Apples to oranges in construction financing

Chart crime and other misdemeanours

I came across the below notification while browsing the SBP website for REIT regulations (which will be a topic of a future post). The notification was issued in collaboration with Pakistan Banking Association (PBA) on April 21, 2021.

Financing to the housing and construction sector in Pakistan has almost always remained quite negligible in the credit portfolios of banks when compared with other developed and developing countries for various reasons. To support the vision of the Government of Pakistan, the State Bank of Pakistan has taken several measures since July 2020 to support the provision of financing for the housing and construction sector by way of giving incentives and targets to the banks. A key regulatory measure in this direction was assigning mandatory targets to banks to increase financing for mortgages to builders and developers. Banks are required to increase their housing and construction finance portfolios to at least 5 percent of their private sector advances by end December 2021.

In October 2020, the Government of Pakistan augmented these efforts by introducing the Government Markup Subsidy Scheme, now commonly known as Mera Pakistan Mera Ghar Housing Finance Scheme. This scheme enables banks to provide financing for the construction and purchase of houses at very low markup rates, targeting low to middle income segments of the population.

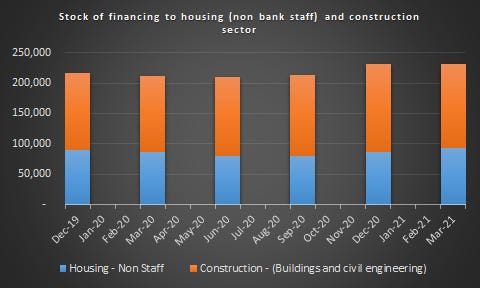

As a result of the recent measures by the GoP and SBP, housing and construction finance has been progressing significantly and a momentum in housing and construction finance is building up. The banks’ housing and construction finance portfolio has increased from Rs148 billion by the end of June 2020 to Rs202 billion in March 2021 (chart). This represents a growth of Rs54 billion or 36% in three quarters of FY21 compared to a stagnant position in earlier quarters. Such growth in housing and construction finance in such a period has never been witnessed in Pakistan’s history previously.

Overall financing to the housing and construction sector by banks is likely to increase further significantly as mortgage finance activity under Mera Pakistan Mera Ghar Scheme is picking up pace. As of April 20, 2021banks have received applications for financing of more than Rs52 billion from the general public under this scheme. Of these, the banks have approved financing of more than Rs15 billion to the applicants while the remaining applications are at different stages of the evaluation and approval process.

That is a very significant increase on account of mandatory targets. Before we proceed with the analysis, we should know how does SBP prepare the data. I had covered this earlier in my medium post.

SBP does not have an online access to the database of the banks to see how banks are performing day to day. Each bank is running its own banking system and banking system of one bank may be completely different from another bank and from SBP. At the end of the month, each bank generates an Excel sheet consisting of the data required by SBP in the format required by SBP. SBP compiles all the Excel sheets, sums up the data and reports it on its website showing the performance of the bank. SBP does not audit this report every month unless there is something that stands out as extraordinary. It has been years since I worked on this report so the system may have changed to where SBP will provide automatic forms etc but the bottom line remains that SBP data is based on reports prepared by the banks.

How do banks prepare this report? Do they update every time a loan is disbursed which industry it is going to? In most cases, no. When a borrower opens an account with the bank, the borrower is assigned an industry classification. Thereafter, every loan that is provided to that borrower is shown as going to that industry even if the purpose of the borrowing is unrelated to it. This is not a big deal as most borrowers usually borrow for their own industry and a single loan by a borrower for a different purpose won’t sway the overall industry data in a meaningful way.

To give an example, in 2005, I marketed and booked Crescent Steel and Allied Products Limited (CSAPL). It was very profitable at the time. When we created the account in our banking system, we showed it as a steel manufacturer. At the time, there steel business wasn’t making much money and all the profit they were making was from their trading activity in stock market. We also provided them a loan of, I think, around Rs.100million to trade in the stock market. When the month end reporting went to SBP, it showed that funds are being provided to a steel manufacturer. If research houses and business press is monitoring the SBP data, they will report that steel manufacturing is in expansion mode or their working capital requirements are increasing.

Similarly, if CSAPL requests us to finance their setting up of a PVC pipe manufacturing facility as now they are experts in pipes, we are not going to update in our outdated system that this new loan is going for a PVC factory and not a steel factory (unless it’s a completely different borrowing entity).

The title of the SBP report is Advances by Borrower (industry classification). The loan given to CSAPL to set up a PVC pipe factory will be reported as loan given to a steel pipe manufacturer.

Now that we have got the primer out of the way, let’s get back to the topic of this post. The below chart is from the SBP report "Credit/Loans Classified by Borrower" type. [If the images in this appear small, click on them to enlarge].

Looking at construction (green line), the total outstanding in Jun'19 (Rs.153 billion) was higher than what it is in Mar’21 (Rs.138 billion). Not shown above, but the highest outstanding balance was Rs. 170 Billion in Sep'18. Construction has been disaggregated into buildings (orange line) and civil works (blue line). Loans for the construction of buildings are going up and loans for civil works are going down. One reason could be that projects that were earlier classified as civil works are now classified as construction as it helps to achieve the SBP target.

In Loans Classified by Borrowers (By Type of Finance) report, from June ‘20 onwards, SBP has introduced a new column construction financing. It helps to mitigate some of the challenges I highlighted above with respect to classifying every borrowing by a construction company as an increase in construction financing.

