Mobilink Microfinance Bank(MMB): A loan shark in Fintech's clothing

MMB is rapidly growing by aggressively marketing ultra-high-interest rate nano loans, bancassurance products that skim off the premium for commissions and low interest saving products.

I get details wrong sometimes. I tweeted the following when GoP announced the Kamyab Pakistan Program (KPP) in the presses.

Ammar reached out to me and informed me that 8% isn’t that high as the actual origination costs are considerably higher in double-digit territory.

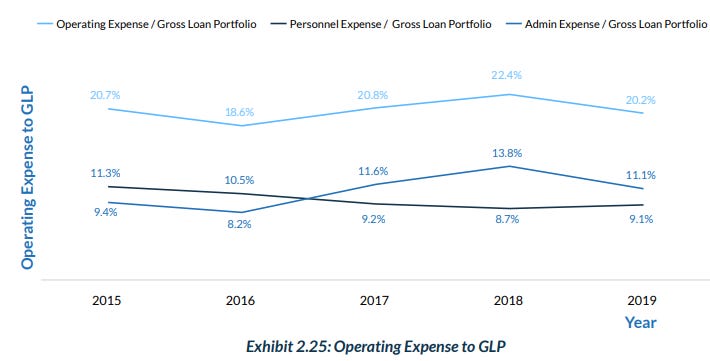

More details became available with the issuance of the operational framework document of KPP. I composed a detailed post on it and searched through the Pakistan Microfinance Network (PMFN) reports to find out the costs of Microfinance Institutes (MFIs). It turns out that the operating cost of MFIs is 20%+.

The entire program stands on the assumption that the 8% subsidy that the GoP is providing suffices to cover the operating expense of MFI. As per PMFN, the operating expense ratio of MFIs is around 20%+.

I dislike the usurious rate that MFIs charge to low-income borrowers and have my doubts about poverty eradication or upliftment MFIs achieve, but discussion of that is beyond the scope of this post. If MFI’s operating expense is 20% and their usual cost of funds is ~10%+, MFIs need to charge above 30% to make money. That is the reason MFIs charge the usurious rate of 36%+ to low-income borrowers.

KPP is reducing the cost of funds of MFI to zero. But the MFI’s still need to cover their operating expenses and 8% is not enough to cover them. The Gross Loan Portfolio of MFIs increased by 3 times from Rs.90 billion in 2015 to Rs.302 in 2019, but the operating expense ratio has remained at 20%. Thus, the MFI business does not have economies of scale.

I concluded with the following:

5. KPP as envisaged, currently presents a dilemma. The success of the program means MFIs will go out of business as it will cannibalize their existing profitable business. Alternatively, MFIs may not offer KPP products, resulting in the program failing to take off.

For reference, these are the rates on loan products of Telenor Microfinance Bank. 36% isn’t unusual.

Mobilink Microfinance Banks (MMB)

Yesterday I learned that Mobilink Microfinance Bank (MMB) is charging interest at a rate of 260% p.a. on short tenor nano loans.

Big power of nano-loans - Newspaper - DAWN.COM

Mobilink Microfinance Bank became the largest provider of micro-credit in terms of the number of active borrowers, recently surpassing Khushhali Microfinance Bank, one of the oldest players. By the end of June, the market share of Mobilink Microfinance Bank was 22.1pc as opposed to 7.4pc a year ago.

“We started offering nano-loans of Rs500 a while back. Its uptake was slow initially as we were also learning and improving our leaalgorithms. As of the last quarter, as many as 1.7m people used nano-credit,” said Mobilink Microfinance Bank CEO Ghazanfar Azzam.

For context, the number of its total active borrowers in the April-June quarter was higher than the corresponding figure for the second and third largest microfinance providers combined.

Telenor Microfinance Bank, another player with a telecom operator as its sister concern, is also actively engaged in the nano segment, although its number of borrowers is lower than that of Mobilink Microfinance Bank.

“The idea was that 60m Jazz customers should not simply stay on as phone customers. They should also be encouraged to turn their phones into bank accounts,” he told Dawn.

