Monetary Policy #4: SBP is encouraging carry trades

Pakistani money market's open secret: There is no liquidity shortage

I have benefited from discussion with market participants in writing this post. The errors are all my own.

I tweeted the below yesterday. The tweet is quoting the reply of the SBP governor in the post-MPC conference in answer to a question posed by The Profit.

The question was posed by Ariba.

To which Ali suggested that instead of doing OMOs, SBP should go for outright purchases.

Small digression before continuing on the topic.

RRP vs QE

Outright purchases are what the Federal Reserve does in the US under Quantitative Easing (QE). Under Section 18 of SBP Act, OMOs can be repos(and RRPs) as well as outright purchases (QE). However, to date, SBP has limited its liquidity injections to RRPs.

Whether SBP does an RRP or QE, the T-account of SBP in both cases will be the same, i.e. SBP’s balance sheet will expand to hold more T-bills/PIBs on the asset side with the reserves of commercial banks increasing on the liability side. The difference in RRP and QE will be in the length of the expansion of SBP’s balance sheet.

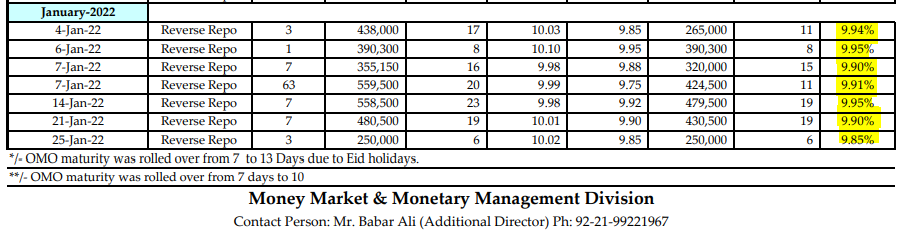

Textbook RRPs are usually for a short period, i.e. 1-day to 7-days. The recent 63-day RRPs were an exception, I think. At maturity, it is up to SBP whether it will roll over the RRP or let it mature. If SBP lets the RRPs mature, SBP’s balance sheet will contract, and commercial banks will have to arrange reserves to buy back the T-bills to unwind the RRPs. Thus, in RRP, the commercial banks are always at SBP’s mercy.

In contrast, in QE, once SBP outright buys the T-Bill from the commercial banks, there is no risk for commercial banks. The T-bill will remain on SBP’s book until either the T-bill matures or SBP decides to sell the T-Bill in the secondary market.

When the balance sheet of SBP starts shrinking as T-bills on its books start maturing, it is called “asset runoff” in QE parlance.

Digression over.

Permanent Liquidity Shortage

Ali’s article intrigued me. As I have recently started following SBP OMOs, I didn’t realize that the outstanding RRPs have become a sort of permanent liquidity.

….The point to ponder is that liquidity shortage is being consistently over Rs1 trillion and even after normalizing, it may hover around Rs1.5 trillion – 10 percent of deposits.

That is too high a number. This implies that a decent chunk is becoming permanent liquidity shortage.

The aforementioned article was written in June 2021. I wasn’t following the OMOs at the time, so I don’t know what was the reason at the time. However, I have been following the OMOs for a couple of weeks and once I read Ali’s article, I had to find out more.

We learned in Money and Banking 101 is that OMOs are done to inject or mop up liquidity, to keep the overnight rate in the interest rate corridor. RRPs, being of short nature, temporarily increase the reserves of commercial banks to allow them to meet either reserve requirements or to settle interbank payments. RRPs are supposed to be unwound/repaid at maturity by the banks as they either arrange more permanent reserves or modify their balance sheet that such reserves are no longer required. Borrowing against RRP isn’t exactly cheap either, as the current RRP rate is a little less than 10% p.a.

Unfortunately, RRPs, by permanently remaining outstanding, are indicating that SBP’s recent OMOs aren’t textbook OMOs i.e. to help the banks meet their reserve shortfall or to help the overnight rate remain within the corridor. Permanent liquidity shortage is hinting at something deeper.

Open Secret - Backdoor lending to GoP

Yesterday, SBP carried out another 3-day RRP of Rs.250 billion, taking the total RRP outstanding to Rs. 2.5 trillion.

I made a few phone calls and exchanged messages with a few people. I don’t know about the earlier RRPs but the perception is that the recent RRPs are all backdoors for SBP to lend to GoP.

The pricing on all the recent RRPs is around 9.9%. This is SBP lending money to banks at 9.9% to lend to GoP in T-bill auctions at 10.3% in 3-month tenor, thus allowing the banks to make a spread of around 40bps on three-month T-bills.

SBP encouraging a carry trade

To summarize,

The current OMOs are not for liquidity shortages.

This is SBP encouraging carry trade in T-bills.

This is an open secret in the money markets of Pakistan: Borrow short term on RRPs at 9.9% and lend to GoP for 3 months 10.4%.

Things to look forward to this week:

January 26: T-Bill Auction. Yields are expected to remain the same under the carry trade implies.

January 27: SBP Bill to be presented in parliament. Once the bill passes the parliament, SBP will be “independent”.

January 28: OMO roll over. Does SBP change its behavior after becoming independent?

Market participants will be looking to see how SBP’s behavior changes once it becomes independent? Does it try to eliminate this carry trade by shrinking its balance sheet?

Had it not been for the 63-day OMO, after which I have started following OMOs, I would have remained oblivious to this amazing development.

Bonus feature

At 1:40 mark, Reza Baqir states that the tax exemption bill will contract the GDP by 1%.