More on the uselessness of CFA Charter: UBank edition

One expected better analysis from Managing Director, CFA, FRM

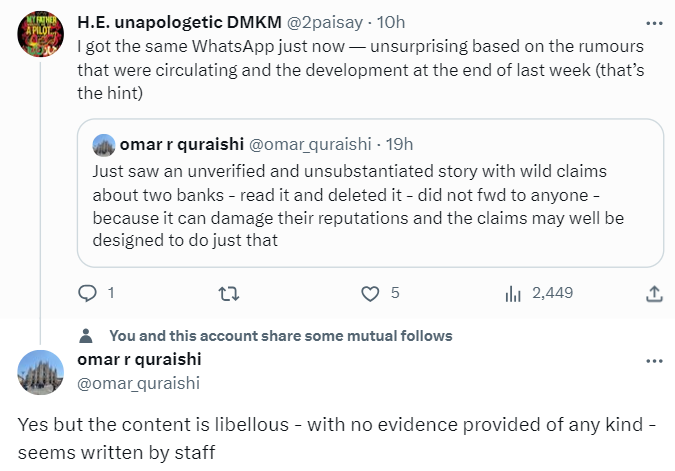

A WhatsApp message was going around yesterday about UBank. The message was based on hearsay, hence it wasn’t talked about much. I saw one tweet about it that didn’t mention any details so I didn’t know that the message was about UBank. I did say that if the message is as the tweet is describing it, it amounts to nothing more than rumor-mongering.

Later I did receive the said WhatsApp message (talk about my lack of connections: 9 hours after Omar Qureshi had received, read, deleted, and tweeted about deleting the WhatsApp message, I got the WhatsApp forwarded many times message). As there was no way to verify the claims, I didn’t mention UBank but I did say that the message is about what was being discussed last week.

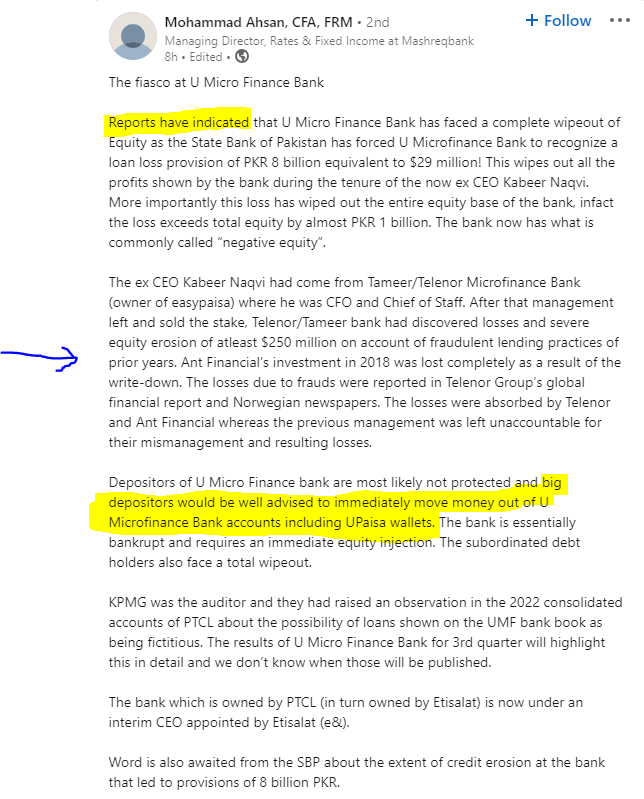

A few hours ago, I was sent a link to the below post published on LinkedIn by a Managing Director at Mashreq Bank.

I want to zoom into two statements that are highlighted in yellow.

Reports have indicated…

What reports is the author of the post referring to? The author hasn’t bothered to go through UBank’s 1Q2023 accounts as he uses FY2022 financials in his post. Probably doesn’t even know that UBank still hasn’t released 2Q2023 financials. That is why he says in the 5th paragraph that 3Q2023 financials will highlight these issues in detail. In the financial sector, there are always rumors about one thing or another. But one never publishes them without having evidence of it. Even with a substack that very few people read, if I publish something like this, I usually preface it with that what follows now is my guess. The claim about Rs.8 billion loss may turn out to be true but it is based on “reports”. One would expect that people in the financial sector and that too a managing director would be more cautious in making such claims.

