SBP: Addicted to micromanagement

The central bank does not believe that the fiscal authorities can manage the economy.

Alarm bells are ringing somewhere.

Panic at the disco

Kamran Khan who is known as “agencion ka aadmi” mentioned “sky tearing deficit” and “uncontrollable camel imports” in his latest tweet. (I think a literal translation better conveys the urgency of what Kamran Khan is trying to assert).

Yesterday, SBP issued revised prudential regulations for consumer financing, mainly personal loans and auto loans. As per the press release, the revised regulations

... will help to moderate demand growth in the economy, leading to slower import growth and thus supporting the balance-of-payments... Following changes have been made.

Maximum tenure of auto finance has been reduced from seven (7) to five (5) years;

Maximum tenure of personal loan has been reduced from five (5) to four (4) years

Maximum debt-burden ratio, allowed to a borrower, has been decreased from 50 to 40 percent;

Overall auto financing limits availed by one person from all banks/DFIs, in aggregate, will not exceed Rs3,000,000, at any point in time; and

Minimum down payment for auto financing has been increased from 15 percent to 30 percent.

SBP’s mission creep and politically motivated loosening of monetary and credit policies have been a matter of interest for me for a while now.

Mission Creep

The purpose of Prudential Regulations is to restrain commercial banks from over exposing themselves to leverage and endangering the entire financial sector to systemic risk. The share of car financing is 2% in the scheduled banks’ credit portfolio. It presents no systemic risk such that a revision in Prudential Regulations is required.

Nurturing man-child banks

Prudential Regulations should give broad rules, but SBP gets a high from breathing down the neck of commercial banks. Commercial banks have risk officers, risk committees, risk policies and I presume internal risk rating metrics. For loans that comprise measly 2% of their credit portfolio, with the qualified human resources and IT systems they have acquired, the commercial banks should be able to put in place appropriate processes, controls and risk assessment criteria. It appears SBP doesn’t trust the bank’s management and systems to be capable of managing a car financing portfolio. SBP is advising the bank the maximum tenure of such loans, the maximum financing exposure to a single borrower for such loans and the minimum down payment required.

This tweet said it perfectly

The problem with the SBP guidelines is that they are unduly restrictive, unduly detailed, and unduly prescriptive.

Once is a mistake, twice is a pattern

Tabadlab, a think tank based in Islamabad, published a paper on SBP’s regulations to finance under construction housing with the provocative title Central Bank as Real Estate Regulator: Can the SBP’s Latest Guidelines Help Meet the Housing Shortfall?

The paper made two remarks:

1. The reason is simple: the SBP cannot substitute for RERA. One of the benefits identified by SBP in its press release is strong monitoring and oversight of by the banks to facilitate timely completion of the projects. Though this is the end result in projects that will be financed by construction lenders, this is akin to introducing accountability in real estate (a RERA domain) through SBP guidelines. (emphasis mine)

2. The commercial banks’ risk departments are staffed with well qualified risk professionals and their board of directors comprise of internationally experienced professionals that also sit on the board risk committees. SBP should trust the banks’ risk departments and risk committees to develop robust assessment criteria in light of international best practices to manage construction financing. These kinds of conditions indicate a foundational lack of confidence in commercial banks. Only banks that lack the capacity and capability to assess the credit risk of construction projects would require such specific instructions. The counter factual here is obvious: if the SBP opts for such micro-management of processes, then perhaps there is merit to the commercial banks’ preference to invest in PIBs, instead of economy-driving, and consumer-serving products and services. (emphasis mine).

This is exactly what Motasim and Norbert have been referring to in their tweets. Had it been the first time, we could have said that SBP is revising Prudential Regulations due to exceptional circumstances. The above shows that it SBP has become addicted to micromanagement and mission creep.

SBP does not take kindly to such criticism. SBP issued a statement to the newspaper contesting the claims in the Tabadlab paper.

The State Bank of Pakistan has described as “factually incorrect and misleading” contents of a policy analysis paper formulated by an Islamabad-based research firm, Tabadlab, upon which Dawn’s report entitled “SBP package to benefit influential builders only: report” was based.

