The post may have been clipped at the end. If that is the case, please click on the title above to read it on the website.

The regulator yawns

State Bank issued a circular yesterday along with a press release on third party products, specifically bancassurance products sold through the branches

Such offers are often prone to misdeclaration about the quality or pricing of products. Further, banks also don’t assume any responsibility after the sale of products, which leads to difficulties for customers and disputes. To address such concerns and bring transparency to such transactions, SBP has issued a comprehensively revised set of instructions on the sale of third party products. In addition, these instructions will also facilitate the sale of products through digital channels and promote financial inclusion.

Let's talk about the two bold parts.

1. Often prone to misdeclaration

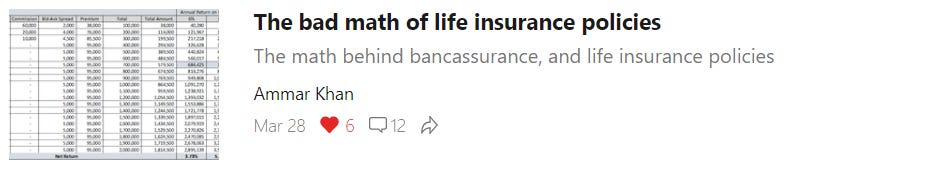

Who is SBP fooling here? “Often” is the wrong word here. Bancassurance products are ALWAYS sold with misdeclaration. Ammar wrote a great post on it with numbers and calculations. I recommend you read his post for the detailed calculations.

The key paragraph in Ammar’s post is

it is clear that you only break-even around the seventh year mark. It is also obvious ... that ‘net return’ is actually much lower than the expected returns. And why is that? It is because of the loaded fee structure, which includes commissions, management fees, and bid-ask spread. So a 6% annual return would eventually be a 3.73% return for you, after adjusting for all fees, etc. Similarly, a 10% expected return would be a 7.82% return for you, after adjusting for all fees, etc.

Breaking even in 7 years means that regardless of what the brochure or projections that the branch staff showed you, you will get less than what you contributed if you withdraw your money before 7 years. You are made whole in the 7th year (and only if the PSX market return rather the fund return is above 6% per annum over this period).

What a scam!!!

2. Facilitate the sale of products through digital channels and promote financial inclusion

If SBP believes selling shitty products to naive customers will promote financial inclusion, I don't even have a snarky comment for this hopeless regulator.

I am just speechless

The Transparent Marketing Pitch

SBP wants the banks to market the products transparently. I don’t think banks will sell a single bancassurance product if they are transparent about it. This is how the transparent pitch will go

We are glad that you have decided to participate in this great "trickle up" wealth transfer mechanism where your hard earned savings are transferred to the rich heartless bank shareholders as commission income. As a first step, from your khoon paseenay ki kamaayi, we deduct, as commission, up to 60% of the money you contribute in the first year and 20% of the money you contribute in the second year.

If you decide to withdraw in first two years, you will not get anything back as we charge 100% of your policy value as policy surrender charges. If you want to withdraw in the third year assuming you had contributed Rs.200,000 by now, you are entitled to only Rs.130,000 (the balance we paid ourselves as commission for the hard work we have done for convincing you to invest in this blood sucking policy) less bid-ask spread and less admin charges.

If you keep contributing Rs.100,000 per year for 7 years, you will be able to get back 700,000 in the 7th year if the underlying fund return is at least 6% p.a. It will be as if your investment period starts after 7 years and you earned absolutely no return on your contribution for first seven years.

If your investment horizon is less than 7 years, you can do much better by keeping this money in a current account, in a locker or even under the mattress.

If your investment horizon is longer than seven years, your returns will be higher if you invest the money in an ordinary saving account or in a DSC or in any PSX mutual fund from day one.

You tell me, how can SBP expect that the product that I have described above will be sold without misdeclaration or that this product will promote financial inclusion?

Financial Inclusion - my foot!!

There is this clause in the SBP circular

The option of premium deduction through direct debit shall only be allowed on the written consent of the customer and the banks and/ or insurers shall send free SMS and/ or email alert to the customer regarding direct debit before 3 working days at the time of each periodic premium deduction. In the case of distribution through alternate delivery channels, the consent for deduction through direct debit shall be obtained electronically i.e. interactive SMS, option in internet banking, mobile application, etc. The customer giving electronic consent shall also be sent free SMS and/or email alert regarding each direct debit before 3 working days of the premium deduction.

This person just moved the money out of his bank account.

Is this how SBP expects to promote financial inclusion?

Incentives

From SBP circular

No bank employee should be allowed to receive incentives directly from the third party/ seller of these products. Further, compliance with the instructions contained in BPRD Circular Letter No. 09 of 2017 regarding foreign travel policy should be complied in letter and spirit.

