SBP and Hot Money #3: Is there a method to SBP’s madness?

To satisfy its addiction to prize ceremonies with the PM, SBP is exposing the country to fx risk

We should be getting ready for MPC but I came across the January 19, 2022 presentation (attached at the end of post) of SBP on RDA so I had to quicklyturn this post out. SBP is providing too much content for me to keep up.

This post and yesterday’s were written on the iPhone so I apologize for the typos, punctuation and grammatical mistakes.

Hot money masquerading as Roshan Digital Account

I wrote the first two posts on the topic where I shared the term sheets showing that SAMBA is offering 10x leverage and UBL/HBL are offering 3x leverage.

The table below shows the absolute distribution of returns on the SAMBA scheme. SAMBA is providing 10x leverage and making 3.29 times the return earned by overseas Pakistani.

Below is a table that shows how much the absolute returns are being made on the scheme. SAMBA is providing 10x leverage and making 3.29 times the return earned by overseas Pakistani.

The last column indicates that when GoP pays out interest expense of $715,000, only $150,000 goes to overseas Pakistanis. The rest of the amount (less WHT) is going to the SAMBA. SAMBA is getting almost 70% of the return that GoP is paying.

I had written at the time that these flows are hot money and aren’t exactly low risk.

This is not a low-risk debt for GoP

The assumption of SBP, GoP, and the financial press may be that this investment is permanent financing as they may be hoping that eventually, overseas Pakistan will convert this into rupees at a slightly higher interbank rate. That will be a huge mistake.

In the SAMBA term sheet, 91% of the investment ($1,000,000 out of $1,100,000) is debt and will have to be repaid. There is no way that SAMBA UAE will be converting its loan of $1,000,000 into Rupees.

GoP/SBP should clearly show these investments as short-term debt in the books. When GoP issues T-bills, PIBs, or Eurobonds, it raises funds for a fixed tenor. If an investor sells the instrument in the secondary market, the payment to the investor is being made by the buyer of the instrument and not GoP. In the case of NPCs, these are encashable at any time i.e., GoP will have to repay them on demand.

Does SBP not remember the 13.25% discount rate fiasco where most likely GoP ended up paying 13.25% or much more in dollar terms despite the 13.25% being a return in rupees? When free flows are encouraged in capital account, and that too by Governor of the central bank, that is what ends up happening. After that, I thought SBP had learnt the lesson and it’s the overseas branches offering leverage at own initiative. I would have found it SCANDALOUS if SBP was actively encouraging the leverage flows as it would mean that not only GoP is paying higher returns in absolute terms to overseas banks (not overseas Pakistanis) but SBP is AGAIN actively courting hot money. I sincerely believed that SBP couldn’t be this inane.

I have never been this wrong. Is SBP out of its mind?

