Islamic Mutual Funds Respond: Leading to more questions.

I wrote a post on Al Meezan Sovereign Fund’s (MSF) flawed benchmark asking tongue-in-cheek if this makes the benchmark unIslamic. The Profit published an article on it too titled Inside the high returns of the Meezan Sovereign Fund. Being a print publication, they reached out to the mutual funds to get their viewpoint. The reponse gave me a reason to do another post on the topic.

A few questions

This is what Al Meezan said to The Profit

When reached for comment, the management at Al Meezan stated that there was a dissonance in the markets as the government had not issued any Islamic bonds. Trying to use old or unrelated data to calculate benchmarks would not be advisable in such circumstances. This has been stated by the management at many of the other AMCs as well as they were told to change this benchmark. In such a case, the SECP asked the funds to change their benchmark to the deposit rate being offered by 3A or higher rated Islamic banks.

Al Meezan said that there was “dissonance” because 6M PKISRV wasn’t available and as such SECP asked the funds to use the deposit rate of Islamic banks. This simple response raises many questions. Let’s begin:

How does it make sense to replace a dissonant benchmark with an irrelevant benchmark?

If SECP asked the funds to use the irrelevant benchmark, then why is UBL’s Al Ameen Islamic Sovereign Fund not using it? Did SECP give the funds an option to choose whichever benchmark they wanted to use and Al Meezan went with the lowest one?

Was it really SECP that asked the Islamic sovereign funds or was it Al Meezan who approached SECP to allow them to use the bank deposit rates?

Why didn’t SECP suggest a more relevant benchmark as the new benchmark doesn’t convey any information about the performance of asset managers?