As for the interest rate, Mr Azzam insisted that it shouldn’t be seen in annual terms because of its small tenor. So a four-week loan of Rs50 will have a “total fee charged” of Rs12 at a weekly rate of Rs3. This translates into a monthly interest rate of 24pc.

For a loan of Rs4,400 of the same tenor, the total fee will be Rs880 charged at a monthly interest rate of 20pc. The annual percentage rate, a measure often used for loans that are paid back in instalments, comes to 261pc in this case.

The 24%+ p.a. interest rate MFIs charged on microfinance loans was bad enough. Now MFIs are charging an interest rate equal to 260%-288%. If that isn’t loan sharking, then I don’t know what is.

Mr Azzam brushed aside the charge of loan sharking, saying a number of reasons compel the industry to issue loans at rates that are still lower than the ones charged on credit cards by commercial banks.

Loans

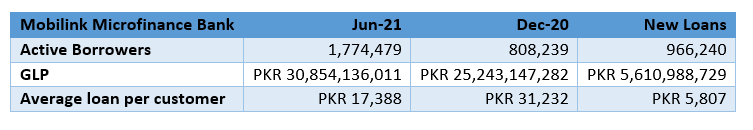

The growth in loans at MMB is staggering. In a span of a single year, MMB lifted its market share from 7.4% to 22.1%, and turned into the largest MFI in terms of active borrowers.

While MMB has the largest number of active borrowers, as per Microwatch issue #60 (April - Jun 2021), its gross loan portfolio (GLP) is the third-largest at the moment.

I went through the Microwatch issue from a year ago i.e. #56 (April - Jun 2020), and MMB wasn’t even in the top 5. This makes the success of MMB even more remarkable.

MMB appears in the subsequent quarter’s issue, #57, with the greatest number of borrowers, but in Gross Loan Portfolio (GLP) terms, it still hasn’t made it to the top 5.

I calculate where the new growth is coming from.

In December 2019, the average loan amount of MMB was Rs.47K. This has dropped to Rs.17K in Jun 2021. Thus, all the growth is from smaller loans, most likely nano loans that charge an interest rate of 250%+. The number of borrowers has roughly tripled.

MMB appears to be a loan shark on a startup like growth spree.

Using FINCA GLP as a proxy for MMB GLP in the above table may understate the size of the new loans. Next, I employ the statistics from Microwatch Issue #58 when MMB also makes it to the top 5 in terms of GLP.

Lo-and-behold. Turns out that employing the proxy was inflating the average loan size. The average loan size to the new borrowers is even smaller, i.e. Rs.5.8K. Nano loan is the tailwind for MMB’s growth.

Is it only MMB or are other MFIs also engaging in nano loans? I calculated the average loan for Khushali Bank which was number one earlier and now has dropped to number two position.

The average loan size of Khushali Bank has actually increased. It seems it is only MMB that is going gung-ho in nano loans.

Interest rate

Let’s calculate the interest rate on the new loans based on MMB’s financial statements.

The average interest rate on the new loans at 64% is approximately double the rate of the Dec 2020 loan book at 34%. The reason it is not 260% is that the nano loans are short tenor loans (duration of a month or less) and by selecting six-monthly loan outstanding numbers we have assumed as if the loans were outstanding for 6 months and therefore our computation of 64% understates the actual interest rate on nano loans.

It could also be that the interest rate alone isn’t the whole story. In addition to the interest rate, the borrower is also charged a loan processing fee and for a nano loan, it may be that the fee is what is taking the total cost to 260%+.

We have established that the rapid drive for nano loans underpins the growth of MMB as the average loan size of the book has decreased from PKR 47K to PKR 17K and the average interest rate on the new loans is at least 64%.

Needless to point out that these are informed guesses arrived at after sleuthing through the financial statements. The financial statements of MMB do not have directors’ reports, which generally present such information with colorful charts.

