Construction Financing and Goodhart's Law : Part Deux

It would be a shame if the banks don't achieve the construction and housing finance target.

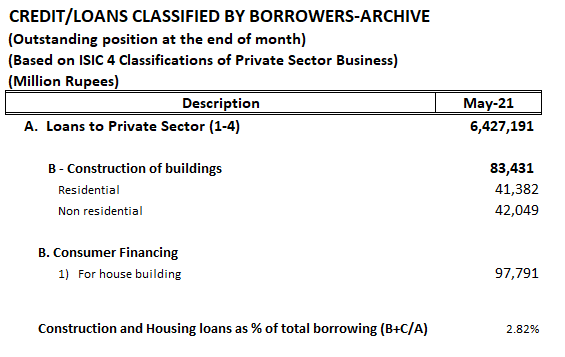

BR published this chart a few days ago about construction lending.

The SBP has set a target for banks to achieve 5 percent construction and housing finance as a share of total private sector loans by Dec-21.

When I look at the chart above, the target set by SBP doesn’t appear ambitious at all. Construction and mortgage financing in November 2018 already hovering around 5% of the private sector loans. Will SBP declare victory in front of the PM that the mandate has helped achieve the target when the increase will be only marginally over what was achieved in November 2018?

I had covered in an earlier post that though there is growth in the construction financing numbers, SBP along with PBA is committing chart crime for the sake of brownie points and misleading us into believing that the growth is faster than it actually is.

I also claimed that the comparison isn’t apples to apples.

Looking closely at the numbers, it appears that SBP and PBA are over-reporting the numbers by Rs.17 to 22 billion for the last three quarters. Are SBP and PBA fudging the numbers?

There are only two justifications for the difference:

Either a new segment has been included in 2021 which didn't exist till the end of Q4-2020 which makes the comparison not apples-to-apples

or

SBP and PBA are adding arbitrary numbers (fudging) to make their performance appear slightly better than it is.

What is included in the calculation? Let's see how close is the SBP data to the mandated target. I use the numbers in the SBP tables, i.e., un-fudged data. The growth is not at the pace that it will help achieve the 5% mandated target any time soon.

Let's calculate how much incremental loans need to be made to meet the target. Whatever the number we add to the numerator, we will have to add an equivalent amount to the denominator, as the numerator is a subset of the denominator.

Using the data for May 2021 and assuming that all other private sector borrowings remain the same, loans to the targeted sectors need to increase by Rs.147 billion to meet the target of 5%. The existing borrowing of these sectors is Rs.181 billion. Thus, borrowings have to increase by 80%. This assumes that borrowing by other sectors remains the same.

If we are embarking on a consumer financed growth, there is a likelihood that overall private sector borrowing (the denominator) will increase. This implies that the numerator may actually have to increase by 100% or more to achieve the mandated target.

That seems like a big task. Or is it?

What does the numerator comprise?

Construction comprises both residential and non-residential. It may be hard to increase loans for residential construction. The same may not be true for non-residential construction on account of TERF and RFCC.

SBP has approved Rs.435 billion under TERF and Rs.15 billion under RFCC i.e. a total of Rs.450 billion. Borrowers may require a sizable amount, which can easily run into hundreds of billions of rupees, for constructing the hospital or constructing factories and plants to install the imported machinery. This construction when added to the numerator may make the mandated target easily achievable.

From the history of the mandate, we know that it was initially announced by Asad Umar in March 2019 when he was finance minister. The purpose was to encourage mortgages and residential construction. However, by the time SBP released the mandate circular in July 2020, Asad Umar was long gone and populist Reza Baqir was heading SBP. As per the circular, non-residential construction was to be counted towards the mandatory targets.

Mandatory Targets for Housing and Construction Finance

1. With a view to promote housing and construction of buildings (Residential and Non-Residential) in Pakistan, State Bank of Pakistan (SBP) has decided to advise mandatory targets to the banks. Accordingly, each bank shall ensure that the financing for housing and construction of buildings (Residential and Non-Residential) shall be at least 5 percent of their domestic private sector credit by December, 2021.

With TERF, RFCC, and financing of other non-residential construction are financed, SBP can declare the target has been achieved its objective without a significant increase in house financing whether residential construction or mortgages.

On April Fool’s day 2021, SBP released the following circular

Mandatory Targets for Housing and Construction Finance

Please refer to IH&SMEFD Circular No. 10 of July 15, 2020 whereby banks and DFIs were advised to achieve mandatory financing targets for housing and construction of buildings (Residential and Non-Residential) equivalent to at least 5 percent of their domestic private sector advances by December 31, 2021.

2. In order to increase funding for housing and construction through capital markets and microfinance banks (MFBs), State Bank has decided to allow counting of following exposures of banks/DFIs towards achievement of their housing & construction finance mandatory targets:

a. Direct financing to/or investments in bonds/TFCs/Sukuk issued by Real Estate Investment Trusts (REITs) Management Companies.

b. Investments in units/shares issued by Real Estate Investment Trusts (REITs) subject to compliance with all other applicable regulations.

c. Investment in Sukuk/bonds issued by Pakistan Mortgage Refinance Company (PMRC), however, investment in PMRC’s Sukuk/bonds and amount of refinancing availed from PMRC shall be netted off towards counting the mandatory target.

3. However, the above exposures will be considered on aggregate basis up-to a maximum of 15% of mandatory targets for housing and construction finance of a bank/ DFI on a given date.

In my earlier post, I presented the following hypothetical scenarios to show that the above SBP circular is an example of Goodhart’s law, i.e. it can be used to achieve construction finance target without delivering much.