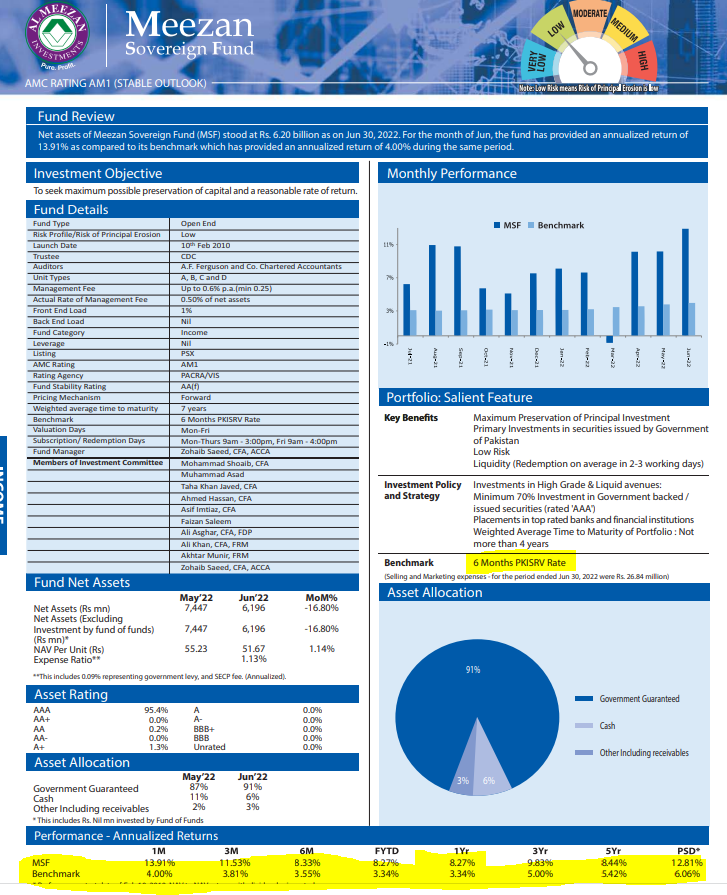

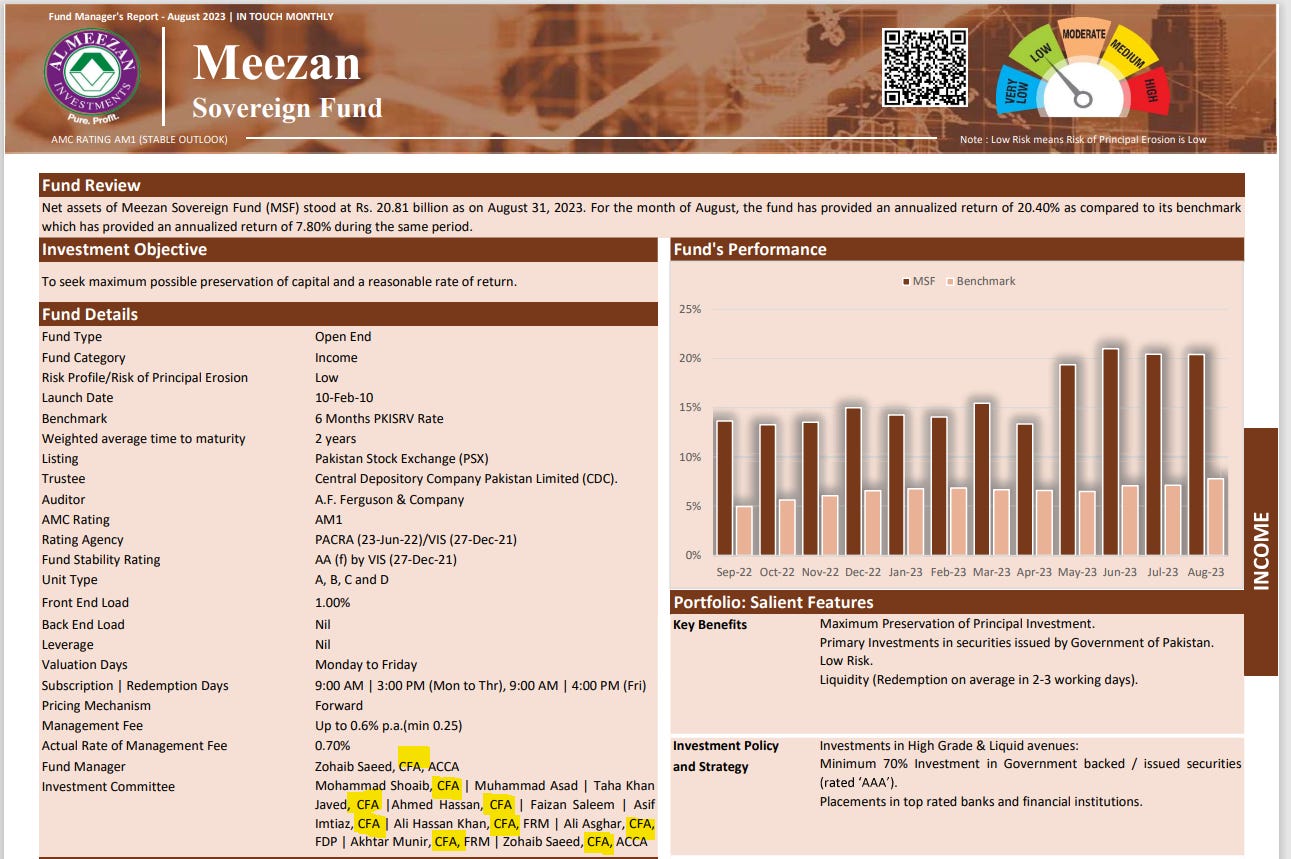

Once MSF received the approval or direction from SECP and changed its benchmark (it appears that the benchmark was changed more than a year ago - See below from June 2022.), why does Al Meezan continue to report 6M PKISRV rates as the benchmark?

The Profit also reached out to the CIO of HBL Asset Management for comments who seconded what Al Meezan said.

