The absurdity of June 2021 SBP statistics

The SBP statistics don’t represent an accurate picture of the financing for construction activity. At the very least, the numbers are not reporting what we think they are reporting.

For those who are new to this substack, I have linked to a few of my earlier posts at the end that will provide a background to my arguments.

As always, if the images appear too small, click on them to enlarge.

SBP Statistics

As per SBP banking statistics, the June advances for construction financing are extraordinary. We will focus on two SBP reports.

1. Credit / Loans Classified by Type of Borrowers

Below is the snapshot of loans classified by Borrowers. The way it works is every bank identifies each borrower as a particular category. Every loan taken by that borrower will be classified as borrowing by that industry.

How does this report come about? From my earlier blogpost

SBP does not have an online access to the database of the banks to see how banks are performing day to day. Each bank is running its own banking system and banking system of one bank may be completely different from another bank and from SBP. At the end of the month, each bank generates an Excel sheet consisting of the data required by SBP in the format required by SBP. SBP compiles all the Excel sheets, sums up the data and reports it on its website showing the performance of the bank. SBP does not audit this report every month unless there is something that stands out as extraordinary. It has been years since I worked on this report so the system may have changed to where SBP will provide automatic forms etc but the bottom line remains that SBP data is based on reports prepared by the banks.

How do banks prepare this report? Do they update every time a loan is disbursed which industry it is going to? In most cases, no. When a borrower opens an account with the bank, the borrower is assigned an industry classification. Thereafter, every loan that is provided to that borrower is shown as going to that industry even if the purpose of the borrowing is unrelated to it. This is not a big deal as most borrowers usually borrow for their own industry and a single loan by a borrower for a different purpose won’t sway the overall industry data in a meaningful way.

To give an example, in 2005, I marketed and booked Crescent Steel and Allied Products Limited (CSAPL). CSAPL was a very profitable entity at the time. When we created the account in our banking system, we showed it as a steel pipe manufacturer. However, at the time, their steel business wasn’t making much money and all the profit they were making was from their trading activity in stock market. We provided them a loan of, I think, around Rs.100million to trade in the stock market. When the month end reporting went to SBP, it showed that funds are being provided to a steel pipe manufacturer. If research houses and business press is monitoring the SBP data, they will report that steel manufacturing is in expansion mode as borrowings are increasing. Similarly, if CSAPL requests us a term loan of Rs.1 billion for setting up of a PVC pipe manufacturing facility, unless CSAPL establishes a completely different borrowing entity and is borrowing under the new entity, our outdated system and SBP reporting will reflect that this Rs.1 billion loan is going to a steel pipe factory.

This why the title of the SBP report is Advances by Borrower (industry classification) and not what is the specific purpose of the advance. The loan given to borrower to set up a PVC pipe factory is being reported as loan given to a steel pipe manufacturer.

We just need to be cognizant of how these reports are generated. This is not a state-of-the-art up-to-date flawless reporting system. This reporting is prepared by humans and a lot of judgment and manual input goes into it.

2. Credit / Loans Classified by Type of Finance

Here, SBP divides the borrowing by type of finance. If you look at the column headings, it breaks down the borrowings by export refinance, working capital, etc. The construction financing column (shown in yellow) was added last year.

The advantage of this report is if CSAPL borrows for constructing a new headquarters building, it will be reported as construction financing (yellow column). In contrast, the earlier report (by type of Borrower) would just report that borrowing by CSAPL has increased, and we would have been none the wiser whether the borrowing is for working capital or construction financing, or export financing.

If you want to match the numbers in the two reports, compare the values in the red boxes.

June 2021 statistics

Now that we understand how the numbers come about, lets get into June 2021 numbers.

Construction - by type of borrower

Financing for construction, both residential and non-residential, went up in June 2021. The numbers overlap, that is why you can't see the blue line in June 2021. The magnitude of the increase in June 2021 is unprecedented as per the chart.

If we look at it on a net basis, the June 2021 numbers feel absurd.

In June 2021, commercial banks provided Rs.23 billion of net construction financing to borrowers classified in the construction of residential and non-residential buildings.

It is unfathomable that banks could have financed the construction of Rs.23 billion in a single month (based on their historical track record), unless the banks are financing the acquisition of land or a pre-existing building. As I had explained in an earlier post, construction financing is disbursed gradually

Cost of the project can be divided into land cost and construction cost (for the sake of simplicity we are assuming soft costs such as architecture costs, municipal charges, approval and permit charges are all included in construction cost). Land usually comprises 25% of project cost with construction cost comprising balance 75%. Banks in Pakistan don’t finance land and limit their financing to around 50% of the total cost of the project i.e. 50% of loan-to-cost (LTC). If a builder wants to finance a building, he will have to arrange money to purchase the land. Plus he will also arrange another 25% for carrying out initial construction cost. Once the builder has financed 50% of the project from his own sources (equity, borrowing from friends, family, associates, purchaser deposits etc), then the bank will start financing balance of the cost. The bank will not hand over the 50% loan amount in lump sum. Instead the bank will receive a monthly report from Quantity Surveyor of how much work has been done that month and will release only that amount of the loan.

Let’s take an example. Assume cost of high rise is Rs.1 billion. 25% land cost means the construction cost is Rs.750 million. Say it will take 3 years to construct the building from the date excavation is started. Thus, every month approximately Rs.21 million construction cost will be incurred on project (Rs.750 million construction cost / 36 months). If the bank is financing at 50% LTC, it means bank will only finance the final Rs.500 million of the project. The builder will have to arrange the initial Rs.500 million from own sources: the builder will initially pay Rs.250 million for the land. Then he will pay Rs.21 million every month towards construction for the next 12 month bring the total cost incurred on the project to Rs.500 million. When the 50% milestone is achieved, now the bank will enter the picture. As stated above, the bank will not hand over Rs.500 million to complete the project. Rather bank will release only Rs.21 million. In the next month, Quantity Surveyor will present a report to the bank that Rs.21 million that was disbursed last month has been used in the project as required. Then the bank will release the next instalment of Rs.21 million. This is done to minimize leakage i.e. prevent the builder from diverting the bank’s loan for non-project related costs.

