Capital controls through the back door in Pakistan?

SBP making it harder to invest in foreign currency

The freezing of foreign currency accounts was the last time when SBP took a drastic step to impose capital controls. Since then, SBP has wisened up and instead of shutting the barn door after the horse has bolted, is taking multiple measured steps in the hope of stopping the outflow of FCY.

We covered some of the measures earlier such as discouraging financing of imported cars and the ridiculous step of imposing 100% margin on imports of items that comprise less than 2% of import bill.

This was followed by imposing curbs on outflow of cash FCY.

And rounding up CEO of Paracha Exchange for helping the money to flow abroad.

All of the above steps show SBP leading from the front. Now SBP has also started tightening the screws behind the scenes.

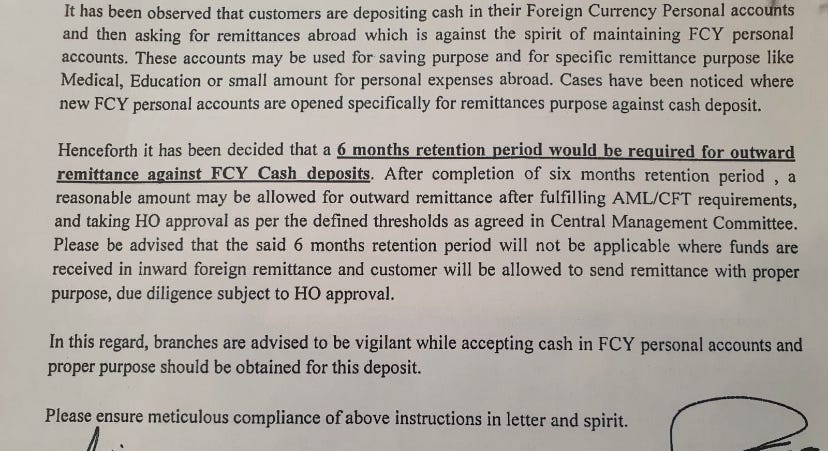

Below is a internal circular from Habib Meteopolitan Bank (HMB).

As per the circular, remitting from FCY accounts is against the “spirit of maintaining FCY personal accounts”. This is news to me that banks presume a certain spirit when opening personal FCY accounts.

The unusual thing here is that HMB isn’t the only bank doing it. Quite a few banks have imposed similar limitations of three months or six months ie FCY funds should remain in the account for a certain period before the money could be remitted abroad. As all the banks are doing it, without any formal notification from SBP and without sharing any circular or notification with the customer, this indicates that the instructions have come from above most likely SBP. Moreover, such instructions aren’t in writing as SBP doesn’t want to show that it’s panicking. But panicking it is.

I have no investment advice to give. Talk to your investment advisor on how to proceed in such circumstances.