1. The REIT can issue shares or bonds to acquire existing buildings. The purpose of the mandate is to encourage construction but if a bank acquires shares/bonds that are issued to acquire an already constructed building, this will be counted towards meeting 5% of mandatory construction targets.

2. REITs are in the rental business. The rental yield on residential properties is nominal around 4% in Karachi. There will not be many investors for such low-yielding REIT shares. It is highly likely that REITs launched, if any, will be focused on commercial or office space. The mandate is for both residential and non-residential. However, only non-residential will get built or bought. Not the end of the world but also not going towards the objective of the mandate.

3. Investment in PMRC Sukuk/bond has the potential to be double-counted. Say Bank Al Falah (BAFL) writes Rs.1 billion of mortgages. These mortgages will be counted towards the 5% target. Now Bank Al Falah gets these mortgages refinanced by PMRC which issues a bond to finance the refinance. Assume Habib Bank Limited (HBL) buys that Sukuk. Now for measuring the mandate, SBP will count both BAFL’s mortgages and HBL’s investment in PMRC Sukuk to measure performance towards meeting the mandatory targets. A case of double counting.

4. The circular says that exposure will be netted-off (i.e. counted once) if it is the same bank getting its mortgages refinanced from PMRC and then investing in PMRC bond. But as this whole post has shown, when push comes to shove, SBP isn’t above counting/not counting stuff to achieve its targets.

5. Ali Jameel of TPL is a close friend of Abdul Hafeez Shaikh and is on the board of SBP. He had bought Katrak Mansion for a large sum and is about to spend a good chunk of change on renovating it. It is assumed that he will launch a REIT to finance/refinance it. This is pure speculation: a reason that SBP is issuing this circular to make it easy for him to launch that REIT.

And I just thought up the following:

6. Even if an existing REIT does not engage in any acquisition or development, yet the bank acquires some outstanding shares or Sukuk/TFCs of the REIT, this will also be counted towards meeting the construction and housing finance mandate. Ridiculous!

On June 2, 2021, SBP issued another circular.

Basel Capital Adequacy Framework: Investment in Real Estate Investment Trusts (REITs)

Please refer to Chapter 4 “Investment in the Units of Mutual Fund/ Collective Investment Scheme” of BPRD Circular No. 6 of August 15, 2013 regarding instruction for Basel III implementation in Pakistan.

2. In this regard, based on the representation of REIT Management Companies and to facilitate the development of Housing Finance as well as Capital Market in the country, capital adequacy treatment for banks/ DFIs’ (banks) investment in Real Estate Investment Trusts (REITs) has been revised as under:

a. Considering the nature of underlying exposure of REITs, banks’ investment therein shall be categorized in the “Banking Book” instead of “Trading Book”.

b. Banks’ investment in REITs will attract a uniform risk weight of 100%. However, SBP may review this revised treatment after a period of five years based on the banks’ exposure and performance of REITs sector."

REIT shares are sensitive to interest rates on account of high leverage. The latest budget exercise has made it clear that GoP is aggressively targeting consumption-financed growth. There is a possibility that this will lead to an increase in interest rates rising in the near future. This will put downward pressure on REIT share prices. In addition, shares listed on PSX can exhibit volatility for unknown reasons. Investments in listed instruments such as REIT shares are usually categorized in "Trading Book" and are to be marked-to-market (MTM) on daily/weekly/monthly basis. Due to the volatility and interest rate sensitivity, banks may not be too keen on investing in REIT shares, even if it allows them to meet the construction target as per April 1, 2021 circular, because MTM may make their profitability unpredictable. With this latest circular, SBP is removing this objection. Investment in REITs is now to be categorized in "Banking Book" and hence MTM not required. They will be held on the books of the banks at book cost. It is amazing that how far SBP is willing to bend to help the banks achieve the 5% mandatory target.

If that is not enough, SBP has also reduced the risk weight from 200%] to 100%. As per the SBP press release accompanying the circular. (Emphasis in bold - mine)

With the aforesaid changes in capital adequacy regulations, banks/DFIs will now be able to increase their investments in REITs without the need to allocate relatively large amount of capital. This will, in turn help banks to promote development of real estate sector in the country. The enhanced participation of financial institutions, backed by regulatory initiatives, would also encourage REIT Management Companies to launch new REITs, providing further boost to the Government’s agenda for development of housing and construction sectors.

It may not be out of place to mention that SBP has been taking a number of regulatory steps to enhance banks/DFIs’ participation in such sectors through their financing and investment activities, In line with Government of Pakistan’s various initiatives for the development of housing and construction sector. Earlier, SBP amended certain provisions of its existing Prudential Regulations for Corporate & Commercial Banking to encourage enhanced participation and investment of banks/DFIs in the REITs that enabled banks/DFIs to make higher investments in REITs to the tune of 15% of their equity as against the previous limit of 10%. Moreover, SBP has allowed the banks to count their investments in shares/units/bonds/TFCs/Sukuks issued by REIT Management Companies towards achievement of their mandatory targets for housing and construction finance. The amendments in SBP’s capital adequacy regulations will further incentivize banks to contribute towards a well-functioning capital market for real estate sector.

I have already covered in earlier posts that GoP is financing subsidies on mortgages. In addition, we have the longest-running state-sanction money-laundering scheme aka construction amnesty to enhance construction activities. SBP has given every relaxation that is possible to the banks to help them achieve the target. Ok... not every relaxation. SBP still has one more card up its sleeve. SBP can launch a refinancing scheme to finance the construction activities.

I don’t think any other sector of the economy has received this much attention, love, and relaxation from SBP. It will be a shame if the banks don’t achieve the mandated target now.