My understanding is that classification of the borrowers as “construction” is doing the heavy lifting here. It seems highly unlikely that the actual construction of Rs.23 billion was financed in a single month.

Construction Finance - by type of finance

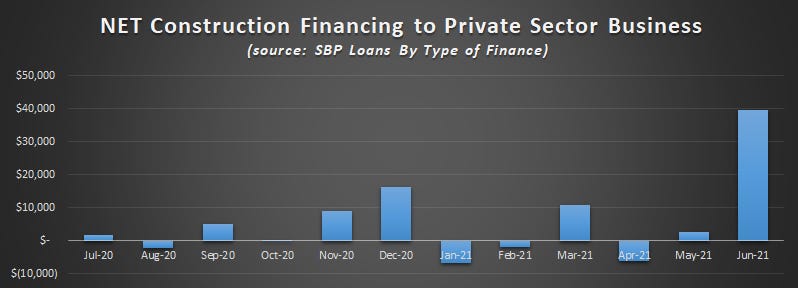

If we look at the construction financing across all types of borrowers, June 2021 stands out here again.

It is hard to believe when compared to earlier months. Commercial banks provided almost Rs.40 billion of construction financing in one month across all types of borrowers.

If we look at the below chart, which shows the same data on the net basis, there is a surge at every quarter-end. The surge could be due to the relationship managers trying to meet their quarter-end targets. But as I explained earlier, construction does not happen overnight. Such huge disbursement for construction is only possible if the loan is being provided either for the acquisition of an already constructed building or for land (both of which aren’t really construction activities).

I believe that the numbers in SBP statistic don’t represent an accurate picture of the financing for construction. At the very least, the numbers are not reporting what we think they are reporting.

I used Microsoft Excel's conditional formatting to isolate the segments where the major change is coming from. We will look at June 21 and Dec 2020 figures.

In June 2021, the net construction financing provided to the private sector is Rs.39.7B: Rs.22 billion is provided to the construction sector as already discussed while Hotels, Education, and Real Estate activities each have borrowed in excess of Rs.3 billion each.

In Dec 2020, the month with the second-highest net borrowing for construction financing of Rs.16.2 billion, the construction sector received Rs.7.5 billion including Rs.4.2 billion for civil engineering i.e. roads, bridges, dams, etc followed by the hotel sector and real estate activities with 1 billion and 4 billion respectively.

Mortgage finance

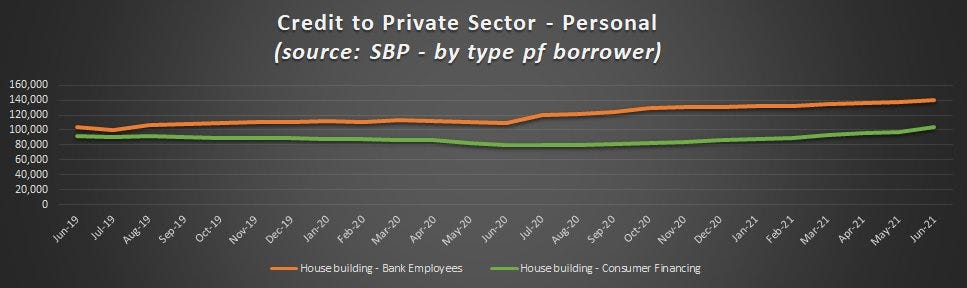

Mortgage financing continues to gather pace.

Initially, the increase came from loans to bank staff, now the increase is coming from consumers.

SBP Mandate

The SBP is targeting housing financing and construction of buildings (residential and non-residential) as per SBP's own circular of July 2020.

Mandatory Targets for Housing and Construction Finance

1. With a view to promote housing and construction of buildings (Residential and Non-Residential) in Pakistan, State Bank of Pakistan (SBP) has decided to advise mandatory targets to the banks. Accordingly, each bank shall ensure that the financing for housing and construction of buildings (Residential and Non-Residential) shall be at least 5 percent of their domestic private sector credit by December, 2021.

The way I would read it is, SBP will measure the target aggregating the following to measure the progress of banks as a percentage of total private sector borrowing.

Housing finance and

All borrowings by borrowers classified as construction (residential and non-residential)

This is substantiated by the fact that based on the above, my numbers match exactly with SBP/PBA press release till June 2020. Subsequently, a discrepancy pops up. It was around Rs.17 billion in Sep 2020 (Q1-FY2021) and has increased to Rs.49 billion by June 2021. It appears SBP is including a category other than construction (residential and non-residential) and non-staff housing finance when calculating the progress towards achieving the target. The outstanding balance of this category was zero in the entire 2020 (as my and SBP/PBA numbers match) but has since ramped up to Rs.49 billion by June 2021, more than half of it in just the last quarter.

Below is the chart where the data (A) in row 1 in the above table is derived from. If the chart is ugly, don't blame me. It is from SBP and PBA's press release. It is also an example of chart crime.

If we ignore the discrepant SBP/PBA press release data and only use the data as per the credit classified by the type of borrower report, remarkable progress has been made towards meeting SBP's target mandate in the month of June 2021. The lines that were almost parallel till May 2021 may eventually intersect at some point in the future now.

Whereas in May 2021, an additional Rs.147 billion was required to be disbursed to meet the 5% target, now banks need only disburse Rs.130 billion to achieve the target of 5% private sector borrowing to be construction and housing finance.