The reality

Banks are it again

Banks love this product. They get free commission income and then transfer all responsibility to the insurance company.

UBL

UBL loved it so much that in its 1H 2021 directors' report, UBL specially mentioned the 81% growth in its bancassurance income.

Among all the banks, UBL is bringing in the highest amount from the bancassurance commission. UBL should change its logo to the below:

MCB

MCB had 60% growth in its bancassurance income in 1H 2021.

HBL

HBL with almost 50% growth in bancassurance income.

Other banks’ income statements should be similar, but their intake would likely be smaller. I do have a day job you know, i.e., I don’t have time to go through the financials of all the banks for this altruistic work :) .

The Culprits

If you are looking for who to blame, it is the board of directors of the banks. The fish rots from the top.

Role of Regulators

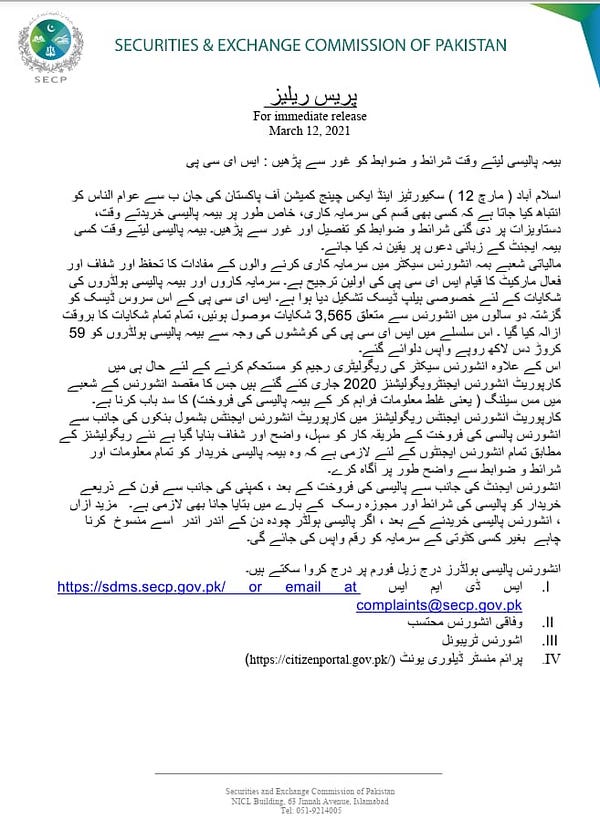

SECP

SECP keeps initiating investigations, but it hasn’t been having any effect on improving the behavior of the banks or insurance companies. After my previous substack, SECP issued a circular asking the prospective buyers to carefully read all the terms and conditions before signing an investment document.

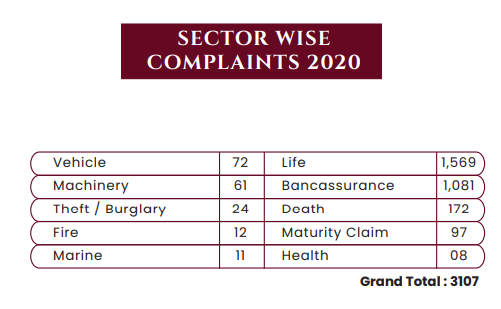

As per the above notice, SECP had received 3,565 complaints against insurance companies between 2018 and 2020 and provided relief of Rs.591 million to policyholders.

Not many people that have been scammed by the banks into buying the policy would know about SECP or how to approach it. The people who have approached SECP are just the financially savvy ones. This just tells you how aggressive the marketing of the bancassurance products is that it even ropes in the financially savvy.

Federal Insurance Ombudsman (FIO)

The highest number of complaints registered with FIO is with respect to life insurance. Bancassurance is mainly sold by life insurance companies.

Bancassurance has 2nd highest number of complaints at FIO.

Federal Banking Ombudsman (FBO)

These would mainly be related to bancassurance. Considering that 2020 was a COVID year, the complaints with FBO increased by 43% over 2019 (there may be a lag effect in play as well).

SBP

SBP which is supposedly the best regulator apparently is the last one to wake up. As I showed in my various posts about construction financing, SBP appears to be more interested in gaming the system. Rather than shutting the bancassurance window down, SBP is giving the bank's checkboxes and guidelines to continue selling the product to promote financial inclusion.

You can't polish a 💩

Bottom line is that bancassurance products need to be shut down and banned. There is no way any bank customer would buy the policy if it is marketed transparently.

Redressal Mechanism

For those who have been scammed into buying these products, you have the following channels to seek relief.

In addition, you can also approach the Federal Banking Ombudsman.

Further Reading

I had written the below post on the topic earlier.