You should always use the HBL credit card

Despite the pathetic service that HBL provides, the discounts are sometimes worth the pain.

Disclaimer: I am not covering the other cards because I am lazy. The lessons are applicable to all the reward cards.

When it comes to online banking, Habib Bank Limited appears to have the worst service. This is not based on any scientific survey rather based on a few tweets that made it across my Twitter timeline.

Then there is this where the app stops working on the first of every month probably due to all the salaried employees accessing or checking their balances. Or is it the HBL backend IT system processing payroll?

There was this yesterday.

And this

You get the drift. Ok, a couple of more as these were funny.

So should you go for an HBL credit card considering it is such a pain? If you often use the following services/outlets, then the answer is MOST DEFINITELY YES.

The reason I am doing this post is because of the following tweet:

The assumption in the above tweet is that HBL is bearing the cost of those discounts. Considering that HBL is a bank that made 14% of its net income in 2019 by scamming the aged, the pensioners, and the vulnerable by forcing needless and very expensive bancassurance products onto them, a very charitable assumption.

Let’s take the example of Okra, which is offering a discount of up to 30% to HBL cardholders. That is a huge discount. On an order of Rs.20,000, that translates into a discount of Rs.6,000. Similar discounts will be offered to reward cardholders of other banks. Okra doesn’t know how many customers will come in and use the HBL credit card. If perchance, all the customers turn out to be reward cardholders, Okra will go bankrupt or approach near bankruptcy by offering a discount of 30% on every order. Okra cannot price discriminate i.e. have a different price for the people who use the HBL card and another price for customers that pay in cash or use a non-reward card from a different bank as it will defeat the purpose of the reward card. Thus the only way for Okra to maintain profits is to increase the price of all the food items on the menu.

Let’s take a hypothetical example. Assuming two customers place an order for Rs. 10,000 each. Okra would be expecting revenue of Rs.20,000 in total. One customer pays through the reward card and the other customer pays using cash. The total revenue of Okra is now Rs.17,000 (Rs.10,000 from the cash payer plus Rs.7,000 from the reward card payer). The next day, Okra will increase the price of food items by 20% as there is a shortfall in revenue. The price of that item will now be Rs.12,000. The same customers place an order again. This time the revenue is Rs.20,400 (Rs.12,000 from the cash payer and Rs.8,400 from the reward card payer). The intake is almost the same as Okra was expecting without the discount. Instead of Okra bearing the cost of the discount, it is the cash-paying customer that is financing or subsidizing the order of a reward cardholder.

This is how the system of reward cards and loyalty points works: the non-program members or non-reward cardholders are subsidizing the benefits of reward cardholders.

Why does Okra sign up for such rewards? Because it directs HBL cardholders to Okra. I have myself many times chosen a restaurant because it was offering a discount on the credit card I held.

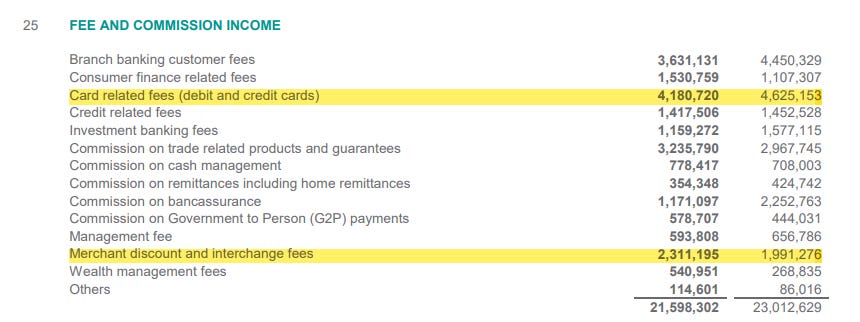

What does HBL get out of it? Quite a few customers sign up for the cards based on the rewards. HBL charges them annual fees. They run significant bills at Okra which allows HBL to charge a small percentage as issuer fees. All of this adds up. Below is from 2020 financials of HBL. HBL earned revenue of Rs.6 billion in fees from credit/debit cards, merchant discounts, and interchange fees. It is ironic that merchant discount is appearing on the income side and not the expense side as if by offering rewards, HBL was able to get cardholders to spend more money at the retailer and generate more income. But this discount isn’t coming out of the pocket of the retailer or reward cardholder. It is the non-reward cardholders who are providing this income of Rs.2.3 billion to HBL in FY2020.

There may be some expenses related to it but not large enough to warrant a mention on the expense side as seen below. There is nothing with respect to card expenses in the expense statement of HBL.

There is a significant discount on Aga Khan health services. Once you start running into health issues, the healthcare bill can reach for the skies. This discount isn’t insignificant. If you are not using the reward card to pay for the services, rest assured that you are also subsidizing the exorbitant bill of the person who is using the card to pay for the Aga Khan health services.

Yes, it is a pain maintaining these cards. The annual fees aren’t cheap either. But if you are a frequent patron at these outlets or outlets that offer discounts on other reward cards, it behooves you to get the reward card. Otherwise, you are just subsidizing the reward cardholders.

NOTE: The author didn’t get any commission from HBL for reviewing their card nor the author endorses the HBL card.