Referring to a key issue raised in the Tabadlab paper, the regulator said: “The objective of the SBP guidelines issued is not to micro manage the banks. On the contrary, these guidelines, prepared after detailed consultations with banks, provide an enabling framework that will help banks to venture into this new segment of financing. It is entirely up to the banks to decide which project(s) and builder(s) are credit worthy in accordance with their internal credit policies and due diligence.”

Fools in the shower

In case you don’t know what fools in the shower is referring to, this is how Investopedia describes

“Fool in the shower” is a metaphor attributed to Nobel laureate Milton Friedman, who likened a central bank that acted too forcefully to a fool in the shower. The notion is that changes or policies designed to alter the course of the economy should be done slowly, rather than all at once. This phrase describes a scenario where a central bank, such as the Federal Reserve, acts to stimulate or slow down an economy.

The expression is best summed up as the scenario when central banks or governments overreact to swings in the economic cycle and loosen monetary and fiscal policies too far and too fast, without waiting to gauge the impact of their initial actions. When the fool realizes that the water is too cold, they turn on the hot water. However, the hot water takes a while to arrive, so the fool simply turns the hot water up all the way, eventually scalding themself.

Earlier this week, SBP increased the policy rate by 25bps. As per SBP Monetary Policy Statement:

Following historic cuts in the policy rate and the introduction of SBP Covid-related support packages, private sector credit grew by more than 11 percent during FY21, on the back of consumer loans (mainly auto finance and personal loans) followed by a broad-based expansion in credit for fixed investment and finally working capital loans. The MPC felt that some macroprudential tightening of consumer finance may also be appropriate to moderate demand growth as part of the move toward gradually normalizing monetary conditions.

In the Treasury auction following the policy rate increase, the three-month treasury rate increased by 41bps.

This will translate into higher fiscal expense because of higher interest expense on GoP debt, forcing the GoP to reduce its expenses as a larger proportion will go towards paying interest expense, leaving less for GoP to spend on development. This effect will be visible in a few weeks. SBP just increased the policy rate earlier this week. It should allow the effects to play out before introducing new moves.

SBP mentioned the credit expansion due to “historic cut in policy rate” in the following sectors in its MPS in decreasing order of credit increase:

Car financing

Personal financing

Fixed term loans

Working capital loans

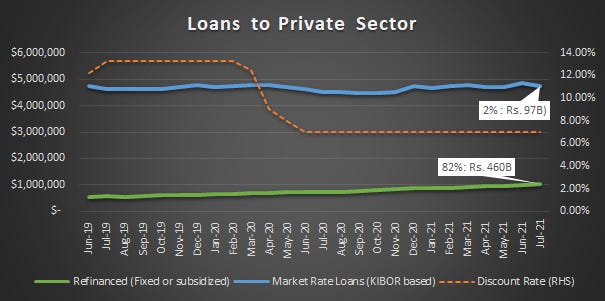

Regarding the last two categories, the below chart shows that real growth has been in subsidized or fixed-rate loans such as ERF or TERF. The growth “due to historic cut in policy rate” in the KIBOR linked loans isn’t visible in the last two categories.

SBP : State Bank of (overseas) Pakistanis

The revised Prudential Regulations do not apply to cars financed by overseas Pakistanis through Roshan Apni Car account. I had missed a trick, a week ago, by not including Roshan Apni Car in the below tweet.

For the benefits continued to be lavished on overseas Pakistanis by SBP for remitting dollars to Pakistan, SBP should be renamed.

SBP has even negotiated a priority delivery with car dealers and manufacturers for the overseas Pakistanis.

Resident pakistanis are children of a lesser god.

One theory states Roshan Apni Car is a brilliant product as it is akin to exporting cars. True. However, this theory assumes that 100% of dollars for purchase of car are remitted on Day 1, which is not the case. Minimum down payment is 15%, implying the rest of the dollars flow into the country over 5 to 7 years. Yet, the full payment of import of CKD or CBU is made in the first year. Hence, it isn’t helping minimize CAD as much as we think it is. We may argue over what percentage of the cost of the car comprises imported material and labor, but that is a discussion for another day.