State of Microfinance in Pakistan

The below are a few of my excerpts from the State of Microfinance in Pakistan report State Of Microfinance In Pakistan – Akhuwat | Islamic Micro Finance]

The Rural Financial Markets study found that nearly two-thirds of the large loans were borrowed for consumption purposes

A study to assess the impact of NRSP found that generally, the income level of households in the control villages is lower than in the treatment villages. However, the differences in the household income between members and non-members or households in the treatment and control villages are not statistically significant.

The PPAF data shows that neither of the two groups, borrowers and non-borrowers made notable contribution to employment generation. Apparently, the size of their business or agricultural and livestock activity as well as the scale of loan is insufficient to make substantial contribution in this area.

The evidence that is given here differs somewhat depending upon whether qualitative or quantitative methods of analysis were used. Where interviews and case studies were conducted they report a much greater increase in consumption of borrowing households. Where quantitative techniques are used for data collection and analysis such as in surveys including both borrowers and non-borrowers, the findings show that there is little or no difference between the consumption levels of borrowing and non-borrowing households.

Either MFIs commission most of the studies, or it’s their donors and NGOs on their board, and it is in everyone’s interest to show that microfinance despite charging anywhere from 30% to 289% is making a huge impact in alleviating poverty, is creating entrepreneurs and helping them launch and grow businesses. But is it really at such exorbitant rates?

Bancassurance

MMB also broke into the top 5 micro-insurance providers in the Mar-Jun 2021 quarter. MMB wasn’t on the list in the earlier quarters.

Presumably, MMB has recently started aggressively selling insurance products, as its income went from 0 in 2019 to Rs.53M in 2020. The income is a result of the commission paid by insurance companies for selling bancassurance products.

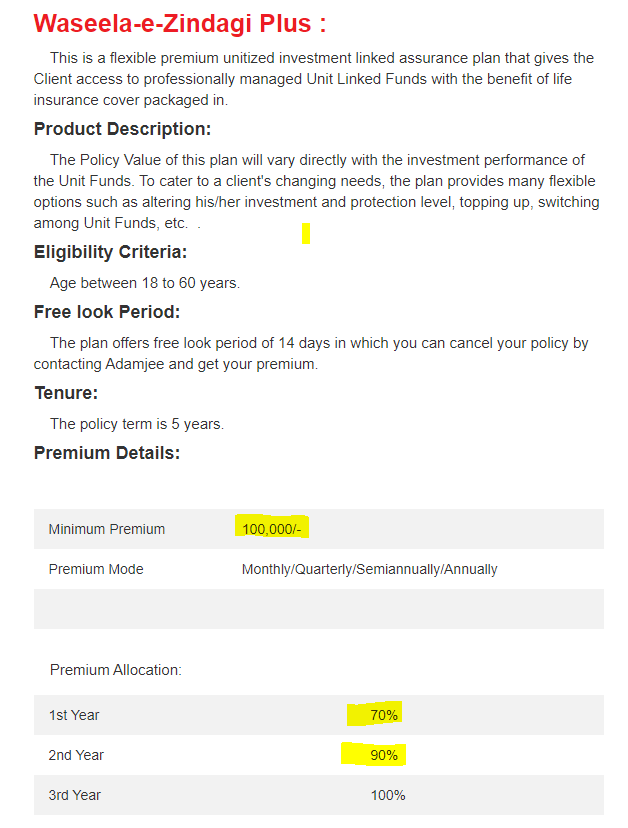

On MMB’s website, three insurance products are listed under bancassurance. You know where this is going. The fee structure of two of the life insurance products is:

I don’t think many of the MFI clients can afford the Rs.100,000 premium of Waseela-e-Zindagi Plus. They would be signing up for Waseela-e-Zindagi (WeZ).

60% of the first-year premium of WeZ is going towards paying commissions. I wonder if the MMB clients have realized what is going on here. They won’t even know how to approach SBP, SECP, Insurance ombudsman, etc. for resolving their problems. Such bancassurance products when sold at commercial banks brought inconvenience and pain to educated, middle-income, and financially savvy clients. I covered the shenanigans of commercial banks regarding bancassurance in the below two posts.