Depositors of U Micro Finance bank are most likely not protected and big depositors would be well advised to immediately move money out of U Microfinance Bank accounts including UPaisa wallets.

For a financial advisor or a consultant, it does make sense to advise their clients discreetly to move their funds out of a vulnerable institution, however, making such statements on a LinkedIn post will induce a bank run which isn’t good for anyone and may even prevent the central bank or the shareholders of the bank to stabilize the bank. One would expect better from a Managing Director, that too a CFA charter holder and FRM certified one.

Finally, let’s come to the paragraph about Kabeer Naqvi’s profile in the LinkedIn post. Earlier I assumed that the WhatsApp message was based on the LinkedIn post. But now that I see the timing, it appears that the LinkedIn post was copied from the WhatsApp message. Omar Qureshi tweeted almost 20 hours ago. I received the WhatsApp message 10 hours ago. The LinkedIn post was put up 8 hours ago.

History of CEO Kabeer Naqvi:

The CEO Kabeer Naqvi had come from Tameer/Telenor Microfinance Bank (owner of easypaisa) where he was CFO and Chief of Staff…. After that management left Telenor/Tameer bank had discovered losses and severe equity erosion of atleast $250 million on account of fraudulent lending practices of prior years. Ant Financial’s investment in 2018 was lost completely as a result of the write-down. The losses due to frauds were reported in Telenor Group’s global financial report and Norwegian newspapers. The losses were absorbed by Telenor and Ant Financial whereas the previous management was left unaccountable for their mismanagement and resulting losses.

The line in italics isn’t part of the WhatsApp forward. There can be only two conclusions. Either the Managing Director is the author of the WhatsApp forwarded message and after receiving no pushback decided to publish it on LinkedIn or he just copy-pasted the WhatsApp forward and added a few more details such as the last paragraph about notes in PTCL annual report. I like to go with the former but the WhatsApp forward is written a bit amateurishly (yes, more amateurishly than the LinkedIn post calling for a bank run) so going with the latter. Hard to believe that the copy-paste shows the MD in a better light. There is also another possibility that the person who received the original WhatsApp from the MD added his own flourish and then forwarded it. I guess we will never find out.

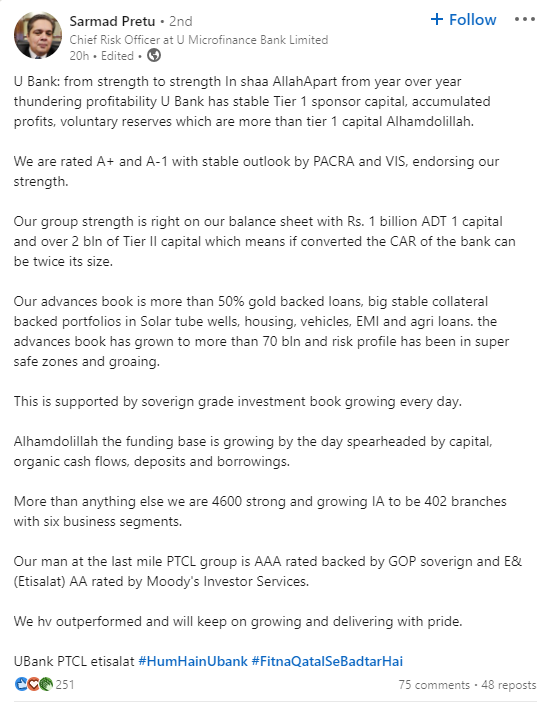

For completeness's sake, the CRO of UBank also wrote a post on LinkedIn. This was 20 hours ago, before any of this started and most likely addressing concerns that arose after the top management of the bank resigned last week.

Considering that the top management of the bank resigned and as per The Profit, the CEO Kabeer Naqvi is moving to Chicago to be with his wife and kids, it is hard to buy that there was underreporting of loan losses to the extent of Rs.8 billion. If indeed it was a case of underreporting, either the CRO or the CFO should have been the ones fired on account of having weak controls in place. Considering that the CRO is putting out statements on LinkedIn that all is hunky dory at UBank and there is no report about the CFO getting fired or resigning, it is improbable (but not impossible) that the resignations were not due to under-reporting of loan losses.