Technocratic Overreach

Regarding authority vested in SBP under the SBP Amendment Act 2016 to offer refinancing facilities, I had earlier written:

It can take forever for the federal government or legislature to come up with such [fiscal stimulus] measures in times of crisis. The advantage of having such powers [powers to carry out quasi-fiscal activities] vested with central bank authorities is that it allows the central bank to respond quickly to the changing economic environment by creating money out of thin air. Plus, when the federal government does it, it leads to brouhaha about favoritism, corruption and adds to the budget deficit.

At the end of the day, it is for the legislature to decide if they want unelected technocrats at SBP to wield so much power.

It is ironic that on one hand, the Ministry of Finance and the Government is trying to increase consumption oriented growth by encouraging car purchases and personal loans, and on the other hand, SBP is retarding the government efforts by changing the Prudential Regulations.

The government had cut FED on all vehicles up to 3,000cc by 2.5pc while on vehicles from 660cc to 1,000cc the FED had been abolished. The GST had been cut to 12.5pc from 17pc for cars up to 1,000cc. For 1,001cc to 2,000cc vehicles, the FED was decreased to 2.5pc from 5pc and for 2,001cc to 5pc from 7.5pc. The government has also cut ACDs on all vehicles from 7 to 2pc and its notification has been issued on June 30, 2021.

In addition, GoP was about to launch Kamyab Pakistan Program (KPP) to disburse to low income groups and amout of Rs.1.6 trillion over next 5 years with Rs.315 billion distributed in first year. Approximately half of the KPP loans can be classified as personal loans, while the balance are housing loans.

In addition, there is Naya Pakistan Housing Program, wherein GoP has allocated Rs.30 billion for house price subsidies and another Rs.36 billion for interest rate subsidies. It is reinforced by SBP’s housing and construction financing mandate and the largest running amnesty.

At one end, the government is striving to blow wind into the sails of the nascent growth by cutting taxes on automobiles to boost sales, introducing historic and ambitious programs as KPP flooding the low-income households with personal loans, and pushing for mortgages and housing construction. At the other end, the unelected technocrats at SBP are dropping the anchor by making it harder to finance cars or take out personal loans.

This is a classic illustration of how technocrats undermine the authority of the elected representatives to make decisions. No denying that Pakistan is facing macroeconomic challenges, yet, the elected representatives, the appointed ministers and advisors, and the federal government, in general, are not deemed qualified by the central bank bureaucracy to take timely decisions to address these challenges.

A sensitive central bank

One should be mindful when criticizing SBP as it is very sensitive. One of the Dawn reports raised questions about the statistics as reported by SBP. SBP issued the following statement to the newspaper.

Apropos to the story ‘Making houses in the air’ published in your esteemed newspaper dated August 30, 2021. At the outset we would like to clarify that State Bank releases monthly data under the title of “Loans Classified by borrower” which includes financing provided by banks to the construction sector (including residential, non-residential and others). With respect to recent initiative of promoting housing and construction finance, State Bank of Pakistan has allocated targets to banks, under which they are required to increase their financing for the purpose of housing and construction gradually to 5 percent of their domestic private sector advances by December, 2021. The financing of banks for the purpose of construction covers information more comprehensively rather than remaining limited to financing for construction sector (builder and developer financing) only. (emphasis mine)

SBP releases information about housing and construction finance on quarterly basis. Hence, the assertion in the article that State Bank is cherry-picking numbers is factually incorrect and misleading.

What SBP is calling “covers information more comprehensively”, the fact is both SBP and commercial banks are colluding in reporting the wrong data as I had shown in my earlier post where the Rs.13.2 billion refinancing in June 2021 of existing and already completed Nishat Hotel and Shopping Mall was reported as construction financing by banks and SBP.

Another time, Khurram Husain tweeted an excerpt from my post, SBP gave him a call which he threaded as follows:

You can read the whole saga and much more in the below post.

If you liked this post, please share it with your near and dear ones. You can also leave the comments below. You don’t have to subtweet.