Monetary Policy #8 : Curious case of imported cars

Despite actions by SBP and the government to deter it, the car imports continue to increase.

SBP increased the policy rate on April 7 and on the same day increased the cost of imports. As per the MPS,

…the MPC decided at its emergency meeting today, to raise the policy rate by 250 basis points to 12.25 percent. This increases forward-looking real interest rates (defined as the policy rate less expected inflation) to mildly positive territory. The MPC was of the view that this action would help to safeguard external and price stability.

The MPC also noted that SBP is in the process of taking further actions to reduce pressures on inflation and the current account, namely an increase in the interest rate on the export refinance scheme (EFS) and …

…widening the set of import items subject to cash margin requirements. These items are mostly finished goods including luxury items and exclude raw materials.

SBP is straight up lying misleading us with the last sentence. As I covered in my earlier post, almost 95% of the import items subject to cash margins comprise intermediate goods, staple food such as daal, and medicinal raw material. If there are any finished goods, they comprise a minute proportion of the 177 items.

While we can all agree that the current trade deficit is unsustainable and imports have to be compressed, using the 2021 data and SBP’s list, it appears that SBP is on the wrong path. It is deterring imports of items that lead to industrialization, electrification, and commercialization. While it is at it, it is also adding to malnutrition by making staple food expensive as well as exacerbating medicinal shortage.

Business Recorder published Hafiz Pasha’s Op-Ed today where he suggested that to manage the Balance of Payments crisis facing the country, the government should increase custom duties on imported items and eventually impose import quotas on luxury and non-essential items.

Other measures have been adopted to control imports. This has included the introduction of regulatory import duties of 5 percent to 60 percent by the FBR on 599 import items at the 8-digit level of the Harmonized Code on the 30th of June 2021. The SBP also imposed a 100 percent import margin requirement on a number of items. This list has been expanded recently by 177 items. Also, the interest rate on loans for cars has been raised.

However, the impact of these measures on the level of imports has been marginal. Despite the levy of regulatory duties, the effective duty on non-oil imports has declined from 9.1 percent to 7.2 percent. Clearly, there is need for FBR to explain this fall in the presence of high regulatory duties.

….

A key measure for controlling imports will be the levy of higher customs duties. All imports will need to be covered, with the exception of basic food items and medicines. Currently, there are four standard duty slabs of 3, 11, 16 and 20 percent. These will have to be raised to 5, 15, 22 and 30 percent respectively. This measure will significantly reduce imports, without raising prices of essential items which are imported. Eventually, import quotas may have to be introduced on non-essential and luxury imports.

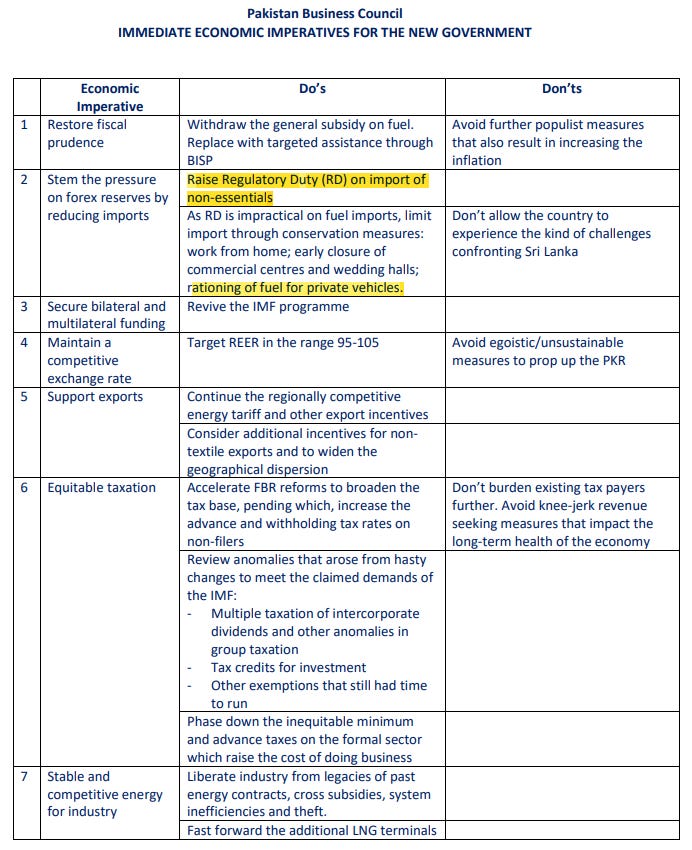

Pakistan Business Council also wrote an open letter to PM Shehbaz Sharif today, and it also suggested imposing regulatory duties on import of non-essential items to preserve foreign exchange. (There was also a suggestion of rationing fuel for private cars. I don’t think PBC has any idea how the rationing is to be implemented.)

What are the luxury items or the non-essential items that everyone wants to be curtailed? From the discussions in various WhatsApp groups, it is the passenger vehicles that are being classified as luxury items or non-essential items.

