Did the size of SBP's balance sheet decrease under Reza Baqir?

In the last four months of Reza Baqir's tenure, SBP expanded its balance sheet by Rs.2.5 trillion.

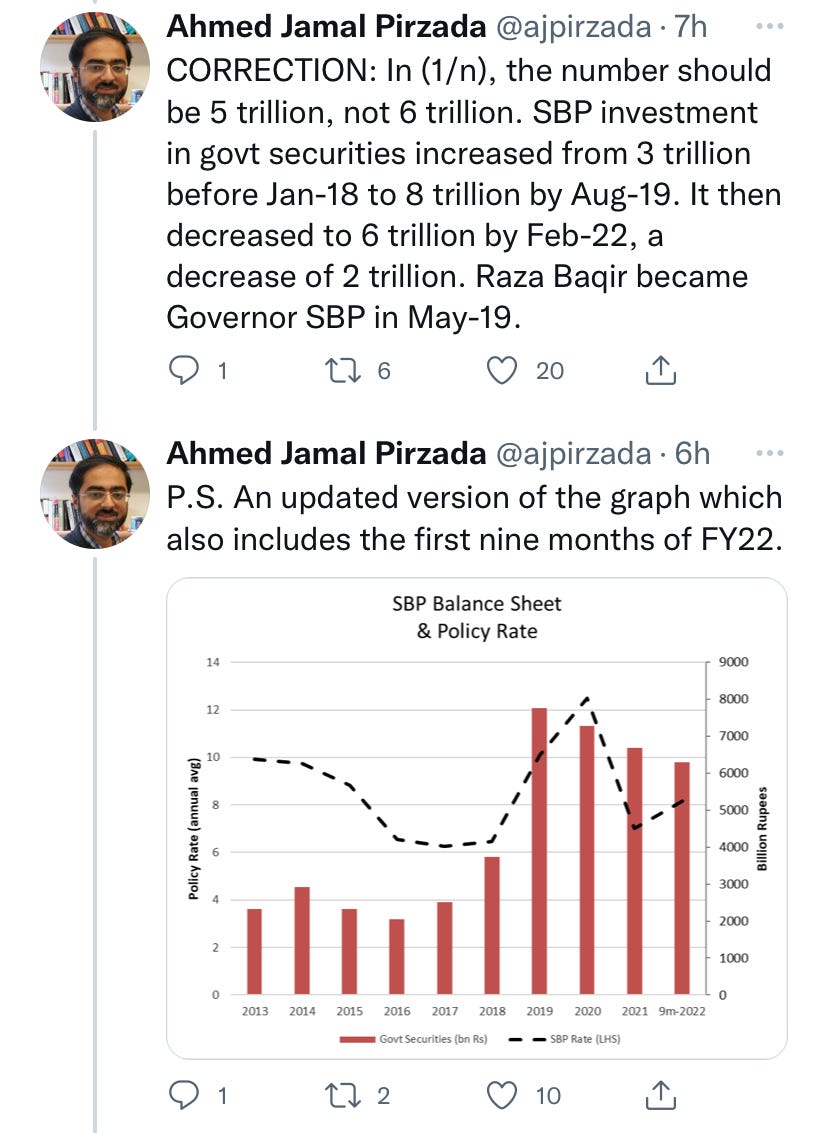

Esteemed Professor Ahmed Jamal Pirzada tweeted that SBP’s balance sheet decreased by Rs. 2 trillion during Reza Baqir’s tenure.

But did it?

For the purpose of this post, there are three ways that the central bank can expand its balance sheet:

Purchase of government securities from the primary market (what was happening in the last days of PML-N).

Purchase of government securities from the secondary market, aka Quantitative Easing (QE).

Reverse Repos (RRPs), which in normal circumstances are temporary expansions of the balance sheet.

The assumption in the aforementioned tweets is that SBP only lends to the government by buying government securities from the primary market. But readers of this substack know that SBP is also lending to the government through reverse repos (RRPs). I have covered it many a time (most recently in “SBP is encouraging carry trades”) so I will not repeat the arguments in detail here.

You don’t have to take my word for it. The Governor of SBP said it in his own words in answer to The Profit question

Status quo policy rate: 9.75% - Profit by Pakistan Today

In response to a question posed by Profit about the OMO injection, Baqir responded that the SBP in accordance with the SBP Act, while not being able to lend directly to the government, can step in and inject liquidity when needed.

The crux of my post was that it is an open secret of Pakistan’s money market that RRPs are SBP lending to the Government of Pakistan through the backdoor and not what is normally construed as temporary liquidity injection.

Ali Khizar also mentioned in his BR Research piece that the RRPs, which are supposed to be temporary, have become permanent.

Permanent liquidity shortage? - BR Research - Business Recorder (brecorder.com)

….The point to ponder is that liquidity shortage is being consistently over Rs1 trillion and even after normalizing, it may hover around Rs1.5 trillion – 10 percent of deposits.

That is too high a number. This implies that a decent chunk is becoming permanent liquidity shortage.

Thus, while Reza Baqir may be reducing the size of the balance sheet by letting the primary market purchased government securities mature, he is increasing the size of the balance sheet by engaging in permanent and ever-larger RRPs. The question we need to answer: on a net basis, is the size of the SBP balance sheet SBP decreasing?

I have made the following table based on SBP's statement of affairs.

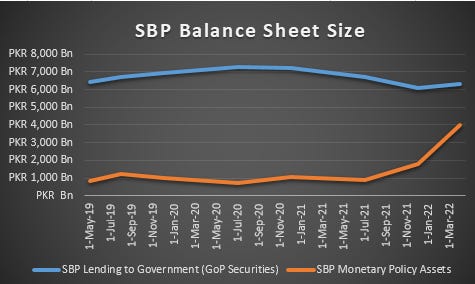

The timeline starts from May 2019 when Reza Baqir joined SBP. We can see that SBP’s holdings of GoP securities continued to increase even after Reza Baqir joined, but then declined afterward. However, SBP’s lending to the GoP through RRPs after remaining stable initially went ballistic in FY2022. I don’t have the data available in Excel readily, but if Ali Khizar is to update the chart with data till April-end 2022 (four days before Reza Baqir’s term ended), this is how it will appear. Not a pretty sight.

Graphing the table, we see that any benefit from the decrease in SBP’s holding of GoP securities was negated and then some by SBP’s RRPs.

This is how the size of SBP’s Balance Sheet evolved, combining the two assets (SBP holdings of GoP securities and Monetary Policy Assets).

Also, to be noted that the increase in SBP’s balance sheet just in the last four months of Reza Baqir’s tenure i.e., from Jan 1, 2022, to Apr 30, 2022, is almost Rs.2.5 trillion.

Thus, contrary to popular perception, the size of SBP’s balance sheet increased during Reza Baqir’s tenure. You can make your own assessment if this is extremely inflationary, as the original tweet implied.