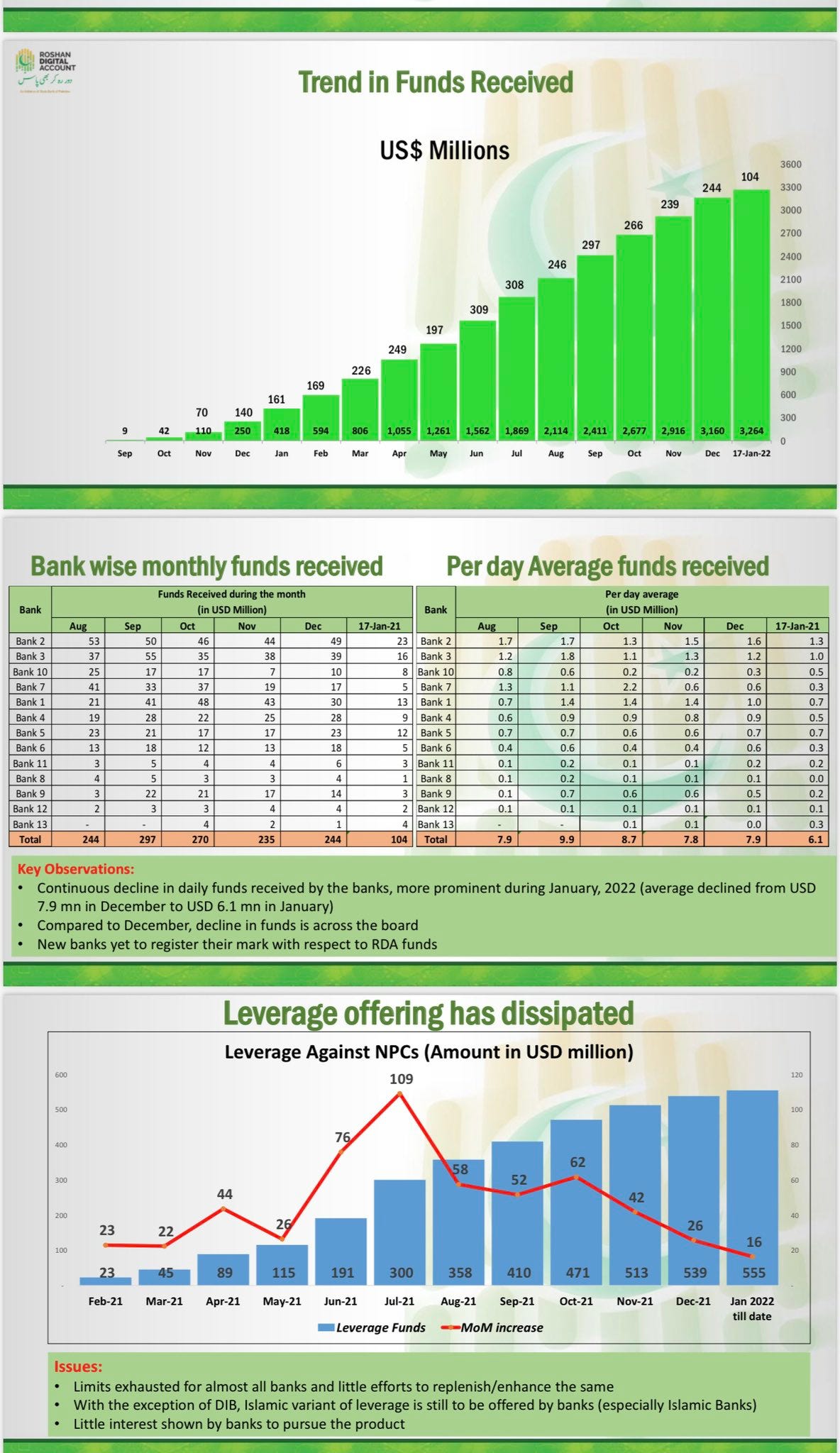

Inflows into Roshan Digital Account (RDA) are slowing. On January 19, 2022, SBP held a meeting with CEOs of the banks and it turns out that SBP is not only aware of the leverage but is DESPERATE to encourage more. The SBP’s presentation says,

