Pakistani Hedge Funds #3: Pak Kuwait Investment Company is leverage on steroids.

PKIC's position in GoP securities is almost one-tenth of the entire banking sector of Pakistan and the size of its repo is almost one-third of SBP's repo outstanding.

Background Reading (if interested)

This is my third substack on the topic in addition to the two articles I cowrote in the Profit. In reverse chronological order:

Grow your company size by 3 to 6 times in just months. At least two Pakistani companies have done this & you can too. Here is how - [The Profit]

Pretty outside, ugly inside: How Pakistani banks window dressed their books to avoid new taxes - [The Profit]

Background Summary

In the Profit piece (#3 in Background Reading) we showed that the business model being followed by PKIC is akin to a perpetual motion machine. It is as if PKIC has discovered a magic money-making formula where it can continue to grow its balance sheet size and income without any ceiling.

We were using December 31, 2022 financial statements. One can easily differentiate the period before and after the discovery of the money-making formula. Till 2021, PKIC was showing healthy growth in asset size. However, in 2022, this growth went exponential. The graph below reads that growth happened over a period of 12 months but if you read the quarterly reports and SBP’s June 2022 circular allowing DFIs to repo PIBs/T-Bills with SBP (see #2 in Background Reading), this 6-7 fold growth took place over a period of 7 months.

This isn’t organic growth i.e., due to growth in corporate finance activities or capital market investments. This is all based on the perpetual motion machine of buy-borrow-pledge of GoP securities.

June 2023 Financials

If growth in 2022 was ridiculous, I was completely unprepared for what half-year 2023 had in store for me. From the already absurd leveraged balance sheet size at the end of Dec 2022, they have more than doubled the balance sheet size (in green) and almost tripled their leveraged investment in GoP securities (in yellow).

All of this growth is funded by Repos from banks ( in blue) with negligible growth in net assets (red). The result of all this is that the leverage ratio of PKIC is now 31x. I am not exaggerating when I call PKIC a hedge fund, and that too a state-owned one.

This would have been acceptable if this strategy had been earning PKIC oodles of money. Unfortunately, that is not the case. While there is negligible growth in 1H 2023 Net Interest Income (NII) when compared to 1H 2022 income (in yellow), on a quarterly basis, the NII is lower in 2Q 2023 when compared to the same period last year (in green). This brings into question the sanity of this strategy that with investment reaching almost Rs. 2 Trillion (I have rounded up Rs.1.7 Trillion investment for exaggerated effect), all PKIC has to show for it is Rs.713 million half-yearly income. This translates into a net interest margin of 0.79%.

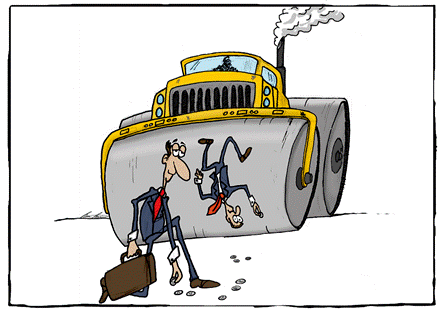

The hedge fund business model is described as “picking up pennies in front of a steam roller” as hedge funds take very large leverage positions in strategies that earn pennies on the dollar (single-digit percentage returns). The large positions mean that the resulting returns are big in absolute terms. While PKIC’s positions are huge, it isn’t even earning a single penny on this strategy which translates into a 1% return as their return on this strategy is less than 1% at 0.79%.

Almost all the income is coming from PKIC’s holding of Meezan Bank’s shares (in blue).

Repo almost one-third of SBP repo outstanding

The total repo size of PKIC is Rs.1.6 trillion as of the end of June 2023. It is more than 3x the repo PKIC six months ago at the end of December 2022.

The notes do not provide explanation of which financial institutions are providing this repo. However, if this repo was provided by SBP (which is allowed under SBP's DMMD circular 11 of 2022), PKIC repo at Rs.1.65T would comprise almost one-third of SBP’s total repo outstanding at the end of June at Rs.4.97T. This is how ridiculous PKIC’s growth is.

Investment in GoP securities reached almost one-tenth of the entire banking sector

Looked at another way, the total investment of scheduled banks in GoP securities was Rs.20 Trillion at the end of June 2023 as per SBP data

PKIC’s investment in GoP securities at Rs.1.6 Trillion is almost reaching one-tenth the size of the investment of the entire banking sector of Pakistan in GoP securities. However, it should be noted that the banking sector takes this position funded by their low-cost deposits. PKIC is taking this position based on repos from SBP and commercial banks. That is how ludicrous this position is.

Hockey Stick Growth

I have updated the chart that was present at the beginning of this post. You just have to compare the balance sheet growth in 18 months i.e., from FYE 2021 to 1H 2023. I believe this is what is called exponential growth or hockey stick growth in startup circles.

The next three months can’t pass soon enough as I can’t wait to get hold of the 3Q 2023 report to see if PKIC continues to double down on this strategy.

If you like this post, please press the like button and send it to your friends in PKIC.

The other hedge fund

Hopefully, the 1H financial statements of the other hedge fund i.e., U Microfinance Bank will be released shortly and I can get my dopamine kick going through it to see if they have changed their ways since I last wrote about them.