No more export refinance or support to Naya Pakistan Housing from SBP

Soliciting public comments through WhatsApp leaks - a new standard by central bank

I had thought that no one will one-up the stunt that Tabish Gauhar, SAPM on Power, had pulled over WhatsApp. He sent his resignation by sending I presume a text message over WhatsApp and then went off the grid.

Gauhar tendered his resignation through Whatsapp after being inaccessible for officials of the Power Division for the last seven days. His cell phone till the filing of the report was powered off. On Wednesday, when Saudi and UAE envoys held separate meetings with Energy Minister Omar Ayub Khan, Power Division officials tried to contact him many times to ensure Tabish attended the meeting with the ambassador of Saudi Arabia. But his phone was found powered off. SAPM on Petroleum Nadeem Nabar and SAPM on Power Tabish Gauhar were supposed to attend those meetings. Gauhar was not available. He last attended the office on Friday last (January 1, 2021) and since then his staff remained clueless about Tabish.

Never say never. State Bank of Pakistan has set a new standard.

No one has seen the full document. Professionals from across the spectrum i.e., journalists, professors, consultants, civil servants, etc have written op-eds, made vlogs, PIDE even held a webinar yesterday to discuss the new amendment based on the WhatsApp leak. I was trying to piece together the amendment from various op-eds and threads till someone shared the PDF of the leaked pages with me.

The hot topics are mandate, independence, and immunity. I wanted to do a post on the mandate using the below meme but that will have to wait.

The controversial clauses discussed in talk shows and op-eds are around the independence of SBP and immunity. I have no objections to the immunity and independence of SBP, not that anyone cares what a pseudonymous blogger thinks about SBP Act amendments. I feel those clauses are red herrings to move the discussion away from the below amendment that I believe no one has touched upon.

I don't know whether this is lazy drafting by SBP’s/IMF’s lawyers or if it is the intention. It is explicitly stating that any activity that promotes any priority sector is prohibited.

What is Reza Baqir saying in the below headline, this will not be allowed anymore.

Housing is a major part of PTI's manifesto. Naya Pakistan Housing is a flagship project of this government. SBP is the loadbearing element in the housing finance edifice through the carrot and stick approach it is taking with the banks to promote housing finance. The latest amendment absolutely prohibits SBP from engaging in any such activity. It leaves no room for interpretation as the clause explicitly mentions housing.

Even the SME sector, which gets no love from commercial banks unless SBP pushes them, can no longer be promoted by SBP.

The export sector is also a priority sector for SBP with its export refinance schemes. Razak Dawood is working very hard to increase the exports of the country. Exporters rely on the cheap finance of SBP's export refinance scheme to remain competitive. If SBP will not provide export refinance, there is a possibility that exports will decrease.

You may say that now I am getting carried away and wrongly interpreting the clause. There is no such sector as "export sector".

If a lawyer is reading this, she may say that "sector" isn't defined in the definitions of the act so I shouldn't attribute to this clause the meanings my biased mind is suggesting.

I am glad you feel this way. Skepticism is healthy. This brings us to the next clause. If you are not someone who reads loan documents or a lawyer, it is hard to zone in on what is going on here as this requires comparing the amendments with the previous act. It is tedious work and I hate this part of my day job. But my day job pays my bills and reading loan agreements with a fine-tooth comb has saved my job countless times so I grudgingly do it.

It says that among other sections, sections 17(2)(a) and 17(2)(d) will be deleted. We need to read the existing SBP Act to see what is being deleted.

Section 17 of the SBP Act defines what business SBP can transact. Below are the two subsections that are being deleted.

(a) The purchase, sale and rediscount of bills of exchange and promissory notes drawn on and payable in Pakistan and arising out of bona fide commercial or trade transactions bearing two or more good signatures one of which shall be that of a scheduled bank, and maturing within107\[one hundred and eighty days\] from the date of such purchase or rediscount, exclusive of days of grace.

(d) The purchase, sale and rediscount of bills of exchange and promissory notes drawn and payable in Pakistan and bearing two or more good signatures one of which shall be that of scheduled bank, or any corporation approved by the 109\[Federal Government\] and having as one of its objects the making of loans and advances in cash or kind, drawn and issued for financing the development of agriculture, or of agricultural or animal produce or the needs of industry, having maturities not exceeding 110\[twelve and a half years\] from the date of such purchase of rediscount;

The first clause is exclusively targeting export refinance part I (ERF-I) and the second one is targeting long-term finance i.e LTF/TERF/RFCC facilities of SBP.