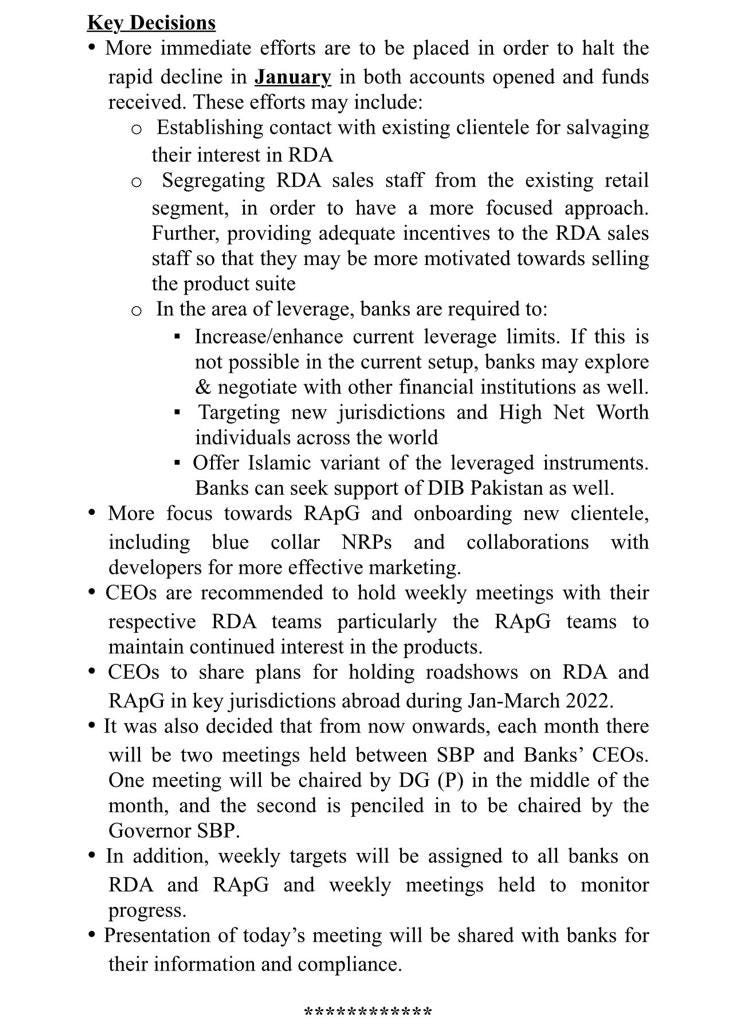

In the area of leverage, the banks are required to

Increase/enhance current leverage limits. If this isn’t possible in the current setup, banks may explore and negotiate with other financial institutions as well.

Targeting new jurisdictions and High Net Worth Individuals across the world

Offer Islamic variant of the leveraged instrument. Banks can seek support of DIB Pakistan as well.

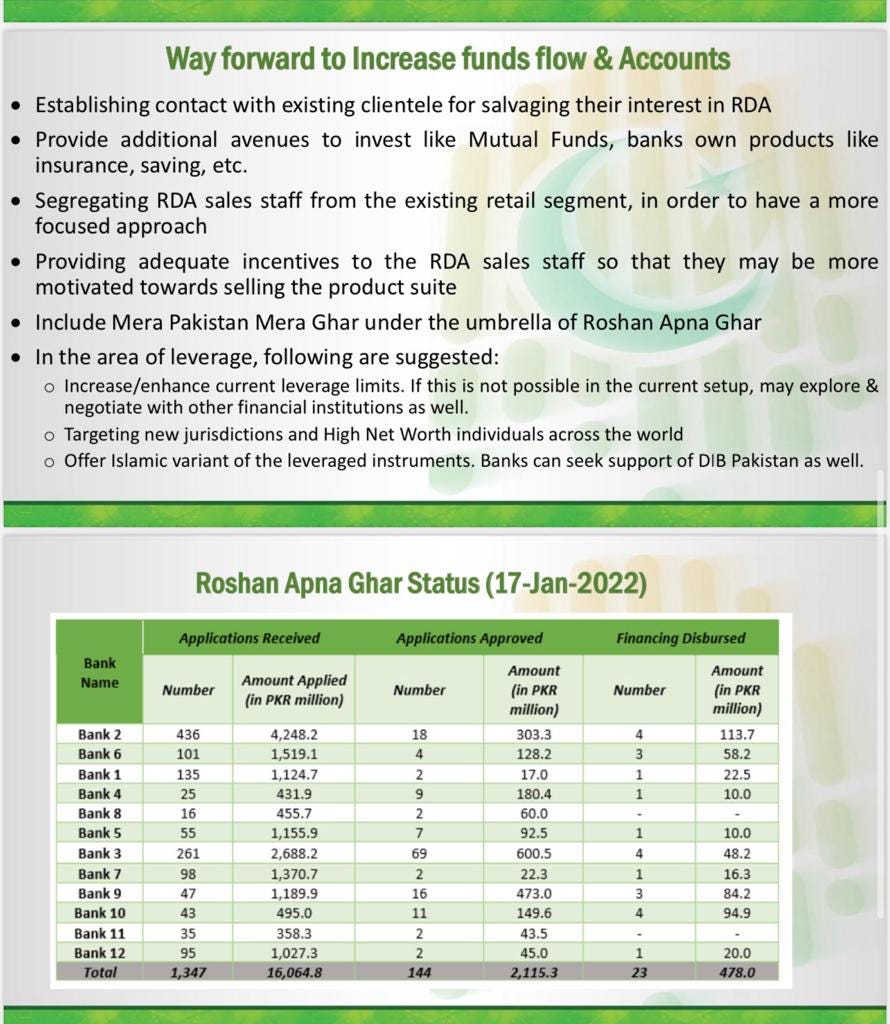

I am speechless. SBP is requesting the banks increase the “hot moneyness” of the RDA inflows.

