Kamyab Pakistan Program : Too cute by half

The success of the program may result in MFIs going out of business. Alternatively, MFIs may not be onboard with the program, resulting in the program failing to take off.

There has been a flurry of announcements with respect to the Kamyab Pakistan Program (KPP) recently where the government intends to disburse interest-free or subsidized loans of Rs.3.7 trillion over a period of 5 years to 7 million low-income families.

Kamyab Program: Bold, beautiful and workable? - BR Research - Business Recorder

KPP wants to have a cumulative loan disbursement of Rs3.7 trillion (over Rs2tn outstanding loans) across seven million families. Of this, Rs1.2 trillion will be disbursed under Kamayab Jawan (KJ) to 3.5 million new borrowers, Rs700 billion are targeted for Kamayab Kissan (KK) for 2.4 million farmers having land of 12.5 acre or less. The remaining Rs1.8 trillion are for low-cost housing mortgages – this is already operational, but the response is lackluster.

Unlike the flawed schemes that are designed under the "trickle-down economics" such as the presently longest-running money-laundering scheme in Pakistan's history aka PTI's construction amnesty that will eventually end up benefitting the rich or end up in bank accounts, KPP is directly targeting the low-income sector.

To wit, consider the construction amnesty registered project Grove Residency with apartments that are targeting the rich i.e. prices starting around Rs.4 crores. The project is a high-end construction which means that unlike low-rise or mid-rise projects, the construction will be machine intensive (the labor intensity will not be high i.e. not many jobs will be created for unskilled and semi-skilled labour). Most of the fixtures and finishing material may be imported. The developer and contractors on the project may use the income made on the project to buy imported cars, undertake foreign travel or it may even end up in their bank accounts as they won't have a high propensity to consume local goods and services on account of being already well-off. I am exaggerating to make a point.

In contrast, the low-income segment has a higher marginal propensity to consume (theoretically), which means that loans disbursed to this segment may have a higher velocity i.e. it will circulate in the economy rapidly and lead to higher growth. This is called the multiplier effect. The higher circulation/multiplier has the potential to bring the lower strata of the population out of subsistence level quickly and directly. If it is successful, KPP will result in across-the-board bottom-up growth as opposed to the lopsided trickle-down growth through the amnesty scheme which will mainly benefit the already well-off.

In terms of the intent, KPP is truly noble and designed as a comprehensive program focusing on shelter, health, financial inclusion, and skill development. For this post, I am only mainly focusing on Kamyab Karobar and Kamyab Kisan components.

Below are the salient terms of of Kamyab Karobar, Kamyab Kisan and Low Cost Housing (LCH).

Cost of the subsidy

Below line in the operational framework document of KPP.

This is a more efficient structure compared to Direct Funding by GOP which is financed by borrowing through T-Bills and PIBs given the Multiplier effect

To unpack the above statement, we need to compare the KPP structure with the Direct Funding structure.

1. KPP Structure

Kamyab Kissan and Kamyab Karobar offer micro-loans of up to Rs.500,000. Commercial Banks (CBs) are not in the business of making microloans. Micro-Finance Institutions (MFIs) are in the business of offering microloans. On the other hand, CBs are flush with liquidity whereas MFIs are always short of funds.

Under the proposed KPP structure, CBs will lend to MFIs at 0%. CBs are not in the business of providing free money. To compensate the CBs for the cost of funds, GoP will pay KIBOR+0.5% p.a to CBs. In addition, GoP will provide a 100% loss guarantee to CBs. As far as CBs are concerned, this is risk-free lending __ it is as if CBs are lending to GoP at KIBOR+0.5% p.a.

In turn, MFIs will lend to low-income borrowers at 0%. The cost of funds of MFI is zero as they are receiving money at 0% from CBs. However, MFIs are doing all the leg work in this structure. MFIs identify the borrower, assess for creditworthiness, disburse the loan and administer the loan for repayment. To compensate for this leg work, GoP will pay MFIs 8% p.a. on the outstanding loan amount. In addition, GoP will absorb the first loss of up to 10% of the loan amount of the MFIs.

The total subsidy calculated by GoP for the first year is Rs. 21 billion on an average outstanding of Rs.271 billion. Thus it cost only Rs. 21 billion for GoP to arrange disbursement of loans of Rs.315 billion. Thus in 2022, GoP will have to issue PIBs of Rs. 21 billion, and it will result in loan disbursement of Rs.315 billion.

