Fool in the shower: Part Deux

Imposing 100% cash margin on import LCs of 114 items is too cute by half

Immediately after announcing the increase in the policy rate to “anchor inflation expectations”, SBP revised prudential regulations to clamp down on car financing and personal loans. We talked about it earlier in the below post.

Without waiting for the impact of the above measures to reflect in the numbers, earlier this week, SBP issued a press release and a circular imposing a cash margin of 100% on the import of certain items.

SBP Imposes 100% Cash Margin Requirement on Import of additional 114 Items

The State Bank of Pakistan (SBP) has decided to impose 100% Cash Margin Requirements (CMR) on import of 114 items, taking the total number of items subject to Cash Margin to 525. The measure will help discourage imports of these items and thus support the balance-of-payments. This is the second step taken in recent days, in this regard. Earlier, SBP revised prudential regulations for Consumer Financing prohibiting financing for imported vehicles.

Cash margins are the amount of money an importer has to deposit with its bank for initiating an import transaction, such as opening a letter of credit (LC), which could be up to the total value of import. Cash margins essentially increase the cost of imports in terms of the opportunity cost of amount deposited and thus discourage imports.

It would be pertinent to mention here that 100% cash margin requirement was initially imposed, in 2017, on 404 items to discourage the import of largely non-essential and consumer goods. The list was further expanded in 2018. However, in order to enable businesses to absorb the shocks of COVID19 pandemic, SBP provided relief by removing CMR on 116 items.

With economic growth having recovered and gaining momentum, SBP has decided to adjust its policy by imposing Cash Margin Requirement on additional 114 import items. This will complement SBP’s other policy measures to ease the pressure of import bill and help to contain the current account deficit at sustainable levels.

The circular attached to the press release has an annexure listing 114 items along with their HS code. Below is a snapshot of the list

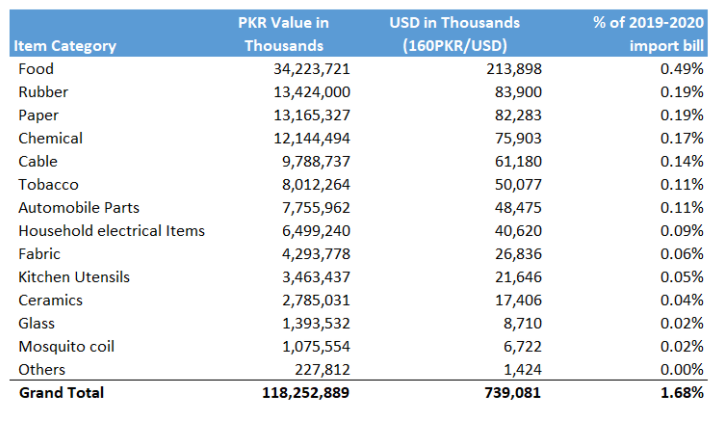

Using Excel’s Lookup function on the data from the Pakistan Bureau of Statistics for 2019-2020, it turns out that the 114 items made up only 1.65% of the 2019-2020 import bill. The total bill for these items in 2019-2020 was $740 million (at PKR 160 / USD). I don’t know about you, but I fail to see how imposing a cash margin on goods that comprise less than 2% of our import bill is going to help contain our current account deficit.

Below, I have distributed the 114 items into categories. These aren’t official categories. I made those up and, using my judgment, classified each of the 114 items as belonging to a particular category (Occasionally, I just have a lot of time on my hands. Actually no. I was rather hoping that someone else will write on this subject. I even suggested to Uzair to write on it, but unfortunately no one is interested. The responsibility fell on me, not that I am complaining).

The largest category is food. If you are wondering, no, the category does not include gourmet cheese.

Except for non-alcoholic beer, I do not think there is any luxury item in the above list. Most of these are essential food items. The largest item is what is used in animal feed. I am guessing those animals that feed on this “imported” material, once fully grown, will eventually make their way onto our plate. Assuming the feed is for poultry or goat/cows, this measure by SBP will make meat consumption expensive. If SBP wants to make us vegetarian or vegan by making meat beyond the reach of the population, it is a noble goal indeed, and SBP can use it to burnish its ESG credentials. Changing the populations’ food consumption pattern, I would presume, is outside SBP’s jurisdiction, but when has that prevented SBP earlier.

I leave the analysis of the rest of the list to the reader. Bottom line, items in Food category comprise less than 0.5% of Pakistan’s import bill.

