We talk quite a bit about microfinance here and if we include nano-finance aka predatory lending into it, I have been on a crusade against them recently. But this post is not about nano-finance or fintech.

About microfinance specifically, I wrote the following posts earlier

I should write another post on Mobilink Microfinance Bank’s evolution into nano finance lender but I will leave it for another time.

I came across this on LinkedIn or as someone commented rightfully CringeIn1

If one is looking for a masterclass in spin, the paragraph above provides it. Let me quote it in text so that we can appreciate it and it is easy to copy for future uses

PTCL.Official & U Microfinance Bank Limited announce successful conversion of U Bank’s Rs. 1,000M debt into equity!

Seeing the potential in U Bank’s ability to further expand and grow, PTCL commits to contribute and support the bank in capturing new segments and customer classes to include more of Pakistan into the banking net and further its ambition of financial and social inclusion. This is not only in line with our commitment to uplift country's economy but also to strengthen ties between banking and telecom sector.

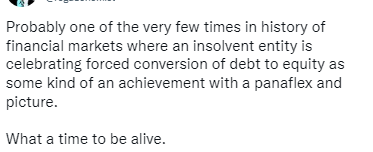

Let me let the other tweeps do the talking on this announcement

For a bank that claims to be digital bank, the 2021 financial statements on their website comprise of a scanned PDF of printout. And not even a clean printout. It was a spirally bound book as you can see the spiral marks at the bottom of the below image.

Anyway, the total outstanding loan portfolio is Rs.36 billion as highlighted above. The non-performing loans are Rs.2 billion which at 5.5% of the loan portfolio isn’t too bad.

However, the aforementioned doesn’t reflect the true picture. SBP had allowed certain relaxations to the banks after Covid-19 allowing the banks to not classify certain loans as non-performing as long as they are servicing their interest.

As per note 9.6 of the 2021 FS, such loans amount to Rs.8.2 billion which is 22% of the loan portfolio.

The total capital of the bank at the end of 2021 was Rs.7.7billion. In the absence of SBP’s relaxation, the aforementioned NPLs would wipe out 75% of the equity of the bank rendering it kaput.

On March 31, 2022, they wrote off around Rs.1 billion of advances that they had already provided for in NPLs. It doesn’t affect their financials as it was already provided for but it brings home the point that those provisions aren’t conservative. That’s more amount written off from the provisions in three months than what was written in entire year of 2020.

It is in light of this that I wonder if this “successful conversion” is really a forced conversion (pun unintended) of Rs.1 billion debt into equity.