Overseas branches of Pakistani banks are usually short of dollar deposits. There is a limit around how much leverage they can provide. SBP is recommending them to borrow dollars in interbank market from other banks (most likely this borrowing will be short term) and then use it to fund relatively long term deposits in NPC. Two frigging things are happening here:

The return GoP pays on RDA is shared between overseas Pakistanis (OPs) and the overseas bank with major share in absolute terms going to overseas bank. Since these are overseas branches of Pakistani banks, I was ok that at excess profit is going to Pakistani institution. But now SBP is asking them to borrow from interbank market, thus the excessively high profit paid by GoP on RDA NPC will be shared amongst three players: overseas Pakistani, overseas branch of a Pakistani bank and now the local/international bank that is lending money. SBP is carrying out a charade under RDA NPC where it gives us the impression that RDAs are providing lucrative return to valuable overseas Pakistanis but in reality, SBP is making GoP borrow expensively from anyone as long as an overseas Pakistani is the frontman.

There is a limit to how much overseas branches of Pakistani banks can borrow in the interbank market and usually such borrowing is for short term: Overnight to a week and, in a few cases, a month or 3 months. SBP wants the overseas branches of Pakistani banks to commit the “original sin” of banking ie borrow in the short term money market to lend to GoP for 3M to a year. Short term liabilities internationally financing relatively longer term assets in Pakistan. I am amazed that SBP would recommend such a strategy.

I also like the last bullet point about DIB. Once I worked with one of the conventional Middle Eastern banks. They asked me how sharia compliant you want this transaction to be. When I didn’t get it, they explained “there is a spectrum of sharia compliance. Some banks are strict while others don’t care about the underlying as long as a fatwa can be arranged. We call such banks “sharia lite” (an allusion to Coke Lite) and DIB is the epitome of Sharia Lite.” Though sharia compliant version of NPC exists (which is essentially a debt product), leveraging it further would raise eyebrows at sharia boards of other Islamic banks. Hence, SBP is suggesting such conservative Islamic banks/boards to take the lead or inspiration from DIB. Frankly speaking, a product that multiplies leverage on a sharia compliant RDA NPC will be no better than a lipstick on a pig when it comes to sharia compliance.

One trick pony

There was a time that I used to call the incumbent SBP Governor a one trick pony as the only lesson he brought from his earlier stint in Egypt was to solve every BOP problem by bringing in hot money. But after Covid-19, when he brought the rate down and introduced TERF, RFCC, Rozgar scheme etc., I dropped the moniker. Also, it was inappropriate so I apologize to him if he was offended by it.

However, what the hell?

CEOs are recommended to hold weekly meetings with their RDA teams…to maintain continued support in the product.

CEOs to share plans for holding roadshows on RDA …. in key jurisdictions abroad during Jan-Mar 2022

It was also decided that from now onwards, each month there will be two meetings held between SBP and Bank CEOs. One meeting will be chaired by Deputy Governor (Policy) in the middle of the month, and the second is penciled in to be chaired by SBP Governor

In addition, weekly targets to be assigned to banks for RDA… and weekly meetings held to monitor progress.

Banks’ CEOs must have much time on their hands if they are going to have regular meetings with their RDA teams, then plan and hold roadshows on RDA and share the schedule with SBP, and finally meet with SBP twice a month, once with Deputy Governor and once with Governor?

All this for RDA accounts which are mainly expected to comprise hot money.

Maturity Schedule

Now that we know SBP has all the data, SBP should share with us the following so that we know how much risk is SBP exposing GoP to with this focus on RDAs

Maturity profile of the RDA

Maturity date of RDA deposits and the volume

Leverage level across the RDA deposits

Amethod to this madness: What is the end game? These leveraged flows will eventually reverse. How does SBP intend to manage that?

To summarize

SBP is aggressively courting hot money in RDAs and doesn’t care if the funds are leveraged.

SBP is pushing the overseas branches of banks to borrow from interbank market (most likely on short term basis) to offer higher leverage to overseas Pakistanis to invest in relatively longer term RDAs.

SBP is asking Islamic banks to take lead from DIB to offer higher leverage on Islamic products which may fall foul of sharia boards of those banks.

SBP is pushing CEOs of banks to unjustifiably spend higher time and resources on RDA.

SBP Governor has gotten addicted to holding prize ceremonies with the PM. The slowdown in RDA inflows is forcing him to take desperate measures.

The Presentation and meeting minutes

My thanks to the people who shared the presentation and minutes with me.