Muhammad Ali Bhabha, Chief Investment Officer at HBL Asset Management states that the benchmark return is supposed to be 6 month PKISRV rate and “since no instruments were available in the market…..(it) was replaced with 6 month deposit rates of 3 A and above rated scheduled banks selected by MUFAP. Since 8th September…..GOP IS (Islamic) issue is available now.” Based on this issue, it is expected that the benchmark rates will be approved and converge around 20 percent.

I wanted to see if HBL Asset Management also uses the irrelevant benchmark for their sovereign fund but unfortunately, HBL Asset Management doesn’t have such a fund. However, they have their Islamic money market fund which uses the bank deposit rates as the benchmark and has been consistently outperforming the benchmark by more than twofold.

This leads me to my next question

Isn’t the Islamic bank saving rate also a “dissonant” benchmark for the HBL Islamic money market fund?

Why do the funds keep using this irrelevant benchmark that even the worst-performing fund manager in the universe could easily beat? One theory I heard is that fund managers’ and investment committees’ performance bonus is tied to beating the benchmark. So it is in their best interest to have a benchmark that is dissonant/irrelevant and low.

Half-jokingly, can a bonus earned by beating an irrelevant benchmark be Islamic/Halal?

We understand why fund managers aren’t in a hurry to update this benchmark, but MUFAP would have been noticing that these Islamic funds are consistently beating the benchmark, and that too by a large margin. Why MUFAP did not issue a circular updating the benchmark?

Now that SECP, MUFAP, and the funds are aware that we know that the benchmarks for Islamic money market funds are irrelevant, when will they update the benchmark?

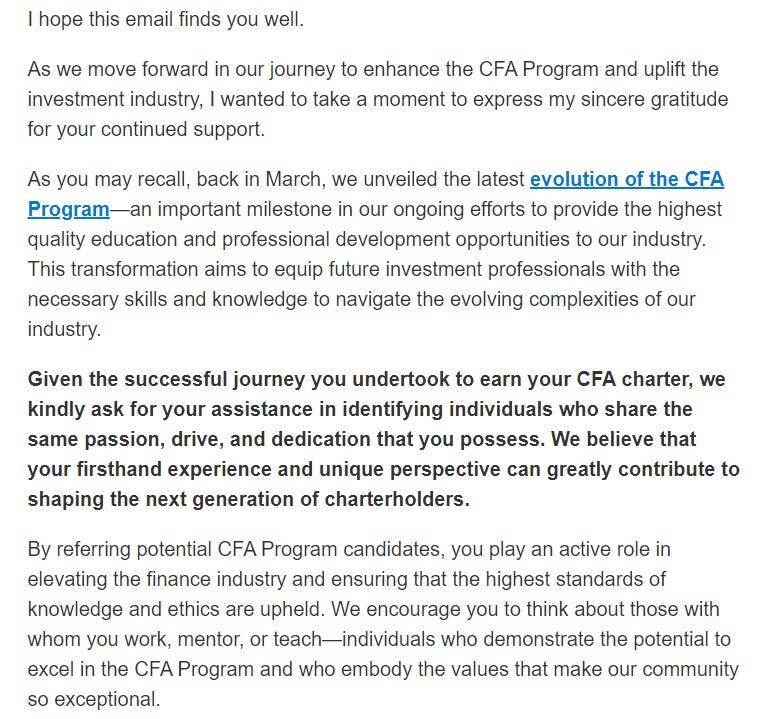

Irrelevance of CFA

This email went out to all CFA Charterholders earlier this week.

I am glad that CFA is becoming irrelevant. Look at the Investment Committee of MSF and count the number of CFA charterholders. While the CFA Institute frequently emphasizes ethics and the need to “embody the values that make our community so exceptional”, it is disconcerting to see that CFA charterholders have no qualms about reporting their results against a benchmark that is dissonant and irrelevant. HBL Asset Management CIO is also a CFA charterholder.