Are Naya Pakistan Certificates camouflaging hot money?

Arbitrage opportunity to earn 15% in Naya Pakistan Certificates by levering up 10 times.

Would you believe me if I tell you that the earnings of foreign banks maybe three times the earning of overseas Pakistanis from the Naya Pakistan Certificates (NPCs)/ Roshan Digital Accounts(RDAs)?

Tricks of the Trade

Let's start with a small digression. I started my career at a small bank in the early 2000s (that bank is huge now but it was small at the time). It didn't have the capital to make large loans to corporate or blue-chip clients. We could lend to SMEs but SMEs are high-risk borrowers. No bank wants to lend to them unless SMEs provide good security preferably in the form of lien over national saving certificates or interest-bearing deposits. A mortgage over land is not considered a security by bank management or risk committees as it is hard to enforce it. SBP considers the land as security, which is beneficial as will become clear below.

SME owners who are shrewd don't keep all of their money in Pakistan as there is always a risk of taxman getting a whiff and attaching the account. A few of the smaller banks (including us) had sister banking institutions registered in European countries where banking privacy laws were stricter making the deposit accounts in those institutions out of the reach of our taxing authority. SME owners would arrange to deposit their 'undocumented' cash in these overseas institutions. We would arrange for a lien to be placed on that deposit. This lien will not appear anywhere in Pakistan because as far as anyone in Pakistan such as SBP / FBR is concerned, this deposit didn't exist.

Our credit proposal to the senior management/credit committee will recommend lending money to this borrower against a mortgage on their land. On a corner of the credit proposal, known only to the relevant people in the bank, there will be a small tag or symbol indicating that the loan is being provided to the borrower against a lien placed on their cash in a foreign country. It is 'almost' a risk-free loan (it is not completely risk-free but going into that is beyond the scope of this post). As far as the State Bank of Pakistan and FBR are concerned, the loan is being provided against the mortgage on the land. SBP reporting will show that the bank is lending against a mortgage. Maybe SBP was aware of it (I highly doubt it) and chose to look the other way.

For what it’s worth, banking to high net worth individuals (HNWIs) globally is mainly this i.e., helping/advising HNWIs to 'evade' (I have deliberately written evade instead of avoid) taxes.

The point of this digression was that SBP reporting (with or without the knowledge of SBP) does not always portray an accurate picture.

Hypothetically Levering up Naya Pakistan Certificate

A couple of months ago I did a Twitter thread giving a hypothetical example of how shrewd and savvy bankers can help high net worth overseas Pakistanis earn double-digit returns in US dollars on the Naya Pakistan Certificates. Later I deleted the thread as

اس میں کچھ پردہ نشینوں کے بھی نام آتے ہیں

What unnerved me at the time was some of my colleagues ("partners in crime" is too strong a phrase) from that small bank refused to believe that it was possible. Now that I have the actual term sheet (someone was generous enough to share it with me), I can do this post without going into hypotheticals.

I had given the example of UBL Dubai. One of the objections was UBL Dubai does not have the dollar deposit base to carry this out on a large scale (UBL has access to a large GBP deposit base in the UK though). This was a valid objection. But then, there are other banks in Dubai that have access to large dollar deposits and have signed up for RDA/NPC program.

The example I tweeted worked in the following manner:

The customer approaches UBL Dubai with $10,000 to invest in NPCs.

UBL Dubai gives a loan to the customer three times the size of equity i.e $30,000.

UBL Dubai remits this to UBL Pakistan to issue NPCs in the RDA of the customer.

UBL Pakistan then issues a standby LC of $30,000 against the NPCs to UBL Dubai.

UBL Dubai uses this SBLC to secure the $30,000 loan to the customer.

Thus the $30,000 loan that UBL Dubai gave to the customer is 100% secured with the SBLC. If the customer had only deposited $10,000, he would be getting 6% which is $600. But now the customer is getting $2400 (i.e. 6% on $40,000). From this, the customer will have to pay interest on the $30,000 he borrowed from UBL Dubai. As it is a low-risk loan (100% secured by SBLC), the cost of borrowing will be low. Let's assume 3%. The customer will pay $900 to UBL Dubai (3% on $30,000). In addition, UBL Pakistan will be charging a fee on the SBLC say around 1%. That's another $300 (1% of $30,000) that will be deducted. SBLC is secured by a lien over the NPCs so it is also low risk.

The borrower will be getting $1000 on $10,000 investment which is a return of 10%. UBL Dubai is earning 3% on a low-risk loan. UBL Pakistan is earning 1% fee income on SBLC(100% secured). In addition, UBL Pakistan is getting prizes and praises from SBP/PM for bringing in deposits in RDA/NPCs from overseas Pakistanis.

Really Levering Up the NPCs

When I gave the example of 3x leverage, I thought I was being aggressive or sensationalist. I was so wrong.

