and 95% of its exports were denominated in dollars.

The range of options to foreigners who find themselves with a pile of yuan is minimal, compared with a pile of dollars, euros or yen. China has far fewer high-quality assets, and the government’s squeamishness about outflows of capital make the risk of not being able to retrieve funds far higher. (China needs a Reza Baqir).

Digitization may speed up transactions and remove some of the friction involved in international payments. But it won’t transform currencies people don’t want to hold into currencies that they do. For most international business, the yuan still sits in the former camp and shows little sign of moving out.

This is not an exhaustive overview of CBDCs but provides you a strong grounding to discuss them. Next time SBP tries to surreptitiously send an SBP Amendment Act to the parliament while leaking excerpts on WhatsApp, we will be ready to discuss the key areas.

It is a new area and continuously evolving. Central banks worldwide are still researching the design and implications of CBDCs. Unsurprisingly, every CBDC framework is a bit different. As time passes, there will be many working papers discussing the pros and cons of various design decisions of CBDCs. Now that the stage has been set, we can do a future post discussing the various designs and their implications.

Asma and Basheer are desi versions of Alice and Bob assuming Asma can jump all the hoops and obtain all the references and signatures that are required in the country for women to open an account.

Coins are a liability of the Government of Pakistan and not SBP. SBP issues coin on behalf of the Government of Pakistan and treat them as an asset.