Received the following press release over WhatsApp a few minutes ago:

Press Release

Financial Strength & Resilience: PTCL Group Dispels False Speculations on U Microfinance Bank

Islamabad, October 23, 2023: PTCL Group, the largest ICT services provider in Pakistan refutes all claims and rumors regarding the financial health of U Microfinance Bank (Ubank) its wholly owned subsidiary. Ubank is Pakistan’s fastest-growing microfinance bank and one of the key players in the banking industry, highlights a robust and unwavering financial structure and has a strong capital base.

PTCL Group ensures that the teams at Ubank, from the management to those on-ground, will continue to make progress, innovate, and endeavor to achieve the bank’s core mission of financial inclusion for all segments of Pakistani society. Ubank’s Gross Loan Portfolio is one of the highest in the industry as a result of the bank’s sustainable growth strategy. Almost 54% of this portfolio is backed by gold, displaying the financial resilience of the bank against its lending practices. The diverse portfolio of Ubank also includes solar financing, agriculture including tractor financing, housing, and vehicle financing, etc.

Ubank enjoys strong and positive backing from PTCL Group. The bank has a paid-up capital of PKR 4 Billion, PKR 1 Billion as additional Tier-1 capital and PKR 1.2 Billion as Tier-2 capital from PTCL. In addition to this, the bank has also raised PKR 1 Billion additional Tier-1 capital from the market. The bank’s funding base continues to grow on a regular basis with consistent cash flows, deposits, lending, and capital influx.

Hatem Bamatraf, President and Group CEO, PTCL & Ufone 4G and Chairman, Board of Directors, U Microfinance Bank, said: “Ubank has always enjoyed strong backing from PTCL Group. The bank has demonstrated impressive financial performance and positive growth trajectory; therefore, I would like to reiterate that PTCL Group firmly stands with the bank and reassures the investors, customers and shareholders of its continued support. Currently, we don’t foresee the need of any equity injection in the bank but are fully committed to meet any future growth requirements.”

Given the strong capital base, diversified revenue engines and portfolio, coupled with unprecedented growth, Ubank remains credible with a long-term credit rating of A+ awarded to it by PACRA Credit Rating Agency and VIS Credit Rating Company. Both the rating agencies in Pakistan have reported Ubank to have a ‘Stable’ outlook, recognizing the bank’s sustainable business strategic initiatives.

The Incumbent President & CEO, U Microfinance Bank, Mohamed Essa Al Taheri was earlier associated with Ubank as a Member of the Board of Directors and has previously worked with e& Group as the Group EVP Financial Policies and Systems. In light of the on-going developments, Al Taheri states, “We want to address recent rumors circulating on various platforms, regarding UPaisa & U Microfinance Bank's capital base. These claims are entirely baseless and unfounded. Ubank has a strong and committed management team and enjoys complete support from its investors, partners, stakeholders and customers as the bank continues to strive for growth and excellence.”

Ubank as a microfinance entity came into existence in 2012 and since then has only witnessed consistent and unwavering growth. The bank has steadily enhanced its profitability as an institution over the years, while significantly increasing its presence across multiple urban, as well as rural regions of Pakistan. Ubank and its wide network of 350+ branches is a testament to the bank’s commitment to reaching the unbanked population at the last mile while providing viable financial products and services to its customers. The bank’s workforce has risen from a mere few hundred to more than 4,800 dedicated employees spread across multiple cities and rural areas of Pakistan, where Ubank continues to provide ample employment opportunities. End

About PTCL:

Pakistan Telecommunication Company Limited (PTCL) is the largest integrated Information Communication Technology (ICT) Company of Pakistan. With a humble start from a telephone and telegraph department in 1947, it has evolved to offer latest digital and telecommunication Technology today. It acts as the communication backbone for the country with the largest fiber cable network that spans from Khyber to Karachi and submarine cables connecting Pakistan to the world. PTCL has been assigned initial long-term entity rating of ‘AAA’ (Triple A) and short-term rating of ‘A-1+’ (A-One Plus). For more information, visit www.ptcl.com.pk

Anyway, I look forward to seeing what else comes out of this in the next few days. At least two news publications are looking into Ubank. This is not a rumor as I know this for sure.