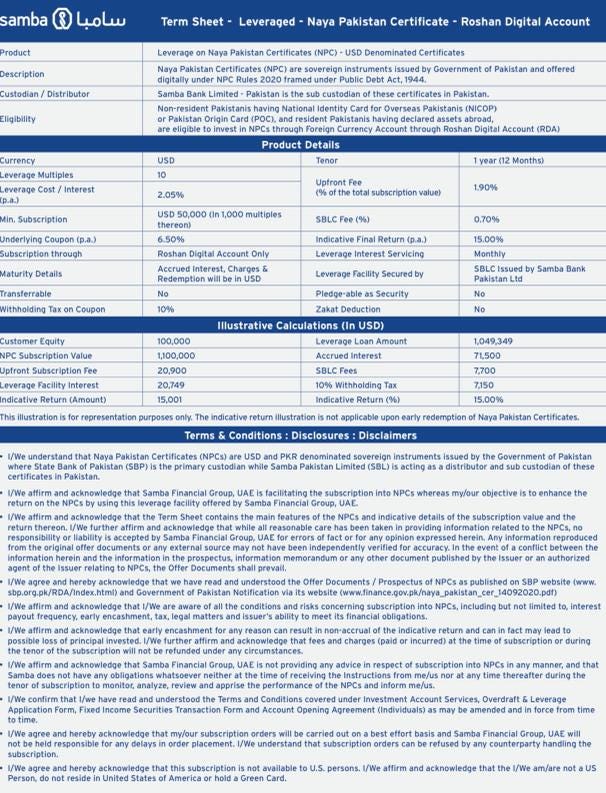

In my post about how Citibank/SCB and HBL were ripping off the Government of Pakistan by $70MM in the name of an oil hedge, I had mentioned that Pakistani banks are slow in product development. Look at the below term sheet from SAMBA. A ready-made product ready to be deployed as soon as you step into the bank. Pakistani banks are nowhere to be seen.

SAMBA is offering 10X leverage to overseas Pakistan for investing in NPCs. Let that sink in. 10X leverage.

SAMBA is charging 2.05% interest on the leverage (110% secured by SBLC). There is a 0.70% fee charged by SAMBA Pakistan on SBLC. In addition, SAMBA UAE charges 1.90% upfront fee (subscription fee) on the $1,100,000.

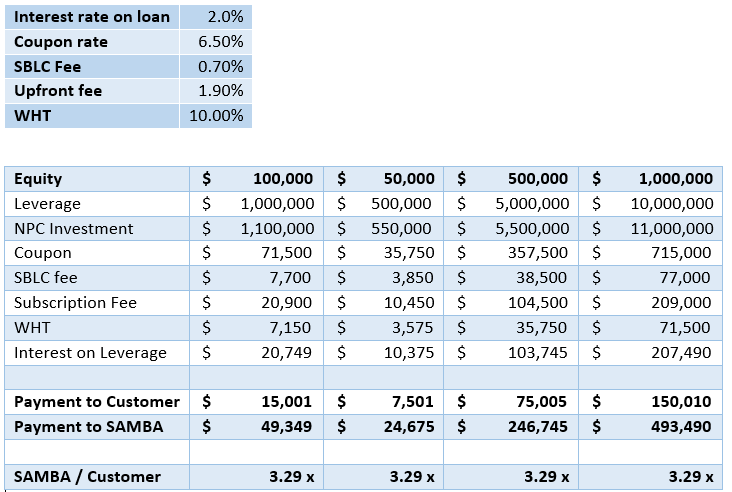

As per the indicative example in SAMBA's term sheet, on an investment of $100,000, SAMBA provides leverage of $1,000,000. Total investment in NPCs is $1,100,000. GoP pays $71,500 interest on the NPC. After deducting 10% withholding tax, the overseas Pakistani earns a total of $15,000 after payment of all fees and charges (net 15% return instead of 6%). SAMBA earns a total of $49,349 i.e. more than three times the overseas Pakistani.

Another trick by the banks to enhance their own returns is to deduct all the charges in advance. Thus the loan amount is not $1,000,000. It is $1,049,349 ( $1,000,000 plus all the fees, interests, charges are deducted in advance). The loan interest is charged on $1,049,349 and not on $1,000,000.

Below is a table that shows how much the absolute returns are being made on the scheme. SAMBA is providing 10x leverage and making 3.29 times the return earned by overseas Pakistani.

I presume other foreign banks with branches in Pakistan will also be doing it though I am not sure of the capabilities of Dubai Islamic Bank.

This is not a low-risk debt for GoP

The assumption of SBP, GoP, and the financial press may be that this investment is permanent financing as they may be hoping that eventually, overseas Pakistan will convert this into rupees at a slightly higher interbank rate. That will be a huge mistake.

In the SAMBA term sheet, 91% of the investment ($1,000,000 out of $1,100,000) is debt and will have to be repaid. There is no way that SAMBA UAE will be converting its loan of $1,000,000 into Rupees.

GoP/SBP should clearly show these investments as short-term debt in the books. When GoP issues T-bills, PIBs, or Eurobonds, it raises funds for a fixed tenor. If an investor sells the instrument in the secondary market, the payment to the investor is being made by the buyer of the instrument and not GoP. In the case of NPCs, these are encashable at any time i.e., GoP will have to repay them on demand.

Role of SBP

What SAMBA is doing isn't illegal but if communication from SBP is to be believed, it is not the purpose of the NPC (or may this was the plan of hot-money-loving RB all along) i.e. to camouflage short-term borrowing from foreign banks as investments from overseas Pakistanis. But then communication from SBP senior management hasn't been credible anymore especially after the "ballot stuffing" and "mystery shopping" claims.

This is SBP deputy governor announcing yesterday that March 9th is a good day as on this day investments in RDA have touched $500 million. If you go up a few paragraphs to where UBL is getting the award, a special ceremony was held on February 22 to mark the investment in RDA reach $500 million. What or whom to believe?

This SBP regime may truly be the most pedigreed but their statements should be taken with a pinch of salt. Reminds me of what Zulfiqar Mirza said about Rehman Malik and apple and bananas.

UPDATE: My bad. The above tweet is part of the SBP promotion campaign. In later tweets (I like to think as a result of this substack) SBP explicitly mentions in that the $500 million mark was achieved on Feb 18. SBP's Twitter account is getting sports stars and commercial bankers to praise RDA too. It is as if Reza Baqir is campaigning to be the next PM. I don’t think any other central bank in the world markets their governor as much as SBP.