Using the new column, we can see that for overall private sector (blue line), construction financing rapidly increased from Q1 2021 to Q2 2021, the borrowing has been stable since. The construction industry (orange line) also shows a similar trend. However, its trajectory is not like how SBP and PBA chart is showing. The civil engineering sector (grey line) is too small to matter.

If you are interested, at the end of this section, I have copied two more ways showing how banks can manipulate the construction statistics.

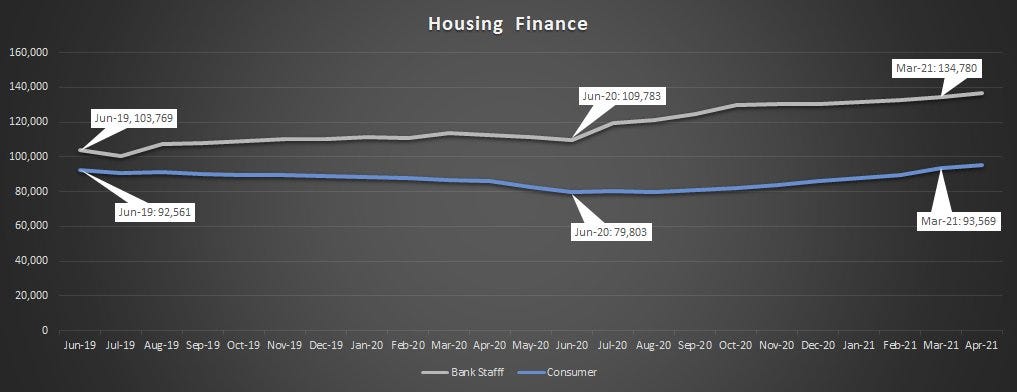

Let’s look at consumer financing. In housing finance (mortgages), the real growth is in mortgages given to bank staff (grey line). Consumer mortgages (blue line) are also rising, but in April 2020 they are only as high as they were in June 2019.

Focusing on the consumer mortgage, extending the trend back till Jan 2018 and overlaying it with the discount rate, we see that the consumer mortgages were increasing before Reza decided to attract hot money with a high discount rate. This led to a fall in consumer mortgages. Once the discount rate was brought back to a reasonable level, consumer mortgages started increasing again. They just reached the June 2019 level.

This brings me back to the question that I asked yesterday, i.e. Should it be called a stimulus when the central bank is revisiting its disastrous policies? Similarly, should we attribute all the growth in mortgage financing to SBP’s new push when part of it, if not all of it, maybe due to the discount rate coming back to the normal level?

Based on the charts we saw based on SBP schedules, there is an increase in construction financing and housing finance. However, it is not as rapid as the chart in SBP and PBA joint announcement was showing. Looking at the latter chart again, we see that there is no index on the left or right.

Below I draw a chart by plugging the above figures in Excel. There is an increase, but it is not as pronounced as SBP and PBA are making it out to be. This is chart crime 101.

The above chart is based on the data from the SBP/PBA notification. Now that we have gone through the exercise of reviewing all SBP schedules of borrowings both by industry and by type of advances, we might as well add one more chart based on the schedule data. Using consumer mortgages (non-bank-staff) and total borrowings of the construction industry (including non-construction financing borrowing such as working capital etc), the bar charts for the first three quarters appear to exactly match. However, the growth in the last three quarters again appears less pronounced than the above chart.

Looking closely at the numbers, it appears that SBP and PBA are over-reporting the numbers by Rs.17 to 22 billion for the last three quarters. Are SBP and PBA fudging the numbers?

There are only two justifications for the difference:

Either a new segment has been included in 2021 which didn't exist till the end of Q4-2020 which makes the comparison not apples-to-apples

or

SBP and PBA are adding arbitrary numbers (fudging) to make their performance appear slightly better than it is.

I wouldn’t be surprised if conclusion number 2 above turns out to be true. Reza Baqir had pulled a similar stunt earlier where he falsely claimed before the PM that we have achieved housing finance objectives despite the fact that on the previous day, PBA had sent out an email to banks lamenting that their performance with respect to giving out housing finance is disappointing.

As promised, the bonus feature from my earlier post on how to manipulate the statistics.

… if you work in a bank and are having a tough time meeting the construction lending targets set by SBP or want to earn brownie points with the government, you can use the below methods, based on my experience, to achieve the targets if push comes to shove. However, don’t forget the first rule of innovative thinking in corporate world: always CYA by getting your highers up to sign off on it.

Review the clients who are borrowing for any construction activity. For example, it could be a trading client who is borrowing money for building its new headquarters. If the borrowed money is significant (it is the judgment call of the bank what qualifies as significant) change the industry classification of the borrower from a trader to construction because as far as the bank is concerned, the borrower is engaged in construction activity. The overall lending position of the bank remains the same (but now all the loans doled out to this trading company will appear as construction loan and resultantly in the SBP reporting, construction financing will increase. SBP will no’t object rather along with the government, it will be more than pleased with the bank.

Say you have a construction client that the risk committee refused to finance earlier because he was asking for unreasonable amount of money. He is now building with his own money or buyer’s money and lets say his project is now 80% complete. With the blessing of your risk committee, request him to borrow money from you at a very cheap rate. If you are limited to providing 50% loan-to-cost, it means that the bank pays out 30% of the loan on day 1 instead of the trickling 2% every month. This helps you achieve the construction loan disbursement target at a very low risk. Though you may not be making as much money as you would like, but if you are seeking some brownie points from SBP or the government, this will help you achieve those for not to steep a price.