Crowding out theory and Meezan Bank

Neither do the commercial banks want to lend to the private sector nor does the private sector want to borrow.

In Pakistan, we talk a lot about credit to the government sector crowding out the credit to the private sector. Below is the result of googling "crowding out" on the Business Recorder website. All of these articles were written within a year of today. And this is just the first page. I didn't look further, but I am confident there would be pages and pages of similar articles over the years1.

‘Crowding out’ assumes that there is a fixed pot of money, and if some portion of it is allocated to the government sector, then there is less available for lending to the private sector. Usually an area graph is shared when proposing such a theory, it gives an impression that credit to the government sector is pushing out the private sector.

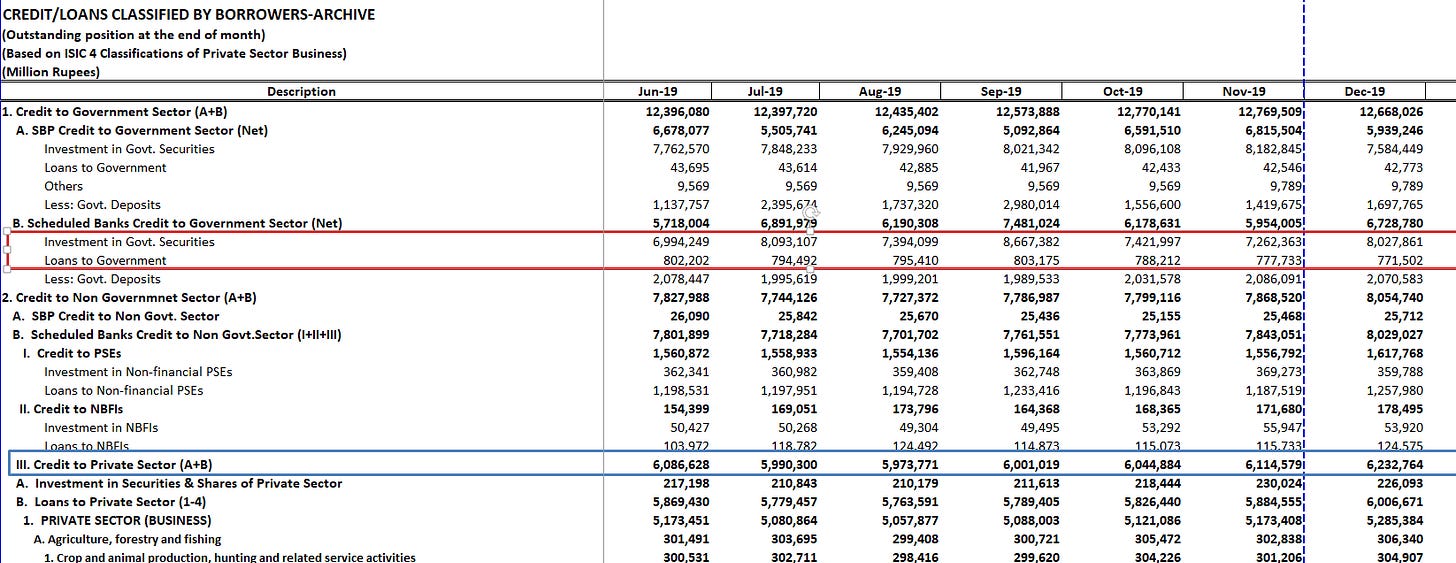

Let's look at the raw data. We have learned from SBP's shenanigans in manipulating statistics that it matters what is being measured. For lending to the government, we will use the data in the red row (sum of 'Investment in Government Securities' and 'Loans to Government'), and for credit to the private sector, we will use the data in the blue row (‘Credit to Private Sector’).

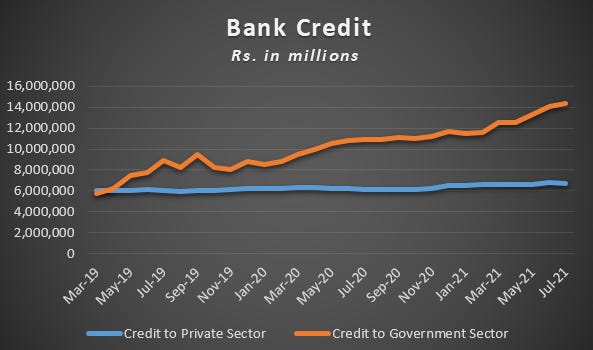

Graphing the above data, we don’t get the impression that the government is crowding out the private sector.

Before March 2012, private sector borrowing was leading the government borrowing. Afterwards, government borrowing increased rapidly till December 2017 when there was significant volatility to the extent that government borrowing for a brief moment fell below private-sector borrowing in March 2019. Thereafter, government borrowing again increases rapidly.

