Naya Pakistan Certificates as Hot Money: Part Deux

Leveraged funds in Naya Pakistan Certificates means that a major share of profit flows to banks (not Pakistanis) and funds will have to be repatriated at maturity.

This is an update to my earlier post which you can read at Are Naya Pakistan Certificates camouflaging hot money?

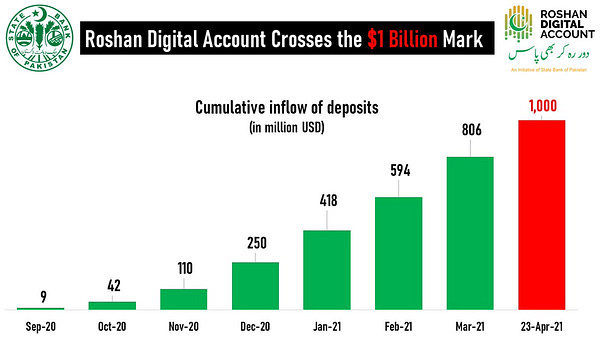

The funds in Naya Pakistan Certificates (NPCs) through Roshan Digital Accounts (RDAs) have crossed the $1 billion mark. The perception from the government and SBP is that it is all savings of non-resident Pakistanis (NRPs).

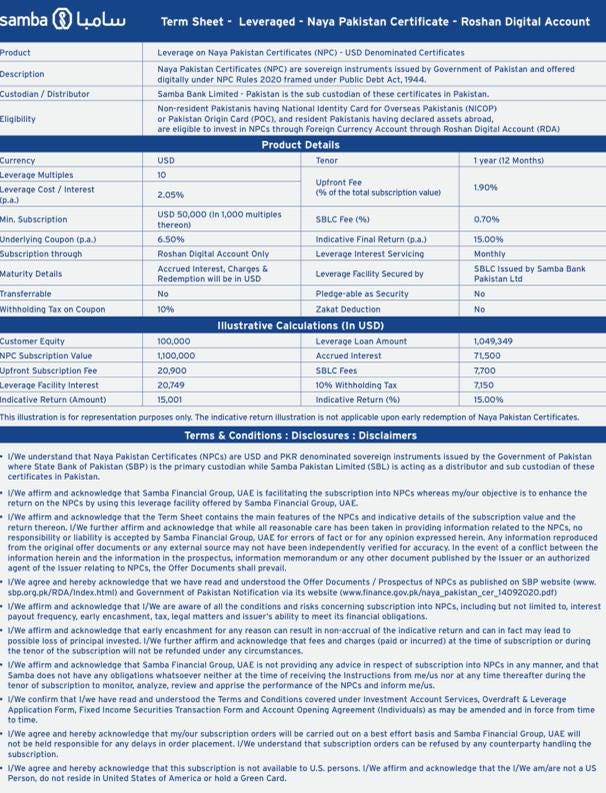

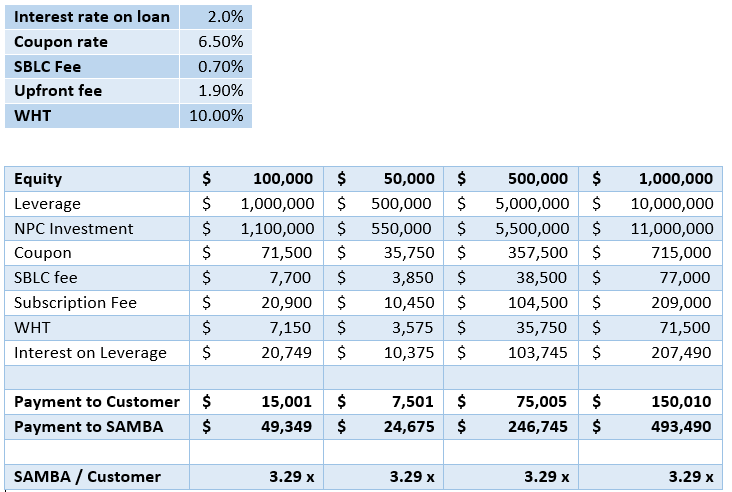

In my earlier post, I had covered that a portion of these funds is leveraged funds with SAMBA providing the extreme case of offering 10x leverage against the savings enabling the NRPs to earn up to 15% income on an NPC that offers 6.5% while at the same time SAMBA is earning a return that is more than 3x of NRPs. This income to SAMBA is coming out of GoP i.e. Pakistan based taxpayers.

If all the $1 billion RDA funds came through SAMBA, then the actual investment by NRPs is $100 million with the remaining provided by SAMBA as leverage. If anyone would’ve deserved an award for the large increase in NPCs, it would have been SAMBA for providing this 10x leverage. But this is just a hypothetical example.

I had hypothesized in my post that SAMBA can do this as it has access to access to dollar deposits in UAE and Saudi Arabia. Pakistani banks in GCC are always hungry for dollar deposits and may not be able to offer leverage.

I had spoken (or written) too soon. HBL and other Pakistani banks are also offering such leveraged products.

I like the fact that HBL Asset Management thought to educate its customer on the definition of leverage.

The process is similar to what we had discussed for SAMBA. Digressing a bit, I derived pleasure from the fact that instead of “lien marked”, the slide says “lean marked”. Probably the person making the slide typed it as someone dictated it to him or her. The slide deck is 10 pages long. This would have gone out to HNWIs (High Net Worth Individuals) in Pakistan and GCC. Did no one in the entire hierarchy of HBL notice or cared enough to get it corrected?