MMB is selling similar products by the same insurance agencies that the commercial banks were shoving down the throats of their depositors.

Savings

CEO of MMB on the savings:

Then the cost of fund mobilisation for microfinance providers is 8-10pc, which is “significantly higher” than that of their commercial banking counterparts, he says. That’s because microfinance providers operate primarily on a lending model, unlike traditional banks. Hardly 15 of the 100 branches of Mobilink Microfinance Bank “actively mobilise” deposits, he said, as the potential for deposits is low in the rural market.

Below are the June 2020 and June 2021 data of

I don’t know, man. In the previous year alone, MMB added 1.3 crore savers - a growth of 66%. Amazing deposit mobilization by just 15 branches.

I would love to learn what is MMB doing to produce such speedy expansion in deposits. I look forward to another conversation of the CEO with Dawn’s Kazim Alam, where Kazim extracts this information from the CEO.

Based on MMB’s 2020 financials, the average interest rate offered on these deposits is around 4%.

That is a pretty low cost of funds. Under the KPP program, GoP is paying commercial banks KIBOR+0.5% (8.5%) and was giving a 100% backstop (now reduced to 50% under pressure from IMF).

MMB has invested 25% of the mobilized deposits in GoP securities, earning 11%.

Growth Expenses

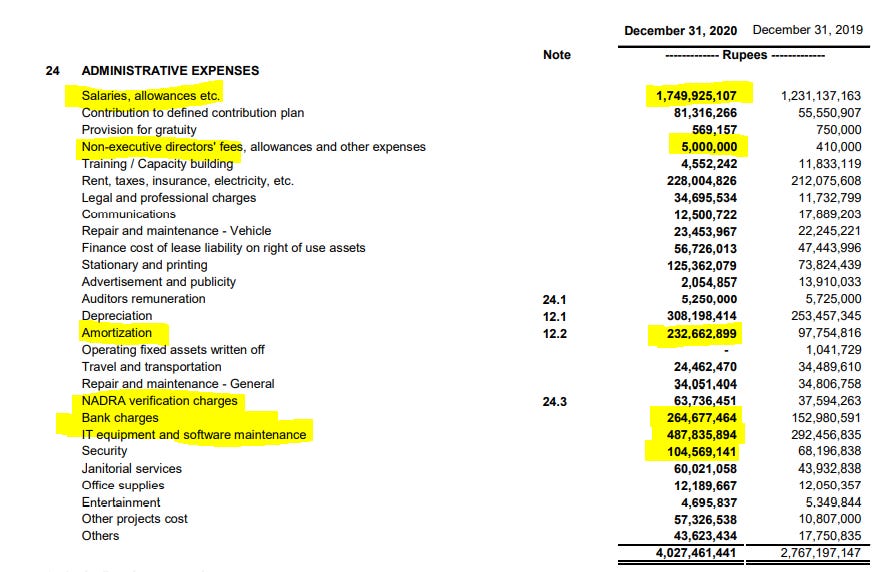

MMB has not attained this growth at the cheap. Salary expenses, bank charges, and NADRA charge all increased. The other highlighted elements pertain to IT infrastructure costs that are needed to achieve this growth in products and client base.