UPDATE:

On the feed for animals

The next two categories are paper and rubber. The paper includes writing paper and Kraft paper, which is mainly used in packaging material both for local items and for exports. I am not intelligent enough, but I hope the readers of this post can think of the reasons why paper and tires need to be made expensive. Together these make 0.38% of the import bill.

Next, we have cable and chemicals, which combined are 0.31% of import bill. I don’t know about these items to have an opinion.

Next was tobacco. Ban its import for all I care. But then how would FBR meet its targets. Moreover, there is a chance that banning imports will lead to smuggling, which will be detrimental both from revenue perspective and fx perspective. I am ok with 100% cash margin on tobacco (0.11% of 2019-2020 import bill).

The next items are those that should be increasing as a consequence of GoP’s construction amnesty and SBP’s push for construction financing. Everyone, except for GoP and SBP’s public relations departments, knows that the construction amnesty has only benefited the elite of the country. These elites will whiten their ill-gotten money, finance construction of high-end units due to SBP’s construction financing push, use the whitened money to install imported electrical devices and ceramics. For those who have whitened millions of rupees, they really don’t care if the imported items that they want to be installed in their house cost a few thousand rupees more due to 100% cash margin.

Below news is from 5 days ago, wherein HBL and DIB are announcing a large financing for an elite housing society. They thank SBP and GoP for this.

Next, we have automobile parts that are used by local assemblers. These comprise 0.11% of the import bill in 2019-2020. The percentage may have increased this year due to SBP itself promoting car financing, including Roshan Apni Car for overseas Pakistanis.

Mosquito coils, that were 0.02% of the import bill in 2019-2020, are also included in the SBP annexure.

No idea what SBP expects to achieve by making import of mosquito coils expensive, considering the following:

Business Recorder has an editorial on dengue today.

Referring to the last line, we don’t know if bodies of medical practitioners are doing anything, but we know that the central bank has made it expensive to import mosquito coils to help with the current account deficit.

Now let’s revisit the SBP press release about the cash margin

SBP Imposes 100% Cash Margin Requirement on Import of additional 114 Items

The State Bank of Pakistan (SBP) has decided to impose 100% Cash Margin Requirements (CMR) on import of 114 items, taking the total number of items subject to Cash Margin to 525. The measure will help discourage imports of these items and thus support the balance-of-payments. This is the second step taken in recent days, in this regard. Earlier, SBP revised prudential regulations for Consumer Financing prohibiting financing for imported vehicles.

Cash margins are the amount of money an importer has to deposit with its bank for initiating an import transaction, such as opening a letter of credit (LC), which could be up to the total value of import. Cash margins essentially increase the cost of imports in terms of the opportunity cost of amount deposited and thus discourage imports.

It would be pertinent to mention here that 100% cash margin requirement was initially imposed, in 2017, on 404 items to discourage the import of largely non-essential and consumer goods. The list was further expanded in 2018. However, in order to enable businesses to absorb the shocks of COVID19 pandemic, SBP provided relief by removing CMR on 116 items.

With economic growth having recovered and gaining momentum, SBP has decided to adjust its policy by imposing Cash Margin Requirement on additional 114 import items. This will complement SBP’s other policy measures to ease the pressure of import bill and help to contain the current account deficit at sustainable levels.

To summarize, SBP hopes to control current account deficit by imposing a 100% cash margin on items that comprise less than 2% of import bill. In terms of value, 25% of the items on the list comprise essential food items. Another 15% by value are such items as imported tiles, ceramics, kitchen electronics that would be a consequence of GoP’s construction amnesty and SBP’s push for construction financing and may not be affected by the cash margin at all as the end users are immune to such minor inconveniences as 100% cash margin. The rest is rubber, chemicals, paper etc. While dengue is prevalent, SBP feels that imposing a 100% cash margin on mosquito coils that comprise 0.02% of Pakistan’s import bill is beneficial.

A lot of tweeps are upset that why do we import black pepper or mosquito coil, not realizing that the import value is small. Just because it is on SBP’s list doesn’t mean we are importing tonnes of this stuff.

When I started this substack, and I mentioned this earlier as well, I did not expect to continue to publish as many posts as I have. I expected to run out of material after 5-6 posts, with half of those comprising real estate. This is me expressing gratitude to Reza Baqir and SBP who continue to provide me the material to continue with this. Also, a big thank you to you too, dear reader, for continuing to read and share it.