Under the amended act, SBP cannot provide refinancing facilities such as export refinance and LTF/TERF/RFCC.

Digression: If you are finding it hard to parse the clause let me see if I can explain it. When an exporter borrows from a commercial bank, the commercial bank provides a loan to the exporter against the exporter providing a promissory note to a commercial bank, which says that the exporter promises to pay the bank on the maturity of the export refinance. The commercial bank then presents this promissory note for discounting/purchase to SBP and SBP provides money (refinance) to the commercial bank. If the export proceeds do not arrive by the maturity date or 180 days, the promissory note forces the borrower to repay the commercial bank and the commercial bank is supposed to repay SBP. If the borrower fails to repay in 180 days, the exporter can be taken to court on the basis of the promissory note.

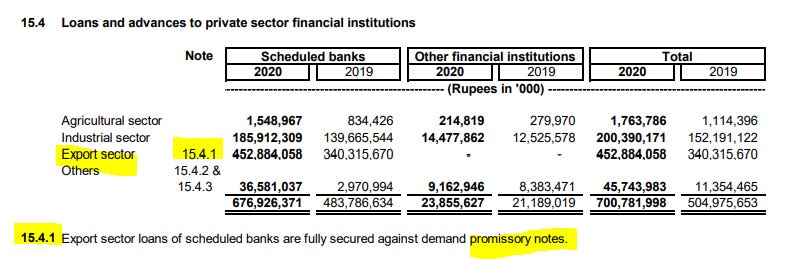

The reader may still not believe that this clause is relating to ERF-I. I admire the skepticism. So let’s open the annual report of 2020 of SBP.

Lo and behold. What you know. Export is a "sector" as per SBP annual report. In 2020, the total export refinance outstanding is Rs.450 billion. Assuming it turns over 2X, it means that in 2020 SBP supported exports of at least Rs.900 billion which translates into $6 billion. Under the new act, SBP can no longer provide this support.

The one above it is the industrial sector wherein RFCC/TERF/LTF facilities are accounted for and SBP has been gathering lots of plaudits for that scheme to the extent of claiming that it will increase investment-to-GDP by a 1% point.

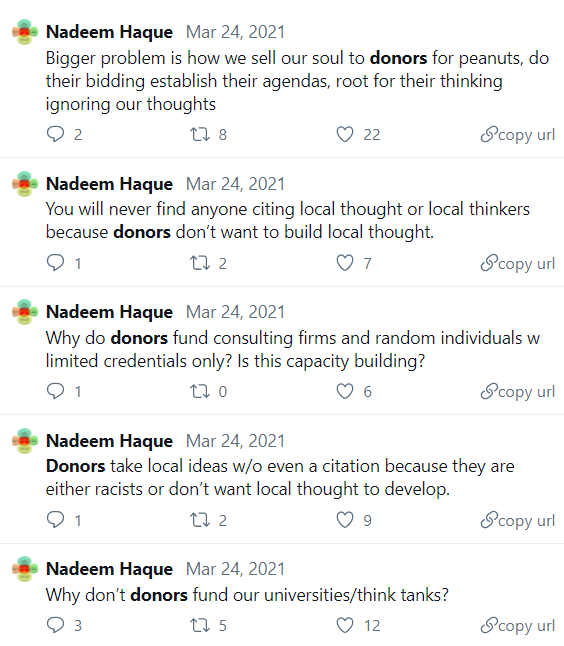

Why is SBP trying to ruin a good thing by making it not possible for SBP to provide export and industrial refinancing? Reportedly this is being done at the behest of IMF, a donor. I leave you with inimitable Nadeem Haque's words of wisdom when it comes to taking recommendations from donors.

There you have it. To summarize,

SBP leaked portions of its internal board memo over WhatsApp to solicit feedback.

All the feedback is based on the leaked portions.

All of the feedback is focused on supporting SBP's independence and immunity of its officers.

SBP slipped in clauses which will make it impossible for SBP to engage in refinancing activities or support the country in Naya Pakistan Housing or increasing exports.

I do wonder whether Razak Dawood, General Anwar Hyder of Naya Pakistan Housing, Pakistan Business Council, banks, and other export and industrial associations are aware of this clause.

There is also this view.