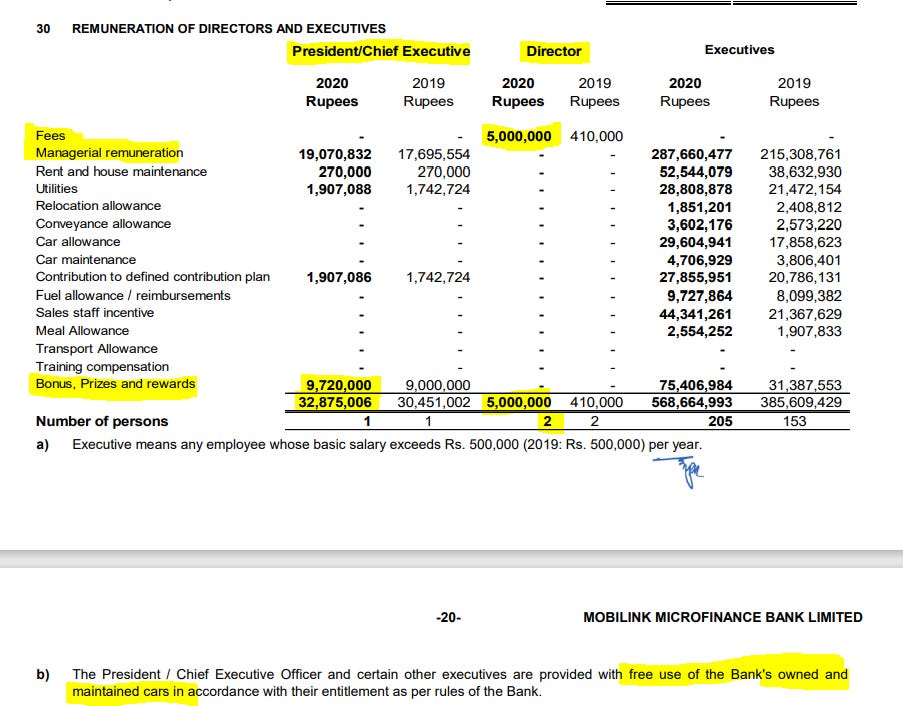

The CEO is remunerated handsomely, so he has drunk the Kool-Aid. Two non-executive directors were paid Rs.5 million between them for attending board meetings. In addition, as per the note at the bottom of the snapshot, the CEO and certain executives also get bank-owned and maintained cars. You can’t erase poverty without those extras.

To summarize,

MMB is growing rapidly by aggressively marketing

Nano loans at an interest rate 260%+,

Bancassurance where 60% of 1st-year premium goes towards paying commissions, and

Saving products that pay around 4%.

Bonus Feature

Nadeem Hussain, Tez Financial and Telenor Microfinance Bank

Telenor Microfinance Bank is another bank which is making a push for nano loans. I don’t want to dwell more on this, but Nadeem Hussain of Tez financial has been campaigning for nano loans. The below news items are from late 2018. It has been 3 years since. It would be good to know how the nano financing experiment of Tez Financial with tech and data science worked out.

A quick solution to your cash crunch - Newspaper - DAWN.COM

The brain behind EasyPaisa and Telenor Bank, Nadeem is optimistic that this is time for tech, and nano.

Tez’s brand equity lies in two things: (lending through) tech and data science. And at the moment both have been outsourced. The former is done by Venturedive - the IT firm looking after Careem’s system - while Nexdegree oversees the latter. How exactly can a startup hope to succeed if its core offerings are being done by someone else?

“We are too young a startup to be able to afford development and analytics on our own so we partnered up these companies, where there’d be specific teams working on Tez and after a certain timeframe, will join us,” Nadeem explains.

Globally, the microfinance industry has come under fire for its exorbitant interest rates. Nano-finance, given even greater risks, ought to have higher interest rates (currently around 15 per cent a month).

Tez Financial transforming data into credit insights (thenews.com.pk

“In order to develop the algorithm, we have to take risk,” said Hussain, co-founder of Tez Financial Services that eyes 20,000 nano-borrowers by this month-end.

One year old startup Tez Financial loans up to Rs10,000 for maximum one month in 10 minutes. It is for everybody who has smartphone, which is the only requirement to be eligible for the loan.

Customers just need to give consent of data being used – no bank statement, no guarantee, no salary statement and no collateral. Their mobile wallet accounts are instantly credited after they fill in a form on the app.

The loan depends on the evaluation of data in smartphone.

The system takes 12,000 data points from the aspiring borrower’s phone.

The startup has already implemented first pilot and its data scientists extracted data of 5,000 consumers.

“We look at the common traits of people who defaulted versus the people who paid back. For example, people who default have lots of incoming calls. Their mindset is to give a call and hang up,” Tez chief executive said. “We are relying on the data. Our algorithm is already learning. We have implemented first pilot and second pilot is of 10,000 and then it will be commercially opened.”