Earlier, On September 23, SBP revised the Prudential Regulations to make it harder for banks to finance vehicles and thereby restrict their imports. I wrote a post on it titled SBP: Addicted to Micromanagement. This section comprises excerpts from the said post. Feel free to skip it.

Kamran Khan aka Agencies ka aadmi did a program on it the same day. The tweet promoting the program is interesting as it talks about sky tearing deficit and record car imports.

Yesterday, SBP issued revised prudential regulations for consumer financing, mainly personal loans and auto loans. As per the press release, the revised regulations

... will help to moderate demand growth in the economy, leading to slower import growth and thus supporting the balance-of-payments... Following changes have been made.

Maximum tenure of auto finance has been reduced from seven (7) to five (5) years;

Maximum tenure of personal loan has been reduced from five (5) to four (4) years

Maximum debt-burden ratio, allowed to a borrower, has been decreased from 50 to 40 percent;

Overall auto financing limits availed by one person from all banks/DFIs, in aggregate, will not exceed Rs3,000,000, at any point in time; and

Minimum down payment for auto financing has been increased from 15 percent to 30 percent.

I called this mission creep.

SBP’s mission creep and politically motivated loosening of monetary and credit policies have been a matter of interest for me for a while now.

Mission Creep

The purpose of Prudential Regulations is to restrain commercial banks from over exposing themselves to leverage and endangering the entire financial sector to systemic risk. The share of car financing is 2% in the scheduled banks’ credit portfolio. It presents no systemic risk such that a revision in Prudential Regulations is required.

I went on to say that such micromanaging of the banks isn’t healthy, neither for SBP nor for the banking sector as a whole.

Nurturing man-child banks

Prudential Regulations should give broad rules, but SBP gets a high from breathing down the neck of commercial banks. Commercial banks have risk officers, risk committees, risk policies and I presume internal risk rating metrics. For loans that comprise measly 2% of their credit portfolio, with the qualified human resources and IT systems they have acquired, the commercial banks should be able to put in place appropriate processes, controls and risk assessment criteria. It appears SBP doesn’t trust the bank’s management and systems to be capable of managing a car financing portfolio. SBP is advising the bank the maximum tenure of such loans, the maximum financing exposure to a single borrower for such loans and the minimum down payment required.

This tweet said it perfectly

The problem with the SBP guidelines is that they are unduly restrictive, unduly detailed, and unduly prescriptive.

In that post, I wrote SBP policies are incoherent. On the one hand, SBP is discouraging car imports through these prudential regulations. While on the other hand, SBP and commercial banks continue to market Roshan Apni Car which encourages car purchases (only a portion of which is paid through remittances). You can read the entire piece here.

How wrong was I!!

Coming back to the SBP’s prudential regulations, some changes were quite aggressive.

Maximum tenure of auto finance has been reduced from seven (7) to five (5) years;

Maximum tenure of personal loan has been reduced from five (5) to four (4) years

Maximum debt-burden ratio, allowed to a borrower, has been decreased from 50 to 40 percent;

Overall auto financing limits availed by one person from all banks/DFIs, in aggregate, will not exceed Rs3,000,000, at any point in time; and

Minimum down payment for auto financing has been increased from 15 percent to 30 percent.

I really believed that regulation (4) and (5) will kill the car financing market. Regulation (4) limits the number of cars a person can finance at a time and (5) doubles the down payment. I was so wrong.

The below is from SBP’s latest CREDIT LOANS CLASSIFIED BY BORROWERS. If you squint, you can see that after September 2021 the trend of ever-increasing car loans appears to be slowing down rather stops increasing. Thus, the SBP regulations did achieve their objective. But then it appears to pick up again in January 2022. [Note to self to research for later: what changed in May 2020 that after being stable for years, car loans started to increase rapidly].

Let’s look at car loans on M-o-M net-basis. After the revised SBP prudential regulations, there was significant decrease in the rate of new car loans falling down to around zero by Jan 2022. However, since then, the car loans are back and back with a vengeance. It’s as if, all of a sudden, the new prudential regulations had no impact at all.

What’s going on? Cars aren’t cheap. And the new regulations don’t make it easy for anyone to buy these cars.

I don’t know how true is the above theory, but I can tell you that in mid-2000s, a textile group had requested me for a financing facility that they will use to book cars for selling on “on”/”own”.

With volatile stock market and a falling rupee, the investment in cars appear as an inflation hedge. If rupee keeps falling, the dealers will increase the price every few months. This gives an investor an opportunity to book the car at pre-increase price and sell it at the post-increase price. In addition, such cars sell of “on”/”own” premium, thus providing a larger profit margin to the investor for a short term investment.

Despite such exorbitant prices and financing restrictions, the country just can’t have enough of imported vehicles.

If new passenger vehicles are considered a store of value, an inflation hedge and/or an investment product, it is unlikely that any increase in regulatory duty or financing costs will deter their imports. The only option left to explore is an outright ban on import of cars, but that will have its own “distortionary” effects.

On a related note, this is a great thread by Senior Economist of World Bank on how the import restrictions as proposed by Hafiz Pasha and Pakistan Business Council can backfire.