Looking at the components of credit to the government sector, the volatility is mainly due to investment in government securities.

On the other hand, private sector borrowing was not at all affected by government borrowing. It was either stable or was rising gradually, regardless of government borrowing.

Below we break out private sector borrowing for the last 5 years on a 12-month basis i.e. Jan - Dec. In 2016, 2017 and 2018 when credit to the government was increasing, credit to the private sector was also increasing by double digits (the percentage in the callouts are increase in credit for that year between Jan to Dec). In 2019 the increase in private sector credit was only 4%. 2020 was COVID year, so we will disregard it.

The below table shows government and private sector borrowing from March 2019 onwards. If the government sector was crowding out the private sector, the credit to the private sector would decrease to compensate for the rapid rise in credit to the government sector, similar to the area graph at the beginning of this post.

We could test the crowding-out hypothesis if there was a bank that didn't invest in government securities. Fortunately for us, Meezan Bank is such a bank. It can't invest in government securities due to sharia compliance. Comparing Meezan Bank's balance sheet with conventional banks’ balance sheet can tell us if government borrowing is crowding out the private sector. (Click on the image if it appears too small.)

I am using HBL, UBL, Bank Al Habib (BAH) and Habib Metro (HMB) for comparison, i.e. two large banks and two medium-sized banks.

The vertical analysis in the lower table shows that while the conventional banks have 50-60% of their total assets in Investments (primarily government securities), Meezan Bank has only 28% of its assets in Investments as it can’t find sufficient sharia-compliant government securities to invest in.

When we look at the next line i.e. Advances, conventional banks have around 30%+ of their total assets in Advances i.e private sector credit. For conventional banks, we can hypothesize that 60% of government borrowing is crowding out the private sector. But the hypothesis fails when we look at Meezan Bank's balance sheet. Meezan Bank also has 30%+ of its assets in private sector Advances when clearly no crowding out is taking place at Meezan Bank.

If we look at the first three line items, which I have summed up as Subtotal Liquid Assets as the returns on these assets is de minimis compared to Advances and Investments, we see that conventional banks have around 10% of their assets in cash, and Meezan Bank has 30% of its assets in cash. Despite the fact that government borrowing isn't sucking up liquidity at Meezan Bank, Meezan Bank would rather prefer to keep the money idle in liquid assets rather than lend it to the private sector. The quantum of funds in liquid assets at Meezan Bank is half a trillion rupees, almost equivalent to the balance held by HBL which is almost three times the size of Meezan Bank in asset size.

On an unrelated note, UBL should get out of banking business and become a mutual fund (fixed income or money market) if 75% of its assets comprise investments and liquid assets.

If it is not crowding out, then what is preventing private sector credit from growing. I have a few hypotheses.

Commercial banks will lend only to their existing clients, whether for existing projects or for new projects. Though commercial banks would do the cash flow analysis and credit structuring to check all the boxes (file ka pait bharnay ke liay), however, what they are really doing is name lending. Unfortunately, their existing clients aren’t requesting new borrowings.

The existing blue-chip borrowers that commercial banks are willing to lend to don’t find the investment climate conducive, either due to economic and political uncertainties or the fact they have gotten used to rent-seeking and will only invest when there are subsidies or guarantees from the government.

The cost of debt (discount rate, KIBOR, etc.) is too high, and the blue-chip borrowers will only borrow when they get cheap refinancing from SBP such as Export Refinance or TERF.

On a lighter note,

Meezan Bank ko Deewar say lagaya ja raha hai

[September 2020:] Their longstanding demand that there be a robust and liquid Islamic debt market has finally received due attention from the PTI government. It decided to roll out sukuk, or Islamic bonds, of Rs600 billion in three tranches of Rs200bn each to raise liquidity for reducing the circular debt in the power sector.

Two of the three issues have taken place so far, but Islamic banks are not happy. In fact, they are furious.

“What we want are government-guaranteed sukuk whose yield is equivalent to that of PIBs. But every time there is a sukuk issue, the government ends up raising money at a cheaper rate,” said Irfan Siddiqui, CEO of Meezan Bank, Pakistan’s largest and most profitable Islamic bank.

It was the first time the government managed to raise liquidity at a rate below Kibor. This means the government will save Rs1.8bn on its debt repayment every year until the instrument’s maturity a decade later.

“Two days ago, the finance adviser said at a ceremony the government would save Rs18bn in 10 years. I always tell the government: don’t save money by pushing us up against the wall. Give us an instrument that is comparable to conventional instruments,” he told _Dawn_ in a recent interview.

“The only benefit to us was that we got to invest money that was otherwise lying idle,” he said, adding that the bank sometimes has up to Rs30bn parked with the central bank for months because it does not have Shariah-compliant investment avenues.

Yes, I know the joke that the best place to hide a dead body is page 2 of Google results.