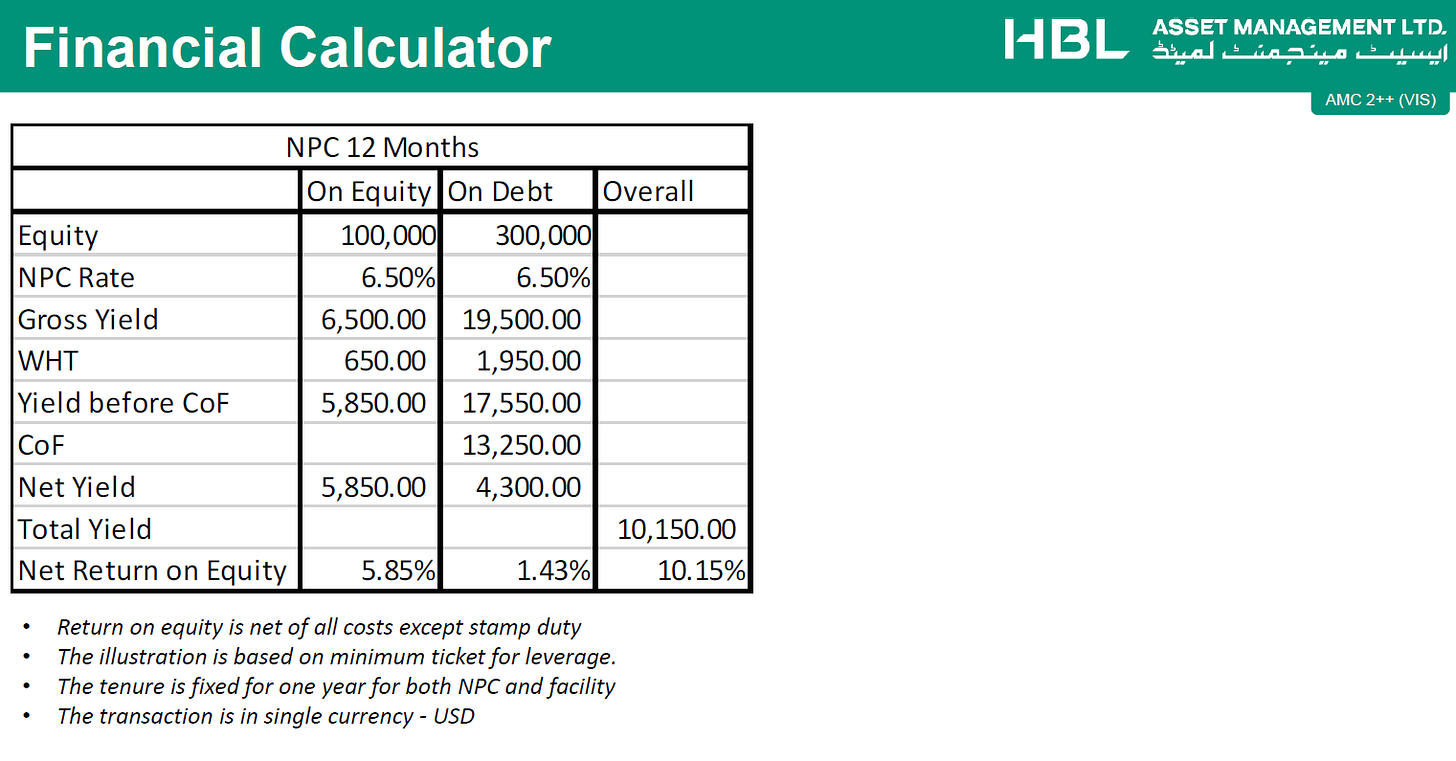

However, no one is as extreme as SAMBA i.e. offering 10x leverage. Pakistani banks in the Middle East are offering leverage of 3 - 4x of equity investment. On a similar note as above, even tables in my quickly turned out blog posts are prettier than the one below going out to HNWIs.

If a foreign bank like SAMBA can trust GoP with 10x leverage, there is no reason that Pakistani banks should do anything less. One reason for low leverage by Pakistani banks could be the low deposit base. Alternatively, Pakistani banks can borrow in the interbank market. With a small asset base, there will be a limit to how much Pakistani banks can borrow. On the high side, a Pakistani bank can borrow at LIBOR+2% for 1 year in the UAE interbank market.

Out of the profit paid by GoP on NPCs, less than 50% is going to the NRP as more than half is being recovered by HBL as cost of fund (and shared with UAE banks).

It is not as if SBP isn’t aware of this. SAMBA Pakistan as well as other Pakistani banks are issuing SBLCs (Standby Letter of Credits) to their Middle East branches to secure the leverage. SBP will be regularly receiving updates from the banks on the magnitude of SBLCs issued to secure this loan. I am not dissing on the product either. If GoP believes that this is a cheap way to raise a 1-year loan, then go for it. However, the perception here is that it is patient capital which it isn’t as SAMBA as well as other Middle East-based Pakistani banks will be requesting the leverage back at maturity or when there is another international crisis. These deposits will not be converted to rupees at above-market rates. Depending on the level of leverage the payment isn’t all going to NRPs either. In SAMBA’s case, SAMBA is getting 75% of the payment made on the NPC. GoP may be able to raise cheaper funding by going directly to foreign banks, maybe.