The subsidy multiplier is 15x in 2022 and goes down to 3x by 2026 as the subsidy on the outstanding loans increase. The average of multiples (15,7,5,4,3) comes to around 6. Thus when the KPP document states that the multiplier is 6, this is what GoP is referring to and not the economic multiplier.

However, I think this is the wrong way to calculate the multiplier. GoP is only considering the disbursement amount when calculating the multiplier. We need to consider it cumulatively. The cumulative disbursement over 5 years is Rs.3.7 trillion at a subsidy of Rs.926 trillion. This translates into a multiplier of 4x. This assumes that Rs.2 trillion that is outstanding at year-end will be repaid in full at year-end. We know this to be unrealistic. Even if GoP does no disbursements after 2026, GoP still has to pay subsidies on the outstanding Rs.2 trillion loans as they are paid down over the next few years. Thus the actual multiplier will be even lower maybe around 3x. This is not the only way to calculate the multiplier. One may use the average outstanding during the year to calculate it instead of the cumulative disbursement. That may result in an even lower multiplier.

This is the first time that I have come across a scheme where the multiplier is cited to justify the structure. Let's go by the usual benchmark i.e. cost of the subsidy as a percentage of the loan amount. If we assume a KIBOR rate of 8%, the per annum subsidy (before loan loss guarantee) comes to around 16.5% i.e. (8% KIBOR + 0.5% CB spread + 8% MFI overhead).

The aforementioned calculation assumes the prevailing KIBOR rate. If the KIBOR rate goes up because Reza Baqir wants to attract hot money, the subsidy amount increases and the multiplier decreases further.

2. Direct Funding

The way it works is GoP will issue PIBs of the loan amount to be disbursed. Thus for disbursing Rs.315 billion, GoP would issue PIBs of Rs.315 billion. The multiplier here is 1. Contrast this with KPP mechanism where GoP was issuing PIBs of Rs. 21 billion only for disbursing Rs.315 billion loan. As I have stated, the multiplier is the wrong benchmark to use.

The cost of 3Y PIBs today is 9%. Add 8% spread of MFIs, the total subsidy comes to around 17% (before loan loss guarantee).

The advantage compared to the proposed KPP structure

The cost of funding is fixed if the funds are raised through fixed-rate PIBs. The cost of the subsidy will not fluctuate based on the KIBOR rate.

The disadvantages:

The cost is slightly higher than what it would have under the KPP mechanism because the PIB rate is higher than the CB spread.

The federal government has to decide which MFI to fund. This may add 1-2% as overhead.

3. Quasi Fiscal Activity (QFA)

This approach is not mentioned anywhere. I am adding it for "chaskay k liay". It appears that SBP has had enough of quasi-fiscal activities after the Covid19 stimulus. If SBP wanted to fund the KPP through QFA, the mechanism would be SBP provides refinancing to CBs at 0% and CBs provide financing to MFIs at a spread of 1%. The MFIs keep their spread of 8%. The total subsidy cost here would be 9% (which is much lower than both KPP and Direct funding) before the loan loss guarantee. 1% spread to CBs is due to the fact that MFIs don't have an account with SBP and we need CBs to act as the intermediary. We have discussed in my Central Bank Digital Currency post that SBP Act allows SBP to open and maintain accounts of individuals and companies. If the SBP allows MFIs to directly open an account with SBP, we can save the 1% spread that we are paying to CBs thus reducing the cost further.

Advantage

The cost of the subsidy is almost half of the KPP model which implies the multiplier is almost twice.

The cost of funds and thereby subsidy is fixed and will not vary with the discount rate, KIBOR, or inflation.

Disadvantage

SBP's balance sheet will have to increase significantly. The current Balance Sheet size of SBP is Rs.14 trillion. The SBP balance sheet will increase by almost 15% i.e. Rs. 2 trillion by end of 2026 on account of KPP.

SBP will have to decide which MFI to fund. However, SBP being a regulator can easily develop the skillset to assess MFIs.

To summarize,

MFI issues

MFI Capacity

As mentioned above, MFIs are expected to do all the legwork of disbursing and administering the loan while SBP and CBs provide oversight. Do the MFIs have the capacity to extend the loans?

