Q1 2023 performance of Pakistan's Two Hedge Funds: U Microfinance Bank (UBank) and Pak Kuwait Investment Company (PKIC)

Picking up "do paisay" in front of steamroller.

The business model of hedge funds is referred to as “picking up pennies in front of a steam roller” as their strategies make money by earning a small premium but run the risk of exorbitant loss in case a negative event occurs. The loss is a consequence of hedge funds taking large and extremely leveraged positions.

I had written about UBank and PKIC in The Profit earlier.

I also covered similar ground in a substack about PKIC later.

Pak Kuwait Investment Company and State Bank of Pakistan: Backdoor lending to Government of Pakistan

What SBP calls “liquidity management” is just another backdoor for SBP to lend to the Government of Pakistan.

The first quarter results of both entities are now available. Let’s look at the state-owned hedge fund PKIC first (technically PKIC is a JV between the Government of Pakistan and the Government of Kuwait).

On account of the huge positions PKIC has taken in GoP bills and bonds, the interest earned increased by more than 10 times (i.e., 1107%) between Q12023 and Q2022. Yet the net interest income only increased by 19%.

While they were making an 18% margin on their positions in 1Q 2022, the margin has reduced to 2% (i.e., making 2 paisay on every 1 rupee loan) in 1Q 2023. Literally, picking up pennies.

This shows the riskiness of their positions. If the circumstances turn adverse, it can easily wipe out that 2% income and turn it into a loss.

They also recorded a Rs.387MM surplus on the revaluation of Government Securities. If we account for the revaluation gain inthe interest income (pass it through P&L), the net interest margin comes to around 3% (3 paisay).

At the end of 2021, the net asset ratio (net assets / total assets) of PKIC was 31% which has now (15 months later) fallen to 5%. The total assets have increased 6x during this period almost all funded by leverage.

While in absolute terms, this growth has resulted in net income growth of 69%, the Return on Asset has gone down to 1.6% (not even earning 2 paisay on the assets) from 6.4%.

Let’s look at the other hedge fund. They still have their microfinance business so they are doing significantly better in terms of net interest margin. The Net Interest Margin has halved but it is still at a healthy 22%.

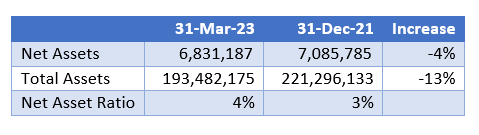

Their balance sheet size has shrunk, from Rs.221M on 31 Dec 2022 to Rs.193 million on 31 March 2023, mainly due to a reduction in the size of investments. It appears UBank is moving away from the hedge fund model.

While the Net Asset Ratio improved, what’s surprising here is that the Net Assets reduced by 4%.

This was mainly due to losses on revaluation.

Most likely it would be on account of the revaluation of government securities. UBank has reclassified the securities from fair value through profit and loss (FVTPL) to fair value through other comprehensive income (FVOCI).

Under IFRS 9, a reclassification is to be justified by a change in the business model for that financial instrument. I wonder what changed between Dec 31, 2022, and March 31, 2023, requiring this reclassification.

If this reclassification wasn’t carried out, the revaluation loss would have passed through P&L, and UBanks 1Q2023 net income would have been less than 1Q2022.

The return on assets of UBank improved from 0.6% in 1Q2022 to 0.7% in 1Q2023 compared to the same period last year. I will be a little unfair here and will assume that all the revaluation loss would have passed through P&L. Unsurprisingly, the ROA decreases to 0.4%.

It would be interesting to see how the financial position of these two hedge funds evolve at the end of 2H 2023. They seem to have landed on a magic formula that allows them to take highly levered positions in Government securities and so far their bet appears to be paying off. Will PKIC continue to double down on picking up the pennies and UBank continue to move away from this model?