It is hard to do a comparison when data is not apples-to-apples. The data on the left graph is from Pakistan MicroFinance Network Review 2019 report. The PMFN report doesn't provide info on new disbursements every year (flow). The KPP does not provide a breakdown of the outstanding balance (stock) of the Kamyab Karobar and Kamyab Kisan program which would be the comparable number to PMFN data. Thus I am using the disbursement data on the right side. What is to be noted here is that the total outstanding loan balance of MFIs was Rs.302 billion in 2019. KPP projects that almost equivalent of loans Rs.276 billion will be disbursed in 2023 and the disbursement amount again will double in another three years. (I have excluded the Low-Cost Housing disbursements to keep the comparison as apples-to-apples as possible). Though in percentage terms, the historical increase is similar, one needs to keep in mind the low base of historical numbers.

If I add the low-cost housing, the total disbursement in 2022 is almost equal to the outstanding balance of 2019 and the new disbursement is expect to increase by 4 times in 5 years i.e., from Rs.315 billion in 2022 to Rs.1.1 trillion in 2026.

I do not think that these are realistic projections.

MFI cost of operations

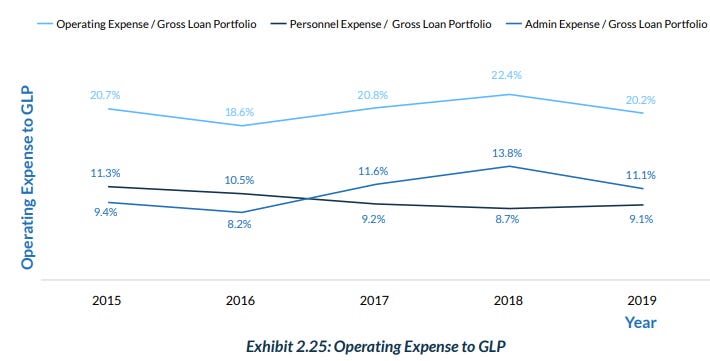

The entire program stands on the assumption that the 8% subsidy that the GoP is providing is sufficient to cover the operating expense of MFI. As per PMFN, the operating expense ratio of MFIs is in the range of 20%.

I dislike the usurious rate that MFIs charge to low-income borrowers and have my doubts about poverty eradication or upliftment if any, MFIs achieve but discussion of that is beyond the scope of this post. If MFI's operating expense is 20% and their usual cost of funds is ~10%+, MFIs need to charge above 30% to make money. That is the reason MFI's charge the usurious rate of 36%+ to low-income borrowers.

KPP is reducing the cost of funds of MFI to zero. But the MFI's still need to cover their operating expenses and 8% is not enough to cover them. The Gross Loan Portfolio of MFIs increased by 3 times from Rs.90 billion in 2015 to Rs.302 in 2019, but the operating expense ratio has remained at 20%. Thus the MFI business does not have economies of scale.

Cannibalization

After KPP, MFIs will have two loan products. One, Existing ones charge the borrower the usurious rate of 36% and keep the MFI's lights on and two, KPP that charges the borrower 0% and pays 8% to MFI an amount which is less than half the operating expense ratio of the MFI.

The borrowers (new as well as existing) will request the KPP loan with the result that MFIs’ current usurious loans will be paid down to zero. MFIs may not be able to sustain this and there is a likelihood that the success of KPP as envisaged right now will result in MFIs closing shop. Alternatively, MFIs may not offer the KPP product with the result that KPP will fail to take off.

Conclusion

MFIs expend significant time and resources in assessing the creditworthiness of microfinance borrowers and the administration of microfinance loans. The cost of the resulting overhead is ~20% of the loan outstanding. GoP is paying only 8% to MFI for this and providing a loan-loss guarantee of 10% only.

Commercial Banks are earning KIBOR + 0.5% and are provided a 100% loss guarantee. Commercial banks are enjoying a risk-free return of KIBOR + 0.5% for lending to MFIs.

GoP is assuming that the multiple is 6x and consequently deems the subsidy cheap. The actual multiple will be closer to 3x and the cost of the subsidy is closer to 16.5% (at current KIBOR and ignoring the loan loss guarantee).

If the program was funded through SBP refinancing, the cost of subsidy could be almost halved. The 8% savings could then be paid to MFIs making the MFI's total subsidy at 16% (much closer to their overhead rate of 20%).

KPP as envisaged currently presents a dilemma. The success of the program means MFIs will go out of business as it will cannibalize their existing profitable business. Alternatively, MFIs may not offer KPP products resulting in the program failing to take off.

My background is in corporate banking so my understanding when it comes to microfinance may be flawed. Experts in the microfinance industry can provide a more detailed and correct analysis and may even disagree with my conclusions.

Further Reading

Kamyab Program: Bold, beautiful and workable? - BR Research - Business Recorder (brecorder.com)